DEFR14A: Definitive revised proxy soliciting materials

Published on December 16, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement |

||||

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

||||

|

þ

|

Definitive Proxy Statement |

||||

☐ |

Definitive Additional Materials |

||||

☐ |

Soliciting Material Pursuant to §240.14a-12 |

||||

Becton, Dickinson and Company | |||||

(Name of Registrant as Specified In Its Charter) | |||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||||

Payment of Filing Fee (Check the appropriate box): | |||||

þ |

No fee required. |

||||

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

||||

(1 |

) |

Title of each class of securities to which transaction applies: |

|||

(2 |

) |

Aggregate number of securities to which transaction applies: |

|||

(3 |

) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

(4 |

) |

Proposed maximum aggregate value of transaction: |

|||

(5 |

) |

Total fee paid: |

|||

☐ |

Fee paid previously with preliminary materials. |

||||

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

||||

(1 |

) |

Amount Previously Paid: |

|||

(2 |

) |

Form, Schedule or Registration Statement No.: |

|||

(3 |

) |

Filing Party: |

|||

(4 |

) |

Date Filed: |

|||

Becton, Dickinson and Company

1 Becton Drive

Franklin Lakes, New Jersey 07417-1880

www.bd.com

December 16, 2019

Dear Fellow Shareholders:

You are cordially invited to attend the 2020 Annual Meeting of Shareholders of Becton, Dickinson and Company (“BD”) to be held at 1:00 p.m. EST on Tuesday, January 28, 2020 at The Westin Governor Morris, 2 Whippany Road, Morristown, New Jersey.

The accompanying notice of meeting and proxy statement describe the matters to be acted upon at the meeting. We also will report on matters of interest to BD shareholders.

Your vote is important. Whether or not you plan to attend the 2020 Annual Meeting in person, we encourage you to vote your shares. You may vote by proxy on the Internet or by telephone, or by completing and mailing the enclosed proxy card in the return envelope provided. You may also vote in person at the Annual Meeting.

Thank you for your continued support of BD.

Sincerely, |

||

|

||

|

Vincent A. Forlenza

Chairman and Chief Executive Officer

|

||

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Becton, Dickinson and Company

1 Becton Drive

Franklin Lakes, New Jersey 07417-1880

December 16, 2019

The 2020 Annual Meeting of Shareholders of Becton, Dickinson and Company (“BD”) will be held as follows:

DATE: |

Tuesday, January 28, 2020 |

TIME: |

1:00 p.m. EST |

LOCATION: |

The Westin Governor Morris

2 Whippany Road

Morristown, New Jersey

|

PURPOSE: |

To consider and act upon the following proposals: |

1. The election as directors of the thirteen nominees named in the attached proxy statement for a one-year term; |

|

2. The ratification of the selection of the independent registered public accounting firm; |

|

3. An advisory vote to approve named executive officer compensation; |

|

4. Approval of an amendment to the 2004 Employee and Director Equity-Based Compensation Plan; |

|

5. Approval of the French Addendum to the 2004 Employee and Director Equity-Based Compensation Plan; |

|

6. A shareholder proposal seeking to lower the ownership threshold required to call a special shareholders meeting, if properly presented at the meeting; and |

|

7. Such other business as may properly come before the meeting or any adjournment or postponement thereof. |

|

Important Notice Regarding the Availability of Proxy Materials for the 2020 Annual Meeting of Shareholders to be held on January 28, 2020. BD’s proxy statement and 2019 Annual Report of Shareholders, which includes BD’s consolidated financial statements, are available at www.edocumentview.com/BDX.

Shareholders of record as of the close of business on December 9, 2019 are entitled to notice of, and to vote at, the 2020 Annual Meeting of Shareholders (or any adjournment or postponement thereof).

By order of the Board of Directors, |

||

|

||

|

Gary DeFazio

Senior Vice President and Corporate Secretary

|

||

|

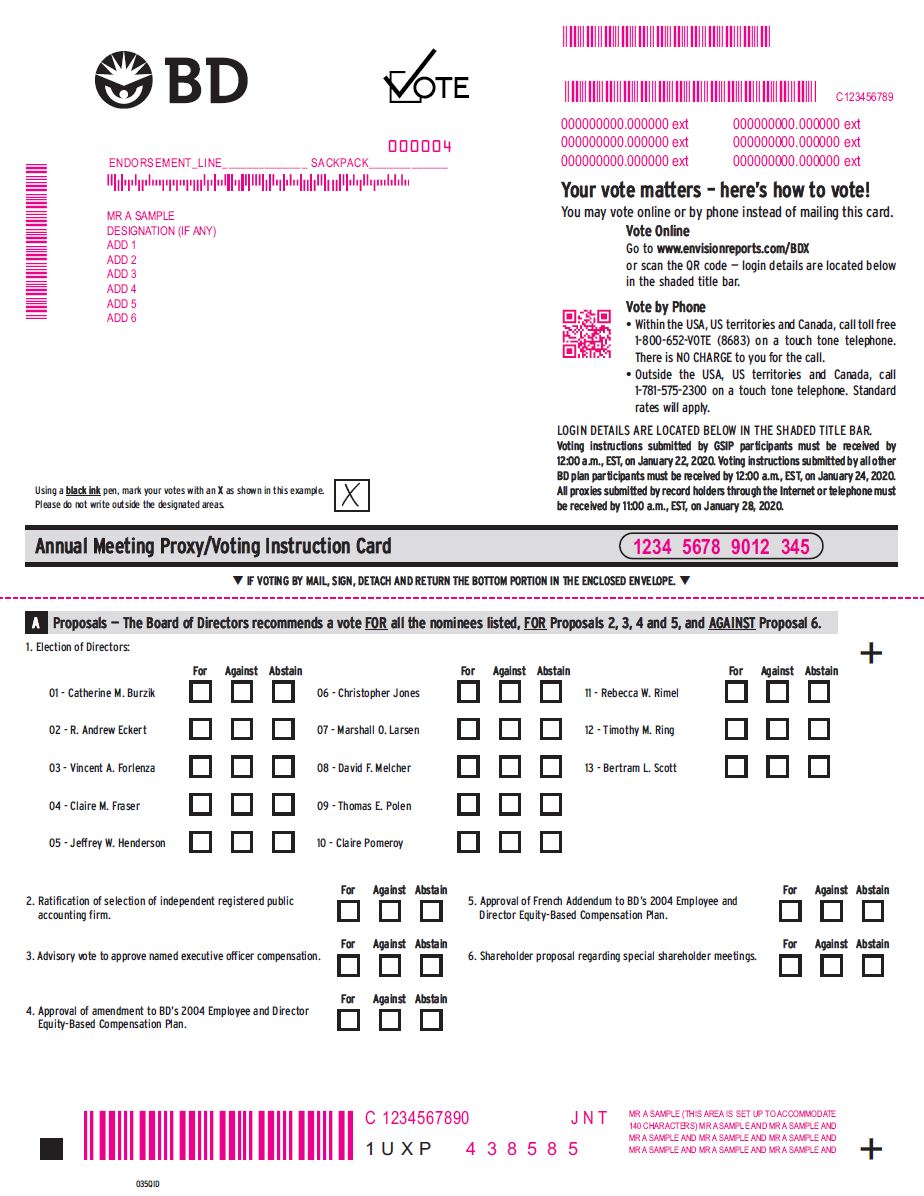

YOU CAN VOTE BY PROXY OR SUBMIT VOTING INSTRUCTIONS IN

ONE OF THREE WAYS:

1. VIA THE INTERNET:

Visit the website noted on your proxy/voting instruction card.

2. BY TELEPHONE:

Use the telephone number noted on your proxy/voting instruction card.

