Section 240.14a-101 Schedule 14A.

Information required in proxy statement.

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Section 240.14a-11(c)

or Section 240.14a-12

Becton, Dickinson & Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

| [X] |

|

No fee required |

| [ ] |

|

Fee computed on table below per Exchange Act Rules

14a-6(i)(1) and 0-11 |

| |

|

|

| |

|

(1) Title of each class of securities to which

transaction applies: |

| |

|

|

| |

|

(2) Aggregate number of securities to which

transaction applies: |

| |

|

|

| |

|

(3) Per unit price or other underlying value of

transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount

on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

(4) Proposed maximum aggregate value of transaction: |

| |

|

|

| |

|

(5) Total fee paid: |

| |

|

|

| |

|

|

| [ ] |

|

Fee paid previously with preliminary materials. |

| |

|

|

| [ ] |

|

Check box if any part of the fee is offset as provided

by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing. |

| |

|

|

| |

|

(1) Amount Previously Paid: |

| |

|

|

| |

|

(2) Form, Schedule or Registration Statement No. |

| |

|

|

| |

|

(3) Filing Party: |

| |

|

|

| |

|

(4) Date Filed: |

| |

|

|

| |

|

|

Becton, Dickinson and Company

1 Becton Drive

Franklin Lakes, New Jersey 07417-1880

www.bd.com

December 20, 2004

Dear Fellow Shareholders:

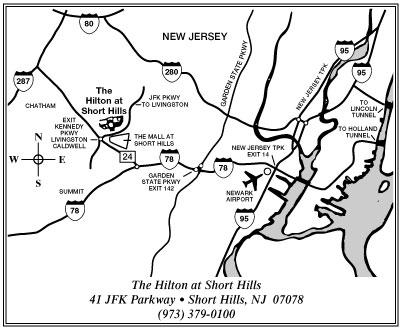

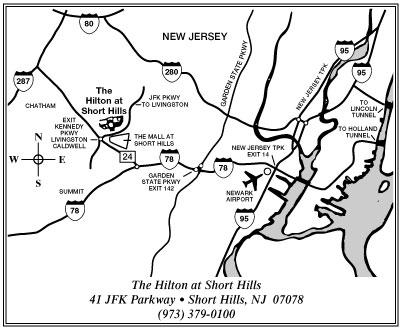

You are cordially invited to attend the 2005 Annual Meeting of Shareholders of Becton, Dickinson and Company to be held at 1:00 p.m. EST on Tuesday, February 1, 2005 at the Hilton Short Hills, 41 John F. Kennedy Parkway, Short Hills, New Jersey. You will find directions to the meeting on the back cover of the accompanying Proxy Statement.

The Notice of Meeting and Proxy Statement describe the matters to be acted upon at the meeting. We will also report on matters of interest to BD shareholders.

Your vote is important. Whether or not you plan to attend the Annual Meeting in person, we encourage you to vote so that your shares will be represented and voted at the meeting. You may vote by proxy on the internet or by telephone, or by completing and mailing the enclosed proxy card in the return envelope provided. If you do not vote by internet, telephone or mail, you still may attend the Annual Meeting and vote in person.

Thank you for your continued support of BD.

| |

|

|

| |

|

Sincerely, |

| |

|

|

| |

|

|

| |

|

EDWARD J. LUDWIG

Chairman, President and

Chief Executive Officer

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Becton, Dickinson and Company

1 Becton Drive

Franklin Lakes, New Jersey 07417-1880

December 20, 2004

The 2005 Annual Meeting of Shareholders of Becton, Dickinson and Company will be held as follows:

| |

DATE: |

|

Tuesday, February 1, 2005 |

| |

TIME: |

|

1:00 p.m. EST |

| |

LOCATION: |

|

Hilton Short Hills

41 John F. Kennedy Parkway

Short Hills, New Jersey |

| |

PURPOSE: |

|

To consider and act upon the following proposals: |

| |

|

|

1. |

|

The election of directors; |

| |

|

|

2. |

|

The ratification of the selection of independent registered public

accounting firm; |

| |

|

|

3. |

|

The approval of BD's Performance Incentive Plan; |

| |

|

|

4. |

|

A shareholder proposal relating to cumulative voting; and |

| |

|

|

5. |

|

Such other business as may properly come before the meeting. |

Shares represented by properly executed proxies that are hereby solicited by the Board of Directors of Becton, Dickinson and Company will be voted in accordance with instructions specified therein. Shares represented by proxies that are not limited to the contrary will be voted in favor of the election as directors of the persons nominated in the accompanying Proxy Statement, for proposals 2 and 3, and against proposal 4.

Shareholders of record at the close of business on December 6, 2004 will be entitled to vote at the meeting.

| |

|

|

| |

|

By order of the Board of Directors, |

| |

|

|

| |

|

DEAN J. PARANICAS

Vice President, Corporate Secretary and Public Policy

|

| |

|

|

|

| |

It is important that your shares be represented and voted

whether or not you plan to attend the meeting. |

| |

|

|

|

| |

YOU CAN VOTE BY PROXY IN ONE OF THREE WAYS: |

| |

|

|

|

| |

1. |

|

VIA THE INTERNET:

Visit the website noted on your proxy card/voting form. |

| |

|

|

|

| |

2. |

|

BY PHONE:

Use the toll-free telephone number given on your proxy card/voting form. |

| |

|

|

|

| |

3. |

|

BY MAIL:

Promptly return your signed and dated proxy card/voting form in the enclosed envelope. |

| |

|

|

|

Table of Contents

PROXY STATEMENT

2005 ANNUAL MEETING OF SHAREHOLDERS

Tuesday, February 1, 2005

BECTON, DICKINSON AND COMPANY

1 Becton Drive

Franklin Lakes, New Jersey 07417-1880

GENERAL INFORMATION

Proxy Solicitation

These proxy materials are being mailed or otherwise sent to BD shareholders on or about December 20, 2004 in connection with the solicitation of proxies by the Board of Directors for BD's Annual Meeting of Shareholders to be held at 1:00 p.m. EST on Tuesday, February 1, 2005 at the Hilton Short Hills, 41 John F. Kennedy Parkway, Short Hills, New Jersey. Directors, officers and other BD employees also may solicit proxies by telephone or otherwise. Brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses. BD has retained MacKenzie Partners, Inc. to assist in soliciting proxies for a fee not to exceed $15,000 plus expenses. The cost of soliciting proxies will be borne by BD.

How to Vote

Shareowners of record and participants in the BD plans described below may cast their votes by proxy by:

| |

(1) using the internet and voting at the website listed on the enclosed proxy/voting instruction card (the “proxy card”);

|

| |

(2) using the toll-free telephone number listed on the enclosed proxy card; or

|

| |

(3) signing, completing and returning the enclosed proxy card in the enclosed postage-paid envelope.

|

The internet and telephone voting procedures are designed to authenticate votes cast by use of a personal identification number. The procedure allows shareowners to appoint a proxy and the various plan participants to provide voting instructions, and to confirm that their actions have been properly recorded. Specific instructions to be followed are set forth on the enclosed proxy card.

Revocation of Proxies

A proxy may be revoked at any time before it is voted by sending written notice of revocation to the Corporate Secretary of BD at the address set forth above, by delivering a duly executed proxy bearing a later date or by voting in person at the meeting.

Required Vote

The holders of a majority of the shares entitled to vote at the meeting must be present in person or represented by proxy to constitute a quorum.

Directors are elected by a plurality of the votes cast at the meeting. Abstentions with respect to one or more of the nominees will be treated as present at the meeting for purposes of determining a quorum, but will not be counted as votes cast and, accordingly, will have no effect on the outcome of the vote. Similarly, shares that brokers do not have the authority to vote in the absence of timely instructions from the beneficial owners (“broker non-votes”), if any, will not be counted and, accordingly, will not affect the outcome of the vote.

