DEF 14A: Definitive proxy statements

Published on December 20, 2012

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| þ | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

| Becton, Dickinson and Company | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

|

|

||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| þ | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

|

|

||||

| (2) | Aggregate number of securities to which transaction applies: | |||

|

|

||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

|

|

||||

| (4) | Proposed maximum aggregate value of transaction: | |||

|

|

||||

| (5) | Total fee paid: | |||

|

|

||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

|

|

||||

| (2) | Form, Schedule or Registration Statement No.: | |||

|

|

||||

| (3) | Filing Party: | |||

|

|

||||

| (4) | Date Filed: | |||

|

|

||||

Table of Contents

Becton, Dickinson and Company

1 Becton Drive

Franklin Lakes, New Jersey 07417-1880

www.bd.com

December 20, 2012

Dear Fellow Shareholders:

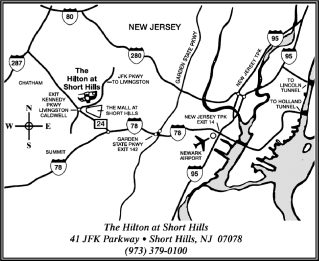

You are cordially invited to attend the 2013 Annual Meeting of Shareholders of Becton, Dickinson and Company (BD) to be held at 1:00 p.m. EST on Tuesday, January 29, 2013 at the Hilton Short Hills, 41 John F. Kennedy Parkway, Short Hills, New Jersey. You will find directions to the meeting on the back cover of the accompanying proxy statement.

The notice of meeting and proxy statement describe the matters to be acted upon at the meeting. We also will report on matters of interest to BD shareholders.

Your vote is important. Whether or not you plan to attend the Annual Meeting in person, we encourage you to vote so that your shares will be represented and voted at the meeting. You may vote by proxy on the Internet or by telephone, or by completing and mailing the enclosed proxy card in the return envelope provided. You may also vote in person at the Annual Meeting.

Thank you for your continued support of BD.

| Sincerely, |

|

| Vincent A. Forlenza |

| Chairman, Chief Executive Officer and President |

Table of Contents

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Becton, Dickinson and Company

1 Becton Drive

Franklin Lakes, New Jersey 07417-1880

December 20, 2012

The 2013 Annual Meeting of Shareholders of Becton, Dickinson and Company (BD) will be held as follows:

| DATE: | Tuesday, January 29, 2013 | |

| TIME: | 1:00 p.m. EST | |

| LOCATION: | Hilton Short Hills 41 John F. Kennedy Parkway Short Hills, New Jersey |

|

| PURPOSE: | To consider and act upon the following proposals: | |

| 1. The election as directors of the fifteen nominees named in the attached proxy statement for a one-year term; |

||

| 2. The ratification of the selection of the independent registered public accounting firm; |

||

| 3. An advisory vote to approve named executive officer compensation; |

||

| 4. Approval of an amendment to BDs Restated Certificate of Incorporation; |

||

| 5. Approval of amendments to the 2004 Employee and Director Equity-Based Compensation Plan; and |

||

| 6. Such other business as may properly come before the meeting. |

Shares represented by properly executed proxies will be voted in accordance with the instructions specified therein. Shares represented by properly executed proxies that do not provide specific voting instructions will be voted in accordance with the recommendations of the Board of Directors set forth in this proxy statement.

Important Notice Regarding the Availability of Proxy Materials for the 2013 Annual Meeting of Shareholders to be held on January 29, 2013. BDs proxy statement and 2012 Annual Report, which includes BDs consolidated financial statements, are available at www.bd.com/investors/.

Shareholders of record at the close of business on December 7, 2012 will be entitled to attend and vote at the meeting.

| By order of the Board of Directors, |

|

| GARY DEFAZIO |

| Vice President and Corporate Secretary |

It is important that your shares be represented and voted,

whether or not you plan to attend the meeting.

YOU CAN VOTE BY PROXY OR SUBMIT VOTING INSTRUCTIONS IN

ONE OF THREE WAYS:

| 1. | VIA THE INTERNET: |

Visit the website noted on your proxy/voting instruction card.

| 2. | BY TELEPHONE: |

Use the toll-free telephone number noted on your proxy/voting instruction card.

| 3. | BY MAIL: |

Promptly return your signed and dated proxy/voting instruction card in the enclosed envelope.

Table of Contents

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 13 | ||||

| 14 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| Director Independence; Policy Regarding Related Person Transactions |

21 | |||

| 22 | ||||

| 23 | ||||

| 25 | ||||

| 39 | ||||

| 39 | ||||

| 41 | ||||

| 43 | ||||

| 45 | ||||

| 45 | ||||

| Payments Upon Termination of Employment or Change of Control |

49 | |||

| PROPOSAL 2. RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

53 | |||

| 54 | ||||

| PROPOSAL 3. ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION |

55 | |||

| PROPOSAL 4. AMENDMENT TO BDS RESTATED CERTIFICATE OF |

55 | |||

| PROPOSAL 5. AMENDMENTS TO THE 2004 EMPLOYEE AND DIRECTOR EQUITY-BASED COMPENSATION PLAN |

56 | |||

| 61 | ||||

| SHAREHOLDER PROPOSALS OR DIRECTOR NOMINATIONS FOR 2014 ANNUAL MEETING |

62 | |||

| Back Cover |

Table of Contents

PROXY STATEMENT

2013 ANNUAL MEETING OF SHAREHOLDERS

Tuesday, January 29, 2013

BECTON, DICKINSON AND COMPANY

1 Becton Drive

Franklin Lakes, New Jersey 07417-1880

These proxy materials are being mailed or otherwise sent to shareholders of Becton, Dickinson and Company (BD) on or about December 20, 2012 in connection with the solicitation of proxies by the Board of Directors for BDs 2013 Annual Meeting of Shareholders to be held at 1:00 p.m. EST on Tuesday, January 29, 2013 at the Hilton Short Hills, 41 John F. Kennedy Parkway, Short Hills, New Jersey. Important Notice Regarding the Availability of Proxy Materials for the 2013 Annual Meeting of Shareholders to be held on January 29, 2013. This proxy statement and BDs 2012 Annual Report to Shareholders are also available at www.bd.com/investors/.

Directors, officers and other BD associates also may solicit proxies by telephone or otherwise. Brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses. BD has retained MacKenzie Partners, Inc. to assist in soliciting proxies for a fee not to exceed $25,000 plus expenses. The cost of soliciting proxies will be borne by BD.

Shareholders Entitled to Vote; Attendance at the Meeting

Shareholders of record at the close of business on December 7, 2012 are entitled to notice of, and to vote at, the meeting. As of such date, there were 195,850,121 shares of BD common stock outstanding, each entitled to one vote.

If your shares are held in the name of a bank, broker or other nominee (also known as shares held in street name) and you wish to attend the meeting, you must present proof of ownership as of the record date, such as a bank or brokerage account statement, to be admitted. BD also may request appropriate identification as a condition of admission.

The holders of a majority of the shares entitled to vote at the meeting must be present in person or represented by proxy to constitute a quorum. Directors are elected by a majority of the votes cast at the meeting (Proposal 1). This means that a director nominee will be elected to the Board only if the number of votes cast for the nominee exceeds the number of votes cast against that nominee.

Approval of Proposals 2, 3 and 5 requires the affirmative vote of a majority of the votes cast at the meeting. Approval of Proposal 4 requires the affirmative vote of two-thirds of the votes cast at the meeting. Under New Jersey law, abstentions and shares that brokers do not have the authority to vote in the absence of timely instructions from the beneficial owners will not be counted as votes cast, and, accordingly, will have no effect on the outcome of the vote for any of the Proposals. Proposal 2 is a discretionary item, and New York Stock Exchange (NYSE) member brokers that do not receive instructions on how to vote from beneficial owners may cast those votes in their discretion.

