DEF 14A: Definitive proxy statements

Published on December 14, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |||||||||||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||||||||

| ☑ | Definitive Proxy Statement | |||||||||||||

| ☐ | Definitive Additional Materials | |||||||||||||

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |||||||||||||

| (Name of Registrant as Specified In Its Charter) | ||||||||||||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||||||||||||

| Payment of Filing Fee (Check all boxes that apply): | ||||||||||||||

| ☑ | No fee required. | |||||||||||||

| ☐ | Fee paid previously with preliminary materials. | |||||||||||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||||||||

|

Becton, Dickinson and Company

1 Becton Drive

Franklin Lakes, New Jersey 07417-1880

www.bd.com

|

|||||||

|

December 14, 2023

Dear fellow shareholders:

As advanced technology and innovation continue to redefine the future of industries, BD is accelerating the integration of robotics, AI, automation and other technologies that have the potential to transform care. Our teams are harnessing this power to deliver innovations that make healthcare simpler, more connected and more accessible.

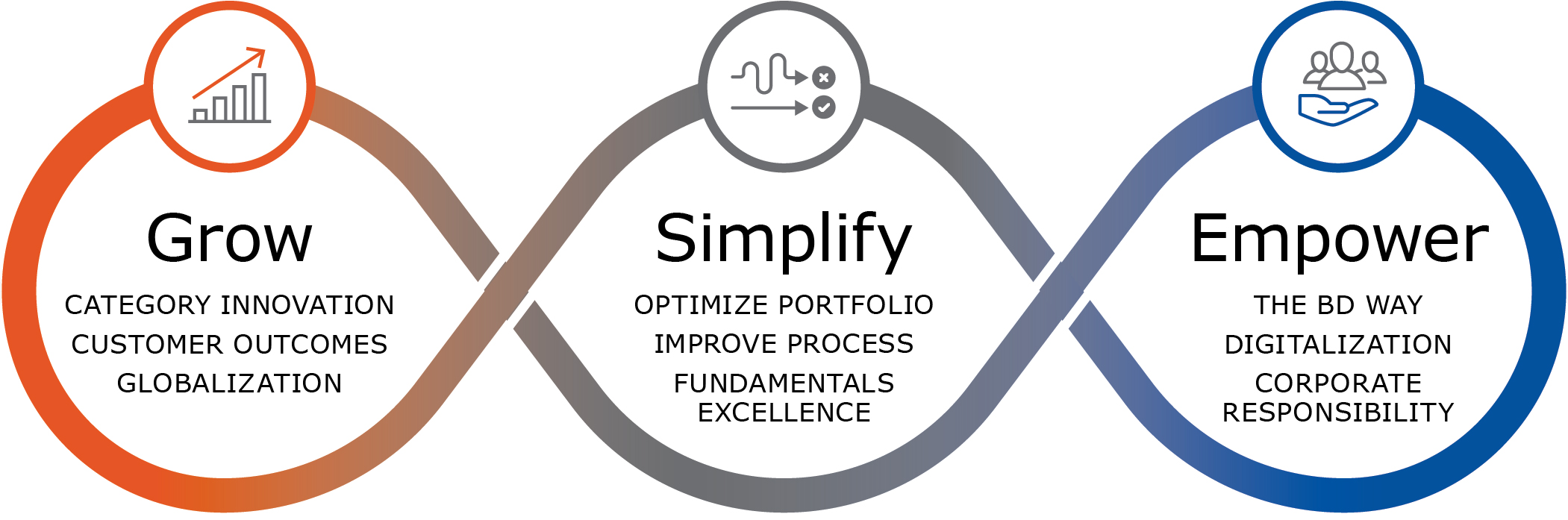

In fiscal year 2023, we delivered another year of consistent performance as a result of continued execution on our BD 2025 strategy to Grow, Simplify and Empower our company. This strategy is fueling our acceleration into a more innovative, agile MedTech leader that is making great contributions to society, delivering great performance and confirming BD is a great place to work.

Through our focus on execution, we are repositioning BD into higher-growth markets and achieving consistent, strong financial performance, as we seek to deliver sustained value for all stakeholders through challenging macroenvironments.

Our growth strategy has led to new innovations that benefit researchers, providers and patients, and our differentiated medical technologies are improving the efficiency of healthcare and the lives of patients around the world. Notably, we delivered on our top priority as a company – obtaining 510(k) clearance for the updated BD Alaris™ Infusion System – bringing this best-in-class device to our customers and their patients who rely on us. We launched 27 new products this year, completed the integration of Parata Systems – which is now part of our Pharmacy Automation business – and are helping to discover new treatments and insights through technologies like BD FACSDiscoverTM S8 Cell Sorter. We are also empowering the delivery of new biologics, such as the growing drug class of GLP-1s for diabetes and weight loss, delivered through our injection solutions.

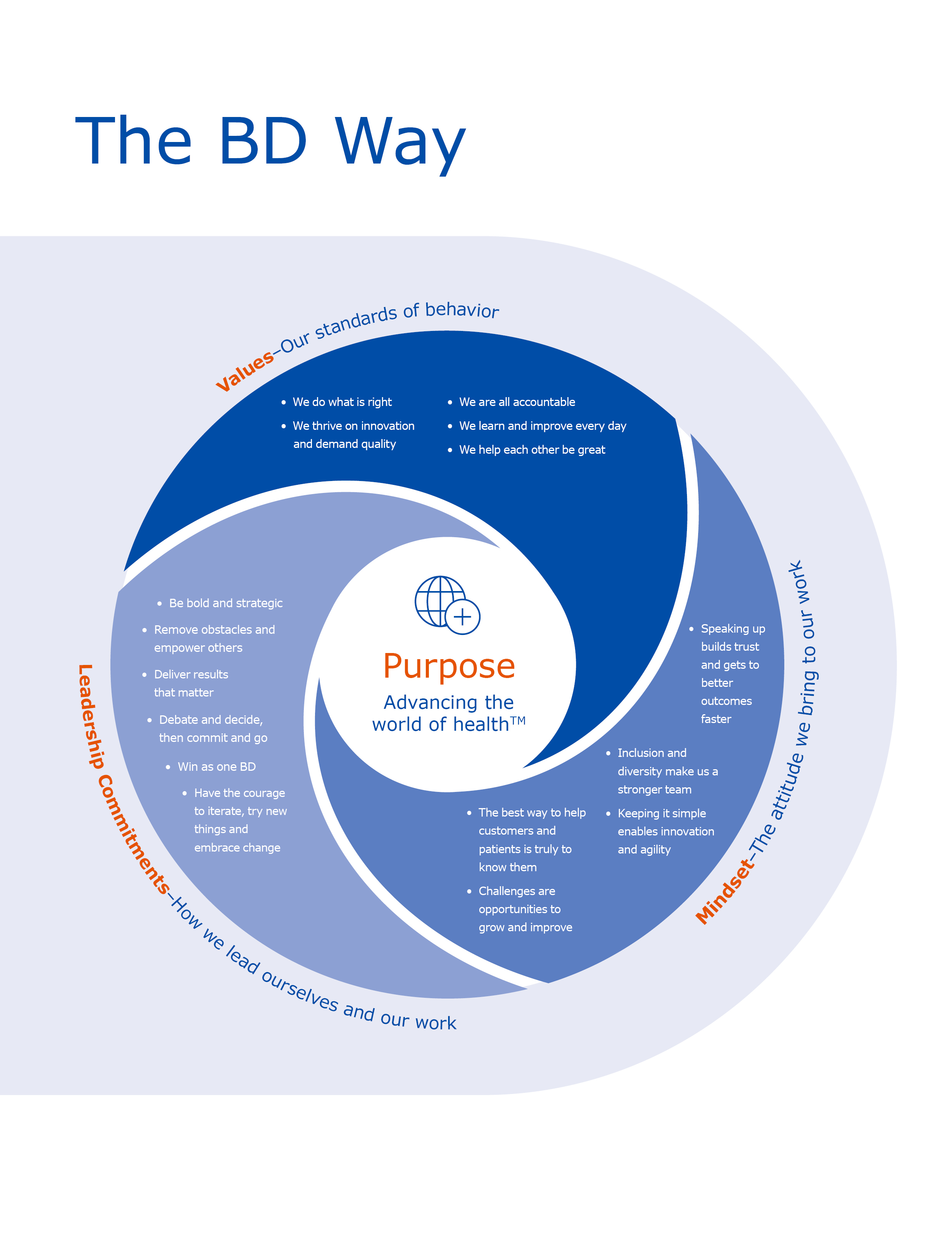

Integral to our success is our cultural foundation, The BD WAY, and our passion to deliver on our purpose of advancing the world of health™. This year, we made meaningful and measurable progress on our environmental, social and governance (ESG) strategy, Together We Advance, from reducing our environmental footprint and addressing the sustainability needs of our customers, to empowering our diverse and thriving workforce. We continue to address health disparities by advancing health equity in under-resourced areas of the world. We have an opportunity to not just develop meaningful healthcare technologies, but to help make these innovations available to people regardless of geography, demographics or socioeconomic status.

Behind these achievements is the dedication of our more than 70,000 global associates whose brilliance, passion and hard work is bringing life-changing products and solutions to patients and providers in every corner of the world, every day.

As we look ahead, we will remain disciplined in executing BD 2025, advancing impactful innovation and our shift into higher growth markets, accelerating our cost leadership, and continuing to deliver on quality and service excellence. We will maintain our disciplined and balanced capital deployment framework, which allows us to support investments in growth while returning capital to shareholders, and seek to continue our long-standing recognition as a member of the S&P 500 Dividend Aristocrats Index, having announced our 52nd consecutive year of dividend increases. I’m confident that we’re advancing in the right areas to capitalize on the opportunities ahead, position ourselves well for sustained performance and contribute meaningfully to healthcare globally.

Thank you for your continued support of BD. We look forward to your participation in the 2024 Annual Meeting of Shareholders.

Sincerely,

Tom Polen

Chairman, Chief Executive Officer and President

|

||||

| 2024 Notice of Annual Meeting and Proxy Statement | 1 |

||||

Table of contents

2 |

|

||||

Notice of annual meeting of shareholders

| Date: | January 23, 2024 |

||||

| Time: | 1:00 p.m. Eastern Standard Time |

||||

| Location: |

The Breakers Palm Beach

1 South County Road

Palm Beach, Florida

|

||||

| Record Date: |

December 4, 2023

|

||||

The Annual Meeting of Shareholders of Becton, Dickinson and Company, a New Jersey corporation (“BD”), will be held on Tuesday, January 23, 2024, at 1:00 p.m. Eastern Standard Time ("EST"), at The Breakers Palm Beach, 1 South County Road, Palm Beach, Florida (the “2024 Annual Meeting”).

At the 2024 Annual Meeting, shareholders will consider and act upon the following proposals:

| 1. | The election as directors of the eleven nominees named in the attached proxy statement for a one-year term | ||||

| 2. | The ratification of the selection of the independent registered public accounting firm | ||||

| 3. | An advisory vote to approve named executive officer compensation | ||||

We will also transact such other business as may properly come before the meeting, or any adjournment or postponement thereof.

Shareholders of record as of the close of business on December 4, 2023 are entitled to notice of and to vote at the 2024 Annual Meeting (or any adjournment or postponement thereof). These proxy materials are being mailed or otherwise sent to shareholders of BD on or about December 14, 2023.