Approval of Proposals 2, 3 and 4 requires the affirmative vote of a majority of the votes cast at the meeting. Under New Jersey law, in determining whether the proposal has received the requisite number of affirmative votes, abstentions and broker non-votes will not be counted as votes cast and, accordingly, will not affect the outcome of the vote.

Shareholders Entitled to Vote

At the close of business on December 6, 2004, the record date fixed by the Board for determining the shareholders entitled to notice of and to vote at the meeting, there were 254,601,235 shares of BD common stock outstanding, each entitled to one vote.

Savings Incentive Plan (SIP)

Participants in BD's Savings Incentive Plan (“SIP”) may instruct the Trustee how to vote all shares of common stock allocated to their SIP accounts, as well as the shares held in SIP which are not allocated to participants' accounts. The Trustee will vote SIP shares for which it has not received instructions in the same proportion as SIP shares for which it has received instructions.

Participants in Other Plans

Participants in the Savings Incentive Plan of Med-Safe Systems, Inc., a wholly-owned subsidiary of BD (the “Med-Safe Plan”), may instruct the Med-Safe Plan's Trustee how to vote all shares of BD common stock allocated to their accounts, as well as a proportionate number of shares held in the Med-Safe Plan for which voting instructions are not received by the Med-Safe Plan's Trustee from other participants. The Med-Safe Plan's Trustee will vote shares for which it has not received instructions in the same proportion as those for which it has received instructions.

The shares of BD common stock held by Wachovia Bank, N.A., as Trustee of both BD's Deferred Compensation Plan (“DCP”) and BD's 1996 Directors' Deferral Plan (“DDP”), and those held by Banque Internationale a Luxembourg (“BIL”) for BD's Global Share Investment Program (“GSIP”), may also be voted on all matters submitted to BD shareholders and carry one vote per share. Each director participating in DDP and each employee participating in DCP and, if so provided under the terms of the local country GSIP plan, in GSIP, may provide voting instructions for all shares of common stock allocated to that person's account, as well as a proportionate number of shares held in the relevant plan for which instructions are not received.

Proxies representing shares of common stock held of record also will serve as proxies for shares held under the Direct Stock Purchase Plan sponsored and administered by EquiServe Trust Company, N.A. and any shares of common and preferred stock allocated to participants' accounts under the DDP, SIP, DCP, the Med-Safe Plan and GSIP, if the registrations are the same. Separate mailings will be made for shares not held under the same registrations.

Other Matters

The Board of Directors is not aware of any matters to be presented at the meeting other than those set forth in the accompanying notice. If any other matters properly come before the meeting, the persons named in the proxy will vote on such matters in accordance with their best judgment.

2

OWNERSHIP OF BD STOCK

Securities Owned by Certain Beneficial Owners

The following table sets forth as of September 30, 2004, information concerning those persons known to BD to be the beneficial owner of more than 5% of BD's outstanding common stock. This information is as reported by such persons in their filings with the Securities and Exchange Commission (“SEC”). No changes in these holdings have come to BD's attention since September 30, 2004. BD is not aware of any other beneficial owner of more than 5% of its common stock.

Name and Address of Beneficial Owner

|

|

Amount and

Nature of

Beneficial Ownership

|

|

Percentage of

Class

|

Barclays Global Investors NA

45 Fremont Street, 17th Floor

San Francisco, CA 94105 |

|

|

26,826,607 |

(1)

|

|

|

10.7 |

% |

FMR Corporation

82 Devonshire Street

Boston, MA 02109 |

|

|

12,959,372 |

(2)

|

|

|

5.2 |

% |

State Street Corporation

225 Franklin Street

Boston, MA 02110 |

|

|

12,932,826 |

(3)

|

|

|

5.2 |

% |

|

| (1) |

|

Barclays Global Investors NA has shared investment power with respect to these shares and sole voting power with respect to 24,467,026 of these shares. |

| (2) |

|

FMR Corporation has shared investment power with respect to these shares, and sole voting power with respect to 2,766,532 of these shares. |

| (3) |

|

State Street Corporation has sole voting power and shared investment power with respect to these shares. |

Securities Owned by Directors and Management

The table on the following page sets forth as of December 6, 2004, information concerning the beneficial ownership of BD common stock by each director continuing to serve following the Annual Meeting, each nominee for director, the persons named in the Summary Compensation Table on page 24, and by all directors and executive officers as a group. In general, “beneficial ownership” includes those shares a director or executive officer has the power to vote or transfer, including shares which may be acquired under stock options that are currently exercisable or become exercisable within 60 days. The following table includes share units previously granted but undistributed under BD's Stock Award Plan and 2004 Employee and Director Equity-Based Compensation Plan (the “2004 Plan”) to executive

officers and directors. While these units may not be voted or transferred, they have been included in the table below as they represent an economic interest in BD common stock.

3

COMMON STOCK

Name

|

|

Shares owned

directly and

indirectly(1)

|

|

Shares which

may be acquired

within 60

days(2)

|

|

Total

Beneficial

Ownership as

Percentage of

Class

|

Basil L. Anderson |

|

|

685 |

(3)

|

|

|

0 |

|

|

* |

Henry P. Becton, Jr. |

|

|

336,325 |

(4)

|

|

|

6,853 |

|

|

* |

Gary M. Cohen |

|

|

79,125 |

|

|

|

281,909 |

|

|

* |

John R. Considine |

|

|

111,489 |

(5)

|

|

|

388,750 |

|

|

* |

Edward F. DeGraan |

|

|

3,116 |

|

|

|

0 |

|

|

* |

Vincent A. Forlenza |

|

|

70,396 |

|

|

|

230,167 |

|

|

* |

William A. Kozy |

|

|

79,899 |

|

|

|

316,882 |

|

|

* |

Edward J. Ludwig |

|

|

230,194 |

(5)

|

|

|

1,082,926 |

|

|

* |

Gary A. Mecklenburg |

|

|

0 |

(3)

|

|

|

0 |

|

|

* |

James F. Orr |

|

|

8,095 |

|

|

|

3,919 |

|

|

* |

Willard J. Overlock, Jr. |

|

|

12,210 |

|

|

|

6,853 |

|

|

* |

James E. Perrella |

|

|

32,669 |

|

|

|

6,583 |

|

|

* |

Bertram L. Scott |

|

|

3,135 |

|

|

|

695 |

|

|

* |

Alfred Sommer |

|

|

11,336 |

|

|

|

3,919 |

|

|

* |

Margaretha af Ugglas |

|

|

22,197 |

|

|

|

6,853 |

|

|

* |

All Directors and Executive Officers as a group (17 persons), including those named above |

|

|

1,044,069 |

(5)

|

|

|

2,455,513 |

|

|

1.6% |

|

| * |

|

Represents less than 1% of the outstanding common stock. |

| (1) |

|

Includes shares held directly and, with respect to executive officers, interests in BD common stock under the SIP and DCP, and with respect to directors, interests in BD common stock under the DDP. Also includes restricted stock units and/or performance units awarded to executive officers and directors under BD's equity-based compensation plans as follows: |