Table of Contents

Shareholders of record may cast their votes at the meeting. In addition, shareholders of record may cast their votes by proxy, and participants in the BD plans described below may submit their voting instructions, by:

(1) using the Internet and voting at the website listed on the enclosed proxy/voting instruction card (the proxy card);

(2) using the toll-free telephone number listed on the proxy card; or

(3) signing, completing and returning the proxy card in the enclosed postage-paid envelope.

Votes cast through the Internet and telephone votes are authenticated by use of a personal identification number. This procedure allows shareholders to appoint a proxy, and the various plan participants to provide voting instructions, and to confirm that their actions have been properly recorded. Specific instructions to be followed are set forth on the proxy card. If you vote through the Internet or by telephone, you do not need to return your proxy card. In order to be timely processed, voting instructions submitted by participants in BDs Global Share Investment Program (GSIP) must be received by 12:00 p.m. EST on January 23, 2013, and voting instructions submitted by participants in all other BD plans must be received by 12:00 p.m. EST on January 25, 2013. All proxies submitted by record holders through the Internet or by telephone must be received by 11:00 a.m. EST on January 29, 2013.

If you are the beneficial owner of shares held in street name, you have the right to direct your bank, broker or other nominee on how to vote your shares by using the voting instruction form provided to you by them, or by following their instructions for voting through the Internet or by telephone. In the alternative, you may vote in person at the meeting if you obtain a valid proxy from your bank, broker or other nominee and present it at the meeting.

Shares represented by properly executed proxies will be voted in accordance with the instructions specified therein. Shares represented by properly executed proxies that do not specify voting instructions will be voted in accordance with the recommendations of the Board of Directors set forth in this proxy statement.

Savings Incentive Plan (SIP)

Participants in SIP, BDs 401(k) plan, may instruct the SIP trustee how to vote all shares of BD common stock allocated to their SIP accounts. The SIP trustee will vote the SIP shares for which it does not receive instructions in the same proportion as the SIP shares for which it does receive instructions.

Participants in Other Plans

Participants in BDs Deferred Compensation and Retirement Benefit Restoration Plan (DCP), the 1996 Directors Deferral Plan (DDP), and GSIP (if so provided under the terms of the local country GSIP plan) may provide voting instructions for all shares of BD common stock allocated to their plan accounts. The trustees of these plans will vote the plan shares for which they do not receive instructions in the same proportion as the plan shares for which they do receive instructions.

Proxies representing shares of BD common stock held of record also will serve as proxies for shares held under the Direct Stock Purchase Plan sponsored and administered by Computershare Trust Company, N.A. and any shares of BD common stock allocated to participants accounts under the plans mentioned above, if the registrations are the same. Separate mailings will be made for shares not held under the same registrations.

Revocation of Proxies or Change of Instructions

A proxy given by a shareholder of record may be revoked at any time before it is voted by sending written notice of revocation to the Corporate Secretary of BD at the address set forth above or delivering such notice at

2

Table of Contents

the meeting, by delivering a proxy (by one of the methods described above under the heading How to Vote) bearing a later date, or by voting in person at the meeting. Participants in the plans described above may change their voting instructions by delivering new voting instructions by one of the methods described above under the heading How to Vote.

If you are the beneficial owner of shares held in street name, you may submit new voting instructions in the manner provided by your bank, broker or other nominee, or you may vote in person at the meeting in the manner described above under the heading How to Vote.

The Board of Directors is not aware of any matters to be presented at the meeting other than those set forth in the accompanying notice. If any other matters properly come before the meeting, the persons named in the proxy card will vote on such matters in accordance with their best judgment.

Securities Owned by Certain Beneficial Owners

The following table sets forth as of September 30, 2012, information concerning those persons known to BD to be the beneficial owner of more than 5% of BDs outstanding common stock. This information is as reported by such persons in their filings with the Securities and Exchange Commission (SEC).

| Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of Class | ||||||

| State Street Corporation |

13,108,193 | (1) | 6.6 | % | ||||

| Vanguard Group, Inc. |

10,430,843 | (2) | 5.2 | % | ||||

| (1) | The owner has shared investment power with respect to all of these shares and sole voting power with respect to 12,987,207 shares. |

| (2) | The owner has shared investment power with respect to 345,622 shares, sole investment power with respect to 10,085,221 shares, and sole voting power with respect to 351,639 shares. |

Securities Owned by Directors and Management

The following table sets forth as of December 1, 2012 information concerning the beneficial ownership of BD common stock by (i) each director, (ii) the executive officers named in the Summary Compensation Table on page 39, and (iii) all nominees for director and executive officers as a group (except that the holdings of Mr. Elkins, who resigned from BD effective November 9, 2012, are shown as of that date). In general, beneficial ownership includes those shares that a director or executive officer has the sole or shared power to vote or transfer, including shares that may be acquired under outstanding equity compensation awards or otherwise within 60 days.

Except as indicated in the footnotes to the table, each person has the sole power to vote and transfer the shares he or she beneficially owns. None of the shares listed below have been pledged as security.

3

Table of Contents

| Amount and Nature of Beneficial Ownership | ||||||||||||||||

| Name |

Shares Owned Directly and Indirectly (1) |

Shares That May Be Acquired Within 60 Days (2) |

Total Shares Beneficially Owned |

Percentage of Class |

||||||||||||

| Basil L. Anderson |

6,120 | 17,374 | 23,494 | * | ||||||||||||

| Henry P. Becton, Jr. (2) |

187,207 | 21,037 | 208,244 | * | ||||||||||||

| Catherine M. Burzik |

0 | 0 | 0 | * | ||||||||||||

| Gary M. Cohen |

73,116 | 172,649 | 245,765 | * | ||||||||||||

| Edward F. DeGraan |

11,596 | 21,037 | 32,633 | * | ||||||||||||

| David V. Elkins |

120 | 66,398 | 66,518 | * | ||||||||||||

| Vincent A. Forlenza |

79,199 | 813,662 | 892,861 | * | ||||||||||||

| Claire M. Fraser |

0 | 11,739 | 11,739 | * | ||||||||||||

| Christopher Jones |

2,266 | 5,237 | 7,503 | * | ||||||||||||

| William A. Kozy |

65,242 | 457,162 | 522,404 | * | ||||||||||||

| Marshall O. Larsen |

2,549 | 10,004 | 12,553 | * | ||||||||||||

| Adel A.F. Mahmoud |

118 | 11,739 | 11,857 | * | ||||||||||||

| Gary A. Mecklenburg |

4,310 | 17,374 | 21,684 | * | ||||||||||||

| James F. Orr |

12,122 | 21,037 | 33,159 | * | ||||||||||||

| Willard J. Overlock, Jr. |

29,448 | 21,037 | 50,485 | * | ||||||||||||

| Rebecca W. Rimel |

148 | 1,143 | 1,291 | * | ||||||||||||

| Bertram L. Scott |

10,818 | 23,818 | 34,636 | * | ||||||||||||

| Jeffrey S. Sherman |

14,454 | 122,064 | 136,518 | * | ||||||||||||

| Alfred Sommer |

13,222 | 16,601 | 29,823 | * | ||||||||||||

| Directors and executive officers as a group (23 persons) |

555,960 | 2,094,758 | 2,650,718 | 1.2 | % | |||||||||||

| * | Represents less than 1% of the outstanding BD common stock. |

| (1) | Includes shares held directly, and, with respect to executive officers, indirect interests in BD common stock held under the SIP and the DCP, and, with respect to the non-management directors, indirect interests in BD common stock held under the DDP. Additional information on certain of these plans appears on pages 61-62. |