By order of the Board of Directors,

Gary DeFazio

Senior Vice President and Corporate Secretary

Senior Vice President and Corporate Secretary

| How To Vote | ||||||||

|

|

|

||||||

| By Mail | By Telephone | Online | ||||||

| Sign, complete and return the proxy card in the postage-paid envelope provided |

1-800-652-8683 | www.envisionreports.com/BDX | ||||||

Important Notice Regarding the Availability of Proxy Materials for the 2024 Annual Meeting of Shareholders to be held on January 23, 2024: BD’s proxy statement and 2023 Annual Report to Shareholders, which includes BD’s consolidated financial statements, are available at www.edocumentview.com/BDX. | ||

| 2024 Notice of Annual Meeting and Proxy Statement | 3 |

||||

Proxy statement overview

This summary highlights information contained elsewhere in this proxy statement and does not contain all of the information that you should consider. You should read the entire proxy statement carefully before voting.

Proposals to be considered at the 2024 annual meeting

| Proposal | Board Recommendation | ||||||||||

| 1. | The election as directors of the eleven nominees named in the attached proxy statement for a one-year term |  |

FOR each of the nominees for director

|

||||||||

| 2. | The ratification of the selection of the independent registered public accounting firm |  |

FOR | ||||||||

| 3. | An advisory vote to approve named executive officer compensation |  |

FOR | ||||||||

BD is an innovative medtech leader with global reach and scale addressing healthcare’s most pressing challenges

|

190+

countries served

|

|

34B+

devices made annually

|

||||||||||||||||||||

|

~6% of sales

annual R&D investment

|

|

33,000+

active patents

|

||||||||||||||||||||

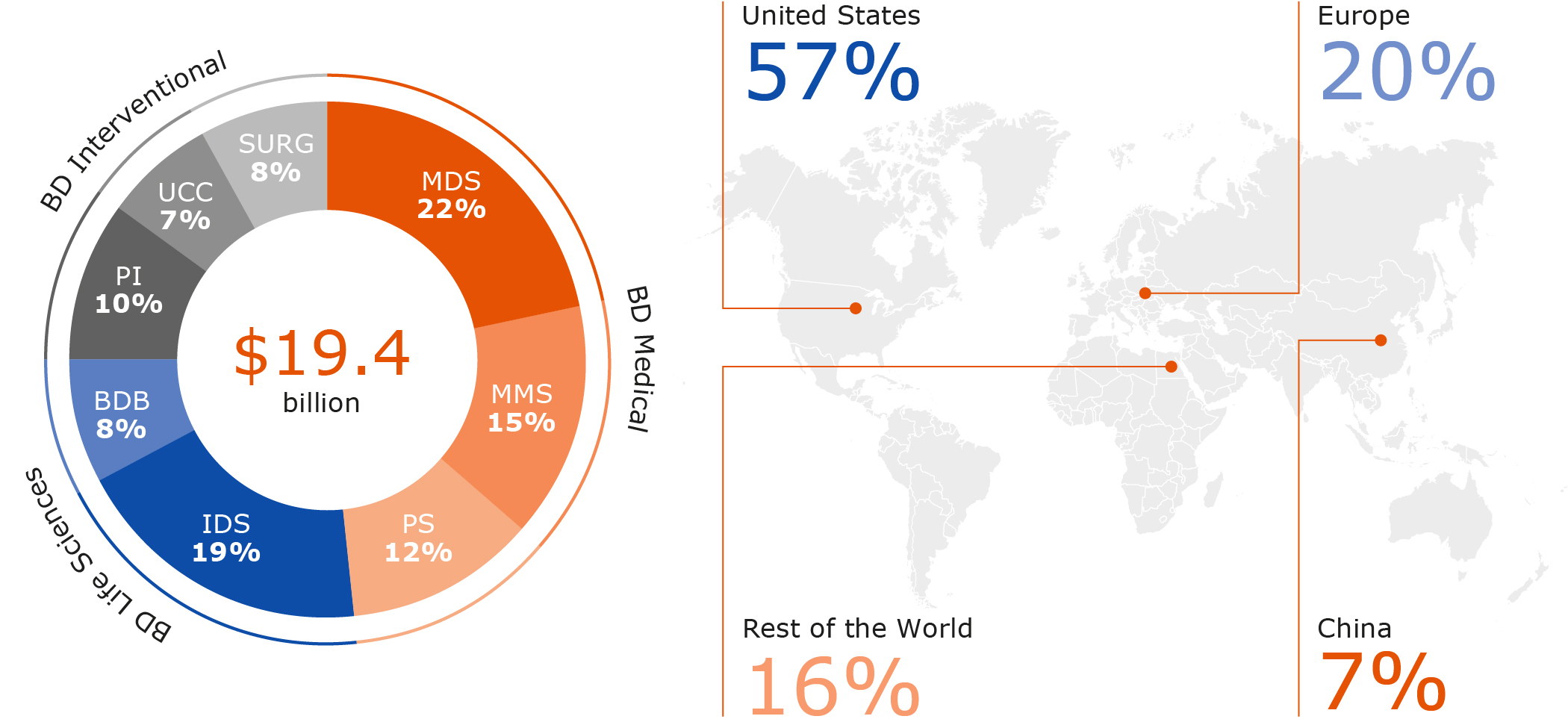

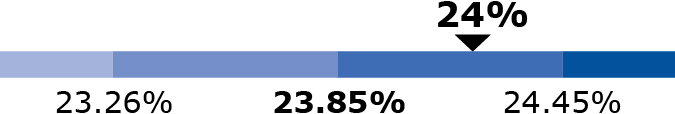

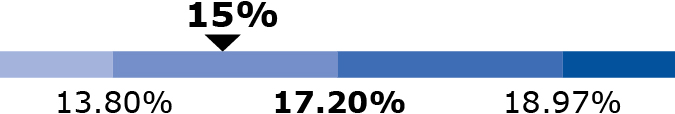

| FY23 Revenues by Segment | FY23 Revenues by Region | ||||

| |||||

Note: Percentages in above tables are rounded.

4 |

|

||||

Proxy statement overview

The BD 2025 strategy positions us to drive future value creation.

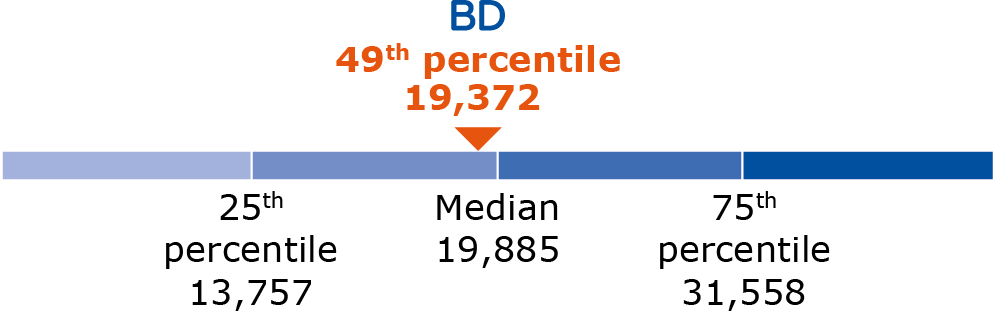

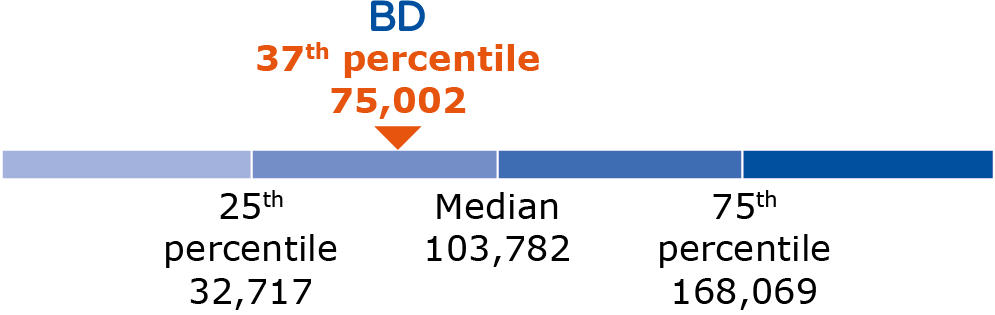

2023 financial performance*

|

$19.4B

Total Revenues

|

$5.10

Reported EPS

$12.21

Adjusted EPS

|

~$3.0B

Operating Cash Flow

|

||||||

Multi-year execution of BD 2025 strategy yields consistent growth and margin improvement |

Through our team’s focused execution, we drove significant margin expansion and delivered strong double-digit, currency-neutral, EPS growth, despite a challenging macroeconomic environment.

•Delivered on our number one priority – obtaining FDA clearance for the updated BD Alaris™ Infusion System.

•Significantly advanced our innovation pipeline, launching 27 key new products that benefit researchers, providers, and patients – integrating AI, robotics, and other advanced technologies.

•Reported FY23 revenues increased 2.7%, while base business revenues (which excludes COVID-19 only diagnostic testing)* increased 5.1% reported, and increased 7.0% currency-neutral*.

•Reported FY23 earnings per share ("EPS") from continuing operations was $5.10, and adjusted EPS from continuing operations* was $12.21.

|

||||

| Our disciplined and strategic capital allocation plan continues to provide value creation opportunities |

Purposeful and balanced investments help fuel growth, maintain financial flexibility and return capital to shareholders.

•R&D spending of $1.2 billion, to advance our pipeline of innovative programs that will support our strong growth profile in 2024 and beyond.

•Paid down approximately $700 million of long-term debt, pursuant to our balanced capital allocation framework and our commitment to reduce outstanding long-term debt.

•Ended year with a net leverage* ratio of 2.6 times - our strongest since 2021, which positions us well to capitalize on opportunities to accelerate our investment in higher-growth categories through our tuck-in M&A strategy.

•Returned approximately $1.1 billion to shareholders during the year through dividends, continuing our long-standing recognition as a member of the S&P 500 Dividend Aristocrats index.

|

||||

| Simplification of portfolio driving operational excellence and creating shareholder value |

•Successfully completed the divestiture of our former Surgical Instrumentation Platform, allowing for reallocation of resources towards more strategic, higher-growth areas.

•Progressed Project RECODE network and portfolio rationalization programs, having now streamlined our portfolio by 20% compared to 2019, achieving our goal laid out at our 2021 Investor Day two years early.

|

||||

* We refer above to certain financial measures that do not conform to generally accepted accounting principles ("GAAP"). Appendix A to this proxy statement contains reconciliations of these non-GAAP measures to the comparable GAAP financial measures. Financial information presented in the tables reflect BD’s results on a continuing operations basis.

