425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on October 10, 2014

Vince

Forlenza CEO and Chairman

BD

FILED

BY

BECTON,

DICKINSON

AND

COMPANY

PURSUANT

TO

RULE

425

UNDER

THE

SECURITIES

ACT

OF

1933

AND

DEEMED

FILED

PURSUANT

TO

RULE

14A-12

OF

THE

SECURITIES

EXCHANGE

ACT

OF

1934

SUBJECT

COMPANY:

CAREFUSION

CORP

COMMISSION

FILE

NO.

001-34273 |

2

BD is a company with strong values and a track record of success

Announcement accelerates CareFusions plans to build greater scale

New growth opportunities for products in emerging markets and

expands global reach by leveraging BDs international infrastructure

Offers a complete suite of medication management and patient safety

solutions

The hard work of CareFusions 17,000 employees got us here today

Key Highlights |

3

BD is a medical technology company that serves healthcare institutions, life

science researchers, clinical laboratories, industry and the general public.

Manufactures and sells a broad range of medical supplies, devices, laboratory

equipment and diagnostic products

Innovative solutions are focused on improving drug delivery, enhancing the

diagnosis of infectious diseases and cancers, supporting the management of

diabetes and advancing cellular research

30,000 employees in 50 countries who strive to fulfill the companys purpose

of Helping all people live healthy lives

HQ in Franklin Lakes, New Jersey

Who is BD?

A Leading Global Medical Technology Company |

4

1897

Company founding

1906

First U.S. syringe and needle factory

1924

First insulin injection device

1942

First penicillin injection device

1949

First evacuated blood collection tube

1952

First sterile disposable device

1954

First disposable syringes for Salk Polio campaign

1962

First mass produced syringes and needles

1968

First automated blood culture system

1972

First fluorescence activated cell sorter

1988

First safety-engineered syringe

1991

First auto-disable syringe

1995

BD Insyte

Autoguard

IV Catheter

2002

BD FACSAria

Cell Sorter

2006

GeneOhm (HAIs) and TriPath (cancer Dx)