| |

|

Name

|

|

Number

of Units

|

|

|

|

|

Henry P. Becton, Jr. |

|

|

1,210 |

|

|

|

|

|

Gary M. Cohen |

|

|

28,582 |

|

|

|

|

|

John R. Considine |

|

|

37,936 |

|

|

|

|

|

Edward F. DeGraan |

|

|

1,210 |

|

|

|

|

|

Vincent A. Forlenza |

|

|

31,119 |

|

|

|

|

|

William A. Kozy |

|

|

35,579 |

|

|

|

|

|

Edward J. Ludwig |

|

|

104,100 |

|

|

|

|

|

James F. Orr |

|

|

1,210 |

|

|

|

|

|

Willard J. Overlock, Jr. |

|

|

1,210 |

|

|

|

|

|

James E. Perrella |

|

|

1,210 |

|

|

|

|

|

Bertram L. Scott |

|

|

1,210 |

|

|

|

|

|

Alfred Sommer |

|

|

1,210 |

|

|

|

|

|

Margaretha af Ugglas |

|

|

1,210 |

|

|

|

| (2) |

|

Consists of stock options available for exercise or which become available for exercise within 60 days. |

| (3) |

|

Messrs. Anderson and Mr. Mecklenburg were elected to the Board of Directors on March 23, 2004 and November 23, 2004, respectively. |

| (4) |

|

Includes 305,292 shares held by trusts of which Mr. Becton is a co-trustee with shared investment and voting power or held by a limited liability company owned by one of such trusts. Does not include 32,320 shares owned by Mr. Becton's spouse, 1,600 shares owned by a daughter, 108,440 shares held in trusts for the benefit of his children or 67,500 shares held in a charitable trust of which he is one of eight trustees, and as to each of which he disclaims beneficial ownership. |

| (5) |

|

In addition to the share ownership indicated, the following named executives have elected, on a discretionary basis, to defer under BD's Deferred Compensation Plan (“DCP”) the following portions of their 2004 bonuses into a BD common stock account, which investment will be made under the DCP in January 2005: Mr. Ludwig—$420,000; and Mr. Considine—$60,000. At an estimated share price of $55, this investment would represent an aggregate additional ownership interest by BD's executive officers in 8,727 shares. |

4

Equity Compensation Plan Information

The following table provides certain information as of September 30, 2004 regarding BD's equity compensation plans.

| |

|

(a) |

|

(b) |

|

(c) |

Plan Category

|

|

Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

|

|

Weighted-average

exercise price of

outstanding

options, warrants

and rights(1)

|

|

Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column(a))

|

Equity compensation plans approved by security holders |

|

|

27,247,936 |

(2)

|

|

$ |

31.13 |

|

|

|

9,086,374 |

(3)

|

Equity compensation plans not approved by security holders |

|

|

1,717,967 |

(4)

|

|

$ |

35.98 |

|

|

|

0 |

(5)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

28,965,903 |

|

|

$ |

31.15 |

|

|

|

9,086,374 |

|

|

| (1) |

|

Shares issuable pursuant to outstanding awards of performance units and restricted stock units under the BD 2004 Employee and Director Equity-Based Compensation Plan (the “2004 Plan”) and Stock Award Plan, as well as shares issuable under BD's 1996 Directors' Deferral Plan, Deferred Compensation Plan and Global Share Incentive Plan (“GSIP”), are not included in the calculation of weighted-average exercise price, as there is no exercise price for these shares. |

| (2) |

|

Includes an aggregate 321,131 shares distributable under performance unit and restricted stock unit awards granted under the 2004 Plan and Stock Award Plan. |

| (3) |

|

Includes 8,873,890 shares available for issuance under the 2004 Plan and 212,484 shares available for issuance under the 1994 Restricted Stock Plan for Non-Employee Directors. |

| (4) |

|

Includes 103,900 shares issuable pursuant to outstanding options granted under BD's Non-Employee Directors 2000 Stock Option Plan. Also includes 157,670 shares issuable under BD's 1996 Directors' Deferral Plan, 178,447 shares issuable under BD's Deferred Compensation Plan, and 1,277,950 shares issuable under GSIP, based on participant account balances as of September 30, 2004. |

| (5) |

|

Does not include shares issuable under the 1996 Directors' Deferral Plan, the Deferred Compensation Plan or the GSIP. There are no limits on the number of shares issuable under these plans, and the number of shares that may become issuable will depend on future elections made by plan participants. |

The following sets forth information regarding the BD equity compensation plans that have not been approved by BD's shareholders.

Non-Employee Directors 2000 Stock Option Plan. The Non-Employee Directors 2000 Stock Option Plan provided for the granting of non-qualified stock options at each annual meeting of BD shareholders to each non-employee director elected at or continuing to serve after such meeting. This plan was terminated with respect to future grants upon the approval of the 2004 Employee and Director Equity-Based Compensation Plan by BD's shareholders at the 2004 Annual Meeting.

The options issued under this plan had a monetary value at the time of grant of $35,000 using a Black-Scholes ratio to calculate the value of the then most recent annual stock option grants to executive officers of BD. The exercise price of stock options granted under the plan was the fair market value of the BD common stock on the date of grant. Each option granted under the plan had a term of 10 years from its date of grant. The options vest over the same period as was provided for with respect to the then most recent annual stock option grants to BD's executive officers. In the event of a tender offer for more than 25% of the outstanding common stock, or a “change in control” of BD (as defined in the plan), all outstanding options under the plan become immediately vested and exercisable.

1996 Directors' Deferral Plan. The 1996 Directors' Deferral Plan allows non-management directors to defer receipt of, in an unfunded cash account or an unfunded BD common stock account, all or part of their annual retainer and other fees. In the event a director elects to have fees deferred in a BD common stock account, the director's account is credited with a number of shares based on the prevailing market price of the BD common stock. The number of shares credited to the BD common stock accounts of participants is adjusted periodically to reflect the payment and reinvestment of dividends on the common stock. Participants may elect to have amounts held in a cash account converted into a BD common stock account, or convert amounts in a BD common stock account into a cash account,

subject to certain restrictions.

The plan is not funded, and participants have an unsecured contractual commitment of BD to pay the amounts due under the plan. When such payments are due, the cash and/or common stock will be distributed from BD's general assets.

5

Deferred Compensation Plan. The Deferred Compensation Plan allows employees, including executive officers, with a base salary of $100,000 or more, to defer receipt of salary and annual incentive awards, and shares issuable pursuant to stock unit awards, either in a BD common stock account or in cash accounts that mirror the gains and/or losses of a number of different investment funds. Under the plan, a participant may defer up to 75% of the participant's base salary and up to 100% of the participant's annual incentive award, until the date or dates specified by the participant. A participant may also defer receipt of up to 100% of the shares issuable under any stock units granted to the participant. A participant's BD common stock account is credited with shares based on the

prevailing market price of the BD common stock. The number of shares credited to the BD common stock accounts of participants is adjusted periodically to reflect the payment and reinvestment of dividends on the common stock. The plan is not funded, and participants have an unsecured contractual commitment of BD to pay the amounts due under the plan. When such payments are due, the cash and/or BD common stock will be distributed from BD's general assets.

GSIP. BD maintains the GSIP for its non-U.S. employees in certain jurisdictions outside of the United States. The purpose of the GSIP is to provide non-U.S. employees with a means of saving on a regular and long-term basis and acquiring a beneficial interest in BD. Participants may contribute a portion of their base pay, through payroll deductions, to the GSIP for their account. BD provides matching funds of up to 3% of the participant's base pay through contributions to the participant's GSIP account, which contributions are immediately vested. Contributions to the GSIP are invested in shares of common stock. A participant may withdraw the vested portion of the participant's account, although such withdrawals must be in the form of a cash payment if the participant is employed

by BD at the time of withdrawal. Following termination of service, withdrawals will be paid in either cash or shares, at the election of the participant.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires BD's executive officers and directors to file initial reports of their ownership of BD's equity securities and reports of changes in such ownership with the SEC and the New York Stock Exchange (“NYSE”). Executive officers and directors are required by SEC regulations to furnish BD with copies of all Section 16(a) forms they file. Based solely on a review of copies of such forms and written representations from BD's executive officers and directors, BD believes that for the period from October 1, 2003 through September 30, 2004, all of its executive officers and directors were in compliance with the disclosure requirements of Section 16(a).