| (2) | Includes shares under outstanding stock options or stock appreciation rights that are exercisable or become exercisable within 60 days, and, with respect to those executive officers who are retirement-eligible (including Messrs. Forlenza and Kozy) (i) unvested stock options or stock appreciation rights that become vested upon retirement, and (ii) shares issuable under restricted stock units upon retirement. Also includes, with respect to each non-management director, shares issuable under restricted stock units upon the directors termination of service on the Board, as more fully described in Non-Management Directors CompensationEquity Compensation on page 14. |

| (3) | Includes 162,137 shares held by trusts of which Mr. Becton is a co-trustee with shared investment and voting power or held by a limited liability company owned by one of such trusts. Does not include 37,166 shares owned by Mr. Bectons spouse, or 108,712 shares held in trusts for the benefit of his children, and as to each of which he disclaims beneficial ownership. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires BDs directors and executive officers to file initial reports of their ownership of BDs equity securities and reports of changes in such ownership with the SEC and the NYSE. Directors and executive officers are required by SEC regulations to furnish BD with copies of all Section 16(a) forms they file with respect to BD securities. Based solely on a review of copies of such forms and written representations from BDs directors and executive officers, BD believes that, for the period from October 1, 2011 through September 30, 2012, all of its directors and executive officers were in compliance with the reporting requirements of Section 16(a), except that one report with respect to the November 2011 equity compensation grant made to Gary M. Cohen was inadvertently filed late.

4

Table of Contents

| Proposal 1. | ELECTION OF DIRECTORS |

Members of our Board of Directors are elected to serve a term of one year and until their successors have been elected and qualified. All of the nominees for director have consented to being named in this proxy statement and to serve if elected. Presented below is biographical information for each of the nominees. Each of the nominees is a current member of BDs Board, except for Ms. Burzik. It is anticipated that the Board will appoint Ms. Burzik as a director prior to the Annual Meeting. Ms. Burzik was identified as a candidate for nomination to the Board by Edward J. Ludwig while he was serving as BDs Chairman.

BD directors have a variety of backgrounds, which reflects the Boards continuing efforts to achieve a diversity of viewpoint, experience, knowledge, ethnicity and gender. As more fully discussed below, director nominees are considered on the basis of a range of criteria, including their business knowledge and background, prominence and reputation in their fields, global business perspective and commitment to strong corporate citizenship. They must also have experience and ability that is relevant to the Boards oversight role with respect to BDs business and affairs. Each nominees biography includes the particular experience and qualifications that led the Board to conclude that the nominee should serve on the Board.

|

Basil L. Anderson, 67, has been a director since 2004. From 2001 until his retirement in 2006, he served as Vice Chairman of Staples, Inc., a supplier of office products. Prior thereto, he was Executive Vice President Finance and Chief Financial Officer of Campbell Soup Company. Mr. Anderson also is a director of Hasbro, Inc., Moodys Corporation and Staples, Inc. He was formerly a director of CRA International, Inc.

Mr. Anderson has an extensive business and financial background as both an operating executive and as a chief financial officer of major multinational public companies. His experience includes strategic, business and financial planning and operations; international operations; and service as a director for public companies in different industries. |

|

|

Henry P. Becton, Jr., 69, has been a director since 1987. Since 2007, he has served as Vice Chairman of the WGBH Educational Foundation, a producer and broadcaster of public television, radio and Internet programs, and books and other educational materials. He served as President of WGBH Educational Foundation from 1984 to 2007. Mr. Becton also serves as Lead Director of the Belo Corporation, is a director of Public Radio International and the PBS Foundation, and is a director/trustee of various DWS mutual funds.

Mr. Becton possesses a broad range of operational, financial and corporate governance experience developed through his professional and board-related activities in a variety of contexts. This broad background is coupled with Mr. Bectons extensive knowledge of BD, which provides him with a unique perspective on BD. |

|

5

Table of Contents

|

Catherine M. Burzik, 62, served as President and Chief Executive Officer of Kinetic Concepts, Inc., a medical device company specializing in the fields of woundcare and regenerative medicine, from 2006 until January 2012 following the sale of the company. Ms. Burzik currently serves as Chair of the Board of Directors of VitaPath Genetics, Inc. and as Chair of the San Antonio Branch of the Dallas Federal Reserve Board. Previously, Ms. Burzik was President of Applied Biosystems; President of Ortho-Clinical Diagnostics, Inc., a Johnson & Johnson company; and held senior executive roles at Eastman Kodak Company. Ms. Burzik was formerly a director of Allscripts Healthcare Solutions, Inc.

Ms. Burzik is a seasoned executive in the healthcare industry, having led major medical device, diagnostic, diagnostic imaging and life sciences businesses. She contributes strong strategic and leadership expertise, and extensive knowledge of the global healthcare field. |

|

|

Edward F. DeGraan, 69, has been a director since 2003. In 2006, he retired as Vice Chairman Gillette of the Procter & Gamble Company, a manufacturer of consumer products. Prior thereto, he was Vice Chairman of The Gillette Company, and served as its President and Chief Operating Officer from 2000 until 2003. He also served as Acting Chief Executive Officer of Gillette from October 2000 to February 2001. Mr. DeGraan also is a director of Amica Mutual Insurance Company and a Senior Advisor of Centerview Partners, L.P.

Mr. DeGraan brings extensive operational, manufacturing and executive experience in a consumer industry with a strong manufacturing base. He possesses a broad background in strategic, business and financial planning and operations, deepened by his global perspective developed through his long tenure with a multinational company. |

|

|

Vincent A. Forlenza, 59, has been a director since October 2011, and became BDs Chairman in July 2012. He was elected BDs Chief Executive Officer in October 2011 and has served as its President since January 2009. He also served as BDs Chief Operating Officer from July 2010 to October 2011, and prior thereto, served as Executive Vice President.

Mr. Forlenza has been with BD for over thirty years in a number of different capacities, including strategic planning, marketing, general management in all three of BDs segments, and overseas roles. Mr. Forlenza brings to the Board extensive business and industry experience, and provides the Board with a unique perspective on BDs strategy and operations, particularly in the area of new product development. |

|

|

Claire M. Fraser, Ph.D, 57, has been a director since 2006. Since 2007, she has been Director of the Institute for Genome Sciences and a Professor of Medicine at the University of Maryland School of Medicine in Baltimore, Maryland. From 1998 to 2007, she served as President and Director of The Institute for Genomic Research, a not-for-profit center dedicated to deciphering and analyzing genomes.

Dr. Fraser is a prominent scientist with a strong background in infectious diseases and molecular diagnostics, including the development of novel diagnostics and vaccines. She also brings considerable managerial experience in her field. |

|

6

Table of Contents

|

Christopher Jones, 57, has been a director since 2010. Mr. Jones retired in 2001 as Chief Executive Officer of JWT Worldwide (previously known as J. Walter Thompson), an international marketing firm. Since 2002, Mr. Jones has been Operating Partner and director at Motion Equity Partners (formerly Cognetas LLP), a pan-European private equity firm. He has been the non-executive Chairman of Results International Group since 2002. He also is Chairman of the Board of The Pavilion Clinic and a member of the Health Advisory Board of The Johns Hopkins University Bloomberg School of Public Health.

Mr. Jones contributes an important international perspective based on his distinguished career as a marketing leader and head of a global marketing firm. He offers substantial marketing, strategic and managerial expertise derived from his broad range of activities in the field. |

|

|

Marshall O. Larsen, 64, has been a director since 2007. Mr. Larsen retired in July 2012 as Chairman, President and Chief Executive Officer of Goodrich Corporation, a supplier of systems and services to the aerospace and defense industry. Mr. Larsen also is a director of Lowes Companies, Inc., United Technologies Corp. and the Federal Reserve Bank of Richmond, and is a member of The Business Council.