3. BY MAIL:

Promptly return your signed and dated proxy/voting instruction card in the envelope provided.

|

TABLE OF CONTENTS

CEO PAY RATIO |

|

PROPOSAL 4. APPROVAL OF AMENDMENT TO 2004 PLAN |

|

PROPOSAL 5. APPROVAL OF FRENCH ADDENDUM TO 2004 PLAN |

|

PROPOSAL 6. A SHAREHOLDER PROPOSAL REGARDING SPECIAL MEETINGS |

|

SHAREHOLDER PROPOSALS OR DIRECTOR NOMINATIONS FOR 2021 ANNUAL MEETING

|

|

APPENDIX A: RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

|

|

APPENDIX B: 2004 EMPLOYEE AND DIRECTOR EQUITY-BASED COMPENSATION PLAN |

|

APPENDIX C: FRENCH ADDENDUM TO 2004 EMPLOYEE AND DIRECTOR EQUITY-BASED COMPENSATION PLAN |

|

PROXY STATEMENT

_____________________________

2020 ANNUAL MEETING OF SHAREHOLDERS

Tuesday, January 28, 2020

_____________________________

BECTON, DICKINSON AND COMPANY

1 Becton Drive

Franklin Lakes, New Jersey 07417-1880

_____________________________

GENERAL INFORMATION

Proxy solicitation

These proxy materials are being mailed or otherwise sent to shareholders of Becton, Dickinson and Company (“BD”) on or about December 16, 2019 in connection with the solicitation of proxies by the BD Board of Directors (the “Board”) for BD’s 2020 Annual Meeting of Shareholders (the “2020 Annual Meeting”) to be held at 1:00 p.m. EST on Tuesday, January 28, 2020 at The Westin Governor Morris, 2 Whippany Road, Morristown, New Jersey.

BD’s directors and its officers and other BD associates also may solicit proxies by telephone or otherwise. Brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses. BD has retained MacKenzie Partners, Inc. to assist in soliciting proxies for a fee not to exceed $25,000 plus expenses. The cost of soliciting proxies will be borne by BD.

Important Notice Regarding the Availability of Proxy Materials for the 2020 Annual Meeting of Shareholders to be held on January 28, 2020. This proxy statement and BD’s 2019 Annual Report to Shareholders are also available at www.edocumentview.com/BDX.

Shareholders entitled to vote; Attendance at the 2020 Annual Meeting

The record date for determining shareholders entitled to notice of, and to vote at, the 2020 Annual Meeting (or any adjournment or postponement thereof) was December 9, 2019. As of such date, there were 271,011,748 shares of BD common stock outstanding, each entitled to one vote.

If your shares are held in the name of a bank, broker or other nominee (also known as shares held in “street name”) and you wish to attend the meeting, you must present proof of ownership as of the record date, such as a bank or brokerage account statement, to be admitted. BD may request appropriate identification for any person seeking to attend the meeting as a condition of admission.

Quorum; Required vote

The holders of a majority of the shares entitled to vote at the 2020 Annual Meeting must be present in person or represented by proxy to constitute a quorum. Directors are elected by a majority of the votes cast at the meeting (Proposal 1). If an incumbent director receives a greater number of votes “against” the director’s election than votes “for” such election, the director must offer to submit his or her resignation, and the Board will decide whether to accept the offer to resign in accordance with the process described on page 17 of this proxy statement.

Approval of each of Proposals 2 through 6 requires the affirmative vote of a majority of the votes cast at the meeting. Under New Jersey law, abstentions and shares that brokers do not have the authority to vote in the absence of timely instructions from the beneficial owners will not be counted as votes cast, and, accordingly, will have no effect on the outcome of the vote for any of these proposals.

How to vote

Shareholders of record may cast their votes at the meeting. In addition, shareholders of record may cast their votes by proxy, and participants in the BD plans described below may submit their voting instructions, by:

• |

using the Internet and voting at the website listed on the enclosed proxy/voting instruction card (the “proxy card”); |

• |

using the telephone number listed on the proxy card; or |

• |

signing, completing and returning the proxy card in the postage-paid envelope provided. |

Votes and voting instructions provided through the Internet and by telephone are authenticated by use of a personal identification number. This procedure allows shareholders to appoint a proxy, and the various plan participants to provide voting instructions, and to confirm that their actions have been properly recorded. Specific instructions to be followed are set forth on the proxy card. If you vote through the Internet or by telephone, you do not need to return your proxy card. In order to be timely processed, voting instructions submitted by participants in BD’s Global Share Investment Program (the “GSIP”) must be received by 12:00 p.m. EST on January 22, 2020, and voting instructions submitted by participants in all other BD plans must be received by 12:00 p.m. EST on January 24, 2020. All proxies submitted by record holders through the Internet or by telephone must be received by 11:00 a.m. EST on January 28, 2020 in order to be timely processed.

If you are the beneficial owner of shares held in street name, you have the right to direct your bank, broker or other nominee on how to vote your shares by following the instructions provided to you by your nominee. In the alternative, you may vote in person at the meeting if you obtain a legal proxy from your bank, broker or other nominee and present it at the meeting.

Shares represented by properly executed proxies will be voted in accordance with the instructions specified therein. Shares represented by properly executed proxies that do not specify voting instructions will be voted in accordance with the recommendations of the Board set forth in this proxy statement. If you hold your shares in street name and do not provide timely voting instructions to your bank, broker or other nominee, your nominee will not be permitted to vote your shares in its discretion on the election of directors (Proposal 1), the advisory vote to approve executive compensation (Proposal 3), either of the proposals relating to our equity compensation plan (Proposals 4 and 5) or the shareholder proposal regarding special meetings (Proposal 6), but may still be permitted to vote your shares in their discretion on the ratification of the independent registered public accounting firm (Proposal 2).

Participants in BD plans

Participants in the BD 401(k) Plan or the 401(k) plans of any BD subsidiary may instruct the plan trustee how to vote the shares of BD common stock allocated to their plan accounts. Shares for which no voting instructions have been received by the plan trustee will be voted in the same proportion as those shares for which timely instructions are received.

Participants in BD’s Deferred Compensation and Retirement Benefit Restoration Plan (the “Restoration Plan”), the 1996 Directors’ Deferral Plan (the “Directors’ Deferral Plan”), and the GSIP (if so provided under the terms of the local country GSIP plan) may provide voting instructions for the shares of BD common stock allocated to their plan accounts. The trustees of these plans will vote the plan shares for which they do not receive instructions from participants in the same proportion as the plan shares for which they do receive instructions.

Proxies representing shares of BD common stock held of record also will serve as proxies for shares held under the Direct Stock Purchase Plan sponsored and administered by Computershare Trust Company, N.A. and any shares of BD common stock allocated to participants’ accounts under the plans mentioned above, if the registrations are the same. Separate mailings will be made for shares not held under the same registrations.

Revocation of proxies or change of instructions

A proxy given by a shareholder of record may be revoked or changed by:

• |

sending written notice of revocation to the Corporate Secretary of BD at the address set forth above, or delivering such notice at the meeting, prior to the voting of the proxy, |

• |

delivering a proxy (by one of the methods described above under the heading “How to vote”) bearing a later date, or |

• |

voting in person by written ballot at the meeting. |

Participants in the plans described above may change their voting instructions by timely delivering new voting instructions by one of the methods described above under the heading “How to vote.”

If you are the beneficial owner of shares held in street name, you may revoke or change your voting instructions in the manner provided by your bank, broker or other nominee, or you may vote in person at the meeting in the manner described above under the heading “How to vote.”

Other matters

The Board is not aware of any matters to be presented at the 2020 Annual Meeting other than those set forth in the accompanying notice. If any other matters properly come before the meeting (or any adjournment or postponement thereof), the persons named in the proxy card will vote on such matters in their discretion in accordance with their best judgment.

OWNERSHIP OF BD COMMON STOCK

Securities owned by certain beneficial owners

The following table sets forth as of September 30, 2019, information concerning those persons known to BD to be the beneficial owner of more than 5% of BD’s outstanding common stock, the only class of BD capital stock with voting rights. This information is based on filings made by such persons with the Securities and Exchange Commission (“SEC”). In general, “beneficial ownership” includes those shares that a person has the sole or shared power to vote or dispose of, including shares that the person has the right to acquire within 60 days.

Name and address of beneficial owner |

Title of Security |

Amount and

nature of

beneficial ownership

|

Percent of class

|

|

T. Rowe Price Associates, Inc.

100 E. Pratt Street

Baltimore, MD 21202

|

Common Stock |

35,303,141 (1) |

12.9% |

|

The Vanguard Group, Inc.

100 Vanguard Boulevard

Malvern, PA 19355

|

Common Stock |

23,281,365 (2) |

8.6% |

|

BlackRock, Inc.