| 2024 Notice of Annual Meeting and Proxy Statement | 5 |

||||

Proxy statement overview

ESG — Together We Advance

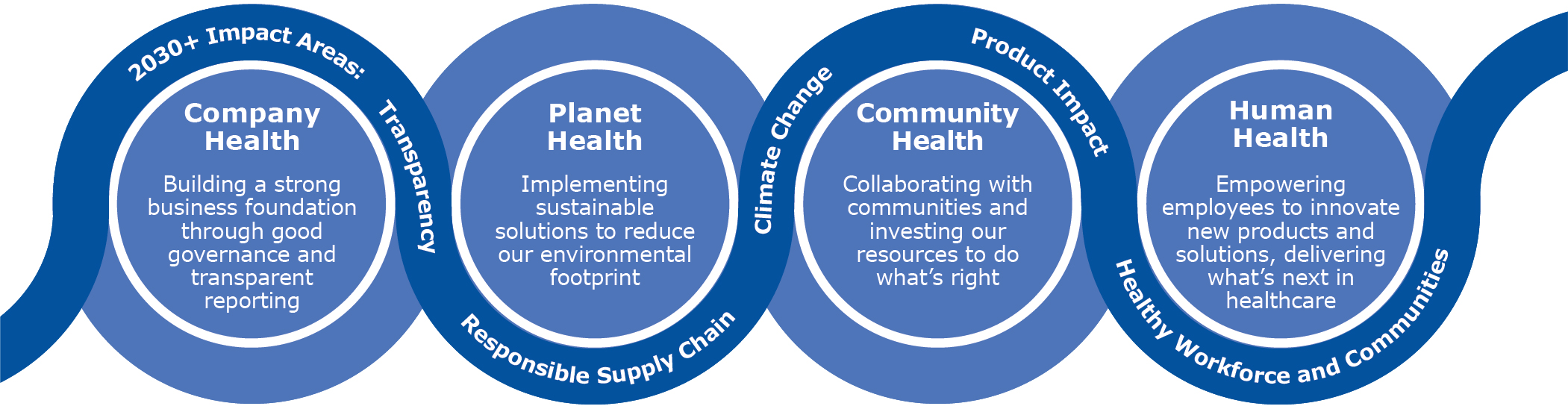

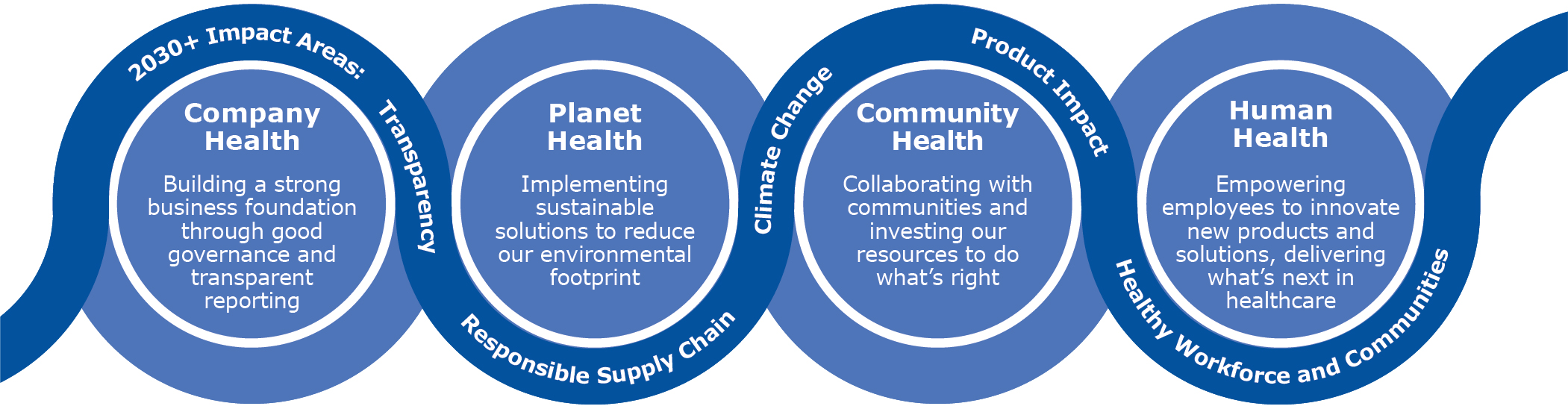

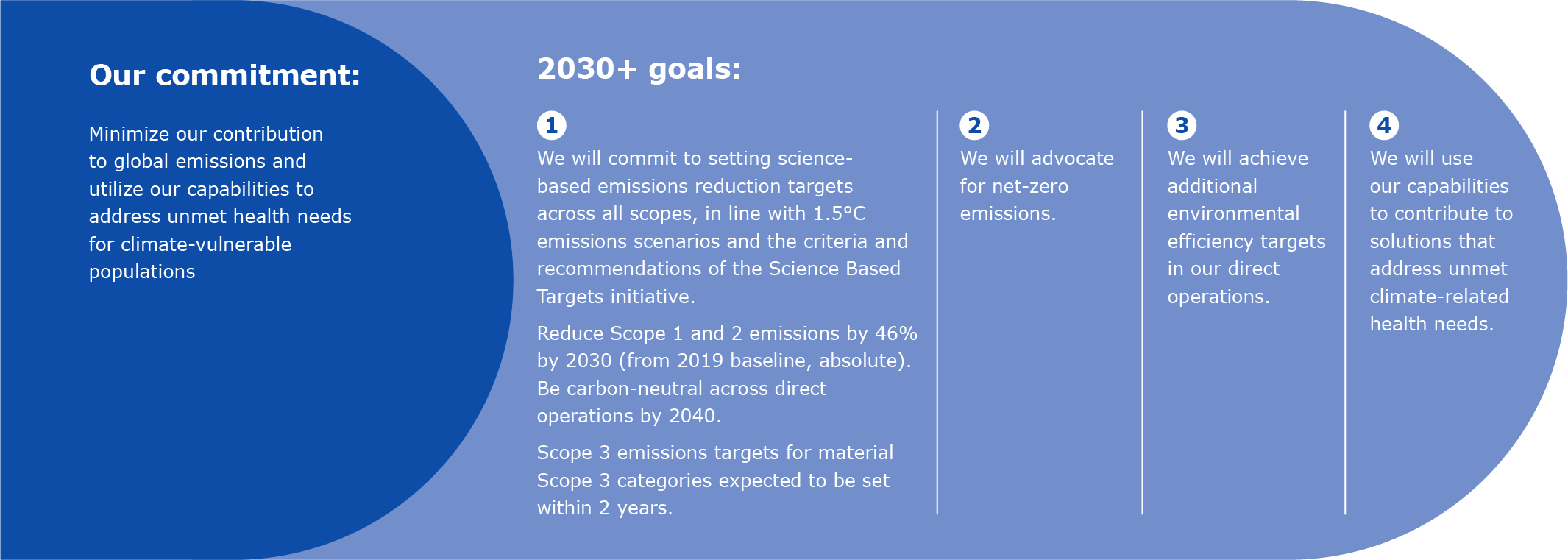

BD’s strategic initiative to advance environmental, social and governance (“ESG”) matters – Together We Advance – was launched in early fiscal year 2022. The Together We Advance initiative focuses on enhancing stewardship of the company, the planet, communities and human health, which serves as a framework through which BD addresses the most relevant ESG issues for BD and its stakeholders. BD has made commitments in five areas where we see the most opportunity to create meaningful change over the next decade: climate change, product impact, a responsible supply chain, a healthy workforce and community, and transparency. For more information regarding BD's ESG strategy and 2030+ ESG goals, see page 31 and our 2022 ESG Report, which is available at www.bd.com/en-us/about-bd/esg#sustainabiity. Our 2022 ESG Report is not part of, or incorporated by reference into, this proxy statement.

As part of our continued commitment to transparency and progress on driving inclusion and equity throughout the company, we publish our Global Inclusion, Diversity and Equity Report, which summarizes BD's inclusion, diversity and equity ("ID&E") accomplishments and highlights the ways that inclusion is central to our culture. Our most recently filed U.S. Federal Employment Information Report (EEO-1) and our latest Global Inclusion, Diversity and Equity Report are each available at www.bd.com/en-us/about-bd/esg#inclusiondiversityequity, which are not part of, or incorporated by reference into, this proxy statement. For additional information regarding our ID&E efforts, including pay equity, see page 34.

For additional information regarding our ESG Reports, see “Note About Website and ESG Reports,” on page 35.

6 |

|

||||

Proxy statement overview

Proposals to be considered at the 2024 annual meeting

|

Proposal

1

|

Election of directors | |||||||

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES FOR DIRECTOR. | |||||||

A more detailed discussion of this proposal and related disclosures can be found beginning on page 12.

Director Nominee Name |

Age | Director Since |

Committee Membership | |||||||||||||||||

| AC | CHCC | QRC | CGNC | |||||||||||||||||

|

William M. Brown

Former Chairman and Chief Executive Officer, L3Harris Technologies

|

61 | 2022 |  |

|

||||||||||||||||

|

Catherine M. Burzik

Former President and Chief Executive Officer, Kinetic Concepts, Inc.

|

73 | 2013 |  |

|

||||||||||||||||

|

Carrie L. Byington, M.D.

Special Adviser to the President, University of California Health

|

60 | 2021 |  |

|

||||||||||||||||

|

R. Andrew Eckert

Former Chief Executive Officer, Zelis Inc.

|

62 | 2016 |  |

|

||||||||||||||||

|

Claire M. Fraser, Ph.D.

Founding Director, Institute for Genome Sciences

|

68 | 2006 |  |

|

||||||||||||||||

|

Jeffrey W. Henderson

Former Chief Financial Officer, Cardinal Health Inc.

|

59 | 2018 |  |

|

||||||||||||||||

|

Christopher Jones

Former Chief Executive Officer, JWT Worldwide

|

68 | 2010 |  |

|

||||||||||||||||

|

Thomas E. Polen

Chairman, Chief Executive Officer and President, BD

|

50 | 2020 | ||||||||||||||||||

|

Timothy M. Ring

Former Chairman and Chief Executive Officer, C. R. Bard, Inc.

|

66 | 2017 |  |

|

||||||||||||||||

|

Bertram L. Scott

Former Chief Executive Officer, Affinity Health Plan

|

72 | 2002 |  |

|

||||||||||||||||

|

Joanne Waldstreicher, M.D.

Former Chief Medical Officer, Johnson & Johnson

|

63 | 2023 |  |

|

||||||||||||||||

|

AC – Audit Committee

CHCC – Compensation and Human Capital Committee

QRC – Quality and Regulatory Committee

CGNC – Corporate Governance and Nominating Committee

|

|

Chair | |||||||||

|

Member | ||||||||||

|

Independent | ||||||||||

|

Lead Director | ||||||||||

| 2024 Notice of Annual Meeting and Proxy Statement | 7 |

||||

Proxy statement overview

Nominee snapshot

| Tenure | Age | ||||||||||

> 10 years |

|

≥ 70 years |  |

||||||||

| 5-10 years |  |

61-69 years |  |

||||||||

| < 5 years |  |

≤ 60 years |  |

||||||||

|

7.9 years

(average director tenure)

|

63.8 years old

(average director age)

|

||||||||||

Nominee representation

Total Number of Nominees: 11

| Female | Male | |||||||

| Director Nominees | 4 | 7 | ||||||

| Number of Director Nominees who identify in Any of the Categories | ||||||||

| African American or Black | — | 1 | ||||||

| Alaska Native or Native American | — | — | ||||||

| Asian | — | — | ||||||

| Hispanic, Latino or Spanish Origin | 1 | — | ||||||

| Native Hawaiian or Other Pacific Islander | — | — | ||||||

| White | 3 | 6 | ||||||

| Other | — | — | ||||||

| Two or More Races or Ethnicities | — | — | ||||||

| Did not Disclose Demographic Background | — | — | ||||||

8 |

|

||||

Proxy statement overview

Governance best practices

BD’s commitment to good corporate governance is embodied in our Statement of Corporate Governance Principles ("Governance Principles"). The Governance Principles set forth the BD Board of Director’s views and practices regarding a number of governance topics, and the Corporate Governance and Nominating Committee (the "Governance Committee") assesses the Governance Principles on an ongoing basis in light of current best practices.

The following is a summary of our significant corporate governance practices. A further discussion of our governance practices can be found beginning on page 36.

| Corporate Governance Practices | ||

|

•Annual election of directors

•Majority voting standard for election of directors

•10 out of 11 director nominees are independent

•Robust lead director structure

•Rigorous annual board self-evaluation and director renomination process

•Shareholder right to call special meetings

•Proxy access bylaw

•Shareholder right to act by written consent

•Restrictions on corporate political contributions

•Annual report of charitable contributions

•Director and executive officer share ownership requirements

•Overboarding policy

•No poison pill

•Active shareholder engagement process

•Mandatory director retirement policy

•Robust director orientation and education process

| ||

|

Proposal

2

|

Ratification of selection of independent registered public accounting firm | |||||||

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 2. | |||||||

Ernst & Young LLP (“E&Y”) has been selected by the Audit Committee as the Company’s independent registered public accounting firm (referred to herein as the “independent auditors”) for fiscal year 2024. The Audit Committee is solely responsible for the appointment, compensation, retention and oversight of BD’s independent auditors. Shareholders are being asked to ratify the Audit Committee’s selection of E&Y. If ratification is withheld, the Audit Committee will reconsider its selection.