2012

KIESTRA Lab Automation

BD Legacy of Health Impact |

5

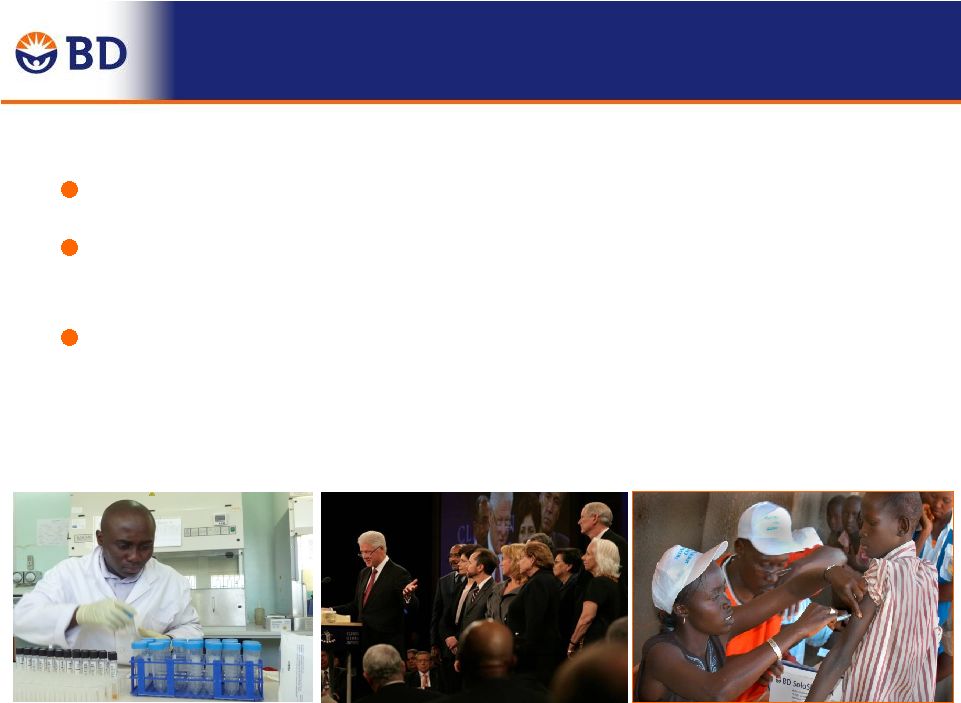

Advancing the quality, accessibility, safety and affordability of

healthcare around the world

Long-standing relationships with non-governmental organizations

Social investment includes corporate grants, product donations,

volunteer service initiatives and disaster relief programs

Donate time, technical expertise and resources

Associate engagement programs

International volunteer opportunities

Helping all people live healthy lives |

6

118 years of successful legacy in the healthcare industry

More than just a world-class quality medical technology

company

Committed to addressing customer needs and foremost

health priorities around the world

Conclusions |

Tom

Polen Segment President

BD Medical |

8

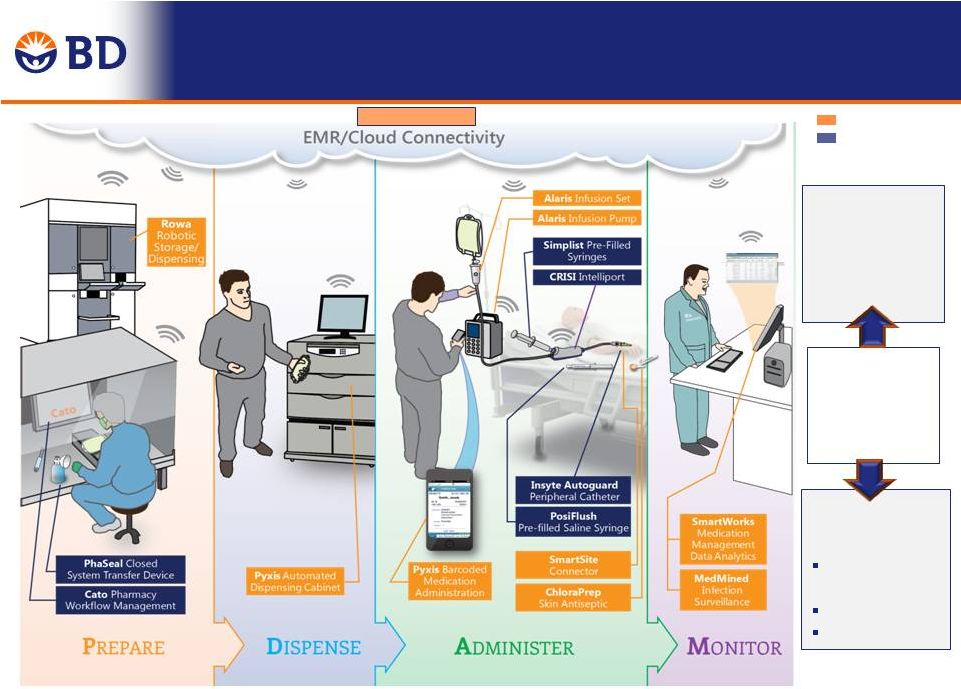

CareFusion Portfolio

BD Portfolio

In Medication Management, Our Combined Portfolios

Provide an End-to-End Solution from Pharmacy to Patient

End-to-End

medication

management

Solution

Reduction in

Costs

Labor

Efficiency

Drug Waste

Inventory

Smartworks

Improvement

in Quality

Med Errors

Infections

TM |

9