40 East 52nd Street

New York, NY 10022

|

Common Stock |

21,496,802 (3) |

7.9% |

|

FMR, LLC

245 Summer Street

Boston, MA 02210

|

Common Stock |

13,621,875 (4) |

5.0% |

_____________________________________________

(1) |

The beneficial owner has sole dispositive power with respect to these shares and sole voting power with respect to 12,039,687 shares. Includes approximately 3,385,222 shares underlying depositary shares that are convertible into common stock at the option of the holder. |

(2) |

The beneficial owner has sole dispositive power with respect to 22,897,636 shares and shared dispositive power with respect to 383,729 shares, and has sole voting power with respect to 317,956 shares and shared voting power with respect to 85,845 shares. |

(3) |

The beneficial owner has sole dispositive power with respect to these shares, and sole voting power with respect to 18,978,595 shares. Includes approximately 1,010,019 shares underlying depositary shares that are convertible into common stock at the option of the holder. |

(4) |

The beneficial owner has shared dispositive power with respect to these shares and sole voting power with respect to 2,008,521 shares. Includes approximately 316,395 shares underlying depositary shares that are convertible into common stock at the option of the holder. |

Securities owned by directors and management

The following table sets forth as of December 1, 2019 information concerning the beneficial ownership of BD common stock by (i) each director and nominee, (ii) the executive officers named in the Summary Compensation Table on page 36, and (iii) all BD directors and executive officers as a group. Each person has the sole power to vote and dispose of the shares he or she beneficially owns. None of BD’s directors or executive officers has pledged or hedged against any of the shares listed.

BD Common Stock

Name |

Amount and nature of beneficial ownership(1) |

Percentage of class |

||||

Catherine M. Burzik |

10,007 |

* |

||||

R. Andrew Eckert |

3,491 |

* |

||||

Vincent A. Forlenza |

1,416,995 |

* |

||||

Claire M. Fraser |

21,603 |

* |

||||

Jeffrey W. Henderson |

1,336 |

* |

||||

Christopher Jones |

22,664 |

* |

||||

Patrick K. Kaltenbach |

4,236 |

* |

||||

Marshall O. Larsen |

24,899 |

* |

||||

Alberto Mas |

104,673 |

* |

||||

David F. Melcher |

6,200 |

* |

||||

Thomas E. Polen |

77,222 |

* |

||||

Claire Pomeroy |

7,309 |

* |

||||

Christopher R. Reidy |

191,664 |

* |

||||

Rebecca W. Rimel |

11,113 |

* |

||||

Timothy M. Ring |

85,043 |

* |

||||

Bertram L. Scott |

43,727 |

* |

||||

Directors and executive officers as a group (22 persons) |

2,398,478 |

* |

||||

_______________________________________

* |

Represents less than 1% of the outstanding BD common stock. |

(1) |

Includes (a) shares held directly, (b) with respect to executive officers, indirect interests in BD common stock held under BD plans, and (c) with respect to the non-management directors, indirect interests in BD common stock held under the Directors’ Deferral Plan. Additional information on certain of these plans appears on page 55. Includes shares that executive officers may acquire within 60 days under outstanding equity compensation awards, including: Mr. Forlenza, 1,209,329 shares; Mr. Kaltenbach, 4,236 shares; Mr. Mas, 87,177 shares; Mr. Polen, 63,410 shares; and Mr. Reidy, 167,062 shares. Also includes, with respect to each non-management director, shares issuable under equity awards as follows: Ms. Burzik, 4,883 shares; Mr. Eckert, 932 shares; Dr. Fraser, 18,092 shares; Mr. Henderson, 932 shares; Mr. Jones, 10,794 shares; Mr. Larsen, 16,144 shares; Mr. Melcher, 4,418 shares; Dr. Pomeroy, 2,345 shares; Ms. Rimel, 6,199 shares; Mr. Ring, 17,897 shares and Mr. Scott, 23,547 shares. The above table does not reflect the grant of restricted stock units that the persons elected as non-management directors at the 2020 Annual Meeting will receive, as the amount of these grants cannot be determined at this time. See “Non-management directors’ compensation” on page 12. |

Delinquent Section 16(a) reports

Section 16(a) of the Securities Exchange Act of 1934 requires BD’s directors and executive officers to file initial reports of their ownership of BD’s equity securities and reports of changes in such ownership with the SEC and the New York Stock Exchange (“NYSE”). Directors and executive officers are required by SEC regulations to furnish BD with copies of all Section 16(a) forms they file with respect to BD securities. Based solely on a review of copies of such forms and written representations from BD’s directors and executive officers, BD believes that during fiscal year 2019, all of its directors and executive officers were in compliance with the reporting requirements of Section 16(a), except that reports for four transactions by Cathleen M. Burzik were inadvertently filed late due to an oversight by the broker who effected the transactions without Ms. Burzik’s knowledge.

PROPOSAL 1. ELECTION OF DIRECTORS

Members of our Board are elected to serve a term of one year and until their successors have been elected and qualified. All of the nominees for director have consented to being named in this proxy statement and to serve if elected.

Each of the nominees is a current member of our Board, except for Thomas E. Polen. Mr. Polen is BD's current President and Chief Operating Officer ("COO"), and has been elected by the Board to become BD's Chief Executive Officer ("CEO") and President, effective upon the conclusion of the 2020 Annual Meeting. BD does not know of any reason why any nominee would be unable to serve as director. If any nominee is unable to serve, the shares represented by valid proxies will be voted for the election of such other person as the Board may nominate, or the size of the Board may be reduced.

BD directors have a variety of backgrounds, which reflects the Board’s continuing efforts to achieve a diversity of viewpoint, experience, knowledge, ethnicity and gender. As more fully discussed below, director nominees are considered on the basis of a range of criteria, including their business knowledge and background, prominence and reputation in their fields, global business perspective and commitment to strong corporate governance and citizenship. They must also have experience and ability that is relevant to the Board’s oversight of BD’s business and affairs. Each nominee’s biography includes the particular experience and qualifications that led the Board to conclude that the nominee should serve on the Board.

Nominees for Director

|

Catherine M. Burzik, 69, has been a director since 2013. From 2006 until the sale of the company in 2012, she served as President and Chief Executive Officer of Kinetic Concepts, Inc., a medical device company specializing in the fields of wound care and regenerative medicine. Prior thereto, she was President of Applied Biosystems and President of Ortho-Clinical Diagnostics, Inc., a Johnson & Johnson company. Ms. Burzik also is a director of Haemonetics Corporation.

Ms. Burzik is a seasoned executive in the healthcare industry, having led major medical device, diagnostic, diagnostic imaging and life sciences businesses. She contributes strong strategic, product development and leadership expertise, and extensive knowledge of the global healthcare field.

|

|

R. Andrew Eckert, 58, has been a director since 2016. From 2017 until the sale of the company in October 2019, he served as President and Chief Executive Officer of Acelity L.P. Inc., a global wound care company. From 2015 until 2016, he served as the Chief Executive Officer of Valence Health, Inc., a healthcare information technology and services company. Prior thereto, Mr. Eckert served as Chief Executive Officer of TriZetto Corporation, a healthcare information technology solutions firm, and Chief Executive Officer of CRC Health Group, a provider of specialized behavioral healthcare services. Mr. Eckert also is the Chairman of Varian Medical Systems.

Mr. Eckert is a leader in the growing field of healthcare information technology, with extensive experience as an executive officer of several healthcare companies. He has a deep knowledge of operations, strategic planning, product development and marketing, and has valuable corporate governance insight gained from having served as a director of several public companies.

|

|

Vincent A. Forlenza, 66, has been a director since 2011. Mr. Forlenza became BD’s Chairman in 2012. He was elected BD's CEO in 2011 and will retire as CEO upon the conclusion of the 2020 Annual Meeting. He also served as BD’s President from 2009 to April 2017, and as its COO from July 2010 to October 2011. Mr. Forlenza also is a director of Moody’s Corporation. He is the former Chairman and a current director of the Advanced Medical Technology Association (AdvaMed), an international medical technology trade organization, a director of the Quest Autism Foundation, and a member of the Board of Trustees of The Valley Health System.