A representative of E&Y is expected to attend the 2024 Annual Meeting to respond to appropriate questions and will have the opportunity to make a statement.

| 2024 Notice of Annual Meeting and Proxy Statement | 9 |

||||

Proxy statement overview

|

Proposal

3

|

Advisory vote to approve named executive officer compensation | |||||||

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 3. | |||||||

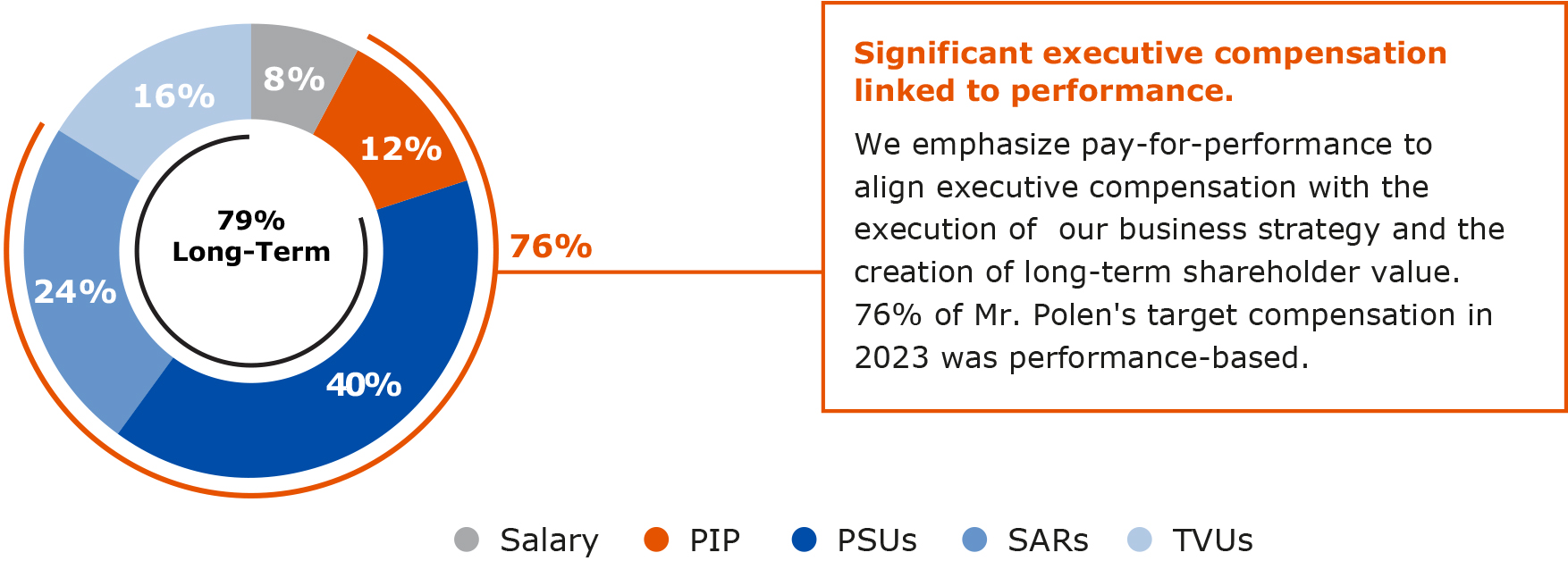

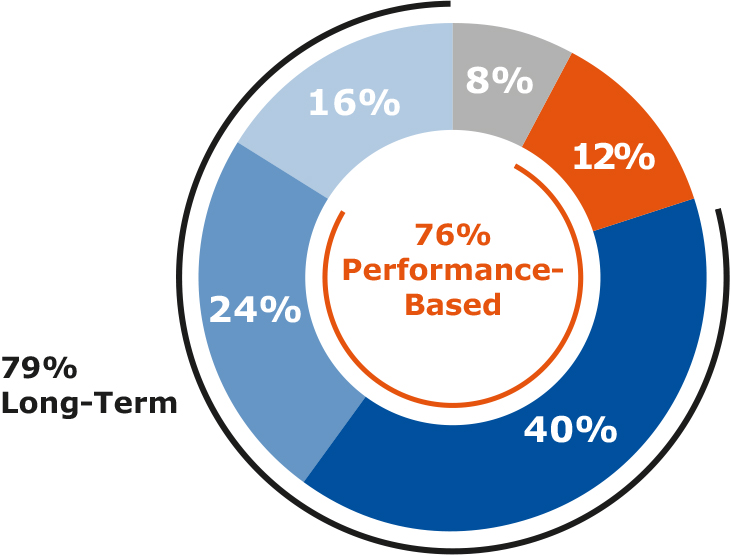

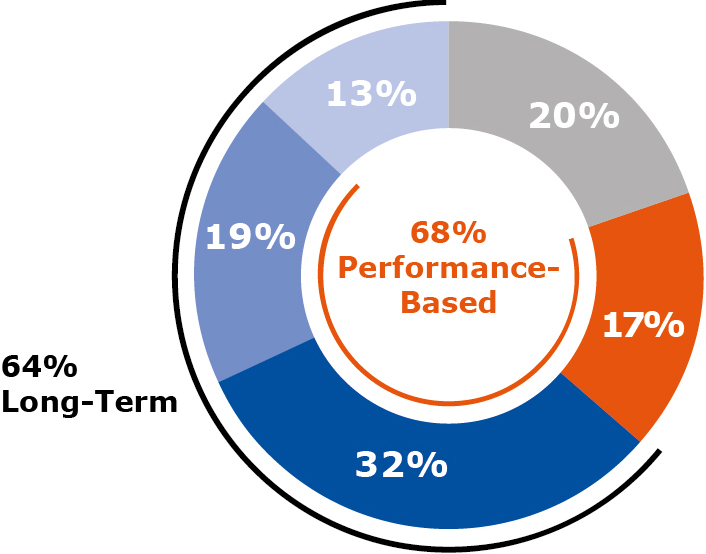

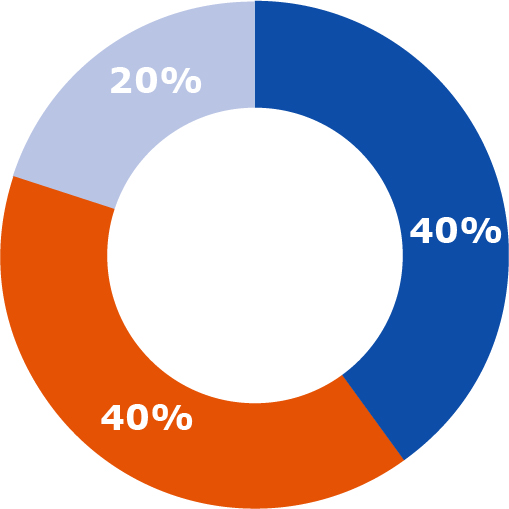

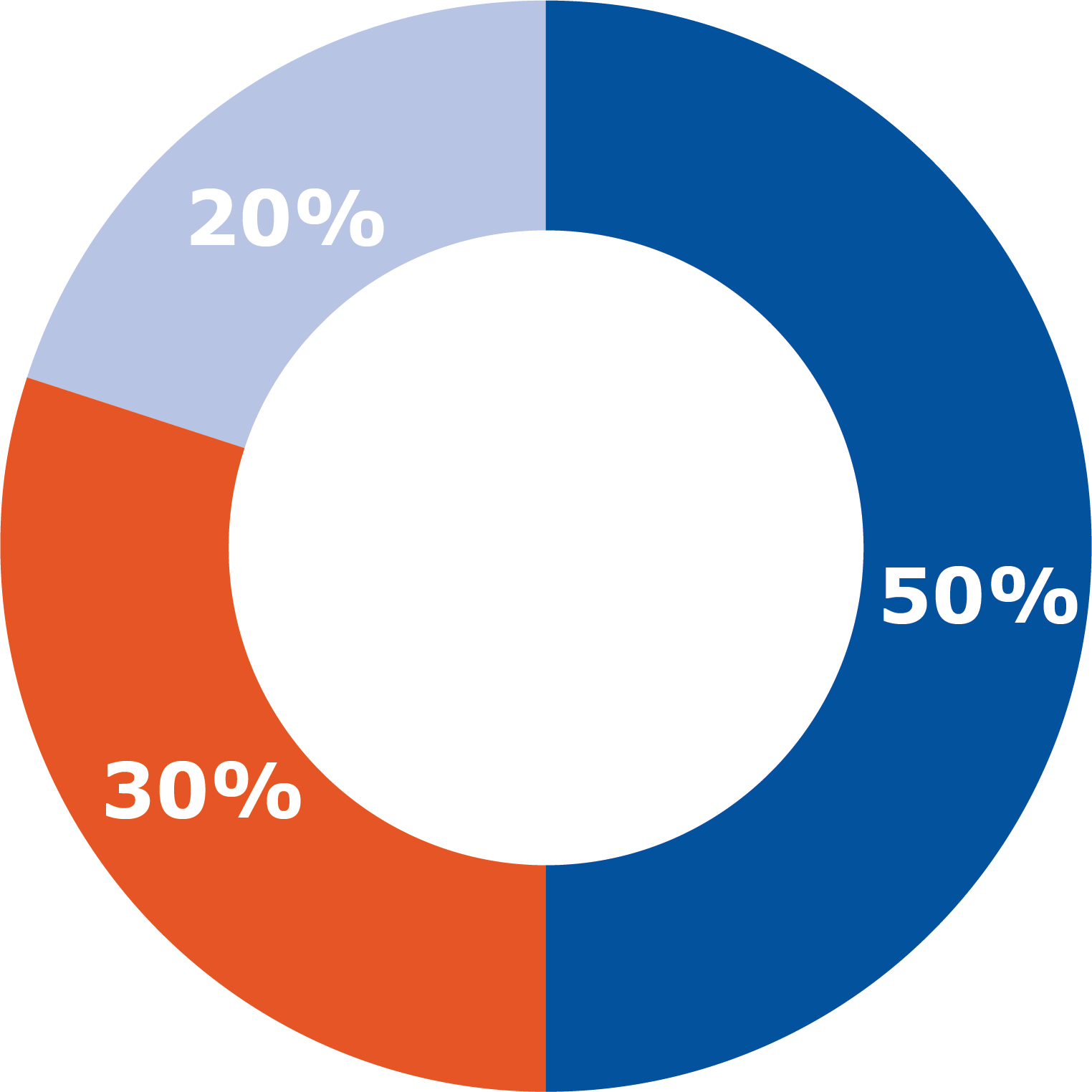

The Compensation and Human Capital Committee (the "Compensation Committee") believes the primary objective of the BD compensation program is to fully support the strategic business goal of delivering superior long-term shareholder returns through sustained profitable revenue growth, EPS growth, and return on capital. As such, the program is intended to ensure a high degree of alignment between pay and the long-term value and financial soundness of BD.