6

Proposal 1.

ELECTION OF DIRECTORS

The Board of Directors is divided into three classes, the terms of which expire alternately over a three-year period. The Board proposes the election of Basil L. Anderson, Gary A. Mecklenburg, James E. Perrella and Alfred Sommer to serve for a term of three years until the 2008 Annual Meeting and until their successors have been duly elected and qualified. Mr. Anderson and Mr. Mecklenburg were recommended to the Board by executive search firms retained by the Corporate Governance and Nominating Committee. Dr. Harry N. Beaty and Frank A. Olson, each of whom has reached the mandatory retirement age under BD's Corporate Governance Principles, will retire as members of the Board effective at the Annual Meeting.

All of the nominees for election have consented to being named in this proxy statement and to serve if elected. Presented below is biographical information for each of the nominees and directors continuing in office following the 2005 Annual Meeting.

NOMINEES FOR DIRECTOR

Term to Expire 2008

|

|

Basil L. Anderson, 59, was elected a director by the Board effective March 23, 2004. He has served as Vice Chairman of Staples, Inc., a supplier of office products, since 2001. Prior thereto, he was Executive Vice President—Finance and Chief Financial Officer of Campbell Soup Company. Mr. Anderson also is a director of Hasbro, Inc., Charles River Associates, Inc., Moody's Corporation and Staples, Inc.

|

| |

|

|

|

|

Gary A. Mecklenburg, 58, was elected a director by the Board effective November 23, 2004. He has served as President and Chief Executive Officer of Northwestern Memorial HealthCare, the parent corporation of Northwestern Memorial Hospital, since 1986. Mr. Mecklenburg also served as President and Chief Executive Officer of Northwestern Memorial Hospital from 1985 to 2002. Mr. Mecklenburg also is a director of Northwestern Memorial HealthCare.

|

| |

|

|

|

|

James E. Perrella, 69, has been a director since 1995. In 2000, he retired as Chairman of the Board of Ingersoll-Rand Company, a manufacturer of industrial machinery and related products. Mr. Perrella also served as President and Chief Executive Officer of Ingersoll-Rand. He also is a director of Bombardier Inc. and Arvin Meritor, Inc.

|

| |

|

|

7

|

|

Alfred Sommer, M.D., M.H.S., 62, has been a director since 1998. He is Dean of The Johns Hopkins University Bloomberg School of Public Health, and Professor of Ophthalmology, Epidemiology and International Health. Dr. Sommer was founding Director of the Dana Center for Preventive Ophthalmology at Johns Hopkins, which focuses on clinical epidemiology and public health aspects of blindness prevention and child health. Dr. Sommer is also a director of T. Rowe Price Group, Inc.

|

CONTINUING DIRECTORS

Term to Expire 2007

|

|

Henry P. Becton, Jr., 61, has been a director since 1987. He is President of WGBH Educational Foundation, a producer and broadcaster of public television and radio programs and books and other educational materials. Prior thereto, he was President and General Manager of WGBH Educational Foundation. Mr. Becton is a director of Belo Corporation, various Scudder mutual funds and Public Radio International.

|

| |

|

|

|

|

Edward F. DeGraan, 61, has been a director since 2003. He is Vice Chairman of The Gillette Company, a manufacturer of a wide variety of consumer products. Prior thereto, he served in various capacities as Executive Vice President with Gillette, and served as President and Chief Operating Officer from July 2000 until November 2003. Mr. DeGraan served as Acting Chief Executive Officer of Gillette from October 2000 to February 2001.

|

| |

|

|

|

|

James F. Orr, 59, has been a director since 2000. Mr. Orr is the Chairman, President and Chief Executive Officer of Convergys Corporation, a provider of outsourced billing, employee care and customer management services. Mr. Orr also is a director of Ohio National Financial Services, Inc.

|

| |

|

|

|

|

Margaretha af Ugglas, 65, has been a director since 1997. She is the former Minister of Foreign Affairs of Sweden. Ms. af Ugglas is a director of the Karolinska Institute, a leading Swedish medical research university, and of the Jarl Hjalmarson Foundation, an organization that focuses on European integration and cooperation.

|

8

Term to Expire 2006

|

|

Edward J. Ludwig, 53, has been a director since 1999. He was elected President of BD in May 1999 and became President and Chief Executive Officer in January 2000. Mr. Ludwig was elected to the additional role of Chairman effective February 2002. He is a director of Aetna Inc., the U.S. Fund for UNICEF, and a member of the Board of Trustees of The Johns Hopkins University.

|

| |

|

|

|

|

Willard J. Overlock, Jr., 58, has been a director since 1999. He retired in 1996 as a partner in Goldman, Sachs & Co., where he served as a member of its management committee, and currently serves as a Senior Advisor to The Goldman Sachs Group, Inc. Mr. Overlock also is an advisor to the Parthenon Group and a trustee of Rockefeller University.

|

| |

|

|

|

|

Bertram L. Scott, 53, has been a director since 2002. He is the President and Chief Executive Officer of TIAA-CREF Life Insurance Company and Executive Vice President of TIAA-CREF. Prior to joining TIAA-CREF in November 2000, Mr. Scott served as President and Chief Executive Officer of Horizon/Mercy, a joint Medicaid managed care program between Mercy Health Plan of Pennsylvania and Blue Cross/Blue Shield of New Jersey.

|

The Board of Directors recommends a vote FOR Proposal 1.

9

BOARD OF DIRECTORS

The Board and Committees of the Board

BD is governed by a Board of Directors. The Board has established seven Committees consisting of the Executive Committee, the Audit Committee, the Compensation and Benefits Committee, the Corporate Affairs Committee, the Corporate Governance and Nominating Committee, the Finance and Investment Committee and the Qualified Legal Compliance Committee. The Executive Committee and Qualified Legal Compliance Committee meet only as necessary. The Board has adopted a written charter for each of the Committees (other than the Executive Committee), copies of which are posted on BD's website at www.bd.com/investors/corporate_governance. Printed copies of these charters may be obtained, without charge, by contacting the Corporate Secretary, Becton, Dickinson and Company,

1 Becton Drive, Franklin Lakes, New Jersey 07417-1880, telephone 201-847-6800. A copy of the Audit Committee charter is attached as Appendix A to this proxy statement.

Committee Membership and Function

Set forth below is the membership and a summary of the function of each of BD's key standing Committees.

| |

Function |

| |

• |

|

Reviews BD's financial statements and accounting principles, the scope and results of the annual audit by the independent auditors, and BD's internal audit process, including BD's internal controls and accounting systems. |

| |

• |

|

Retains and reviews the qualifications, independence and performance of BD's independent auditors. |

| |

Members: |

|

James F. Orr—Chair

Basil L. Anderson

Harry N. Beaty

Gary A. Mecklenburg

Willard J. Overlock, Jr.

Bertram L. Scott |

| |

The Board has determined that the members of the Committee meet the independence and financial literacy and expertise requirements of the NYSE. Mr. Anderson currently serves on the audit committees of three other public companies. The Board reviewed Mr. Anderson's obligations as a member of the other audit committees in accordance with NYSE rules and BD's Corporate Governance Principles, and determined that his simultaneous service on those other audit committees does not impair his ability to effectively serve on BD's Audit Committee. |

| |

The Board has determined that Messrs. Anderson, Orr and Scott each qualify as an “audit committee financial expert” under the rules of the SEC. |

10

| |

Function |

| |

• |

|

Oversees BD's compensation and benefits policies generally, and approves the compensation of the Chief Executive Officer (which is also approved by the Board) and those members of the BD Leadership Team who report to the Chief Executive Officer, which includes all other executive officers. |

| |

• |

|

Approves all employment and severance contracts of BD or any subsidiary with senior executives who are not also directors. |

| |

• |

|

Serves as the granting and administrative committee for BD's equity compensation plans. |

| |

• |

|

Oversees the administration of employee benefits and benefit plans for BD. |

| |

Members: |

|

Frank A. Olson—Chair

Henry P. Becton, Jr.