Mr. Forlenza has been with BD for over 39 years in a number of different capacities, including strategic planning, business development, research and development and general management, as well as overseas roles. Mr. Forlenza brings to the Board extensive business and industry experience, and provides the Board with a unique perspective on BD’s strategy and operations, particularly in the area of new product development.

|

|

Claire M. Fraser, Ph.D, 64, has been a director since 2006. Since 2007, she has been Director of the Institute for Genome Sciences and a Professor of Medicine at the University of Maryland School of Medicine in Baltimore, Maryland. From 1998 to 2007, she served as President and Director of The Institute for Genomic Research, a not-for-profit center dedicated to deciphering and analyzing genomes. Dr. Fraser is the President-Elect of the American Association for the Advancement of Science (AAAS), and also serves on the Board of AAAS and Ohana Biosciences Inc.

Dr. Fraser is a prominent scientist with a strong background in infectious diseases and molecular diagnostics, including the development of novel diagnostics and vaccines. She also brings considerable managerial experience in her field.

|

|

Jeffrey W. Henderson, 55, has been a director since August 2018. He has been an Advisory Director to Berkshire Partners LLC, a private equity firm, since September 2015. He served as Chief Financial Officer of Cardinal Health Inc., a global healthcare services company, from May 2005 to November 2014. Prior to joining Cardinal Health, Mr. Henderson held multiple positions at Eli Lilly and General Motors, including international positions. Mr. Henderson also is a director of Qualcomm, Inc., FibroGen, Inc. and Halozyme Therapeutics, Inc.

Mr. Henderson is an experienced healthcare executive who brings to the Board a deep knowledge of the industry, along with strong financial, strategic and operational expertise and significant international experience. Mr. Henderson also brings valuable corporate governance experience from his service as a director of other public companies.

|

|

Christopher Jones, 64, has been a director since 2010. In 2001, Mr. Jones retired as Chief Executive Officer of JWT Worldwide (previously known as J. Walter Thompson), an international marketing firm. He is a member of the Board of Trustees of The Pew Charitable Trusts, and a member of the Board of Directors of the Albert and Mary Lasker Foundation. He also is the Non-Executive Chairman of Cello Health plc and Palmer Hargreaves, and a member of the Health Advisory Board of The Johns Hopkins University Bloomberg School of Public Health.

Mr. Jones contributes an important international perspective based on his distinguished career as a marketing leader and head of a global marketing firm. He offers substantial marketing, strategic and managerial expertise derived from his broad range of activities in the field.

|

|

Marshall O. Larsen, 71, has been a director since 2007. In 2012, Mr. Larsen retired as Chairman, President and Chief Executive Officer of Goodrich Corporation, a supplier of systems and services to the aerospace and defense industry. Mr. Larsen also is a director of Air Lease Corporation and United Technologies Corporation, and was formerly a director of Lowe's Companies, Inc.

As a veteran chief executive officer of a public company, Mr. Larsen offers the valuable perspective of an individual with highly-developed executive leadership and financial and strategic management skills in a global manufacturing company. These qualities reflect considerable domestic and international business and financial experience.

|

|

David F. Melcher, 65, has been a director since BD’s acquisition of C.R. Bard, Inc. (“Bard”) in 2017, and had served as a Bard director since 2014. In December 2017, he retired as President and Chief Executive Officer of Aerospace Industries Association, a trade association representing major aerospace and defense manufacturers and suppliers, a position he had held since 2015. From 2011 to 2015, Mr. Melcher was Chief Executive Officer, President and a member of the Board of Directors of Exelis Inc., a public diversified, global aerospace defense, information and technology services company. Lieutenant General (Ret.) Melcher also spent 32 years of distinguished service in the U.S. Army. He also is the Lead Director of Cubic Corporation.

Mr. Melcher brings strong executive experience as a result of his many years in leadership positions in the defense community and as a former chief executive officer of a public company. Mr. Melcher offers the perspective of a seasoned executive with extensive experience and expertise in the areas of domestic and international business, program management, strategy development, finance and information technology.

|

|

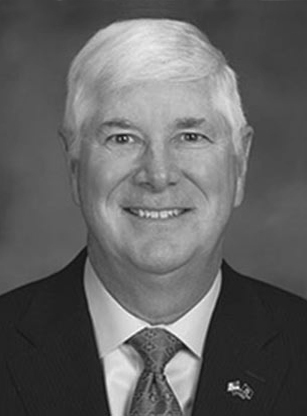

Thomas E. Polen, 46, has served as BD's Chief Operating Officer since October 2018, and as its President since April 2017. Prior thereto, he served as Executive Vice President and President of BD's Medical segment. Mr. Polen has been elected by the Board to serve as BD's CEO and President, effective upon the conclusion of the 2020 Annual Meeting.

Mr. Polen has spent 19 years with BD in a number of capacities of increasing responsibility, and played a key role in leading BD's acquisitions of CareFusion Corporation ("CareFusion") and Bard. As BD's COO, Mr. Polen has had oversight responsibility for all three of BD's business segments, as well as global research and development, innovation, operations and the commercial organization of BD's Americas region. Mr. Polen brings to the Board extensive industry experience and business expertise, particularly in the areas of strategy and innovation, and in-depth knowledge of BD’s various served markets.

|

|

Claire Pomeroy, 64, has been a director since 2014. Since 2013, she has served as President of the Albert and Mary Lasker Foundation, a private foundation that seeks to improve health by accelerating support for medical research through recognition of research excellence, public education and advocacy. Prior thereto, Dr. Pomeroy served as Dean of the University of California, Davis (“UC Davis”) School of Medicine, and Chief Executive Officer of the UC Davis Health System. Dr. Pomeroy also is Chair of the Board of Directors of the Foundation for Biomedical Research and the Sierra Health Foundation, and Vice Chairman of the Board of Trustees of The New York Academy of Medicine. She is a director of Haemonetics Corporation and a member of the Board of Trustees of the Morehouse School of Medicine.

Dr. Pomeroy is an expert in infectious diseases, with broad experience in the area of healthcare delivery, health system administration, higher education, medical research and public health. She brings to the Board important perspectives in the areas of patient care services, global health and health policy.

|

|

Rebecca W. Rimel, 68, has been a director since 2012. Since 1994, she has served as President and Chief Executive Officer of The Pew Charitable Trusts, a public charity that works to improve public policy and inform the public. Ms. Rimel previously served as Assistant Professor in the Department of Neurosurgery at the University of Virginia Hospital and also as Head Nurse of its medical center emergency department. Ms. Rimel also is a director of BioTelemetry, Inc. and a director/trustee of various DWS mutual funds.

Ms. Rimel brings to the Board executive leadership and extensive experience in public policy and advocacy, particularly in the area of healthcare. She also offers the perspective of someone with a strong background in the healthcare field.

|

|

Timothy M. Ring, 62, has been a director since BD’s acquisition of Bard in 2017, at which time he was serving as Bard’s Chairman and Chief Executive Officer, a position he had held since 2003. He also is a director of Quest Diagnostics Incorporated, and a co-founder of TEAMFund, Inc., an impact fund focused on delivering medical technology to sub-Saharan Africa and India.

With over 20 years of experience in various leadership positions at Bard, including as Chairman and Chief Executive Officer, Mr. Ring offers a unique perspective on the Bard business. As an experienced chief executive officer of a public company, Mr. Ring also contributes expertise in many facets of business, including strategy, product development and international operations, and has extensive experience in the healthcare industry.

|

|

Bertram L. Scott, 68, has been a director since 2002. Mr. Scott retired as Senior Vice President of Population Health of Novant Health in 2019. He previously served as President and Chief Executive Officer of Affinity Health Plan, and as President, U.S. Commercial of CIGNA Corporation. Prior thereto, Mr. Scott served as Executive Vice President of TIAA-CREF and as President and Chief Executive Officer of TIAA-CREF Life Insurance Company. Mr. Scott also is a director of AXA Equitable Holdings, Inc., AXA Equitable Life Insurance Company, Lowe’s Companies, Inc., MONY America and Tufts Health Plan.

Mr. Scott possesses strong strategic, operational and financial experience from the variety of executive roles in which he has served during his career. He brings experience in corporate governance and business expertise in the insurance and healthcare fields.

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" EACH OF THE NOMINEES FOR DIRECTOR.