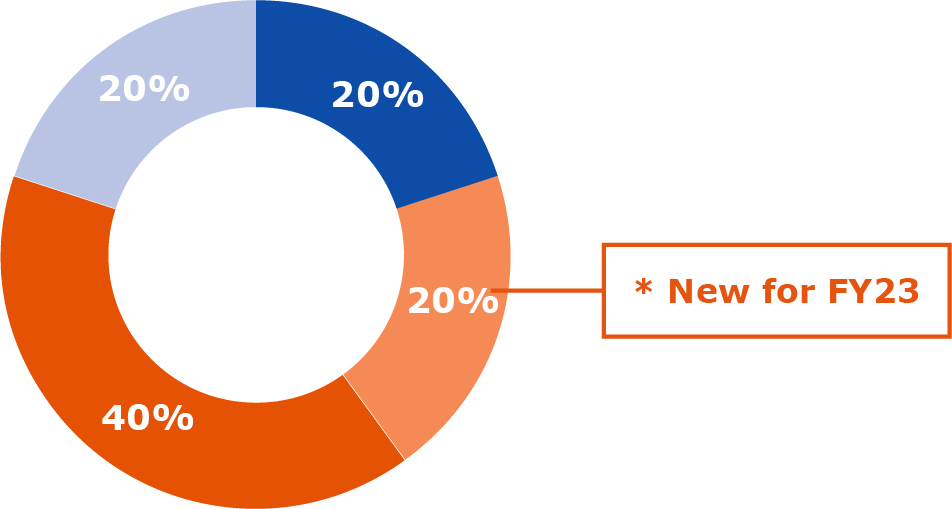

CEO target direct compensation mix

10 |

|

||||

Proxy statement overview

Our compensation objectives and practices

| What We Do | What We Don’t Do | ||||||||||

Competitive Compensation Program |

Use balanced mix of cash and equity compensation and annual and long-term incentives. Use balanced mix of cash and equity compensation and annual and long-term incentives.

Have an independent advisor engaged by our Compensation Committee to assist in designing our compensation program and making compensation decisions. Have an independent advisor engaged by our Compensation Committee to assist in designing our compensation program and making compensation decisions.

|

No employment agreements with our executive officers. No employment agreements with our executive officers.

|

|||||||||

| Pay for Performance |

Align executive compensation with the execution of our business strategy by using performance metrics that reward behaviors that support our business objectives and long-term shareholder value. Align executive compensation with the execution of our business strategy by using performance metrics that reward behaviors that support our business objectives and long-term shareholder value.

Balance performance metrics in our incentive plans so that undue weight is not given to any one metric, and measure performance over annual and multi-year performance periods. Balance performance metrics in our incentive plans so that undue weight is not given to any one metric, and measure performance over annual and multi-year performance periods.

Incorporate ESG metrics relating to product quality and efforts to advance inclusion and diversity as a modifier of our annual incentive plan performance factor. Incorporate ESG metrics relating to product quality and efforts to advance inclusion and diversity as a modifier of our annual incentive plan performance factor.

|

While we emphasize “at risk” pay tied to performance, our program does not encourage excessive risk-taking by management. While we emphasize “at risk” pay tied to performance, our program does not encourage excessive risk-taking by management.

No guaranteed incentive awards for executive officers. No guaranteed incentive awards for executive officers.

|

|||||||||

| Strong Compensation Policies |

Robust share retention and ownership guidelines. Robust share retention and ownership guidelines.

Adopted Executive Officer Cash Severance Policy capping cash payments to executives upon termination under new arrangements to 2.99x salary plus bonus. Adopted Executive Officer Cash Severance Policy capping cash payments to executives upon termination under new arrangements to 2.99x salary plus bonus.

“Double-trigger” change in control agreements with our executive officers, and double-trigger vesting provisions for equity compensation awards. “Double-trigger” change in control agreements with our executive officers, and double-trigger vesting provisions for equity compensation awards.

Clawback policies tied to financial restatements or breaches of restrictive covenants. Clawback policies tied to financial restatements or breaches of restrictive covenants.

Pre-established timing for annual equity awards. Pre-established timing for annual equity awards.

|

No below market exercise prices or reload provisions for equity awards, and no repricing of equity awards without shareholder approval. No below market exercise prices or reload provisions for equity awards, and no repricing of equity awards without shareholder approval.

Prohibition on pledging BD shares or hedging against the economic risk of ownership. Prohibition on pledging BD shares or hedging against the economic risk of ownership.

No excise tax "gross-ups" in our change in control agreements. No excise tax "gross-ups" in our change in control agreements.

|

|||||||||

The Compensation Discussion and Analysis beginning on page 47 of this proxy statement describes BD’s executive compensation program and the compensation decisions made with respect to our Chief Executive Officer ("CEO") and the other executive officers named in the Summary Compensation Table on page 68.

| 2024 Notice of Annual Meeting and Proxy Statement | 11 |

||||

Proposal 1: Election of directors

Members of the BD Board of Directors (the "Board") are elected to serve a term of one year and until their successors have been elected and qualified. All of the nominees for director have consented to being named in this proxy statement and to serve if elected.

The Board currently has 12 members and 11 of our current directors are standing for election at the 2024 Annual Meeting. Marshall O. Larsen, who has reached the mandatory director retirement age under BD's Governance Principles, is not standing for re-election at the 2024 Annual Meeting. The size of the Board will be reduced to 11 members, effective upon the conclusion of the 2024 Annual Meeting.

Other than Dr. Joanne Waldstreicher, who was elected to the Board in July 2023, all of the nominees were previously elected at the 2023 Annual Meeting of Shareholders (the "2023 Annual Meeting").

BD does not know of any reason why any nominee would be unable to serve as director. If any nominee is unable to serve, the shares represented by valid proxies will be voted for the election of such other person as the Board may nominate, or the size of the Board may be reduced.

BD directors have a variety of backgrounds, which reflects the Board’s continuing efforts to achieve a mix of diverse viewpoints, insights and perspectives on the Board. As more fully discussed below, director nominees are considered on the basis of a range of criteria, including their business knowledge and background, prominence and reputation in their fields, global business perspective and commitment to strong corporate governance and citizenship. They must also have experience and capability that is relevant to the Board’s oversight of BD’s business and affairs. Each nominee’s biography includes the particular experience and qualifications that led the Board to conclude that the nominee should serve on the Board.

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES FOR DIRECTOR. |

||||

12 |

|

||||

Proposal 1: Election of directors

Nominees for director—skills and experience

The table below summarizes the key qualifications, skills, and attributes of the nominees for director that served as the basis for the Board's decision to nominate these individuals for election.

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

Skills & Experience | |||||||||||||||||||||||||||||||||||

|

Public Company CEO

Prior experience as the chief executive officer of a publicly-traded company.

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Financial Acumen and Expertise

Experience in financial accounting/reporting and corporate finance.

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

Healthcare Industry

Knowledge of or experience in an industry involving healthcare and medical products and services.

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

Research, Development & Innovation

Experience with the innovation, design and development of new products and services, or expertise in a scientific or technological field.

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Healthcare Insurance & Reimbursement

Experience with the administration of medical care reimbursement programs.

|

|

|

|

||||||||||||||||||||||||||||||||

|

Integrated Health Delivery System

Prior executive or senior management position with an organization that owns and operates a network of one or more healthcare facilities.

|

|

|

|||||||||||||||||||||||||||||||||

|

Healthcare Regulatory or Public Policy

Experience with healthcare regulatory schemes and public policies that promote public well-being.

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Corporate Governance

Knowledge of or experience with the rules, practices, and processes used to direct and manage a company.

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

International Business

Leadership position at an organization that operates internationally.

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Shareholder Relations/Institutional Investor Experience

Leadership position involving interacting with public company investors or investing on behalf of other parties.

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Product Quality & Safety

Experience in product quality control and safety systems.

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

Global Operations & Supply Chain

Experience with the global relationships and activities required to manufacture goods and maximize overall supply chain efficiency, including the sourcing of raw materials and vendor management.

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

Corporate Sales and Marketing

Experience with go-to-market strategies and marketing of an organization’s products and services.

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

Attributes | |||||||||||||||||||||||||||||||||||

Independent |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

Female |

|

|

|

|

|||||||||||||||||||||||||||||||

| 2024 Notice of Annual Meeting and Proxy Statement | 13 |

||||

Proposal 1: Election of directors

Nominees for director

William M. Brown | 61

Former Chairman and Chief Executive Officer, L3Harris Technologies

Former Chairman and Chief Executive Officer, L3Harris Technologies

Director Since: 2022

Independent: Yes

Committees:

•Compensation and Human Capital

•Corporate Governance and Nominating

|

Skills and experience

As a veteran chief executive officer, Mr. Brown brings substantial strategic, financial, operational and innovation expertise to the BD Board, along with a strong corporate governance background and experience in domestic and international business.

Professional background

•Served as Executive Chair of L3Harris Technologies from June 2021 to June 2022, having served as Chairman and Chief Executive Officer from July 2019 to June 2021.

•Previously served as Chairman, President and Chief Executive Officer of Harris Corporation prior to the merger of Harris Corporation with L3 Technologies in 2019. Mr. Brown joined Harris Corporation in November 2011 as President and Chief Executive Officer and was appointed Chairman in April 2014.

•Prior to joining Harris Corporation, served in various leadership roles at United Technologies Corporation (UTC), including Senior Vice President of Corporate Strategy and Development and President of UTC Fire & Safety.

Public directorships

•Celanese Corporation (Lead Director)

Former public directorships (last 5 years)

•L3Harris Technologies, Inc.

•Harris Corporation (until merger with L3 Technologies in 2019)

|

||||

Catherine M. Burzik | 73

Former President and Chief Executive Officer, Kinetic Concepts, Inc.

Former President and Chief Executive Officer, Kinetic Concepts, Inc.

Director Since: 2013

Independent: Yes

Committees:

•Quality and Regulatory (Chair)

•Corporate Governance and Nominating

|

Skills and experience

Ms. Burzik is a seasoned executive in the healthcare industry, having led major medical device, diagnostic, diagnostic imaging and life sciences businesses. She contributes to the Board strong strategic, product development and leadership expertise, and extensive knowledge of the global healthcare field.

Professional background

•Appointed as Interim CEO of Orthofix Medical Inc. in September 2023.

•Served as President and Chief Executive Officer of Kinetic Concepts, Inc., a medical device company specializing in the fields of wound care and regenerative medicine, from 2006 until the sale of the company in 2012.

•Previously served as President of Applied Biosystems and President of Ortho-Clinical Diagnostics, Inc., a Johnson & Johnson company.

Public directorships

•Orthofix Medical Inc. (Chair of the Board and Interim CEO)

Former public directorships (last 5 years)

•Haemonetics Corporation

|

||||

14 |

|

||||

Proposal 1: Election of directors

Carrie L. Byington, M.D. | 60

Special Adviser to the President, University of California Health

Special Adviser to the President, University of California Health

Director Since: 2021

Independent: Yes

Committees:

•Audit

•Quality and Regulatory

|

Skills and experience

Dr. Byington provides the Board extensive knowledge and perspective regarding the integrated delivery of healthcare services as a result of her leadership positions at some of the nation’s largest health systems. Dr. Byington also possesses strong executive management skills and strategic planning experience, as well as expertise in clinical practice and infectious diseases.

Professional background

•Has served as Special Adviser to the President of University of California Health, the largest public academic healthcare system in the United States, since 2023.

•Executive Vice President of University of California Health from 2019 to 2023.

•Served as Dean of the College of Medicine, Senior Vice President for Health Sciences for Texas A&M University, and Vice Chancellor for Health Services for Texas A&M System from 2017 to 2019.

•From 1995 to 2016, served on the faculty of the University of Utah, serving in multiple leadership roles, including as Director and Principal Investigator, Center for Clinical and Translational Science at University of Utah Health from 2015 to 2016.

|

||||

R. Andrew Eckert | 62

Former Chief Executive Officer, Zelis Inc.

Former Chief Executive Officer, Zelis Inc.