Edward F. DeGraan

Willard J. Overlock, Jr.

James E. Perrella |

| |

The Board has determined that each member of the Committee meets the independence requirements of the NYSE. |

| |

Function |

| |

• |

|

Oversees BD's policies, practices and procedures as a responsible corporate citizen in the general areas of ethical conduct and legal compliance, including, without limitation, issues relating to communications, employment practices, community relations, environmental matters, customer relations and business practices and ethics. |

| |

Members: |

|

Margaretha af Ugglas—Chair

Henry P. Becton, Jr.

Bertram L. Scott

Alfred Sommer |

| |

Function |

| |

• |

|

Recommends candidates for election as directors to the Board. |

| |

• |

|

Reviews and makes recommendations concerning the composition, organization, structure and function of the Board and its Committees, as well as the performance and compensation of directors. |

| |

• |

|

Monitors and considers BD's corporate governance and Board practices and recommends matters for consideration by the Board. |

| |

• |

|

Periodically reviews BD's shareholder rights plan. |

| |

Members: |

|

Henry P. Becton, Jr.—Chair

Harry N. Beaty

Edward F. DeGraan

Gary A. Mecklenburg

James F. Orr

Margaretha af Ugglas |

| |

The Board has determined that each member of the Committee meets the independence requirements of the NYSE. |

11

| |

Function |

| |

• |

|

Reviews the financial affairs of BD, including BD's financial structure, dividend policy, share repurchase programs, financial plans and capital expenditure budgets. |

| |

• |

|

Reviews and recommends appropriate Board action with respect to acquisitions and divestitures of assets meeting specified thresholds. |

| |

Members: |

|

Willard J. Overlock, Jr.—Chair

Basil L. Anderson

Frank A. Olson

James E. Perrella

Alfred Sommer |

|

Board, Committee and Annual Meeting Attendance

The Board and its Committees held the following number of meetings during the fiscal year ended September 30, 2004:

| |

Board |

|

|

7 |

|

| |

Audit Committee |

|

|

11 |

* |

| |

Compensation and Benefits Committee |

|

|

6 |

|

| |

Corporate Affairs Committee |

|

|

5 |

|

| |

Corporate Governance and Nominating Committee |

|

|

7 |

|

| |

Finance and Investment Committee |

|

|

6 |

|

| |

Qualified Legal Compliance Committee |

|

|

1 |

|

| |

|

| |

* |

|

Including quarterly conference calls with management and BD's independent auditors to review BD's earnings releases and reports on Form 10-Q and Form 10-K prior to their filing. |

|

|

Each director attended at least 84% of the total number of the meetings of the Board and of the Committees on which he or she served during the year.

Three of the eleven directors then in office, including the Lead Director, attended BD's 2004 Annual Meeting of Shareholders held on February 11, 2004. Since that time, the Board has adopted a new policy pursuant to which directors are expected to attend the Annual Meeting in the absence of a scheduling conflict or other valid reason.

Directors' Compensation

Each non-management director receives an annual retainer of $55,500 for services as a director. An annual fee of $5,500 also is paid to each Committee chair.

Additional directors' fees of $1,500 are paid to non-management directors for each half-day spent on Board-related activities outside of regularly scheduled Board meetings, in meetings of each Board committee in excess of an aggregate of five hours per year, or for time spent by a non-management director becoming familiar with BD's businesses or meeting with representatives or officers of BD.

Directors may defer receipt of, in an unfunded cash account or an unfunded BD common stock account, all or part of their annual retainer and other fees pursuant to the provisions of the 1996 Directors' Deferral Plan. The number of shares credited to the accounts of directors is adjusted periodically to reflect deemed payment and reinvestment of dividends on the common stock.

BD reimburses all directors for travel and other necessary business expenses incurred in the performance of their services for BD.

Each non-management director elected at, or continuing as a director after, each annual meeting of shareholders is granted (a) stock options to purchase shares of common stock at the fair market value of the common stock on the date of grant and (b) 1,200 restricted stock units in tandem with dividend equivalent rights. The options granted have a monetary value of $35,000 on the date of grant (based on the Black-Scholes option pricing model). The distribution of the shares of BD common stock issuable pursuant to restricted stock units will be deferred until a director's separation from the Board.

12

Directors are eligible, on the same basis as employees, to participate in BD's Matching Gift Program, pursuant to which BD matches contributions up to an aggregate of $10,000 annually that are made by a director to qualifying nonprofit organizations.

To the extent any director who is not a resident of the United States is subject to any U.S. or state tax as a result of compensation received for service as a director, BD will pay up to $5,000 towards the director's tax return preparation costs. BD also reimburses the director for any tax liability resulting from the payment of such costs. In fiscal 2004, BD paid $1,475 of tax preparation cost with respect to Margaretha af Ugglas.

Certain Relationships and Related Transactions

Gary A. Mecklenburg, a member of the Board, is the President and Chief Executive Officer, and a member of the Board of Directors, of Northwestern Memorial HealthCare, the parent corporation of Northwestern Memorial Hospital. During BD's fiscal year 2004, BD's sales to Northwestern Memorial Hospital (both direct and through a distributor) were approximately $2.2 million, which represented less than 1⁄4% of Northwestern Memorial HealthCare's consolidated operating revenues.

In addition to the foregoing disclosure that is required under SEC rules, BD has been a party to the following transactions with entities of which a member of the Board serves in an executive capacity.

Basil L. Anderson, a member of the Board, is the Vice Chairman and a member of the Board of Directors of Staples, Inc. (“Staples”). In fiscal year 2004, BD purchased $1.7 million of office products from Staples pursuant to a contract that was competitively bid.

Alfred Sommer,

M.D., M.H.S., a member of the Board, is Dean of the Bloomberg School of Public

Health (the “Bloomberg School”) at The Johns Hopkins University

(“JHU”). In fiscal year 2004, BD sponsored several research arrangements

with the Bloomberg School involving an aggregate of approximately $230,000.

BD also has established a research collaboration with the Bloomberg School pursuant

to which BD has agreed to provide up to $600,000 in funding over the next three

fiscal years.

Directors' Share Ownership Guidelines

Under the Board's formal share ownership guidelines, each non-management director is required to own shares of common stock valued at 50% of the amount obtained by multiplying the annual retainer fee by the number of years the director has served. Each non-management director currently owns shares in an amount sufficient to comply with these guidelines.

13

CORPORATE GOVERNANCE

Corporate Governance Principles

BD first adopted its Corporate Governance Principles in November 2001. The Principles are reviewed by the Corporate Governance and Nominating Committee at least annually and any proposed additions or amendments are reviewed and submitted to the Board for its consideration. BD's Corporate Governance Principles are attached as Appendix B to this proxy statement and are posted on BD's website at www.bd.com/investors/corporate_governance. Printed copies of BD's Corporate Governance Principles may be obtained, without charge, by contacting the Corporate Secretary, Becton, Dickinson and Company, 1 Becton Drive, Franklin Lakes, New Jersey 07417-1880, phone 1-201-847-6800.

Director Independence

Under the NYSE rules and BD's Corporate Governance Principles, a director is not independent if the director has a direct or indirect material relationship with BD. The Corporate Governance and Nominating Committee annually reviews the independence of all directors and reports its findings to the full Board. To assist in this review, the Board has adopted director independence guidelines (“Independence Guidelines”) that are contained in Corporate Governance Principle No. 7. The Independence Guidelines set forth certain relationships that the Board, in its judgment, has deemed to be material or immaterial for purposes of assessing a director's independence. In the event a director has any relationship with BD that is not addressed in the Independence Guidelines, the independent members of the Board

determine whether such relationship is material.