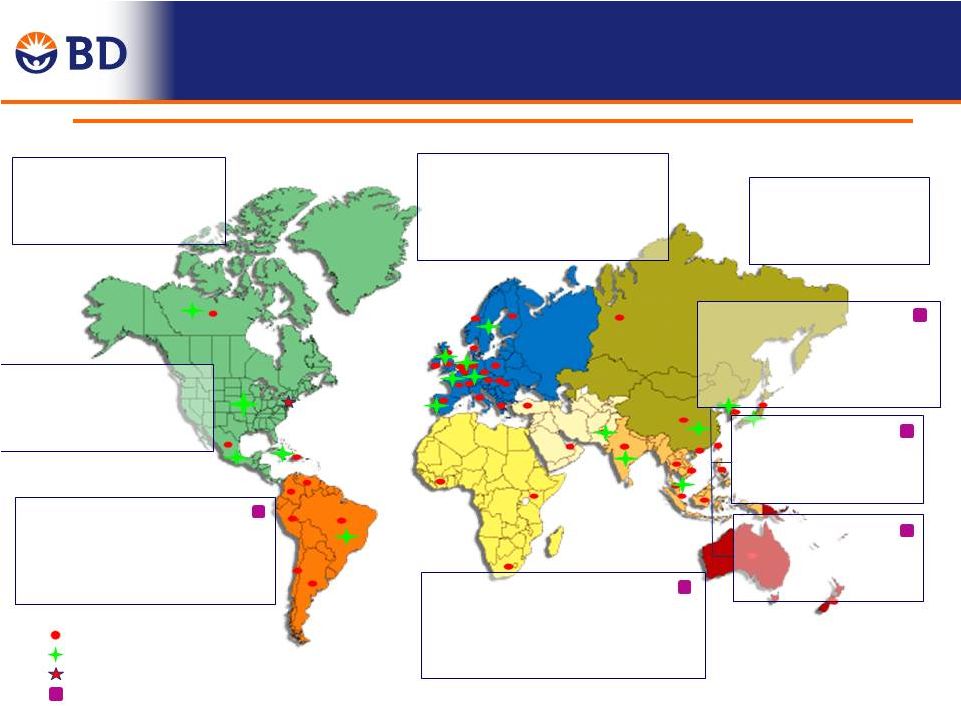

Leading Global Infrastructure enables

accelerated international expansion

Updated September 2013

BD in Western Europe

First

location

-

France

-

1952

Legal Entities in 21 countries

Ten plants

6,000 BD associates

BD in Latin America

First

location

-

Mexico

1952

Legal entities in eight countries

Five plants

5,200 BD associates

BD in Asia Pacific

BD In Japan

Established -

1971

One plant

600 BD associates

BD in EMA

First Location

Dubai, UAE

1994

Legal entities in ten countries

No manufacturing

250 BD associates

Legal Entities

Plant locations

Corporate Office

Emerging Markets

BD In India

Established -

1995

One plant

550 BD associates

BD In China

Established -

1994

Two plants

2,200 BD associates

BD in Canada

Established

1951

One plant

550 BD associates

BD in United States

Established

1897

29 plants

12,000 BD associates

First

location

Australia,1971

Legal entities in 16 countries

Five plants

4,600 BD associates |

Bill

Kozy COO

BD |

11

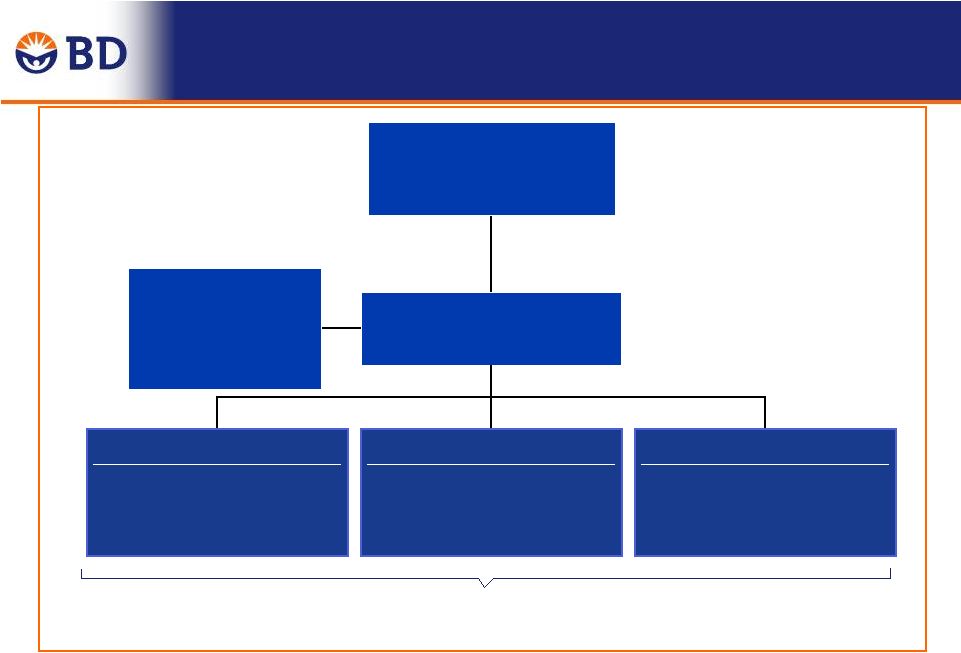

Phases of integration

Timing

Phase I

Phase II

Listen, engage (and focus

on business momentum)