Director Since: 2016

Independent: Yes

Committees:

•Compensation and Human Capital (Chair)

•Audit

|

Skills and experience

Mr. Eckert is a leader in the growing field of healthcare information technology, with extensive experience as an executive officer of several healthcare companies. He also brings to the Board a deep knowledge of operations, strategic planning, product development and marketing, and has valuable corporate governance insight gained from having served as chief executive officer of publicly-held companies and as a director of other public companies.

Professional background

•Currently serves as a Senior Advisor to Permira, a global private equity firm.

•Served as Chief Executive Officer of Zelis Inc., a provider of healthcare cost management and payments solutions, from 2020 to 2021.

•Served as President and Chief Executive Officer of Acelity L.P. Inc., a global wound care company, from 2017 until the sale of the company in 2019.

•Served as the Chief Executive Officer of Valence Health, Inc., a healthcare information technology and services company, from 2015 until its sale in 2016.

•Previously served as Chief Executive Officer of TriZetto Corporation, a payer technology solutions firm, until its sale in November 2014.

Public directorships

•Fortrea Holdings Inc. (Lead Director)

Former public directorships (last 5 years)

•Varian Medical Systems, Inc.

|

||||

| 2024 Notice of Annual Meeting and Proxy Statement | 15 |

||||

Proposal 1: Election of directors

Claire M. Fraser, Ph.D. | 68

Founding Director, Institute for Genome Sciences and Professor of Medicine and Microbiology and Immunology, University of Maryland School of Medicine

Founding Director, Institute for Genome Sciences and Professor of Medicine and Microbiology and Immunology, University of Maryland School of Medicine

Director Since: 2006

Independent: Yes

Committees:

•Compensation and Human Capital

•Corporate Governance and Nominating

|

Skills and experience

Dr. Fraser is an internationally recognized scientist who contributes to the Board a strong background in genomics, infectious diseases and molecular diagnostics, including the development of novel diagnostics and vaccines. She also brings considerable managerial experience, having established and led two large research institutes for over 30 years, and through her experience as a director of several biotechnology companies and non-profit organizations.

Professional background

•Founding Director of the Institute for Genome Sciences and Professor of Medicine and Microbiology and Immunology at the University of Maryland School of Medicine since 2007.

•Served as President and Director of The Institute for Genomic Research, a not-for-profit research organization engaged in human and microbial genomics studies, from 1998 to 2007.

•Previously served as Chair of the Board and a Director of the American Association for the Advancement of Science, and is a member of the National Academy of Sciences and National Academy of Medicine.

•Previously served as a Director of Ohana Biosciences Inc.

Public directorships

•Seres Therapeutics, Inc.

|

||||

Jeffrey W. Henderson | 59

Former Chief Financial Officer of Cardinal Health Inc.

Former Chief Financial Officer of Cardinal Health Inc.

Director Since: 2018

Independent: Yes

Committees:

•Audit (Chair)

•Compensation and Human Capital

|

Skills and experience

Mr. Henderson is an experienced healthcare executive who brings to the Board a deep knowledge of the industry, along with strong financial, strategic and operational expertise and significant international experience. Mr. Henderson also brings valuable corporate governance experience from his service as a director of other public companies.

Professional background

•Served as Chief Financial Officer of Cardinal Health Inc., a global healthcare products and services company, from 2005 to 2014.

•Held multiple positions at Eli Lilly and General Motors, including international positions, prior to joining Cardinal Health.

•President of JWH Consulting LLC, a business and investment advisory firm, focused primarily on the healthcare industry.

•Served as an Advisory Director to Berkshire Partners LLC, a private equity firm, from September 2015 to December 2019.

Public directorships

•Qualcomm, Inc.

•FibroGen, Inc.

•Halozyme Therapeutics, Inc. (Chair of the Board)

|

||||

16 |

|

||||

Proposal 1: Election of directors

Christopher Jones | 68

Former Chief Executive Officer, JWT Worldwide

Former Chief Executive Officer, JWT Worldwide

Director Since: 2010

Independent: Yes

Committees:

•Audit

•Corporate Governance and Nominating (Chair)

|

Skills and experience

Mr. Jones brings to the Board an important international perspective based on his distinguished career as a marketing leader and head of a global marketing firm. He offers substantial marketing, strategic and managerial expertise derived from his broad range of activities in the field.

Professional background

•Served as Chief Executive Officer of JWT Worldwide (previously known as J. Walter Thompson), an international marketing firm, from 1996 to 2001.

•Chair of the Board of Trustees of The Pew Charitable Trusts and member of the Board of Directors of The Albert and Mary Lasker Foundation.

•Member of the Health Advisory Board of The Johns Hopkins University Bloomberg School of Public Health.

•Chair of the Board of Newrotex Ltd.

|

||||

Thomas E. Polen | 50

Chairman, Chief Executive Officer and President, BD

Chairman, Chief Executive Officer and President, BD

Director Since: 2020

Independent: No

Committees:

None

|

Skills and experience

Mr. Polen has spent over 20 years with BD in a number of capacities of increasing responsibility, including oversight responsibility for all three of BD's business segments, global research and development, innovation, operations and the commercial organization of BD's Americas region. Mr. Polen brings to the Board extensive industry experience and business expertise, particularly in the areas of strategy and innovation, and in-depth knowledge of BD’s businesses and served markets.

Professional background

•BD's Chief Executive Officer since 2020, and appointed Chairman in 2021.

•Has served as BD’s President since April 2017, and also served as BD's Chief Operating Officer from October 2018 to January 2020.

•Served as Executive Vice President and President of BD’s Medical segment prior to becoming President.

Public directorships

•Walgreens Boots Alliance

|

||||

| 2024 Notice of Annual Meeting and Proxy Statement | 17 |

||||

Proposal 1: Election of directors

Timothy M. Ring | 66

Former Chairman and Chief Executive Officer, C. R. Bard, Inc.

Former Chairman and Chief Executive Officer, C. R. Bard, Inc.

Director Since: 2017

Independent: Yes

Committees:

•Audit

•Quality and Regulatory

|

Skills and experience

Mr. Ring contributes to the Board deep expertise resulting from his 20 years of experience in various leadership positions at C. R. Bard, including as Chairman and Chief Executive Officer. Mr. Ring's expertise covers many facets of business, including strategy, product development, financial matters and international operations, and he has extensive experience in the healthcare industry.

Professional background

•Served as C. R. Bard’s Chairman and Chief Executive Officer from 2003 until 2017, when it was acquired by BD.

•Co-founder of TEAMFund, Inc., an impact fund focused on delivering medical technology to sub-Saharan Africa and India.

Public directorships

•Quest Diagnostics Incorporated (Lead Director)

|

||||

Bertram L. Scott | 72

Former Chief Executive Officer, Affinity Health Plan

Former Chief Executive Officer, Affinity Health Plan

Director Since: 2002

Independent: Yes

Committees:

•Compensation and Human Capital

•Quality and Regulatory

|

Skills and experience

Mr. Scott adds strong strategic, operational and financial experience to the Board from the variety of executive roles in which he has served during his career. He also brings experience in corporate governance and business expertise in the insurance and healthcare fields.

Professional background

•Served as Senior Vice President of Population Health of Novant Health from 2015 to 2019.

•Previously served as President and Chief Executive Officer of Affinity Health Plan, and as President, U.S. Commercial of CIGNA Corporation.

•Also previously served as Executive Vice President of TIAA-CREF and as President and Chief Executive Officer of TIAA-CREF Life Insurance Company.

Public directorships

•Dollar Tree, Inc.

•Equitable Holdings, Inc.

•Lowe’s Companies, Inc.

Former public directorships (last 5 years)

•AllianceBernstein L.P./AllianceBernstein Holding L.P.

|

||||

18 |

|

||||

Proposal 1: Election of directors

Joanne Waldstreicher, M.D. | 63

Former Chief Medical Officer, Johnson & Johnson

Former Chief Medical Officer, Johnson & Johnson

Director Since: 2023

Independent: Yes

Committees:

•Corporate Governance and Nominating

•Quality and Regulatory

|

Skills and experience

Dr. Waldstreicher brings to the Board over 30 years of experience in clinical and strategic leadership roles, with an emphasis on clinical development, product development strategy, safety and regulatory affairs.

Professional background

•Served as chief medical officer of Johnson & Johnson (J&J) from 2012 to 2023.

•Previously served as chief medical officer of Janssen Pharmaceutical Research and Development, a division of J&J from 2009 to 2012. Prior to that, Dr. Waldstreicher served as vice president and as senior vice president of Global Drug Development at Janssen from 2002 to 2009.

•Prior to J&J, she led endocrinology and metabolism clinical research at Merck Research Laboratories.

•Serves on an expert panel for the Reagan Foundation for the U.S. Food and Drug Administration

•Serves as faculty affiliate of the Division of Medical Ethics, Department of Population Health at New York University School of Medicine.

Public directorships

•Structure Therapeutics, Inc.

|

||||

Board refreshment, nomination and diverse representation

Our Board members have strong track records of success in business, finance, healthcare, and value creation, along with deep management experience that helps guide BD’s strategy. The Board believes sustaining the right mix of diverse skills and experiences on the Board is crucial to BD’s continued success. Therefore, the Board regularly performs self-assessments and conducts a robust director renomination process to ensure it continues to be a source of competitive advantage for BD.

BD’s board evaluation and nomination process includes three essential stages:

| Evaluation of Board Composition |

è | Assessment of Individual Directors |

è | Nomination of Directors |

||||||||||||||||

The Board’s self-evaluation process is used to identify and assess potential gaps in diversity of thought through key skills and experience required to support BD’s current strategic interests. In addition, the Governance Committee undertakes a robust review prior to recommending the renomination of any sitting director, including their effectiveness during the past year, their outside time commitments, their tenure on the Board, and the needs of the Board going forward in the context of BD’s strategy. Our Governance Principles state that Board members should not expect that, once elected, they will necessarily be renominated to the Board.

The Board seeks to have a mix of long-, mid- and short-tenured directors to ensure a balance of views and insights. When reviewing its composition, the Board balances the benefits it receives from the knowledge and understanding of our complex businesses that directors gain from longer-term service with the need to bring fresh ideas and perspectives to the Board through the addition of new directors.

| 2024 Notice of Annual Meeting and Proxy Statement | 19 |

||||

Proposal 1: Election of directors

Board self-evaluation process

The Board believes a rigorous self-evaluation process is important to the ongoing effectiveness of the Board. Each year the Board conducts a self-evaluation of its performance that allows directors to provide individual feedback on the Board’s composition, culture, committee structure, relationship with management, meeting agendas, oversight of strategy and risk, and other Board-related topics. The results of the self-evaluation are presented by the chair of the Governance Committee to the full Board. As part of the evaluation, the Board assesses the progress in the areas targeted for improvement from the prior evaluation, and develops actions to be taken to enhance the Board’s effectiveness over the next year.

The Board believes it is important to periodically obtain an outside perspective on the Board’s overall composition, functioning and effectiveness, and seeks to have its annual self-evaluation facilitated by an independent outside consultant experienced in board and governance practices at least once every three years, with the next one scheduled for 2024.