The Board has determined that the following directors are independent under the Independence Guidelines: Basil L. Anderson, Henry P. Becton, Jr., Edward F. DeGraan, Gary A. Mecklenburg, James F. Orr, Willard J. Overlock, Jr., James E. Perrella, Bertram L. Scott and Margaretha af Ugglas. The Board also determined that each of Edward J. Ludwig and Alfred Sommer has a material relationship with BD, because, in the case of Mr. Ludwig, he is BD's President and Chief Executive Officer, and, in the case of Dr. Sommer, he is Dean of the Bloomberg School of Public Health at The John Hopkins University (“JHU”) and Mr. Ludwig currently serves as a member of the JHU Board of Trustees. Consequently, Messrs. Ludwig and Sommer are deemed by the Board

not to be independent under the NYSE rules and BD's Corporate Governance Principles.

Executive Sessions

During 2004, each of the following Committees met in executive session without members of management present, as follows: Audit (six times); Compensation and Benefits (six times); and Corporate Governance and Nominating (three times). Additionally, as required by BD's Corporate Governance Principles, BD's non-management directors met in executive session three times during fiscal 2004.

Lead Director

BD's Corporate Governance Principles provide for the designation of an independent director to serve as Lead Director when the Chairman is not an independent director. The Lead Director presides over any executive session of the non-management directors and serves as a liaison between the non-management directors and the Chairman. The Lead Director also serves as a contact person to facilitate communications by BD's employees, shareholders and other constituents with the non-management directors. The Corporate Governance and Nominating Committee recommends the nominee for Lead Director to the full Board for approval. BD's Lead Director currently is Frank A. Olson, who is retiring from the Board effective at the Annual Meeting of Shareholders on February 1, 2005 in accordance with the Board's director retirement

policy. The independent directors have designated Henry P. Becton, Jr. to succeed Mr. Olson as Lead Director effective at the Annual Meeting.

Communication with Directors

Shareholders or other interested parties wishing to communicate with the Board, the non-management directors or any individual director may contact the Lead Director either by mail, addressed to BD Lead Director, c/o Corporate Secretary, Becton, Dickinson and Company, 1 Becton Drive, Franklin Lakes, New Jersey 07417-1880, or by calling the BD Ethics Help Line, an independent toll-free service, at 1-800-821-5452

14

(available seven days a week, 24 hours a day). Callers from outside the U.S., Canada and Mexico should use “AT&T Direct” to reach AT&T in the U.S. and then dial the above toll-free number. The communications will be kept confidential and forwarded to the Lead Director. Communications received by the Lead Director are forwarded to the appropriate director(s) or to an individual non-management director. Such items as are unrelated to a director's duties and responsibilities as a Board member may be excluded by the Director of Corporate Security, including, without limitation, solicitations and advertisements; junk mail; product-related communications; job referral materials such as resumes; surveys; and material that is determined to be illegal or otherwise inappropriate. The director(s) to whom such information is addressed is

informed that the information has been removed, and that it will be made available to such director(s) upon request.

Board Evaluation

Each year the Board evaluates its performance and effectiveness. Each director completes a Board Evaluation Form developed by the Corporate Governance and Nominating Committee to solicit feedback on specific aspects of the Board's role, organization and meetings. The collective ratings and comments are then compiled by the Corporate Secretary and presented by the Chair of the Corporate Governance and Nominating Committee to the full Board. As part of the evaluation, the Board assesses the progress in the areas targeted for improvement a year earlier, and develops recommendations to enhance the Board's effectiveness over the next year. Additionally, each Board Committee conducts an annual self-evaluation of its performance through a Committee Evaluation Form based on its charter.

The areas evaluated by the Board in the course of its evaluation are as follows:

| |

A. |

|

ROLE OF THE BOARD: |

| |

1. |

|

The Board evaluates, questions, and approves management's corporate strategy and understands BD's strategic and operating plans. |

| |

2. |

|

The Board understands the industries in which BD operates and the implications of competitive factors and current general economic and political trends to those businesses. |

| |

3. |

|

The Board adequately monitors BD's performance with peer company financial performance and with industry and other relevant comparative data. |

| |

4. |

|

The Board evaluates BD's research and development funding and performance and level of commitment. |

| |

5. |

|

The Board evaluates BD's acquisition and divestiture strategy, and reviews management's activities in those areas. |

| |

6. |

|

The Board reviews and adopts annual capital and operating budgets and monitors BD's performance against them during the year. |

| |

7. |

|

The Board reviews the adequacy of existing accounting and financial controls and oversees ethical conduct and legal compliance by BD. |

| |

8. |

|

BD keeps directors adequately informed of changes in applicable laws, rules and regulations, as well as current trends and best practices in corporate governance. |

| |

9. |

|

The Board evaluates and reviews the performance of the Chief Executive Officer. |

| |

10. |

|

The Board reviews senior management development and compensation and considers the correlation between compensation levels and BD's performance. |

| |

11. |

|

The Board reviews succession plans for the Chief Executive Officer and senior management. |

| |

12. |

|

The Board encourages and ensures open lines of communication between Board members and senior management. |

| |

13. |

|

The Chairman and Chief Executive Officer adequately follows up on goals, expectations and concerns communicated by the Board. |

| |

14. |

|

The Board adequately monitors BD's relations with its associates, including BD's compensation and benefits policies. |

| |

15. |

|

The amount and nature of director compensation realistically reflects the responsibilities related to service on the Board and is sufficient to attract and maintain quality candidates possessing desired abilities and expertise. |

15

| |

16. |

|

The stock ownership guidelines for directors and senior management are appropriate to align their interests with those of shareholders. |

| |

In some instances, the above functions are largely performed by a Committee of the Board. |

| |

B. |

|

ORGANIZATION OF THE BOARD: |

| |

17. |

|

The process for selecting directors is appropriate and effective. |

| |

18. |

|

The process for selecting the Lead Director is appropriate. |

| |

19. |

|

The diversity (age, gender, background) of the Board is appropriate. |

| |

20. |

|

The Board has the appropriate mix of members, skills, experience and other characteristics to be effective. |

| |

21. |

|

The Company's independent directors are independent-minded in dealing with BD issues. |

| |

22. |

|

The existing frequency of rotation of committee memberships and chairs is appropriate. |

| |

23. |

|

The Board seeks to optimally and appropriately utilize each Board member's experiences in terms of Committee appointments. |

| |

C. |

|

MEETINGS OF THE BOARD: |

| |

24. |

|

There are an adequate number of regularly scheduled Board meetings held during a year. |

| |

25. |

|

There are an adequate number of non-management director meetings held during a year. |

| |

26. |

|

Information is provided in a timely manner to Board members prior to Board meetings, and is sufficiently complete and clear to allow for adequate preparation and informed decision-making for the meetings. |

| |

27. |

|

The time at Board meetings is utilized effectively, including sufficient time to consider Board agenda items. |

| |

28. |

|

The reports and presentations to the Board are of high quality and are sufficient for effective evaluation of the performance of BD and its management. |

Director Nomination Process

The Corporate Governance and Nominating Committee reviews the skills, characteristics and experience of potential candidates for election to the Board and recommends nominees for director to the full Board for approval. It is the Committee's policy to utilize a variety of means to identify prospective nominees for the Board, and it considers referrals from other Board members, management, shareholders and other external sources such as retained executive search firms. The Committee utilizes the same criteria for evaluating candidates irrespective of their source.