As a veteran chief executive officer of a public company, Mr. Larsen offers the valuable perspective of an individual with highly-developed executive leadership and financial and strategic management skills in a global manufacturing company. These qualities reflect considerable domestic and international business and financial experience. |

|

|

Adel A.F. Mahmoud, M.D., Ph.D, 71, has been a director since 2006. In 2006, Dr. Mahmoud retired as Chief Medical Advisor, Vaccines and Infectious Diseases and member of the Management Committee of Merck & Co., Inc., a pharmaceutical company. From 1999 to 2005, he served as President, Merck Vaccines. In 2007, he joined Princeton University as Professor, Department of Molecular Biology and the Woodrow Wilson School of Public and International Affairs. Dr. Mahmoud also is a director of GenVec, Inc. and Inovio Pharmaceuticals, Inc. He is also a member of the Board of the International AIDS Vaccine Initiative (IAVI).

Dr. Mahmoud is a distinguished scientist, physician and business leader with broad and deep knowledge of infectious diseases and vaccines. He brings strong technical, strategic and operational experience as a former senior executive with a major global pharmaceutical company, as well as an extensive academic background. |

|

7

Table of Contents

|

Gary A. Mecklenburg, 66, has been a director since 2004. In 2006, he retired as President and Chief Executive Officer of Northwestern Memorial HealthCare, the parent corporation of Northwestern Memorial Hospital, a position he had held since 1986. He also served as President of Northwestern Memorial Hospital from 1985 to 2002. He is currently an Executive Partner of Waud Capital Partners, L.L.C., a private equity investment firm. Mr. Mecklenburg is also a director of LHP Hospital Partners, Inc., and was formerly a director of Acadia Healthcare Company, Inc.

Mr. Mecklenburgs long tenure in hospital administration affords him a broad perspective on the many facets of the delivery of healthcare and a deep knowledge of healthcare financing and administration. As the former leader of a major teaching hospital, Mr. Mecklenburg possesses strong executive management, financial, strategic and operational knowledge as applied in a healthcare setting. |

|

|

James F. Orr, 67, has been a director since 2000. In 2007, he retired as Chairman of the Board of Convergys Corporation, a provider of customer management, employee care and outsourced billing services, a position he had held since 2000. He also served as Convergys Chief Executive Officer from 1998 until his retirement in 2007, and also as its President from 1998 to 2005. Mr. Orr also is a director of Ohio National Financial Services, Inc.

Mr. Orr contributes the important insights of a former chief executive officer of a public company. His background reflects extensive managerial, strategic, operational and financial experience from the perspective of a service industry. He also possesses a depth of understanding of corporate governance and enterprise risk management. |

|

|

Willard J. Overlock, Jr., 66, has been a director since 1999. He retired in 1996 as a partner in Goldman, Sachs & Co., where he served as a member of its Management Committee, and retains the title of Senior Director to The Goldman Sachs Group, Inc. Mr. Overlock also is a trustee of Rockefeller University and a member of the Board of Directors of The Albert and Mary Lasker Foundation.

Mr. Overlock has broad financial and investment banking experience based on his senior leadership roles in these areas. He contributes financial and transactional expertise and acumen in mergers and acquisitions and complex financial transactions. |

|

|

Rebecca W. Rimel, 61, has been a director since July 2012. Since 1994, she has served as President and Chief Executive Officer of The Pew Charitable Trusts, a public charity that provides grants to improve public policy and support community service. Ms. Rimel previously served as Assistant Professor in the Department of Neurosurgery at the University of Virginia Hospital and also as Head Nurse of its medical center emergency department. Ms. Rimel also is a director of CardioNet, Inc., a director/trustee of various DWS mutual funds, and a trustee of Washington College.

Ms. Rimel was added to the Board due to her executive leadership and her extensive experience in public policy and advocacy, particularly in the area of healthcare. She also brings to the Board the perspective of someone with a strong background in the healthcare field. |

|

8

Table of Contents

|

Bertram L. Scott, 61, has been a director since 2002. Mr. Scott is the President and Chief Executive Officer of Affinity Health Plan. He previously served as President, U.S. Commercial of CIGNA Corporation from June 2010 to December 2011. Prior thereto, Mr. Scott served as Executive Vice President of TIAA-CREF from 2000 to 2010 and as President and Chief Executive Officer of TIAA-CREF Life Insurance Company from 2000 to 2007. Mr. Scott also is a director of AXA Financial, Inc.

Mr. Scott possesses strong strategic, operational and financial experience from the variety of executive roles in which he has served during his career. He brings experience in corporate governance and business expertise in the insurance and healthcare fields. |

|

|

Alfred Sommer, M.D., M.H.S., 70, has been a director since 1998. He is Professor of International Health, Epidemiology, and Ophthalmology at The Johns Hopkins University (JHU) Bloomberg School of Public Health (the Bloomberg School) and the JHU School of Medicine, positions he has held since 1986. He is Dean Emeritus of the Bloomberg School, having served as Dean from 1990 to 2005. He is a member of the National Academy of Sciences and the Institute of Medicine. He is a recipient of the Albert Lasker Award for Medical Research. Dr. Sommer also is a director of T. Rowe Price Group, Inc., and Chairman of the Board of Directors of The Albert and Mary Lasker Foundation.

Dr. Sommer is a renowned clinician, researcher and academic administrator with substantial and broad experience in medicine and the public health field, and has valuable board experience in the for-profit and nonprofit realms. These attributes enable him to offer deep insights into global healthcare issues and medical technology. |

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACH OF THE NOMINEES FOR DIRECTOR.

9

Table of Contents

The Board and Committees of the Board

BD is governed by a Board of Directors that currently consists of 14 members, 13 of whom have been determined by the Board to be independent. The Board has established four operating committees (the Committees): the Audit Committee; the Compensation and Benefits Committee (the Compensation Committee); the Corporate Governance and Nominating Committee (the Governance Committee); and the Science, Innovation and Technology Committee. These Committees meet regularly. The Board has also established an Executive Committee that meets only as needed. Committee meetings may be called by the Committee chair, the Chairman of the Board or a majority of Committee members. The Board has adopted written charters for each of the Committees that are posted on BDs website at www.bd.com/investors/corporate_governance/. Printed copies of these charters, BDs 2012 Annual Report on Form 10-K, and BDs reports and statements filed with or furnished to the SEC, may be obtained, without charge, by contacting the Corporate Secretary, BD, 1 Becton Drive, Franklin Lakes, New Jersey 07417-1880, telephone 201-847-6800.

Committee Membership and Function

Set forth below is a summary description of each of the Committees.

AUDIT COMMITTEE

Function

| | Retains and reviews the qualifications, independence and performance of BDs registered public accounting firm (the independent auditors). |

| | Reviews BDs public financial disclosures and financial statements, and its accounting principles, policies and practices; the scope and results of the annual audit by the independent auditors; BDs internal audit process; and the effectiveness of BDs internal control over financial reporting. |

| | Reviews BDs guidelines and policies relating to enterprise risk assessment and risk management, and managements plan for risk mitigation or remediation. |

| | Oversees BDs ethics and enterprise compliance practices. |

| | Reviews financial strategies regarding currency, interest rates and use of derivatives, and reviews BDs insurance program. |

| | Functions as a qualified legal compliance committee, if necessary. |

| Members | Basil L. AndersonChair Christopher Jones Marshall O. Larsen Gary A. Mecklenburg James F. Orr Rebecca W. Rimel Bertram L. Scott |

The Board has determined that the members of the Audit Committee meet the independence and financial literacy requirements of the NYSE for audit committee members. The Board also has determined that each of Messrs. Anderson, Larsen, Orr and Scott qualifies as an audit committee financial expert under the rules of the SEC. The Audit Committee regularly meets separately with BDs internal auditors and the independent auditors to ensure full and frank communications with the Audit Committee.