The Board has made several enhancements to our board practices in prior years as a result of its self-evaluation process, including improvements to our annual director renomination process, rotations of committee chairs and committee composition, and improvements in the conduct of Board meetings. In addition, as a result of its annual review of Board composition and recognizing the need for fresh perspectives, the Board has added three new directors in the last three years.

| All three individuals added to BD’s Board since 2021 bring key skills and experience | ||||||||

Relevant experience adding to the Board’s oversight and guidance capacity |

||||||||

Carrie L. Byington, M.D. |

Special Advisor to President of University of California Health (UCH) and Former Executive Vice President of UCH |

Extensive knowledge regarding the integrated delivery of healthcare services and strong executive management skills and strategic planning experience, as well as expertise in clinical practice and infectious diseases |

||||||

William M. Brown |

Former Chairman and Chief Executive Officer, L3Harris Technologies |

Substantial strategic, financial, operational and innovation expertise, along with a strong corporate governance background and experience in domestic and international business |

||||||

| Joanne Waldstreicher, M.D. | Former Chief Medical Officer of Johnson & Johnson | Vast experience in clinical and strategic leadership with an emphasis on clinical development, product development strategy, safety and regulatory affairs | ||||||

Director representation

Diversity of thought has long been a core value of BD. The Board believes having Board members with a mix of differing viewpoints, insights and perspectives is critical to board effectiveness. BD seeks to have its Board composed of directors that collectively possess a wide range of relevant business and financial expertise, industry knowledge, management experience and prominence in areas of importance to BD. The Board believes that diverse representation of all genders, experiences and backgrounds is an important element in achieving the broad range of perspectives that the Board seeks among its members. Diverse representation on the Board is also important for modeling the inclusive culture at BD. To that end, consideration of the overall diversity of our board remains an important factor in board succession planning and director recruitment, and the Board has adopted a policy that a diverse range of candidates be included in any candidate pool from which new directors are selected.

The Board is committed to maintaining and improving the representation of individuals of all genders, experiences and backgrounds, and will look for opportunities to increase the diversity of the Board where appropriate.

20 |

|

||||

Proposal 1: Election of directors

Director nomination process

Role of the Governance Committee

|

1

Review of the Composition of the Board

|

The Governance Committee reviews potential director candidates and recommends nominees for director to the full Board for its consideration based on the Board's assessment of the overall composition of the Board. | |||||||||||||

|

||||||||||||||

|

2

Consideration of Referrals from Various Sources

|

It is the Governance Committee’s policy to consider referrals of prospective director nominees from Board members and management, as well as shareholders and other external sources, such as retained executive search firms. The Governance Committee seeks to identify a diverse range of highly-qualified candidates, and utilizes the same criteria for evaluating candidates, irrespective of their source. | |||||||||||||

|

||||||||||||||

|

3

Consideration of Director Qualifications

|

When considering potential director candidates, the Governance Committee will seek individuals with backgrounds and qualities that, when combined with those of BD’s other directors, provide a blend of skills and experience that will further enhance the Board’s effectiveness. As provided under our Governance Principles, the Governance Committee believes that any nominee for director that it recommends must meet the following minimum qualifications:

•Candidates should be persons of high integrity who possess independence, forthrightness, inquisitiveness, good judgment and strong analytical skills.

•Candidates should demonstrate a commitment to devote the time required for Board duties, including, but not limited to, attendance at meetings. In this regard, when evaluating director candidates (including the renomination of incumbent directors), the Governance Committee will take into consideration, among other things, the director candidate’s existing time commitments, such as service on other public or private company boards (including chairman/lead director or other leadership positions on public boards) or not-for-profit boards or with a government or advisory group. See "Director Outside Affiliations" on page 37 for a further discussion of the Governance Committee's review of candidates outside time commitments and affiliations.

•Candidates should be team-oriented and committed to the interests of all shareholders as opposed to those of any particular constituency.

|

|||||||||||||

|

||||||||||||||

|

4

Assessment

and Nomination of Candidates |

The Governance Committee assesses the characteristics and performance of incumbent director nominees against the above criteria as well, and, to the extent applicable, considers the impact of any change in the principal occupations of such directors during the last year. Upon completion of its assessment, the Governance Committee reports its recommendations for nominations to the full Board. | |||||||||||||

In July 2023, the Board elected Dr. Joanne Waldstreicher to the Board. Dr. Waldstreicher was identified by a third-party search firm. The search firm assisted the Governance Committee by identifying a pool of potential director candidates based on the specifications provided by the Governance Committee. The firm also reviewed potential candidates with the Governance Committee, performed outreach to candidates selected from the pool to assess interest and availability, conducted reference and background checks and arranged candidate interviews with members of the Governance Committee and members of the Board.

| 2024 Notice of Annual Meeting and Proxy Statement | 21 |

||||

Proposal 1: Election of directors

Shareholder recommendations

To recommend a candidate for consideration by the Governance Committee, a shareholder should submit a written statement of the qualifications of the proposed nominee, including full name and address, to the Corporate Secretary, Becton, Dickinson and Company, 1 Becton Drive, Franklin Lakes, New Jersey 07417-1880.

Proxy access nominations

BD has a “proxy access” by-law, which permits eligible shareholders to nominate director candidates for inclusion in BD’s proxy statement and proxy card. Our proxy access by-law provides that a shareholder (or a group of up to 20 shareholders) owning 3 percent or more of BD’s outstanding common stock for at least three years can nominate up to two individuals or 20 percent of the Board, whichever is greater, for election at an Annual Meeting of Shareholders, subject to the relevant requirements in our By-Laws.

Board leadership structure

The Board seeks to achieve the best board leadership structure for the effective oversight of BD’s affairs and believes there is no single, generally accepted approach to providing effective board leadership. The Board believes that the decision as to whether the positions of Chairman and CEO should be combined or separated, and whether an executive or an independent director should serve as Chairman if the roles are split, should be based upon the particular circumstances facing BD. Maintaining a flexible policy allows the Board to choose the leadership structure that best serves the interests of the company and its shareholders at any particular time. Currently, the Board believes that combining the roles of CEO and Chairman is in the best interest of BD and its shareholders. The Board believes Mr. Polen’s over 20 years of experience at BD and knowledge of our complex businesses makes him uniquely qualified to lead the Board on the most important issues facing BD. The combined roles also allow Mr. Polen to speak for and lead BD and the Board, and creates the clear lines of authority, accountability and leadership necessary to execute BD’s strategy.

The lead director’s role

The Governance Principles provide for the appointment of a Lead Director from among the Board’s independent directors whenever the Chairman is not independent. The Lead Director role allows the non-management directors to provide effective, independent Board leadership and oversight of management.

Bertram L. Scott has served as Lead Director since 2022. As Lead Director, Mr. Scott has the following responsibilities under the Governance Principles. He may also perform other functions or duties as requested by the Board.

•Presides over all meetings of the Board at which the Chairman is not present, including executive sessions of the non-management directors, and at such other times as the Board deems appropriate.

•Possesses authority to call meetings of the independent directors.

•Consults on and approves Board meeting agendas and information provided to the Board.

•Consults on and approves Board meeting schedules to ensure there is sufficient time for discussion of all agenda items.

•Coordinates with the Chair of the Compensation Committee to perform the annual performance evaluation of the Chief Executive Officer by the non-management directors.

•Serves as a liaison between the non-management directors and the Chairman, and as a contact person to facilitate communications by BD’s employees, shareholders and others with the non-management directors.

•If requested by major shareholders, ensures availability for consultation and direct communication.

22 |

|

||||

Corporate governance

The Board and committees of the Board

The Board has established four operating committees (the “Committees”) that meet regularly: the Audit Committee; the Compensation Committee; the Governance Committee; and the Quality and Regulatory Committee (the “QRC”). The Board has also established an Executive Committee that meets only as needed.

|

Governance Materials

The following materials related to corporate governance at BD are available at investors.bd.com/corporate-governance.

•Governance Principles

•Charters of the Audit Committee, Compensation Committee, Governance Committee, QRC and Executive Committee

Printed copies of these documents, BD’s 2023 Annual Report on Form 10-K, and BD’s reports and statements filed with or furnished to the SEC may be obtained, without charge, by contacting the Corporate Secretary, Becton, Dickinson and Company, 1 Becton Drive, Franklin Lakes, New Jersey 07417-1880; telephone 201-847-6800.

| ||

Committee membership and function

Set forth below are the members of each Committee and a summary description of each Committee’s areas of oversight.

Audit Committee

|

Members

Jeffrey W. Henderson (Chair)

Carrie L. Byington, M.D.

R. Andrew Eckert

Christopher Jones

Timothy M. Ring

Meetings in 2023: 9

|

Principal Responsibilities:

•Retains and reviews the qualifications, independence and performance of BD’s independent auditors.

•Reviews BD’s public financial disclosures and financial statements, and its accounting principles, policies and practices; the scope and results of the annual audit by the independent auditors; BD’s internal audit process; and the integrity of BD’s internal control over financial reporting.

•Reviews BD’s guidelines and policies relating to enterprise risk assessment and management, including financial risk and cybersecurity and data privacy risk exposures.

•Oversees BD’s ethics and compliance programs.

•Reviews financial strategies regarding currency, interest rates and use of derivatives, and reviews BD’s insurance program.

|

||||

The Board has determined that each Audit Committee member meets the independence and financial literacy requirements of the New York Stock Exchange ("NYSE") for audit committee members. The Board also has determined that each of Messrs. Henderson and Ring qualifies as an “audit committee financial expert” under the rules of the SEC.

| 2024 Notice of Annual Meeting and Proxy Statement | 23 |

||||

Corporate governance

Compensation and Human Capital Committee

|

Members

R. Andrew Eckert (Chair)

William M. Brown

Clare M. Fraser, Ph.D.

Jeffrey W. Henderson

Marshall O. Larsen

Bertram L. Scott

Meetings in 2023: 5

|

Principal Responsibilities:

•Reviews BD’s compensation and benefits programs, recommends the compensation of BD’s CEO to the independent members of the Board, and approves the compensation of BD’s other executive officers.

•Approves all employment, severance and change in control agreements with BD's executive officers.

•Serves as the granting and administrative committee for BD’s equity compensation plans, including grants to directors.

•Oversees BD's policies and strategies relating to human capital management including recruitment, development, promotion, performance management, senior management succession, pay equity and inclusion and diversity.

•Oversees certain other BD benefit plans.

|

||||

The Board has determined that each member of the Compensation Committee meets the independence requirements of the NYSE for compensation committee members. Each member also qualifies as a “non-employee director” under Section 16 of the Securities Exchange Act of 1934 (the "Exchange Act").

Procedure for determining executive compensation

The Compensation Committee oversees the compensation program for the executive officers named in the Summary Compensation Table on page 68 and for BD’s other executive officers. The Compensation Committee recommends compensation actions regarding the CEO to the other independent directors of the Board and has the authority to take compensation actions with respect to BD’s other executive officers, as discussed below. The Compensation Committee may not delegate these responsibilities to another Committee or members of management.

Role of management

The Compensation Committee’s meetings are typically attended by BD’s CEO, its Chief People Officer and other BD associates who support the Compensation Committee in fulfilling its responsibilities. The Compensation Committee considers management’s views on compensation matters, including the performance metrics and targets used for BD’s performance-based compensation. Management also provides information (which is reviewed by our Internal Audit department and the Audit Committee) to assist the Compensation Committee in determining the extent to which performance targets have been achieved. This includes any recommended adjustments to BD’s operating results when assessing BD’s performance. The CEO and Chief People Officer also work with the Compensation Committee chair in establishing meeting agendas.

Role of the independent consultant

The Compensation Committee is also assisted in fulfilling its responsibilities by its independent consultant, Semler Brossy Consulting Group ("Semler Brossy"). Semler Brossy is engaged by, and reports directly to, the Compensation Committee. The Compensation Committee has not identified any conflict of interest on the part of Semler Brossy, or any factor that would otherwise impair the independence of the firm relating to the services performed by them for the Compensation Committee. No other consultant was used by the Compensation Committee with respect to the 2023 fiscal year compensation of BD’s executive officers.