BOARD OF DIRECTORS

The Board and Committees of the Board

BD is governed by the Board. The Board has established five operating committees (the “Committees”): the Audit Committee; the Compensation and Management Development Committee (the “Compensation Committee”); the Corporate Governance and Nominating Committee (the “Governance Committee”); the Quality and Regulatory Committee (the “QRC”); and the Science, Marketing, Innovation and Technology Committee (the “SMIT Committee”). These Committees meet regularly. The Board has also established an Executive Committee that meets only as needed.

The Board has adopted written charters for each of the Committees that are posted on BD’s website at www.bd.com/investors/corporate_governance/. Printed copies of these charters, BD’s 2019 Annual Report on Form 10-K, and BD’s reports and statements filed with or furnished to the SEC may be obtained, without charge, by contacting the Corporate Secretary, Becton, Dickinson and Company, 1 Becton Drive, Franklin Lakes, New Jersey 07417-1880; telephone 201-847-6800.

Committee membership and function

Set forth below are the members of each Committee and a summary description of each Committee’s areas of oversight.

AUDIT COMMITTEE

Members |

Function |

|

Bertram L. Scott—Chair

R. Andrew Eckert

Jeffrey W. Henderson

David F. Melcher

Rebecca W. Rimel

|

Retains and reviews the qualifications, independence and performance of BD’s registered public accounting firm (the “independent auditors”).

Reviews BD’s public financial disclosures and financial statements, and its accounting principles, policies and practices; the scope and results of the annual audit by the independent auditors; BD’s internal audit process; and the effectiveness of BD’s internal control over financial reporting.

Reviews BD’s guidelines and policies relating to enterprise risk assessment and management.

Oversees BD’s ethics and enterprise compliance programs.

Reviews financial strategies regarding currency, interest rates and use of derivatives, and reviews BD’s insurance program.

|

The Board has determined that each member of the Audit Committee meets the independence and financial literacy requirements of the NYSE for audit committee members. The Board also has determined that each of Messrs. Henderson, Melcher and Scott qualifies as an “audit committee financial expert” under the rules of the SEC.

COMPENSATION AND MANAGEMENT DEVELOPMENT COMMITTEE

Members |

Function |

|

Marshall O. Larsen—Chair

Jeffrey W. Henderson

Christopher Jones

David F. Melcher

Bertram L. Scott

|

Reviews BD’s compensation and benefits programs, recommends the compensation of BD’s CEO to the independent members of the Board, and approves the compensation of BD’s other executive officers.

Approves all employment, severance and change in control agreements with our executive officers.

Serves as the granting and administrative committee for BD’s equity compensation plans, including grants to directors.

Oversees certain other BD benefit plans.

Reviews initiatives for identifying and developing leaders and candidates for senior leadership positions.

|

The Board has determined that each member of the Compensation Committee meets the independence requirements of the NYSE for compensation committee members. Each member also qualifies as an “outside director” under the applicable regulations under Section 162(m) of the Internal Revenue Code, and as a “non-employee director” under Section 16 of the Securities Exchange Act of 1934.

Procedure for determining executive compensation

The Compensation Committee oversees the compensation program for the executive officers named in the Summary Compensation Table on page 36 and for BD’s other executive officers. The Compensation Committee recommends compensation actions regarding the CEO to the other independent directors of the Board and has the authority to take compensation actions with respect to BD’s other executive officers, as discussed below. The Compensation Committee may not delegate these responsibilities to another Committee, an individual director or members of management.

Role of management

The Compensation Committee’s meetings are typically attended by BD’s CEO, its Chief Human Resources Officer and other BD associates who support the Compensation Committee in fulfilling its responsibilities. The Compensation Committee considers management’s views on compensation matters, including the performance metrics and targets for BD’s performance-based compensation. Management also provides information (which is reviewed by our Internal Audit department and the Audit Committee) to assist the Compensation Committee in determining the extent to which performance targets have been achieved. This includes any recommended adjustments to BD’s operating results when assessing BD’s performance. The CEO and Chief Human Resources Officer also work with the Compensation Committee chair in establishing meeting agendas.

Role of the independent consultant

The Compensation Committee is also assisted in fulfilling its responsibilities by its independent consultant, Pay Governance LLC (“Pay Governance”). Pay Governance is engaged by, and reports directly to, the Compensation Committee. The Compensation Committee is not aware of any conflict of interest on the part of Pay Governance or any factor that would otherwise impair the independence of Pay Governance relating to the services performed by Pay Governance for the Compensation Committee. No other consultant was used by the Compensation Committee with respect to the 2019 fiscal year compensation of BD’s executive officers.

During fiscal year 2019, Pay Governance was not engaged to perform any services for BD or BD’s management. The Compensation Committee has adopted a policy prohibiting Pay Governance from providing any services to BD or BD’s management without the Compensation Committee’s prior approval, and has expressed its intention that such approval will be given only in exceptional cases.

In its role as the Compensation Committee's independent consultant, Pay Governance:

• |

Reviewed materials prepared for the Compensation Committee by management, |

• |

Provided market comparison data and other materials requested by the Compensation Committee, |

• |

Assisted the Compensation Committee in the design and implementation of BD’s compensation program, including the selection of the key elements of the program, setting of targeted payments for each element, and establishment of performance targets, |

• |

Made recommendations regarding the compensation of BD’s CEO, |

• |

Assisted with compensation matters related to our CEO succession, |

• |

Conducted an annual review of the compensation practices of select peer companies, and advised the Compensation Committee with respect to the competitiveness of BD’s compensation program in comparison to industry practices, and identified any trends in executive compensation, and |

•Attended Compensation Committee meetings.

Setting compensation

At the end of each fiscal year, the independent directors conduct a review of the CEO’s performance. The independent directors then meet in executive session to set the compensation of the CEO after considering the results of its review, market comparison data and the recommendations of the Compensation Committee. The CEO does not play a role in determining or recommending CEO compensation.

The Compensation Committee is responsible for determining the compensation of BD’s other executive officers. The CEO, in consultation with the Chief Human Resources Officer, reviews the performance of the other executive officers with the

Compensation Committee and makes compensation recommendations for its consideration. The Compensation Committee determines the compensation for these executives, in consultation with Pay Governance, after considering the CEO’s recommendations and market comparison data regarding compensation levels for comparable positions at peer companies. All decisions regarding the compensation of BD’s other executive officers are made in executive session.

The Board has delegated responsibility for formulating recommendations regarding non-management director compensation to the Governance Committee, as discussed below.

CORPORATE GOVERNANCE AND NOMINATING COMMITTEE

Members |

Function |

|

Christopher Jones—Chair

Catherine M. Burzik

Claire M. Fraser

Marshall O. Larsen

Claire Pomeroy

|

Identifies and recommends candidates for election to the Board.

Reviews the composition, structure and function of the Board and its Committees, as well as the compensation of non-management directors.

Monitors BD’s corporate governance and Board practices, and oversees the Board’s self-evaluation process.

Oversees matters impacting BD’s image, reputation and corporate responsibility, including communications, community relations, public policy and government relations, and environmental, social and governance ("ESG") matters.

|

The Board has determined that each member of the Governance Committee meets the independence requirements of the NYSE.

As stated above, the Governance Committee reviews the compensation of BD's non-management directors and makes recommendations to the Board. The Governance Committee may not delegate these responsibilities to another Committee, an individual director or members of management. The Governance Committee has retained Pay Governance as an independent consultant for this purpose. Pay Governance’s responsibilities include providing market comparison data on non-management director compensation at peer companies, tracking trends in non-management director compensation practices, and advising the Governance Committee regarding the components and levels of non-management director compensation. The Governance Committee is not aware of any conflict of interest on the part of Pay Governance or any other factor that would impair Pay Governance’s independence. BD management does not play any role in either recommending or determining non-management director compensation.

QUALITY AND REGULATORY COMMITTEE

Members |

Function |

|

Catherine M. Burzik—Chair

Claire M. Fraser

Christopher Jones

Marshall O. Larsen

Claire Pomeroy

Timothy M. Ring

|

Oversees BD’s quality strategy and the systems and processes in place to monitor product quality and safety and BD's compliance with regulatory requirements.

Reviews the results of any product quality and quality system assessments by BD and external regulators.