10

Table of Contents

COMPENSATION AND BENEFITS COMMITTEE

Function

| | Reviews BDs compensation and benefits policies, recommends the compensation of the Chief Executive Officer to the non-management members of the Board for their approval, and approves the compensation of BDs other executive officers. |

| | Approves all employment, severance and change of control agreements of BD with executive officers. |

| | Serves as the granting and administrative committee for BDs equity compensation plans. |

| | Oversees certain other BD benefit plans. |

| Members | Edward F. DeGraanChair Basil L. Anderson Marshall O. Larsen James F. Orr Willard J. Overlock, Jr. Bertram L. Scott |

The Board has determined that each member of the Compensation Committee meets the independence requirements of the NYSE.

Procedure for Determining Executive Compensation

The Compensation Committee oversees the compensation program for the named executive officers listed in the Summary Compensation Table on page 39 and for BDs other executive officers. The Compensation Committee recommends compensation actions regarding the Chief Executive Officer to the full Board and is delegated the authority to take compensation actions with respect to BDs other executive officers. The Compensation Committee may not delegate these responsibilities to another Committee, an individual director or members of management.

Role of Management

The Compensation Committees meetings are typically attended by BDs Chief Executive Officer, Senior Vice PresidentHuman Resources and others who support the Compensation Committee in fulfilling its responsibilities. The Compensation Committee considers managements views relating to compensation matters, including the performance metrics and targets for BDs performance-based compensation. Management also provides information (which is reviewed by our Internal Audit Department) to assist the Committee in determining the extent to which performance targets have been achieved. This includes any recommended adjustments to BDs operating results when assessing BDs performance. The Chief Executive Officer and Senior Vice PresidentHuman Resources also work with the Compensation Committee chair in establishing meeting agendas.

The Compensation Committee meets in executive session with no members of management present for part of each of its regular meetings. The Compensation Committee also meets in executive session when considering compensation decisions regarding our executive officers.

Role of the Independent Consultant

The Compensation Committee is also assisted in fulfilling its responsibilities by its independent consultant, Pay Governance LLC (Pay Governance). Pay Governance is engaged by, and reports directly to, the Compensation Committee. The Compensation Committee is not aware of any conflict of interest on the part of Pay Governance relating to the services performed by Pay Governance for the Compensation Committee. During fiscal year 2012, Pay Governance was not engaged to perform any services for BD or BDs management. The Compensation Committee has adopted a policy prohibiting Pay Governance from providing any services to BD

11

Table of Contents

or BDs management without the Compensation Committees prior approval, and has expressed its intention that such approval will be given only in exceptional cases. No other consultant was used by the Compensation Committee or management with respect to the 2012 compensation of BDs executive officers.

Pay Governance reviews all materials prepared for the Compensation Committee by management, prepares additional materials as may be requested by the Compensation Committee, and attends Compensation Committee meetings. In its advisory role, Pay Governance assists the Compensation Committee in the design and implementation of BDs compensation program. This includes assisting the Compensation Committee in selecting the key elements to include in the program, the targeted payments for each element, and the establishment of performance targets. Pay Governance also provides market comparison data, which is one of the factors considered by the Compensation Committee in making compensation decisions, and makes recommendations to the Compensation Committee regarding the compensation of BDs Chief Executive Officer.

Pay Governance also conducts an annual review of the compensation practices of select peer companies. Based on this review, Pay Governance advises the Compensation Committee with respect to the competitiveness of BDs compensation program in comparison to industry practices, and identifies any trends in executive compensation.

Setting Compensation

At the end of each fiscal year, the Board conducts a review of the Chief Executive Officers performance. At the following Board meeting, the Board sets the compensation of the Chief Executive Officer after considering the results of the review, market comparison data and the recommendations of the Compensation Committee. Neither the Chief Executive Officer nor any other members of management are present during this session. The Chief Executive Officer does not play a role in determining or recommending his own compensation.

The Compensation Committee is responsible for determining the compensation of BDs other executive officers. The Chief Executive Officer, in consultation with the Senior Vice PresidentHuman Resources, reviews the performance of the other executive officers with the Compensation Committee and makes compensation recommendations for its consideration. The Compensation Committee determines the compensation for these executives, in consultation with Pay Governance, after considering the Chief Executive Officers recommendations, market comparison data regarding compensation levels among peer companies and the views of Pay Governance. All decisions regarding the compensation of BDs other executive officers are made in executive session.

The Board has delegated responsibility for formulating recommendations regarding non-management director compensation to the Governance Committee, which is discussed below.

SCIENCE, INNOVATION AND TECHNOLOGY COMMITTEE

Function

| | Oversees BDs research and development activities. |

| | Oversees BDs strategic marketing activities as they relate to BDs innovation agenda. |

| | Oversees BDs policies, practices and procedures relating to regulatory compliance and product quality and safety. |

| Members | Alfred SommerChair Henry P. Becton, Jr. Claire M. Fraser Christopher Jones Adel A.F. Mahmoud Gary A. Mecklenburg Rebecca W. Rimel |

12

Table of Contents

CORPORATE GOVERNANCE AND NOMINATING COMMITTEE

Function

| | Identifies and recommends candidates for election to the Board. |

| | Reviews the composition, structure and function of the Board and its Committees, as well as the performance and compensation of non-management directors. |

| | Monitors BDs corporate governance and Board practices, and oversees the Boards self-evaluation process. |

| | Oversees BDs policies, practices and procedures impacting BDs image and reputation and its standing as a responsible corporate citizen, including, without limitation, issues relating to communications with BDs key stakeholders, community relations, and public policy and government relations activities. |

| Members | Henry P. Becton, Jr.Chair Edward F. DeGraan Claire M. Fraser Adel A.F. Mahmoud Willard J. Overlock, Jr. Alfred Sommer |

The Board has determined that each member of the Governance Committee meets the independence requirements of the NYSE. As stated above, the Governance Committee reviews the compensation program for the non-management directors and makes recommendations to the Board regarding their compensation, and may not delegate these responsibilities to another Committee, an individual director or members of management. The Governance Committee has retained Pay Governance as an independent consultant for this purpose. Pay Governances responsibilities include providing market comparison data on non-management director compensation at peer companies, tracking trends in non-management director compensation practices, and advising the Governance Committee regarding the components and levels of non-management director compensation. The Governance Committee is not aware of any conflict of interest on the part of Pay Governance arising from these services. Executive officers do not play any role in either determining or recommending non-management director compensation.

Board, Committee and Annual Meeting Attendance

The Board and its Committees held the following number of meetings during fiscal year 2012:

| Board |

6 | |||

| Audit Committee |

11 | |||

| Compensation and Benefits Committee |

7 | |||

| Corporate Governance and Nominating Committee |

5 | |||

| Science, Innovation and Technology Committee |

5 |

The Executive Committee did not meet during fiscal year 2012.

Each director attended 75% or more of the total number of the meetings of the Board and the Committees on which he or she served during fiscal year 2012. BDs non-management directors met in executive session at each of the Board meetings held during fiscal year 2012.

The Board has adopted a policy pursuant to which directors are expected to attend the Annual Meeting of Shareholders in the absence of a scheduling conflict or other valid reason. All but one of the fifteen directors then serving attended BDs 2012 Annual Meeting of Shareholders.

13

Table of Contents

Non-Management Directors Compensation

The Board believes that providing competitive compensation is necessary to attract and retain qualified non-management directors. The key elements of BDs non-management director compensation are a cash retainer, equity compensation, Committee chair fees and Lead Director fees. Of the base compensation paid to the non-management directors (which does not include Committee chair and Lead Director fees), approximately two-thirds currently is equity compensation that directors are required to retain until they complete their service on the Board. See Corporate GovernanceSignificant Governance PracticesEquity Ownership by Directors on page 20. This retention feature serves to better align the interests of the directors and BD shareholders and ensure compliance with the director share ownership guidelines. Mr. Forlenza does not receive compensation related to his service as a director.