During fiscal year 2023, Semler Brossy was not engaged to perform any services for BD or BD’s management. The Compensation Committee has adopted a policy prohibiting its independent consultant from providing any services to BD or BD’s management without the Compensation Committee’s prior approval, and has expressed its intention that such approval will be given only in exceptional cases.

During the past fiscal year, the Compensation Committee's independent consultants:

•reviewed materials prepared for the Compensation Committee by management,

•provided market comparison data and other materials requested by the Compensation Committee, and assisted the Compensation Committee in the design and implementation of BD’s compensation program, including the selection of the key elements of the program, the setting of targeted pay and the selection of performance metrics,

24 |

|

||||

Corporate governance

•made recommendations regarding the compensation of BD’s CEO,

•conducted an annual review of the compensation practices of select peer companies, and advised the Compensation Committee with respect to the competitiveness of BD’s compensation program in comparison to industry practices, and identified any trends in executive compensation, and

•attended Compensation Committee meetings.

Setting compensation

At the end of each fiscal year, the independent directors conduct a review of the CEO’s performance. The independent directors then meet in executive session to set the compensation of the CEO after considering the results of its review, market comparison data and the recommendations of the Compensation Committee. The CEO does not play a role in determining or recommending CEO compensation.

The Compensation Committee is responsible for determining the compensation of BD’s other executive officers. The CEO, in consultation with BD’s Chief People Officer, reviews the performance of the other executive officers with the Compensation Committee and makes compensation recommendations for its consideration. The Compensation Committee determines the compensation for these executives, in consultation with its independent consultant, after considering the CEO’s recommendations and market comparison data regarding compensation levels for comparable positions at peer companies and, if applicable, survey data.

The Board has delegated responsibility for making recommendations regarding non-management director compensation to the Governance Committee, as discussed on page 41.

Corporate Governance and Nominating Committee

|

Members

Christopher Jones (Chair)

William M. Brown

Catherine M. Burzik

Claire M. Fraser, Ph.D.

Marshall O. Larsen

Joanne Waldstreicher, M.D.

Meetings in 2023: 5

|

Principal Responsibilities:

•Identifies and recommends candidates for election to the Board.

•Reviews and recommends the composition, structure and function of the Board and its Committees.

•Reviews and recommends the compensation of non-management directors.

•Monitors BD’s corporate governance and Board practices, and oversees the Board’s self-evaluation process.

•Oversees BD's process and practices relating to the management and oversight of environmental, sustainability, health and safety, inclusion and diversity, political activities, corporate responsibility and other public policy or social matters relevant to BD ("ESG matters").

|

||||

The Board has determined that each member of the Governance Committee meets the independence requirements of the NYSE.

Quality and Regulatory Committee

|

Members

Catherine M. Burzik (Chair)

Carrie L. Byington, M.D.

Timothy M. Ring

Bertram L. Scott

Joanne Waldstreicher, M.D.

Meetings in 2023: 5

|

Principal Responsibilities:

•Oversees BD’s quality strategy and the systems and processes in place to monitor product quality and safety, and BD’s compliance processes and procedures with relevant regulatory requirements.

•Reviews the results of any product quality and quality system assessments by BD and external regulators.

•Reviews any significant product quality, safety or regulatory trends or issues that arise, including any relating to product cybersecurity.

•Reviews product quality, safety or regulatory issues identified with respect to any acquired business and the related integration plans for such business.

|

||||

| 2024 Notice of Annual Meeting and Proxy Statement | 25 |

||||

Corporate governance

Board, committee and annual meeting attendance

The Board and its Committees held the following number of meetings during fiscal year 2023:

| Board | 7 | The Executive Committee did not meet during fiscal year 2023. BD’s non-management directors, all of whom are independent, met in executive session at each of the Board meetings held during fiscal year 2023. The Lead Director presided at these executive sessions. |

|||||||||

| Audit Committee | 9 | ||||||||||

| Compensation Committee | 5 | ||||||||||

| Governance Committee | 5 | ||||||||||

| QRC | 5 | ||||||||||

During fiscal year 2023, all directors attended at least 75% of the total number of meetings of the Board and the Committees on which he or she served. The Board has adopted a policy pursuant to which directors are expected to attend our annual shareholders' meetings in the absence of a scheduling conflict or other valid reason. All of the then sitting directors attended BD’s 2023 Annual Meeting, except for Dr. Byington, who was unable to attend due to a personal matter.

Director independence

Under the NYSE rules and our Governance Principles, a director is not independent if the director has a direct or indirect material relationship with BD (other than his or her relationship as a director). The Governance Committee annually reviews the independence of all directors and nominees for director and reports its findings to the full Board. To assist in this review, the Board has adopted director independence guidelines (“Independence Guidelines”) that are contained in the Governance Principles. The Independence Guidelines set forth certain categories of relationships (and related dollar thresholds) between BD and its directors, their immediate family members, or entities with which they have a relationship, which the Board has judged to be immaterial for purposes of a director’s independence. In the event that a director has any relationship with BD that is outside these immaterial relationships, the other independent members of the Board review the facts and circumstances to determine whether the relationship could impact the director's independence.

The Board has determined that all of our non-management directors serving on the Board (William M. Brown, Catherine M. Burzik, Carrie L. Byington, R. Andrew Eckert, Claire M. Fraser, Jeffrey W. Henderson, Christopher Jones, Marshall O. Larsen, Timothy M. Ring, Bertram L. Scott and Joanne Waldstreicher) are independent under the NYSE rules and our Independence Guidelines. Mr. Polen is an employee of BD and is, therefore, not independent.

In determining that each of our non-management directors is independent, the Board reviewed any transactions or other dealings by BD with organizations with which a director has a relationship, such as service as an employee or as a member of its governing or advisory board. Based on its review, the Board determined that, in each instance, the relationship was immaterial, or that the nature of the relationship, the degree of the director’s involvement with the organization or transaction, and the amount involved did not otherwise constitute a relationship that would impair the director’s independence. The types of transactions with director-affiliated organizations considered by the Board consisted of the purchase or sale of products and/or services (in the cases of directors Brown, Burzik, Byington, Eckert, Fraser, Henderson, Jones, Ring, Scott and Waldstreicher), the licensing of intellectual property rights (in the cases of directors Byington, Fraser and Jones), an equity investment (in the case of Mr. Ring), and charitable contributions (in the cases of directors Jones and Scott).

Related person transactions

The Board has established a written policy (the “Policy”) requiring Governance Committee approval or ratification of transactions involving more than $120,000 per year in which a director or executive officer (or their immediate family members) or any shareholder owning more than 5% of BD’s outstanding common stock (excluding passive investors that own less than 20%), has or will have a material interest (referred to as a "related person transaction"). The Policy excludes certain specified transactions, including transactions available to BD associates generally on the same terms and conditions. The Governance Committee will approve or ratify only those transactions that it determines in its business judgment are fair and reasonable to BD and in (or not inconsistent with) the best interests of BD and its shareholders, and that do not impact the director’s independence.

26 |

|

||||

Corporate governance

BD did not engage in any related person transactions subject to the Policy during fiscal year 2023. It is anticipated that during fiscal year 2024, BD will make an investment in TEAMFund, LP II, a for-profit limited partnership (the “Partnership”) being formed by a non-profit (the “Non-Profit”) established by Timothy Ring, a director, and his wife, Kathryn Gleason. The Partnership is being formed for the purpose of investing in medical technologies that address priority unmet healthcare needs in underserved populations, with areas of focus including medical technologies, medical devices, artificial intelligence-enabled healthcare, digital health, and technologies facilitating access to healthcare. It is anticipated that BD's committed investment in the Partnership will be $2 million, with the capital contribution to be made over a five-year period and BD will not make a capital contribution in any one year of $1 million or more. BD’s capital contribution would represent an approximate 1.3% limited partnership interest based on the amount the Partnership seeks to raise. The Non-Profit will also invest as a limited partner. Mr. Ring and Ms. Gleason do not benefit financially from the Partnership since any return on the Non-Profit’s investment will inure solely to the benefit of the Non-Profit. Neither Mr. Ring nor Ms. Gleason will be employees of or receive any compensation from the Partnership. In addition, a procedure has been established to address any potential conflicts that may arise between the investment activities of the Partnership and BD’s business. The Governance Committee has approved the proposed investment in the Partnership because (i) BD’s investment may provide BD management insight into emerging technologies that BD may have an interest in acquiring or otherwise commercializing and (ii) the purpose of the Partnership of meeting unmet healthcare needs in underserved populations is consistent with BD’s health equity initiatives and 2030+ ESG goals, and with our corporate mission of “advancing the world of health.”

| 2024 Notice of Annual Meeting and Proxy Statement | 27 |

||||

Corporate governance

Board’s oversight of risk

Role of the board and committees

|

BOARD

The full Board reviews the risks associated with BD’s strategic plan and discusses the appropriate levels of risk for the company in light of BD’s business objectives. This is done through an annual strategy review process, and from time-to-time throughout the year as part of the Board’s ongoing review of corporate strategy. Additionally, the Board conducts an annual review of BD's enterprise risk management ("ERM") program. The full Board also regularly oversees other areas of potential risk, such as significant acquisitions and divestitures, and succession planning for BD’s CEO and other members of senior management.

| |||||||||||

|

|||||||||||

|

COMMITTEES

The Committees are responsible for monitoring and reporting to the full Board on risks associated with their respective areas of oversight. In connection with its oversight responsibilities, each Committee often meets with the members of management who are primarily responsible for the management of risk in their respective areas, including, among others, BD’s Chief Financial Officer ("CFO"), Chief People Officer, General Counsel, Chief Risk Officer, Chief Ethics and Compliance Officer and senior leaders in regulatory, information technology and R&D.

| |||||||||||

Audit Committee |

Corporate Governance

and Nominating

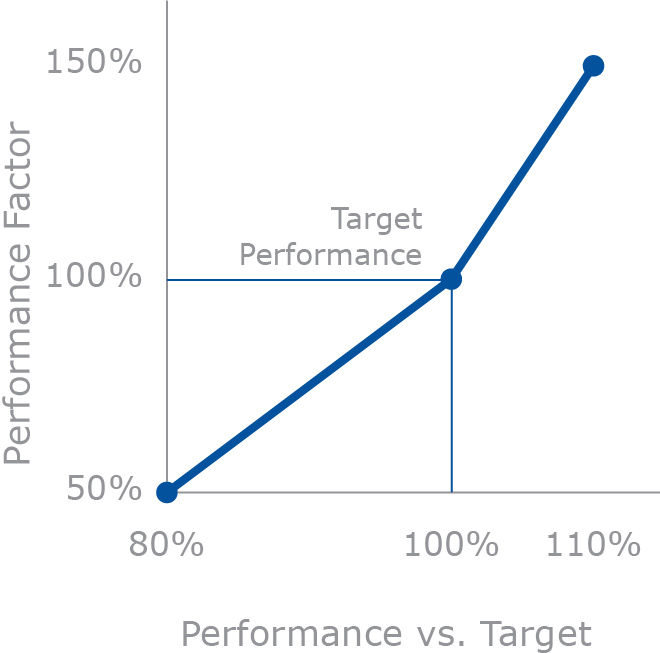

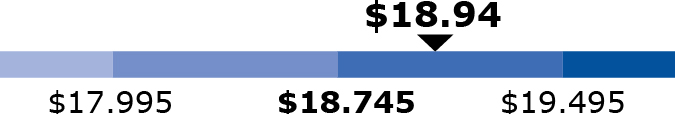

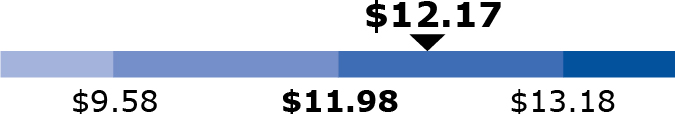

Committee