Reviews any significant product quality, safety or regulatory issues that arise.

|

SCIENCE, MARKETING, INNOVATION AND TECHNOLOGY COMMITTEE

Members |

Function |

|

Claire M. Fraser—Chair

Catherine M. Burzik

R. Andrew Eckert

Claire Pomeroy

Rebecca W. Rimel

Timothy M. Ring

|

Oversees BD’s major innovation activities and new product development and commercialization programs.

Reviews the alignment of BD’s research and development, medical and regulatory affairs, and strategic marketing activities to BD’s corporate strategy.

Reviews potentially disruptive trends in technology, medical practice and the external environment.

|

Board, Committee and annual meeting attendance

The Board and its Committees held the following number of meetings during fiscal year 2019:

Board |

5 |

|

Audit Committee |

9 |

|

Compensation Committee |

5 |

|

Governance Committee |

5 |

|

QRC |

5 |

|

SMIT Committee |

5 |

|

The Executive Committee did not meet during fiscal year 2019. BD’s non-management directors met in executive session at each of the Board meetings held during fiscal year 2019.

During fiscal year 2019, all directors attended at least 75% of the total number of meetings of the Board and the Committees on which he or she served. The Board has adopted a policy pursuant to which directors are expected to attend our annual shareholder meetings in the absence of a scheduling conflict or other valid reason. All of the then-serving directors attended BD’s 2019 Annual Meeting of Shareholders.

Non-management director compensation

The Board believes that providing competitive compensation is necessary to attract and retain qualified non-management directors. The key elements of BD’s non-management director compensation are a cash retainer, equity compensation, Committee chair fees and Lead Director fees. Of the base compensation paid to non-management directors (cash retainer and equity), approximately two-thirds is equity-based compensation. See “Equity ownership by directors” on page 17. Management directors do not receive compensation for their service as director.

Cash retainer

Each non-management director currently receives an annual cash retainer of $107,000 for services as a director. Directors do not receive meeting attendance fees.

Equity award

Each non-management director elected at an annual shareholders meeting is granted restricted stock units then valued at $209,000 (using the same methodology used to value awards made to our executive officers). The restricted stock units vest and are distributable at the following annual shareholders meeting, unless deferred at the election of the director.

Committee chair/Lead Director fees

The chair of each Committees received an annual fee of $25,000. In addition, our Lead Director receives an annual fee of $40,000.

Other arrangements

BD reimburses non-management directors for travel and other business expenses incurred in the performance of their services for BD. Directors may travel on BD aircraft in connection with such activities, and, on limited occasions, spouses of directors have joined them on such flights. Per SEC rules, no compensation is attributed to the directors for these flights in the table below, since the aggregate incremental costs of spousal travel were minimal. Directors are also eligible to participate in BD’s Matching Gift Program, pursuant to which BD matches charitable contributions made to qualifying nonprofit organizations, subject to an aggregate limit per participant of $5,000 per calendar year. Directors are also reimbursed for attending director education courses.

The following table sets forth the compensation earned or received by BD’s non-management directors during fiscal year 2019.

Fiscal Year 2019 Non-Management Directors’ Compensation

Name |

Fees earned or

paid in cash

($)(1)

|

Stock awards

($)(2)

|

All other compensation

($)(3)

|

Total

($)

|

||||||

Catherine M. Burzik |

128,904 |

220,772 |

0 |

349,676 |

||||||

R. Andrew Eckert |

107,000 |

220,772 |

0 |

327,772 |

||||||

Claire M. Fraser |

130,452 |

220,772 |

0 |

351,224 |

||||||

Jeffrey W. Henderson |

107,000 |

220,772 |

0 |

327,772 |

||||||

Christopher Jones |

124,260 |

220,772 |

5,000 |

350,032 |

||||||

Marshall O. Larsen |

168,904 |

220,772 |

0 |

389,676 |

||||||

Gary A. Mecklenburg (4) |

40,311 |

0 |

5,000 |

45,311 |

||||||

David F. Melcher |

107,000 |

220,772 |

0 |

327,772 |

||||||

Willard J. Overlock, Jr. (4) |

35,667 |

0 |

0 |

35,667 |

||||||

Claire Pomeroy |

107,000 |

220,772 |

5,000 |

332,772 |

||||||

Rebecca W. Rimel |

107,000 |

220,772 |

0 |

327,772 |

||||||

Timothy M. Ring |

107,000 |

220,772 |

0 |

327,772 |

||||||

Bertram L. Scott |

130,452 |

220,772 |

0 |

351,224 |

||||||

___________________________________________

(1) |

Reflects cash retainer and Committee chair fees, and the Lead Director fee for Mr. Larsen. |

(2) |

Amounts reflect the grant date fair value under FASB ASC Topic 718 of restricted stock units awarded to non-management directors elected at the 2019 Annual Meeting of Shareholders. Since the average BD closing stock price for the 30 trading days prior to grant is used to value the award and determine the number of units granted, rather than the grant date stock price, the amounts reflected for the grant are higher than the $209,000 target award value. For a discussion of the assumptions made in arriving at the grant date fair value of these awards, see Note 8 to the consolidated financial statements that are included in our Annual Report on Form 10-K for the fiscal year ended September 30, 2019. |

Listed below are the aggregate outstanding restricted stock unit awards held by the persons listed above at the end of fiscal year 2019. The amounts shown include restricted stock units granted prior to January 2015 that are not distributable until the director leaves the Board.

Name |

Stock Awards Outstanding at September 30, 2019 (#) |

|

Catherine M. Burzik |

4,883 |

|

R. Andrew Eckert |

932 |

|

Claire M. Fraser |

18,092 |

|

Jeffrey W. Henderson |

932 |

|

Christopher Jones |

10,794 |

|

Marshall O. Larsen |

16,144 |

|

Gary A. Mecklenburg |

0 |

|

David F. Melcher |

4,418 |

|

Willard J. Overlock, Jr |

0 |

|

Claire Pomeroy |

2,345 |

|

Rebecca W. Rimel |

6,199 |

|

Timothy M. Ring |

17,897 |

|

Bertram L. Scott |

23,547 |

|

(3) |

Amounts shown represent matching gifts under BD’s Matching Gift Program. |

(4) |

Messrs. Mecklenburg and Overlock retired from the Board on January 22, 2019. |

Directors’ Deferral Plan

Directors may defer receipt of all or part of their annual cash retainer and other cash fees under the Directors’ Deferral Plan. Directors may also defer receipt of shares issuable to them under their restricted stock unit awards. A general description of the Directors’ Deferral Plan appears on page 55.

Communication with directors

Shareholders or other interested parties wishing to communicate with the Board, the non-management directors or any individual director (including complaints or concerns regarding accounting, internal accounting controls or audit matters) may do so by contacting the Lead Director either:

• |

by mail, addressed to BD Lead Director, P.O. Box 264, Franklin Lakes, New Jersey 07417-0264; |

• |

by calling the BD Ethics Help Line, an independent toll-free service, at 1-800-821-5452 (callers from outside North America should use “AT&T Direct” to reach AT&T in the U.S. and then dial the above toll-free number); or |

• |

by email to ethics_office@bd.com.

|

All communications will be kept confidential and promptly forwarded to the Lead Director, who shall, in turn, forward them promptly to the appropriate director(s). Such items that are unrelated to a director’s duties and responsibilities as a Board member may be excluded by our corporate security department, including, without limitation, solicitations and advertisements, junk mail, product-related communications, job referral materials and resumes, surveys, and material that is determined to be illegal or otherwise inappropriate.

CORPORATE GOVERNANCE

Corporate Governance Principles

BD’s commitment to good corporate governance is embodied in our Corporate Governance Principles (the "Governance Principles"). The Governance Principles set forth the Board’s views and practices regarding a number of governance topics, and the Governance Committee assesses the Governance Principles on an ongoing basis in light of current practices. The Governance Principles are available on BD’s website at www.bd.com/investors/corporate_governance/. Printed copies of the Governance Principles may be obtained, without charge, by contacting the Corporate Secretary, Becton, Dickinson and Company, 1 Becton Drive, Franklin Lakes, New Jersey 07417-1880; telephone 201-847-6800.