Cash Retainer

Each non-management director currently receives an annual cash retainer of $81,000 for services as a director. Directors do not receive meeting attendance fees.

Equity Compensation

Each non-management director elected at an Annual Meeting of Shareholders is granted restricted stock units then valued at $162,000 (using the same methodology used to value awards made to executive officers). Directors newly elected to the Board receive a restricted stock unit grant that is pro-rated from the effective date of their election to the next Annual Meeting. The shares of BD common stock underlying the restricted stock units are not issuable until a directors separation from the Board.

Committee Chair/Lead Director Fees

An annual fee of $10,000 is paid to each Committee chair, except that the fee for the Audit Committee chair is $15,000 in recognition of the Audit Committees responsibilities. An annual fee of $25,000 is paid to the Lead Director. No fee is paid to the Chair of the Executive Committee.

Other Arrangements

BD reimburses non-management directors for travel and other business expenses incurred in the performance of their services for BD. Directors may travel on BD aircraft in connection with such activities, and, on limited occasions, spouses of directors have joined them on such flights. No compensation is attributed to the director for these flights in the table below, since the aggregate incremental costs of spousal travel were minimal. Directors are also reimbursed for attending director education courses. BD occasionally invites spouses of directors to Board-related business events, for which they are reimbursed their travel expenses.

Directors are eligible, on the same basis as BD associates, to participate in BDs Matching Gift Program, pursuant to which BD matches contributions made to qualifying nonprofit organizations. The aggregate annual limit per participant is $5,000.

14

Table of Contents

The following table sets forth the compensation received by BDs non-management directors during fiscal year 2012.

Fiscal Year 2012 Non-Management Directors Compensation

| Name |

Fees Earned or Paid in Cash(1) |

Stock Awards(2) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings(3) |

All

Other Compensation(4) |

Total | |||||||||||||||

| Basil L. Anderson |

$ | 94,000 | $ | 167,170 | | | $ | 261,170 | ||||||||||||

| Henry P. Becton, Jr. |

114,000 | 167,170 | $ | 1,158 | | 282,328 | ||||||||||||||

| Edward F. DeGraan |

89,000 | 167,170 | | | 256,170 | |||||||||||||||

| Claire M. Fraser |

79,000 | 167,170 | | | 246,170 | |||||||||||||||

| Christopher Jones |

79,000 | 167,170 | | $ | 5,000 | 251,170 | ||||||||||||||

| Marshall O. Larsen |

79,000 | 167,170 | 1,226 | | 247,396 | |||||||||||||||

| Adel A.F. Mahmoud |

79,000 | 167,170 | | | 246,170 | |||||||||||||||

| Gary A. Mecklenburg |

79,000 | 167,170 | | | 246,170 | |||||||||||||||

| Cathy E. Minehan (5) |

25,000 | 0 | | | 25,000 | |||||||||||||||

| James F. Orr |

79,000 | 167,170 | | | 246,170 | |||||||||||||||

| Willard J. Overlock, Jr. |

79,000 | 167,170 | | | 246,170 | |||||||||||||||

| Rebecca W. Rimel |

15,481 | 84,172 | | | 99,653 | |||||||||||||||

| Bertram L. Scott |

79,000 | 167,170 | 986 | | 247,156 | |||||||||||||||

| Alfred Sommer |

89,000 | 167,170 | | 5,000 | 261,170 | |||||||||||||||

| (1) | Reflects a cash retainer at the rate of $75,000 per annum for part of the year, and a cash retainer at the rate of $81,000 per annum for the remainder of the year. |

| (2) | The amounts shown in the Stock Awards column reflect the grant date fair value under FASB ASC Topic 718 of restricted stock units awarded to non-management directors during the fiscal year. The amounts shown are slightly different than the $162,000 target award value, since a 20-day average of BDs stock price is used to value the units granted rather than the grant date price. For a discussion of the assumptions made by us in arriving at the grant date fair value of these awards, see Note 7 to the consolidated financial statements that are included in our Annual Report on Form 10-K for the fiscal year ended September 30, 2012. |

Listed below are the aggregate outstanding restricted stock unit awards and option awards held by each non-management director at the end of fiscal year 2012. Stock options have not been issued to non-management directors since 2005.

| Name |

Stock

Awards Outstanding at September 30, 2012 (#) |

Option Awards Outstanding at September 30, 2012 (#) |

||||||

| Basil L. Anderson |

15,214 | 2,160 | ||||||

| Henry P. Becton, Jr. |

16,601 | 7,217 | ||||||

| Edward F. DeGraan |

16,601 | 4,436 | ||||||

| Claire M. Fraser |

11,739 | 0 | ||||||

| Christopher Jones |

5,237 | 0 | ||||||

| Marshall O. Larsen |

10,004 | 0 | ||||||

| Adel A.F. Mahmoud |

11,739 | 0 | ||||||

| Gary A. Mecklenburg |

15,214 | 2,160 | ||||||

| James F. Orr |

16,601 | 4,436 | ||||||

| Willard J. Overlock, Jr. |

16,601 | 4,436 | ||||||

| Rebecca W. Rimel |

1,143 | 0 | ||||||

| Bertram L. Scott |

16,601 | 7,217 | ||||||

| Alfred Sommer |

16,601 | 0 | ||||||

| (3) | Represents interest on deferred directors fees in excess of 120% of the federal long-term rate. |

| (4) | Amounts shown represent matching gifts under BDs Matching Gift Program, which is more fully discussed on the previous page. |

| (5) | Ms. Minehan left the Board on January 31, 2012. |

15

Table of Contents

Directors Deferral Plan

Directors may defer receipt of all or part of their annual cash retainer and other cash fees pursuant to the provisions of the 1996 Directors Deferral Plan. Directors may also defer receipt of shares issuable to them under their restricted stock unit awards upon leaving the Board. A general description of the 1996 Directors Deferral Plan appears on page 62.

Shareholders or other interested parties wishing to communicate with the Board, the non-management directors or any individual director (including complaints or concerns regarding accounting, internal accounting controls or audit matters) may do so by contacting the Lead Director either:

| | by mail, addressed to BD Lead Director, P.O. Box 264, Franklin Lakes, New Jersey 07417-0264; |

| | by calling the BD Ethics Help Line, an independent toll-free service, at 1-800-821-5452 (callers from outside North America should use AT&T Direct to reach AT&T in the U.S. and then dial the above toll-free number); or |

| | by email to ethics_office@bd.com. |

All communications will be kept confidential and promptly forwarded to the Lead Director, who shall, in turn, forward them promptly to the appropriate director(s). Such items that are unrelated to a directors duties and responsibilities as a Board member may be excluded by our corporate security department, including, without limitation, solicitations and advertisements, junk mail, product-related communications, job referral materials and resumes, surveys, and material that is determined to be illegal or otherwise inappropriate.

16

Table of Contents

Corporate Governance Principles

BDs commitment to good corporate governance is embodied in our Corporate Governance Principles (the Principles). The Principles set forth the Boards views and practices regarding a number of governance topics, and the Governance Committee assesses the Principles on an ongoing basis in light of current practices. The Principles cover a wide range of topics, including voting for directors; board leadership structure; the selection of director nominees; director independence; annual self-evaluations of the Board and its Committees; conflicts of interest; charitable contributions to entities with which BDs executive officers and directors are affiliated, and other significant governance practices. The Principles are available on BDs website at www.bd.com/investors/corporate_governance/. Printed copies of the Principles may be obtained, without charge, by contacting the Corporate Secretary, BD, 1 Becton Drive, Franklin Lakes, New Jersey 07417-1880, phone 1-201-847-6800.