The Committee believes that any nominee must meet the following minimum qualifications:

| |

|

• |

|

Candidates should be persons of high integrity who possess independence, forthrightness, inquisitiveness, good judgment and strong analytical skills. |

| |

|

• |

|

Candidates should demonstrate a commitment to devote the time required for Board duties including, but not limited to, attendance at meetings. |

| |

|

• |

|

Candidates should possess a team-oriented ethic consistent with BD's Core Values, and who are committed to the interests of all shareholders as opposed to those of any particular constituency. BD's Core Values are: |

| |

|

|

|

|

|

– We do what is right |

| |

|

|

|

|

|

– We always seek to improve |

| |

|

|

|

|

|

– We accept personal responsibility |

| |

|

|

|

|

|

– We treat each other with respect |

When considering director candidates, the Committee will seek individuals with backgrounds and qualities that, when combined with those of BD's other directors, provide a blend of skills and experience that will further enhance the Board's effectiveness. The Committee has retained an executive search firm to assist it in its efforts to identify and evaluate potential director candidates.

16

The Committee assesses the characteristics and performance of incumbent director nominees against the above criteria, and to the extent applicable, considers the impact of any change in the principal occupations of such directors during the last year. Upon completion of the individual director evaluation process, the Committee reports its conclusions and recommendations for nominations to the Board.

To recommend

a candidate for consideration, a shareholder should submit a written statement

of the qualifications of the proposed nominee, including full name and address,

to the Corporate Secretary, Becton, Dickinson and Company, 1 Becton Drive, Franklin

Lakes, New Jersey 07417-1880.

Business Conduct and Compliance Guide

BD's ethics policies can be found in its Business Conduct and Compliance Guide (the “Guide”), which was first adopted by the Board in 1995. The Guide is a code of conduct and ethics applicable to all directors, officers and employees of BD, including its Chief Executive Officer and its Chief Financial Officer, Controller and other senior financial officers. The Guide sets forth BD policies and expectations on a number of topics, including without limitation, conflicts of interest, confidentiality, compliance with laws (including insider trading laws), preservation and use of Company assets, and business ethics. The Guide also sets forth procedures for communicating and handling any potential conflict of interest (or the appearance of any conflict of interest) involving directors or executive officers, and

for the confidential communication and handling of issues regarding accounting, internal controls and auditing matters.

In 1995, BD instituted an Ethics Help Line number for BD associates as a means of raising concerns or seeking advice. The Help Line is serviced by an independent contractor and is available to all associates worldwide, 7 days a week, 24 hours a day. Translation services are also available to associates. Associates using the Help Line may choose to remain anonymous and all inquiries are kept confidential. All Help Line inquiries are forwarded to BD's Ethics Director for investigation. Any matters reported to the Ethics Director, through the Ethics Helpline or otherwise, involving accounting, internal control or audit matters, or any fraud involving management or persons who have a significant role in BD's internal controls, are reported to the Audit Committee.

The Ethics Director leads the BD Ethics Office, a unit within BD that administers BD's ethics program. In addition to the Help Line, the ethics program provides for broad communication of BD's Core Values, associate education regarding the Guide and its requirements, and ethics training sessions.

BD regularly reviews the Guide and proposed additions or amendments to the Guide are submitted to the Board for its consideration. The Guide is posted on BD's website at www.bd.com/investors/corporate_governance. Printed copies of the Guide may be obtained, without charge, by contacting the Corporate Secretary, Becton, Dickinson and Company, 1 Becton Drive, Franklin Lakes, New Jersey 07417-1880, phone 1-201-847-6800. Any waivers from any provisions of the Guide for executive officers and directors will be promptly disclosed to shareholders. In addition, any amendments to the Guide, as well as any waivers from certain provisions of the Guide relating to BD's Chief Executive Officer, Chief Financial Officer or Controller, will be posted at the

above website address.

Annual Report of Charitable Contributions

Pursuant to BD's Corporate Governance Principles, any charitable contributions, or pledges of charitable contributions, by BD in any given fiscal year in an aggregate amount of $50,000 or more to an entity for which a BD director or a member of his or her immediate family serves as a director, officer or employee, or as a member of such entity's fund-raising organization or committee, is subject to the prior consideration and approval of the Corporate Governance and Nominating Committee.

The Corporate Governance and Nominating Committee of the Board is provided annually with a report by management of charitable contributions or pledges made by BD during the fiscal year in an amount of $10,000 or more, to any entity for which a BD director or executive officer, or a member of his or her immediate family, serves as a director, officer or employee, or as a member of such entity's fund-raising organization or committee. The report for fiscal 2004 is attached as Appendix C to this proxy statement.

17

REPORT OF THE AUDIT COMMITTEE

November 22, 2004

The Audit Committee reviews BD's financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls. The independent auditors are responsible for performing an independent audit of the Company's consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Committee monitors these processes.

In this context, the Committee met and held discussions with management and the independent auditors. Management represented to the Committee that the Company's consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States, and the Committee reviewed and discussed the consolidated financial statements with management and the independent auditors. The Committee also discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Codification of Statements on Auditing Standards, AU 380), as amended.

In addition, the Committee discussed with the independent auditors the auditors' independence from the Company and its management, and the independent auditors provided to the Committee the written disclosures and letter required by the Independence Standards Board Standard No. 1 (Independence Discussions With Audit Committees).

The Committee discussed with the Company's internal and independent auditors the overall scope and plans for their respective audits. The Committee met with the internal and independent auditors, with and without management present, to discuss the results of their examinations, the evaluations of BD's internal controls, and the overall quality of BD's financial reporting.

Based on the reviews and discussions referred to above, the Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 2004, for filing with the Securities and Exchange Commission.

AUDIT COMMITTEE

James F. Orr, Chair

Basil L. Anderson

Harry N. Beaty

Willard J. Overlock, Jr.

Bertram L. Scott

18

REPORT OF THE COMPENSATION AND BENEFITS COMMITTEE

ON EXECUTIVE COMPENSATION

The Compensation and Benefits Committee (the “Committee”) is composed exclusively of non-employee, independent directors. The Committee reviews the compensation program for the Chief Executive Officer and other members of senior management, including the executive officers listed on the Summary Compensation Table appearing on page 24 (the “named executives”), and determines and administers their compensation. In the case of the Chief Executive Officer, the compensation determination made by the Committee is also subject to approval by the entire Board. The Committee also oversees the administration of employee benefits and benefit plans for BD and its subsidiaries. The Committee has retained an independent consultant to assist the Committee in fulfilling its responsibilities.

Overview

The Committee's philosophy is to provide a compensation package that attracts and retains executive talent and delivers higher rewards for superior performance and consequences for underperformance. It is also the Committee's practice to provide a balanced mix of cash and equity-based compensation that the Committee believes appropriate to align the short- and long-term interests of BD's executives with that of its shareholders and to encourage executives to act as equity owners of BD. Equity ownership is further emphasized through share retention and ownership guidelines established by the Committee, which are discussed later in this report.

The Committee seeks to attract executive talent by offering competitive base salaries, annual performance incentive opportunities, and the potential for long-term rewards under BD's long-term incentive program. It is the Committee's practice to provide incentives that promote both the short- and long-term financial objectives of BD. Achievement of short-term objectives is rewarded through base salary and annual performance incentives, while long-term equity-based incentive grants encourage executives to focus on BD's long-term goals as well. These incentives are based on financial objectives of importance to BD, including revenue and earnings growth, return on invested capital, and creation of shareholder value. BD's compensation program also accounts for individual performance, which enables the Committee

to differentiate among executives and emphasize the link between personal performance and compensation. BD's compensation practices reflect the Committee's pay-for-performance philosophy, whereby a significant portion of executive compensation is at risk and tied to both individual and company performance.