Board leadership structure

The Board’s goal is to achieve the best board leadership structure for effective oversight and management of BD’s affairs. The Board believes there is no single, generally accepted approach to providing effective board leadership, and that each leadership structure must be considered in the context of the individuals involved and the specific circumstances facing a company. Accordingly, what the Board believes is the right board leadership structure for BD may vary as circumstances warrant.

Currently, our CEO, Mr. Forlenza, also serves as Chairman. The Board believes this is the most effective leadership structure for BD at this time, as this combined role allows one person to speak for and lead BD and the Board, creates clear lines of authority and accountability, and provides the necessary leadership to execute BD’s strategy. Mr. Forlenza will continue to serve as Chairman after Mr. Polen becomes our CEO following the conclusion of the 2020 Annual Meeting. The Board believes that having Mr. Forlenza remain as Chairman during this CEO transition is in the best interests of BD, as it allows Mr. Polen to dedicate himself to BD's operations while Mr. Forlenza focuses on Board-related matters.

The Governance Principles provide for the appointment of a Lead Director from among the Board's independent directors whenever the Chairman is not independent. The Lead Director role allows the non-management directors to provide effective, independent Board leadership and oversight of management. Marshall O. Larsen has served as Lead Director since January 2015.

Under the Governance Principles, the Lead Director:

• |

presides over all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors, and at such other times as the Board deems appropriate, |

• |

has the authority to call meetings of the independent directors, |

• |

approves Board meeting agendas and information provided to the Board, |

• |

approves Board meeting schedules to ensure that there is sufficient time for discussion of all agenda items, |

• |

coordinates the evaluation of the performance of the CEO by the non-management directors, |

• |

serves as a liaison between the non-management members of the Board and the Chairman, and as a contact person to facilitate communications by BD’s employees, shareholders and others with the non-management members of the Board, and |

• |

if requested by major shareholders, ensures that he or she is available for consultation and direct communication. |

The Board believes that having an independent Lead Director provides independent Board oversight of management, including risk oversight, while avoiding the risk of confusion regarding the Board’s oversight responsibilities and the day-to-day management of the business.

Board’s oversight of risk

Role of the Board and Committees. BD’s management engages in a process referred to as enterprise risk management (“ERM”) to identify, assess, manage and mitigate a broad range of risks across BD’s businesses, regions and functions, and to ensure alignment of our risk assessment and mitigation efforts with BD’s corporate strategy. The Audit Committee, through the authority delegated to it by the Board, is primarily responsible for overseeing BD’s ERM activities. At least twice a year, senior management reviews the results of its ERM activities with the Audit Committee, including the process used within the organization to identify risks, management’s assessment of the significant categories of risk faced by BD (including any changes in such assessment since the last review), and management’s plans to mitigate potential exposures. The significant risks identified through BD’s ERM activities and the related mitigation plans are also reviewed with the full Board at least once a year. In addition, particular risks are often reviewed in-depth with the Audit Committee or the full Board.

The full Board also reviews the risks associated with BD’s strategic plan and discusses the appropriate levels of risk in light of BD’s business objectives. This is done through an annual strategy review process, and from time-to-time throughout the year as part of the Board’s ongoing review of corporate strategy. The full Board also regularly oversees other areas of potential risk, including BD’s capital structure, acquisitions and divestitures, and succession planning for BD’s CEO and other members of senior management.

The various Committees of the Board are also responsible for monitoring and reporting to the full Board on risks associated with their respective areas of oversight. The Audit Committee, among other things, oversees BD’s accounting and financial reporting processes and the integrity of BD’s financial statements, BD’s ethics and compliance program, and its hedging activities and insurance coverages. The QRC oversees matters relating to regulatory compliance and the quality and safety of BD’s products and services. The Compensation Committee oversees risks associated with BD’s compensation practices and programs, the SMIT Committee reviews risks relating to our innovation and product development and commercialization activities, and the Governance Committee oversees risks relating to BD’s corporate governance practices, including director independence, related person transactions and conflicts of interest. In connection with its oversight responsibilities, each Committee often meets with the members of management who are primarily responsible for the management of risk in their respective areas, including, among others, BD’s Chief Financial Officer ("CFO"), Chief Human Resources Officer, Chief Medical Officer, General Counsel, and senior regulatory, information technology, R&D and compliance officers.

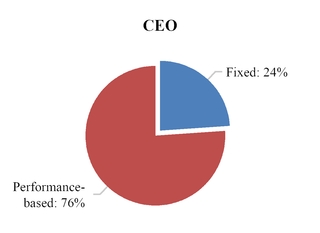

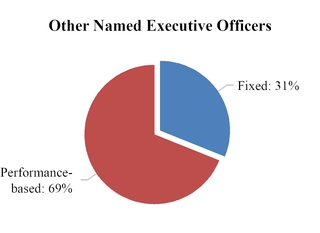

Risk assessment of compensation programs. With respect to our compensation policies and practices, BD’s management has reviewed our policies and practices to determine whether they create risks that are reasonably likely to have a material adverse effect on BD. In connection with this risk assessment, management reviewed the design of BD’s compensation and benefits programs (in particular, our performance-based compensation programs) and related policies, potential risks that could be created by the programs, and features of our programs that help mitigate risk. Among the factors considered were the mix of cash and equity compensation, and of fixed and variable compensation, paid to our associates; the balance between short- and long-term objectives in our incentive compensation; the performance targets, mix of performance metrics, vesting periods, threshold performance requirements and funding formulas related to our incentive compensation; the degree to which programs are formulaic or provide discretion to determine payout amounts; caps on payouts; our clawback and share retention and ownership policies; and our general governance structure. Based on this review, we believe that our compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on BD.

Director nomination process

Role of the Governance Committee

The Governance Committee reviews potential director candidates and recommends nominees for director to the full Board for its consideration. In making its recommendations, the Governance Committee assesses the overall composition of the Board, including diversity, skills, background, experience and prominence in areas of importance to BD. The Board seeks to achieve among its members a diversity of viewpoint, experience, knowledge, ethnicity and gender that fits the current and future needs of the Board.

It is the Governance Committee’s policy to consider referrals of prospective director nominees for the Board from other Board members and management, as well as shareholders and other external sources, such as retained executive search firms. The Governance Committee seeks to identify a diverse range of qualified candidates, including, without limitation, women and minority candidates. The Governance Committee utilizes the same criteria for evaluating candidates, irrespective of their source.

When considering potential director candidates, the Governance Committee will seek individuals with backgrounds and qualities that, when combined with those of BD’s other directors, provide a blend of skills and experience that will further enhance the Board’s effectiveness. The Governance Committee believes that any nominee for director that it recommends must meet the following minimum qualifications:

• |

Candidates should be persons of high integrity who possess independence, forthrightness, inquisitiveness, good judgment and strong analytical skills. |

• |

Candidates should demonstrate a commitment to devote the time required for Board duties, including, but not limited to, attendance at meetings. |

• |

Candidates should be team-oriented and committed to the interests of all shareholders as opposed to those of any particular constituency. |

The Governance Committee assesses the characteristics and performance of incumbent director nominees against the above criteria as well, and, to the extent applicable, considers the impact of any change in the principal occupations of such directors during the last year. To aid in this process, the Governance Committee solicits feedback on each incumbent director from all the other members of the Board. Upon completion of its assessment, the Governance Committee reports its recommendations for nominations to the full Board.

Shareholder recommendations

To recommend a candidate for consideration by the Governance Committee, a shareholder should submit a written statement of the qualifications of the proposed nominee, including full name and address, to the Corporate Secretary, Becton Dickinson and Company, 1 Becton Drive, Franklin Lakes, New Jersey 07417-1880.

Proxy access nominations

BD has a “proxy access” by-law, which permits eligible shareholders to nominate director candidates for inclusion in BD’s proxy statement and proxy card. Our proxy access by-law provides that a shareholder (or a group of up to 20 shareholders) owning 3% or more of BD’s outstanding common stock for at least three years can nominate up to two individuals or 20 percent of the Board, whichever is greater, for election at an annual meeting of shareholders, subject to the relevant requirements in our By-Laws.

Other significant governance practices

Described below are some of the other significant corporate governance practices at BD.

Annual election of directors

BD’s directors are elected annually. The Board believes that annual elections of directors reflect a corporate governance best practice, as it provides shareholders the opportunity to express their views on director performance each year.