The Boards goal is to achieve the best board leadership structure for effective oversight and management of BDs affairs. The Board believes that there is no single, generally accepted approach to providing board leadership, and that each possible leadership structure must be considered in the context of the individuals involved and the specific circumstances facing a company. Accordingly, what the Board believes is the right board leadership structure may vary as circumstances warrant.

In connection with Vince A. Forlenzas appointment as Chief Executive Officer in October 2011, succeeding Edward J. Ludwig, Mr. Ludwig continued to serve as the Chairman of the Board during Mr. Forlenzas transition to his new role. Upon Mr. Ludwigs departure from the Board in June of this year, the Board appointed Mr. Forlenza to the additional role of Chairman. The Board believes it is in BDs best interests to have Mr. Forlenza also serve as Chairman, as this arrangement permits a clear, unified strategic vision for BD that ensures alignment between the Board and management, provides clear leadership for BD and helps ensure accountability for BDs performance. As the individual with primary responsibility for managing BDs day-to-day operations and with in-depth knowledge and understanding of BD, Mr. Forlenza is best positioned to lead the Board through reviews of key business and strategic issues.

At the same time, the role of Lead Director, currently being served by Henry P. Becton, Jr., allows the non-management directors to provide independent Board leadership and oversight of management. The Principles provide for the appointment of a Lead Director from among the independent directors whenever the Chairman is not independent. The responsibilities of the Lead Director include:

| | Presiding over executive sessions of the non-management directors and over Board meetings in the absence of the Chairman; |

| | Consulting on and approving Board agendas and meeting schedules; |

| | Ensuring the adequacy of the flow of information to the non-management directors; |

| | Together with the Chair of the Compensation Committee, coordinating the evaluation of the Chief Executive Officer by the non-management directors; |

| | Acting as a liaison between the non-management directors and the Chief Executive Officer; and |

| | Serving as a contact person to facilitate communications between BDs associates, shareholders and other constituents and the non-management directors. |

The Board believes having an independent Lead Director provides independent oversight of management, including risk oversight, while avoiding the risk of confusion regarding the Boards oversight responsibilities and the day-to-day management of the business. As such, this structure provides independent Board leadership and engagement, while deriving the benefit of having the Chief Executive Officer also serve as Chairman.

17

Table of Contents

BDs management engages in a process referred to as enterprise risk management (ERM) to identify, assess, manage and mitigate a broad range of risks across BDs businesses, regions and functions and to ensure alignment of our risk assessment and mitigation efforts with BDs corporate strategy. The Audit Committee, through the authority delegated to it by the Board of Directors, is primarily responsible for overseeing BDs ERM activities to determine whether the process is functioning effectively and is consistent with BDs business strategy. At least twice a year, senior management reviews the results of its ERM activities with the Audit Committee, including the process used within the organization to identify risks, managements assessment of the significant categories of risk faced by BD (including any changes in such assessment since the last review), and managements plans to mitigate the potential exposures. On at least an annual basis, the significant risks identified through BDs ERM activities and the related mitigation plans are reviewed with the full Board. Often, particular risks are reviewed in-depth with the Audit Committee or the full Board at subsequent meetings.

In addition, the full Board reviews the risks associated with BDs strategic plan and discusses the appropriate levels of risk in light of BDs objectives. This is done through an annual strategy review process, periodically throughout the year as part of its ongoing review of corporate strategy, and otherwise as necessary. The full Board also regularly oversees other areas of potential risk, including BDs capital structure, acquisitions and divestitures, and succession planning for BDs Chief Executive Officer and other members of senior management.

The various Committees of BDs Board are also responsible for monitoring and reporting on risks associated with their respective areas of oversight. The Audit Committee oversees BDs accounting and financial reporting processes and the integrity of BDs financial statements, BDs processes to ensure compliance with laws, and its hedging activities and insurance coverages. The Compensation Committee oversees risks associated with BDs compensation practices and programs, and the Governance Committee oversees risks relating to BDs corporate governance practices, including director independence, related person transactions and conflicts of interest. In connection with its oversight responsibilities, each Committee often meets with members of management who are primarily responsible for the management of risk in their respective areas, including BDs Chief Financial Officer, Senior Vice PresidentHuman Resources, General Counsel, Senior Vice PresidentRegulatory Affairs, Chief Ethics and Compliance Officer and other members of senior management.

Risk Assessment of Compensation Programs

With respect to our compensation policies and practices, BDs management reviewed our policies and practices to determine whether they create risks that are reasonably likely to have a material adverse effect on BD. In connection with this risk assessment, management reviewed the design of BDs compensation and benefits programs (in particular our performance-based compensation programs) and related policies, potential risks that could be created by the programs, and features of our programs and corporate governance generally that help to mitigate risk. Among the factors considered were the mix of cash and equity compensation, and of fixed and variable compensation, paid to our associates; the balance between short- and long-term objectives in our incentive compensation; the performance targets, mix of performance metrics, vesting periods, threshold performance requirements and funding formulas related to our incentive compensation; the degree to which programs are formulaic or provide discretion to determine payout amounts; caps on payouts; our clawback and share ownership policies; and our general governance structure. Management reviewed and discussed the results of this assessment with the Compensation Committee. Based on this review, we believe that our compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on BD.

The Governance Committee reviews potential director candidates and recommends nominees for director to the full Board for approval. In making its recommendations, the Committee assesses the overall composition of the Board, including diversity, age, skills, international background, and experience and prominence in areas of

18

Table of Contents

importance to BD. The Board seeks to achieve among its directors a diversity of viewpoint, experience, knowledge, ethnicity and gender that fits the needs of the Board at that particular time.

When considering individual director candidates, the Governance Committee will seek individuals with backgrounds and qualities that, when combined with those of BDs other directors, provide a blend of skills and experience that will further enhance the Boards effectiveness. From time-to-time, the Governance Committee has retained an executive search firm to assist it in its efforts to identify and evaluate potential director candidates.

The Governance Committee believes that any nominee for director must meet the following minimum qualifications:

| | Candidates should be persons of high integrity who possess independence, forthrightness, inquisitiveness, good judgment and strong analytical skills. |

| | Candidates should demonstrate a commitment to devote the time required for Board duties, including, but not limited to, attendance at meetings. |

| | Candidates should be team-oriented and be committed to the interests of all shareholders as opposed to those of any particular constituency. |

The Governance Committee assesses the characteristics and performance of incumbent director nominees against the above criteria as well, and, to the extent applicable, considers the impact of any change in the principal occupations of such directors during the last year. Upon completion of the individual director evaluation process, the Governance Committee reports its conclusions and recommendations for nominations to the full Board.

It is the Governance Committees policy to consider referrals of prospective nominees for the Board from other Board members and management, as well as shareholders and other external sources, such as retained executive search firms. The Governance Committee utilizes the same criteria for evaluating candidates irrespective of their source.

To recommend a candidate for consideration, a shareholder should submit a written statement of the qualifications of the proposed nominee, including full name and address, to the Corporate Secretary, BD, 1 Becton Drive, Franklin Lakes, New Jersey 07417-1880.

Significant Governance Practices

Described below are some of the significant corporate governance practices that have been instituted by the BD Board.

Annual Election of Directors

BDs directors are elected annually. The Board believes that annual elections of directors reflect a corporate governance best practice, as it provides shareholders the opportunity to express their views on the performance of the entire Board each year.

Voting for Directors

Under our By-Laws, in uncontested elections (where the number of nominees does not exceed the number of directors to be elected), nominees for director must receive the affirmative vote of a majority of the votes cast in order to be elected to the Board of Directors. Any incumbent director who fails to receive the requisite

19

Table of Contents

affirmative vote is required to offer to submit his or her resignation to the Board following the shareholder vote. The Governance Committee will consider and recommend to the Board whether to accept the resignation offer. The Board will act on such recommendation and publicly disclose its decision within 90 days following the shareholder vote. This structure allows the Board the opportunity to identify and assess the reasons for the vote, including whether the vote is attributable to dissatisfaction with a directors overall performance or is the result of shareholder views on a particular issue, and enables it to avoid undesirable and disruptive governance consequences.