Jointly plan and

countdown to close

Transition to NewCo

2-4+ months

Key

Activities

First ~30 days

Close to 2-3 years

Create the integration

architecture and launch

the integration teams

(IMO, value capture and

functional)

Develop talent selection,

retention and business

protection approach

Initiate baseline creation

and target setting

Launch culture

assessment and frequent

communications

Develop Day 1/100 plans

Develop detailed synergy

ideas and value creation

plans

Countdown to close: lock

targets, finalize plans and

prepare for Day 1

Leverage culture insights

in org design and Day 1

plans

Execute Day 1/100 plans,

onboard employees, track

progress

Ensure culture integration

and execute interventions

Phase III |

12

Integration project structure

Integration Management Office

Tom Jaeger

Chair

CareFusion

Vice Chair

Value Capture

Advisory Council

Bill Kozy

Chair

Chairmans Integration

Council

Vince Forlenza

Chair

Bill Kozy

Vice Chair

Function teams

Create NewCo infrastructure

and capture cost synergies

BU/Geographic teams

Capture business value

Issue resolution teams

Resolve targeted issues

Team members drawn from both companies |

|

Forward-Looking Statements

This communication contains certain estimates and other forward-looking statements (as defined under Federal securities laws). Forward looking statements generally are accompanied by words such as will, expect, outlook or other similar words, phrases or expressions. These forward-looking statements include statements regarding the estimated or anticipated future results of BD, and of the combined company following BDs proposed acquisition of CareFusion, the anticipated benefits of the proposed combination, including estimated synergies, the expected timing of completion of the transaction and other statements that are not historical facts. These statements are based on the current expectations of BD and CareFusion management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties regarding BD and CareFusions respective businesses and the proposed acquisition, and actual results may differ materially. These risks and uncertainties include, but are not limited to, the ability of the parties to successfully close the proposed acquisition, including the risk that the required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the transaction; risks relating to the integration of CareFusions operations, products and employees into BD and the possibility that the anticipated synergies and other benefits of the proposed acquisition will not be realized or will not be realized within the expected timeframe; the outcome of any legal proceedings related to the proposed merger; access to available financing for the refinancing of BDs or CareFusions debt on a timely basis and reasonable terms; the ability to market and sell CareFusions products in new markets, including the ability to obtain necessary regulatory product registrations and clearances; the loss of key senior management or other associates; the anticipated demand for BDs and CareFusions products, including the risk of future reductions in government healthcare funding, changes in reimbursement rates or changes in healthcare practices that could result in lower utilization rates or pricing pressures; the impact of competition in the medical device industry; the risks of fluctuations in interest or foreign currency exchange rates; product liability claims; difficulties inherent in product development, including the timing or outcome of product development efforts, the ability to obtain regulatory approvals and clearances and the timing and market success of product launches; risks relating

to fluctuations in the cost and availability of raw materials and other sourced products and the ability to maintain favorable supplier arrangements and relationships; successful compliance with governmental regulations applicable to BD, CareFusion and the combined company; changes in regional, national or foreign economic conditions; uncertainties of litigation, as well as other factors discussed in BDs and CareFusions respective filings with the Securities Exchange Commission. BD and CareFusion do not intend to update any forward-looking statements to reflect events or circumstances after the date hereof, except as required by applicable laws or regulations.

IMPORTANT INFORMATION FOR INVESTORS

In connection with the proposed transaction, BD will file with the SEC a registration statement on Form S4 that will constitute a prospectus of BD and include a proxy statement of CareFusion. BD and CareFusion also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by BD and CareFusion with the SEC at the SECs website at www.sec.gov. In addition, you will be able to obtain free copies of these documents by phone, email or written request by contacting the investor relations department of BD or CareFusion at the following: Monique N. Dolecki, Investor Relations 201-847-5378 Monique_Dolecki@bd.com or Jim Mazzola, Investor Relations 858-617-1203 Jim.Mazzola@CareFusion.com

PARTICIPANTS IN THE SOLICITATION

BD and CareFusion and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about BDs directors and executive officers is available in BDs proxy statement dated December 19, 2013, for its 2014 Annual Meeting of Shareholders and subsequent SEC filings. Information about CareFusions directors and executive officers is available in CareFusions proxy statement dated September 25, 2014, for its 2014 Annual Meeting of Stockholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the merger when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from BD or CareFusion as indicated above. This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

2