Voting for directors

Under our By-Laws, in uncontested elections (that is, where the number of nominees does not exceed the number of directors to be elected), nominees for director must receive the affirmative vote of a majority of the votes cast in order to be elected to the Board. Any incumbent director who receives a greater number of votes “against” the director’s election than votes “for” is required to offer to submit his or her resignation to the Board following the shareholder vote. The Governance Committee will consider and recommend to the Board whether to accept the resignation offer. The Board will act on such recommendation and publicly disclose its decision within 90 days following the shareholder vote. This process allows the Board the opportunity to identify and assess the reasons for the vote, including whether the vote is attributable to dissatisfaction with a director’s overall performance or is the result of shareholder views on a particular issue, and enables the Board to avoid undesirable and disruptive governance consequences.

Board self-evaluation

The Board believes a rigorous self-evaluation process is important to the ongoing effectiveness of the Board. To that end, each year the Board conducts a self-evaluation of its performance. The self-evaluation addresses the Board’s composition, Board culture, committee structure, the Board’s relationship with management, Board meetings, the Board’s oversight of strategy and risk, and other Board-related topics. The results of the self-evaluation are presented by the chair of the Governance Committee to the full Board. As part of the evaluation, the Board assesses the progress in the areas targeted for improvement a year earlier, and develops actions to be taken to enhance the Board’s effectiveness over the next year. Each Committee conducts an annual self-evaluation of its performance through a similar process.

Equity ownership by directors

The Board believes that directors should hold meaningful equity ownership positions in BD. To that end, a significant portion of non-management director compensation is in the form of equity awards. The Board believes that this helps to further align the interests of the non-management directors with our shareholders. Under the Board’s share ownership guidelines, each non-management director is required to own shares of BD common stock (which includes restricted stock units) valued at five times the annual cash retainer and must comply with the guidelines within three years of joining the Board. All of our non-management directors have achieved the required share ownership or are within the three-year grace period.

Shareholder engagement

Our relationship with our shareholders and their views about BD are important to us, and the Board recognizes the value of director engagement with BD’s shareholders. To that end, the Board has established a process by which shareholders can request direct engagement with our non-management directors regarding executive compensation, corporate governance, board and CEO succession, risk management oversight and other matters within the purview of the Board. This process can be found on our website at www.bd.com/investors/corporate_governance/. The Board may also initiate direct communications with BD shareholders at any time, in its discretion.

Annual Report of Charitable Contributions

In furtherance of BD’s commitment to good governance and transparent disclosure practices, the Governance Principles provide that BD’s charitable contributions or pledges in an aggregate amount of $50,000 or more in any fiscal year (excluding contributions under BD’s Matching Gift Program) to entities with which BD’s directors and executive officers, or their families, are affiliated must be approved by the Governance Committee. In addition, BD posts on its website, at www.bd.com/investors/corporate_governance/, an Annual Report of Charitable Contributions (the “Contributions Report”) listing all contributions and pledges made by BD during the preceding fiscal year in an amount of $10,000 or more to such affiliated organizations. The Contributions Report includes a discussion of BD’s contributions philosophy and the alignment of BD’s philanthropic activities with this philosophy.

Enterprise compliance

Under the oversight of the Audit Committee, BD’s enterprise compliance function seeks to ensure that BD has policies and procedures designed to prevent and detect violations of the many laws, regulations and policies affecting our business, and that BD continuously encourages lawful and ethical conduct. BD’s enterprise compliance function supplements the various compliance and ethics functions that are also in place at BD, and seeks to ensure better coordination and effectiveness through program design, prevention, and promotion of an organizational culture of compliance. A committee comprised of members of senior management oversees these activities. Another key element of this program is training. This includes a global on-line compliance training program focused on BD’s Code of Conduct, as well as other courses covering various compliance topics such as antitrust, anti-bribery, conflicts of interest, financial integrity, industry marketing codes and information security.

Political contributions

We prohibit the use of BD corporate funds to support any candidate, political party, ballot measure or referendum campaign, unless an exception is approved by the CEO and the General Counsel. To date, no exceptions have been sought or approved. If an exception is approved, it may only be granted without regard to the personal political affiliations or views of any individual BD associate at any level across the organization.

As permitted under U.S. law, BD operates a political action committee. The BD PAC allows eligible U.S. associates to voluntarily support candidates for elected office who share BD’s perspectives and approaches to public policy issues. BD provides administrative support to the BD PAC, as permitted under federal law.

In all cases, BD policy prohibits directors and employees from using company resources to promote their personal political views, causes or candidates, and specifies that the company will not directly or indirectly reimburse any personal political contributions or expenses.

BD is a member of numerous trade associations that provide a venue for the medical technology sector to work together to advocate positions on issues that impact our industry. In the U.S., the major associations of which BD is a member include AdvaMed and AdvaMedDx, the Healthcare Institute of New Jersey and the California Life Sciences Association. We have informed our major U.S. trade associations that they are not permitted to use any BD fees to support any candidate, political party, ballot measure or referendum campaign, unless approved by BD’s CEO and General Counsel.

Director independence; Policy regarding related person transactions

Director independence

Under the NYSE rules and our Governance Principles, a director is not independent if the director has a direct or indirect material relationship with BD (other than his or her relationship as a director). The Governance Committee annually reviews the independence of all directors and nominees for director and reports its findings to the full Board. To assist in this review, the Board has adopted director independence guidelines (“Independence Guidelines”) that are contained in the Governance Principles. The Independence Guidelines set forth certain categories of relationships (and related dollar thresholds) between BD and directors or their immediate family members, or entities with which they have a relationship, which the Board has judged to be immaterial for purposes of assessing a director’s independence (referred to as the "safe harbor" provision). In the event that a director has any relationship with BD that is not addressed in the Independence Guidelines, the independent members of the Board review the facts and circumstances to determine whether such relationship is material.

The Board has determined that all of our non-management director nominees (Catherine M. Burzik, R. Andrew Eckert, Claire M. Fraser, Jeffrey W. Henderson, Christopher Jones, Marshall O. Larsen, David F. Melcher, Claire Pomeroy, Rebecca W. Rimel, Timothy M. Ring, and Bertram L. Scott) are independent under the NYSE rules and our Independence Guidelines:. Vincent A. Forlenza and Thomas E. Polen are employees of BD and, therefore, are not independent under the NYSE rules and the Independence Guidelines.

In determining that each of our non-management directors is independent, the Board reviewed BD’s transactions or other dealings with organizations with which a director has a relationship, such as service by the director as an employee of the organization or as a member of its governing or advisory board. Based on its review, the Board determined that, in each instance, the relationship fell within the safe harbor provision, or that the nature of the relationship, the degree of the director’s involvement with the organization and the amount involved was such that it would not otherwise constitute a material relationship or impair the director’s independence. The types of transactions with director-affiliated organizations considered by the Board consisted of the purchase or sale of products and/or services (in the cases of directors Burzik, Eckert, Fraser, Jones, Larsen, Pomeroy, Ring and Scott), the licensing of intellectual property rights (in the cases of directors Fraser and Jones), an equity investment (in the case of Mr. Ring), and charitable contributions (in the case of Mr. Scott).

Related person transactions

The Board has established a written policy (the “Policy”) requiring approval or ratification of transactions involving more than $120,000 per year in which a director, executive officer or shareholder owning more than 5% of BD’s outstanding common stock (excluding passive investors that own less than 20%) or their immediate family members has, or will have, a material interest. The Policy is available on BD’s website at www.bd.com/investors/corporate_governance/. The Policy excludes certain specified transactions, including transactions available to BD associates generally. The Governance Committee is responsible for the review and approval or ratification of transactions subject to the Policy. The Governance Committee will approve or ratify only those transactions that it determines in its business judgment are fair and reasonable to BD and in (or not inconsistent with) the best interests of BD and its shareholders, and that do not impact the director’s independence.

During 2019, BD did not engage in any transactions involving members of the Board or BD's executive officers that were subject to the Policy. BD engaged a unit of Fidelity, which beneficially owns 5% of BD’s common stock, to serve as the record keeper of certain BD plans, for which services BD paid approximately $847,000. This transaction was not required to be approved under the Policy because Fidelity is considered a passive investor in BD under the Policy.

Code of Conduct