Board Self-Evaluation

Each year the Board conducts a self-evaluation of its performance and effectiveness. As part of this process, each director completes an evaluation form on specific aspects of the Boards role, organization and meetings. The collective comments are then presented by the Chair of the Governance Committee to the full Board. As part of the evaluation, the Board assesses the progress in the areas targeted for improvement a year earlier, and develops actions to be taken to enhance the Boards effectiveness over the next year. The Boards evaluation covers many areas (a complete list is available on BDs website at www.bd.com/investors/corporate_governance). Additionally, each Committee conducts an annual self-evaluation of its performance through a similar process.

Equity Ownership by Directors

The Board believes that directors should hold meaningful equity ownership positions in BD. To that end, a significant portion of non-management director compensation is in the form of restricted stock units that are not distributable until a director completes his or her service on the Board. The Board believes these equity interests help to better align the interests of the non-management directors with shareholders. Under the Boards share ownership guidelines, each non-management director is required to own shares of common stock (which includes restricted stock units) valued at five times the annual cash retainer and must comply with the guidelines within three years of joining the Board.

Annual Report of Charitable Contributions

In furtherance of BDs commitment to good governance and disclosure practices, the Principles require that BDs charitable contributions or pledges in an aggregate amount of $50,000 or more (not including contributions under BDs Matching Gift Program) to entities with which BDs directors and their families are affiliated must be approved by the Governance Committee. In addition, BD is required by the Principles to post on its website, at www.bd.com/investors/corporate_governance/, an Annual Report of Charitable Contributions (the Contributions Report) listing all contributions and pledges made by BD to organizations affiliated with any director or executive officer during the preceding fiscal year in an amount of $10,000 or more. The Contributions Report, which BD has voluntarily issued since 2002, includes a discussion of BDs contributions philosophy and the alignment of BDs philanthropic activities with its philosophy, together with additional information about each contribution or pledge.

Enterprise Compliance

Under the oversight of the Audit Committee, BDs enterprise compliance function seeks to ensure that BD has policies and procedures designed to prevent and detect violations of the many laws, regulations and policies affecting its business, and that BD continuously encourages lawful and ethical conduct. Launched in 2005, BDs enterprise compliance function supplements the various compliance and ethics functions that are also in place at BD, and seeks to ensure better coordination and effectiveness through program design, prevention, and promotion of an organizational culture of compliance. A Compliance Committee comprised of members of senior management oversees the activities of the Chief Ethics and Compliance Officer. Another key element of this program is training. Courses offered include a global on-line compliance training program focused on BDs Code of Conduct, as well as other courses covering various compliance topics such as antitrust, anti-bribery, conflicts of interest, financial integrity, industry marketing codes and information security.

20

Table of Contents

Political Contributions

We have a policy that prohibits the expenditure of company assets for political campaigns without the express authorization of the Chief Executive Officer or Chief Financial Officer, compliance with company policies and all applicable laws, and clearance from BDs internal law department. Contributions outside the United States must also be approved by the relevant country leaders. In 2012, no corporate funds were used to support political campaigns. BDs general prohibition on the use of corporate funds for political campaigns extends to super PACs. We have also advised the major industry associations in which BD has membership that we do not authorize them to use any portion of our dues or other funds for super PACs or any other political campaign purpose.

Director Independence; Policy Regarding Related Person Transactions

Under the NYSE rules and our Principles, a director is deemed not to be independent if the director has a direct or indirect material relationship with BD (other than his or her relationship as a director). The Governance Committee annually reviews the independence of all directors and nominees for director and reports its findings to the full Board. To assist in this review, the Board has adopted director independence guidelines (Independence Guidelines) that are contained in the Principles. The Independence Guidelines set forth certain categories of relationships (and related dollar thresholds) between BD and directors and their immediate family members, or entities with which they are affiliated, that the Board, in its judgment, has deemed to be either material or immaterial for purposes of assessing a directors independence. In the event a director has any relationship with BD that is not addressed in the Independence Guidelines, the independent members of the Board review the facts and circumstances to determine whether such relationship is material. The Principles are available on BDs website at www.bd.com/investors/corporate-governance/. The Independence Guidelines are contained in Principle No. 7.

The Board has determined that the following nominees for director are independent under the NYSE rules and our Independence Guidelines: Basil L. Anderson, Henry P. Becton, Jr., Catherine M. Burzik, Edward F. DeGraan, Claire M. Fraser, Christopher Jones, Marshall O. Larsen, Adel A.F. Mahmoud, Gary A. Mecklenburg, James F. Orr, Willard J. Overlock, Jr., Rebecca W. Rimel, Bertram L. Scott and Alfred Sommer. The Board had also previously determined that Cathy E. Minehan, who had served on the Board up to last years annual meeting, was independent under the NYSE rules and the Principles. Vincent A. Forlenza is an employee of BD and, therefore, is not independent under the NYSE rules and the Principles.

In determining that each of the nominees is independent, the Board reviewed BDs transactions or other dealings with organizations with which a director may be affiliated. Such affiliations included service by the director or an immediate family member as an officer, employee, or member of a governing or advisory board. In conducting its review, the Board determined that, in each instance, the nature of the relationship, the degree of the directors involvement with the organization and the amount involved would not impair the directors independence under the Independence Guidelines. In addition, in most instances, the director played no active role in the organizations relationship with BD, and, in some instances, the relationship involved a unit of such organization other than the one with which the director is involved. Accordingly, the Board determined that none of these relationships was material or impaired the directors independence or judgment.

The types of transactions with director-affiliated organizations considered by the Board consisted of payments related to the purchase or sale of products and/or services (in the cases of Anderson, Becton, Burzik, Fraser, Jones, Larsen, Mecklenburg, Minehan, Orr, Overlock, Scott, and Sommer), the licensing of intellectual property rights (in the cases of Fraser, Mahmoud and Sommer) and charitable contributions (in the cases of Jones, Overlock and Sommer).

The Board has also established a written policy (the Policy) requiring Board approval or ratification of transactions involving more than $120,000 per year in which a director, executive officer or shareholder owning more

21

Table of Contents

than 5% of BDs stock (excluding certain passive investors) or their immediate family members has, or will have, a material interest. The Policy is available on BDs website at www.bd.com/investors/corporate_governance/. The Policy excludes certain specified transactions, including certain charitable contributions, transactions available to associates generally, and indemnification and advancement of certain expenses. The Governance Committee is responsible for the review and approval or ratification of transactions subject to the Policy. The Governance Committee will approve or ratify only those transactions that it determines in its business judgment are fair and reasonable to BD and in (or not inconsistent with) the best interests of BD and its shareholders, and that do not impact the directors independence.

During fiscal year 2012, BD paid affiliates of State Street Corporation (State Street), a holder of more than 5% of BD common stock, $870,000 for banking services and investment management of various 401(k) funds. These transactions were not required to be approved under the Policy, since State Street is considered a passive investor in BD.

BD maintains a Code of Conduct (the Code) that is applicable to all directors, officers and associates of BD, including its Chief Executive Officer, Chief Financial Officer, principal accounting officer and other senior financial officers. It sets forth BDs policies and expectations on a number of topics, including conflicts of interest, confidentiality, compliance with laws (including insider trading laws), preservation and use of BDs assets, and business ethics. The Code also sets forth procedures for the communicating and handling of any potential conflict of interest (or the appearance of any conflict of interest) involving directors or executive officers, and for the confidential communication and handling of issues regarding accounting, internal controls and auditing matters.