Prior to 2004, the long-term incentive component of BD's compensation program consisted solely of stock options. During fiscal 2004, the long-term incentive component was re-designed to include grants of performance-based stock awards and time-vested restricted stock units, along with stock options or stock appreciation rights. These changes reflect the Committee's philosophy that long-term incentive compensation serves three purposes: to align the interests of executives with those of BD's shareholders (through stock options or stock appreciation rights), promote BD's long-term performance goals (through performance-based awards), and further executive retention (through time-vested restricted stock units).

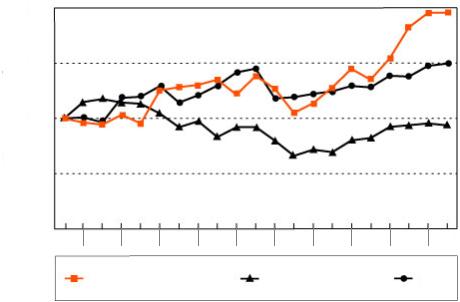

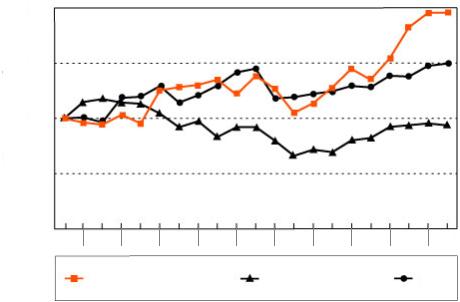

The Committee compares BD's senior management compensation levels with those of a group of fourteen companies (the “Compensation Comparison Group”). The Compensation Comparison Group is comprised of eight companies that are included in the “Performance Peer Group” used for the Performance Graph on page 30 (compensation information regarding the remaining companies, Bausch & Lomb Inc. and Stryker Corporation, is not publicly available), as well as the following additional companies with which BD competes for talent: Alcon Inc; Allergan, Inc.; Apogent Technologies Inc.; C.R. Bard Inc.; PerkinElmer Inc; and Roche Diagnostics.

The Committee periodically reviews the effectiveness and competitiveness of BD's executive compensation structure with the assistance of its independent consultant. This consultant is engaged by, and reports directly to, the Committee.

The key elements of executive compensation are base salary, annual performance incentive awards, and long-term equity-based incentive grants. It is the Committee's practice to target each of these elements to deliver compensation to each executive and all executives as a group at approximately the 50th percentile of the Compensation Comparison Group companies. In so doing, the Committee considers compensation data ranging between the 50th and 75th percentiles for that group. The Committee also considers the total value of the annual compensation for each executive and all executives as a group. A table showing the value of total annual compensation provided to the named executive officers is set forth below under “Value of Total Compensation.”

19

Elements of Executive Compensation

Base Salary

The Committee annually reviews and determines the base salaries of the Chief Executive Officer and other members of senior management, with its determination with respect to the Chief Executive Officer being subject to approval by the entire Board. In each case, the Committee takes into account the results achieved by the executive, his or her future potential, scope of responsibilities and experience, and competitive salary practices.

Performance-Based Annual Incentive Awards

Annual performance incentives are tied to BD's overall performance, as well as the performance of each executive and of his or her area of responsibility or business unit. For fiscal 2004, the Committee set an earnings per share target. In addition, management sets certain financial and operational objectives for each business unit, region/country and function that are designed to promote key company initiatives.

Incentive award payments are made from a pool that is funded based on BD's performance levels, ranging from 80% (threshold) to 110% (maximum) of the performance target(s) pre-established by the Committee, as follows.

| |

Performance Level

|

|

Funding Level

|

| |

|

|

|

| |

Below 80% of target |

|

No funding |

| |

At 80% of target |

|

50% of funding |

| |

Every 1% increase between 80% and 100% of target |

|

An additional 2.5% of funding |

| |

Every 1% increase above 100% of target |

|

An additional 5% of funding (to a maximum of 150%) |

| |

|

|

|

The Committee relies heavily, but not exclusively, on the criteria mentioned. The Committee does not use any fixed formula in determining incentive awards. Instead it exercises discretion in light of these measures and in view of its compensation objectives to determine overall funding and individual incentive award amounts.

For fiscal 2004, BD achieved 102.1% of its annual incentive target, which generated a funding level of 111%.

Long-Term Incentive Awards

Long term-term incentive awards for each member of senior management consist of a grant comprised of three components: stock options, performance-based stock units and time-vested restricted stock units (the latter being referred to as “career shares”). In consultation with the independent consultants, the Committee first determines the value of the award to be granted to each recipient. Then, using valuation methodologies determined by the Committee in consultation with its independent consultant, the award is allocated among its components, with stock options and performance units generally targeted to deliver approximately 40% each of the total long-term incentive value, and career shares generally targeted to deliver the remaining 20%.

|

• |

Stock Options. Options vest over a four-year period, with 25% becoming exercisable on each anniversary of the grant date, and have a ten-year term. All options are granted with an exercise price equal to the fair market value of the BD common stock on the date of grant, and option re-pricing is expressly prohibited by the terms of BD's equity compensation plan. Certain senior executives, including the named executives, are required to hold 25% of the net, after-tax gain received upon exercise in shares of BD common stock. This requirement is in addition to the share retention and ownership guidelines discussed later in this report.

|

| |

|

• |

Performance Units. Performance-based stock units vest after three years, and are tied to BD's performance against pre-established targets, including its compound growth rate of consolidated revenues and average return on invested capital, over a three-year performance period. Under BD's long-term incentive program, the actual payout under these awards may vary from zero to 250% of an executive's target payout, based on BD's actual performance over the three-year performance period. These awards are granted in tandem with dividend equivalent rights.

|

| |

|

• |

Career Shares. Payment of career shares is deferred until one year following the executive's retirement or upon the happening of other events, such as an involuntary termination without cause. These awards are granted in tandem with dividend equivalent rights. Executives are subject to a non-compete covenant during this one-year period, and the career shares may be forfeited in the event of a breach of that covenant.

|

20

The performance units and career shares in fiscal 2004 were granted under the BD Stock Award Plan, and in fiscal 2005, under the BD 2004 Employee and Director Equity-Based Compensation Plan (the “2004 Plan”), which was approved by shareholders in February 2004. See “Long-Term Incentive Plan—Performance Unit Awards in Fiscal 2004” and “Long-Term Incentive Plan—Performance Unit Awards in Fiscal 2005.” With the approval of the 2004 Plan, the Committee also broadened the scope of BD's long-term incentive program to include similar equity grants to a larger group of BD associates.

Deferred Compensation Plan

BD maintains a Deferred Compensation Plan (“DCP”) that allows certain associates, including the named executive officers, to defer receipt of their salary and/or annual incentive payments into BD common stock or in cash accounts that mirror the gains and/or losses of several different investment funds selected by BD. Participants may defer up to 75% of salary and 100% of annual incentive awards until the date(s) they have specified. In 2004, the DCP was amended to allow associates to defer receipt of up to 100% of the shares issuable under any stock unit awards granted under the long-term incentive program.

BD is not required to make any contributions to the DCP, other than to the extent a participant in both the DCP and BD's 401(k) Savings Incentive Plan (“SIP”) would receive a lower matching contribution from BD under the SIP as a result of salary deferral under the DCP.

The DCP is not funded by BD, and participants have an unsecured contractual commitment by BD to pay the amounts due under the DCP. When such payments are due, the cash and/or stock will be distributed from BD's general assets.

Compensation of the Chief Executive Officer

The non-employee directors meet each year in executive session to evaluate the performance of the Chief Executive Officer, the results of which are used to determine his compensation.

In November 2004, the Committee approved a 4.8% salary increase for Mr. Ludwig from $945,000 to $990,000, effective January 1, 2005.