425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on January 14, 2015

FILED BY BECTON, DICKINSON AND COMPANY

PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933 AND

DEEMED FILED PURSUANT TO RULE 14A-12 OF THE SECURITIES EXCHANGE ACT OF 1934

SUBJECT COMPANY: CAREFUSION CORP

COMMISSION FILE NO. 333-199830

The following slides were used in a presentation made by Becton, Dickinson and Company at the 33rd Annual J. P. Morgan Healthcare Conference, held on January 14, 2015.

|

|

33rd Annual J. P. Morgan Healthcare Conference

January 14, 2015

Vincent A. Forlenza

Chairman, Chief Executive Officer and President

|

|

Forward-Looking Statements

These materials include forward-looking statements and its possible that actual results could differ from our

expectations. Factors that could cause such differences appear in our fourth quarter earnings release and in

our recent SEC filings.

Non-GAAP Financial Measures

These materials also include Non-GAAP financial measures. A reconciliation to the comparable GAAP

measures can be found in our fourth quarter 2014 earnings release, the financial schedules attached thereto

and the related earnings call slides, all of which are posted on the Investors section of the BD.com website.

FXN = Estimated foreign exchange-neutral currency growth.

$ = Dollars in millions except per share data.

Note: All figures on accompanying slides are rounded. Totals may not add due to rounding. Percentages are based on un-rounded figures.

2

|

|

Topics for Discussion

Strategic Focus 4

Financial Review and Outlook . 7

Growth Drivers . 12

CareFusion Acquisition . 16

Summary . 22

3

|

|

Strategic Focus

4

|

|

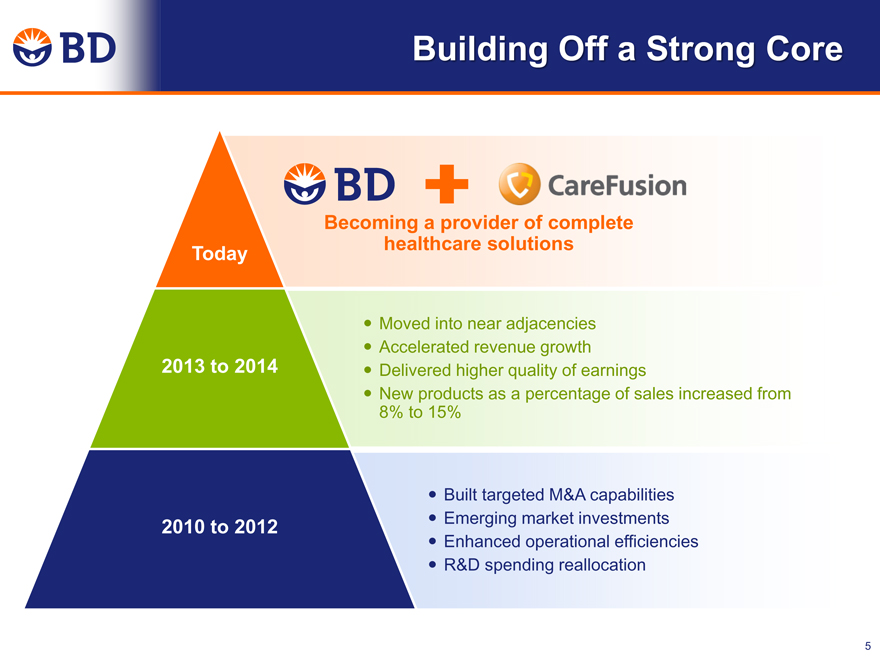

Building Off a Strong Core

Becoming a provider of complete

Today healthcare solutions

Moved into near adjacencies

Accelerated revenue growth

2013 to 2014 Delivered higher quality of earnings

New products as a percentage of sales increased from

8% to 15%

Built targeted M&A capabilities

2010 to 2012 Emerging market investments

Enhanced operational efficiencies

R&D spending reallocation

5

|

|

Strategic Focus:

Sustainable, Profitable Growth

Strong Core Portfolio

Customer Regional Acquisitions &

Innovation

Centricity Investments Partnerships

Built on a Foundation of Ethics, Compliance and Shared Value

6

|

|

Financial Review

and Outlook

7

|

|

Our Strategy Delivered Results in FY2014

2014 Key Achievements:

Strong revenue growth of 5.2%

Launched an array of new products bringing new products as a percentage of sales to 15%

Emerging Market investments continue to fuel growth

Operating effectiveness and efficiency initiatives continued to drive underlying margin expansion

42nd consecutive year of dividend increases

Proactively adapting to the dynamic healthcare environment by transitioning to a customer-focused provider of healthcare solutions

Growth and Innovation Strategy Continues to Deliver Results

8

|

|

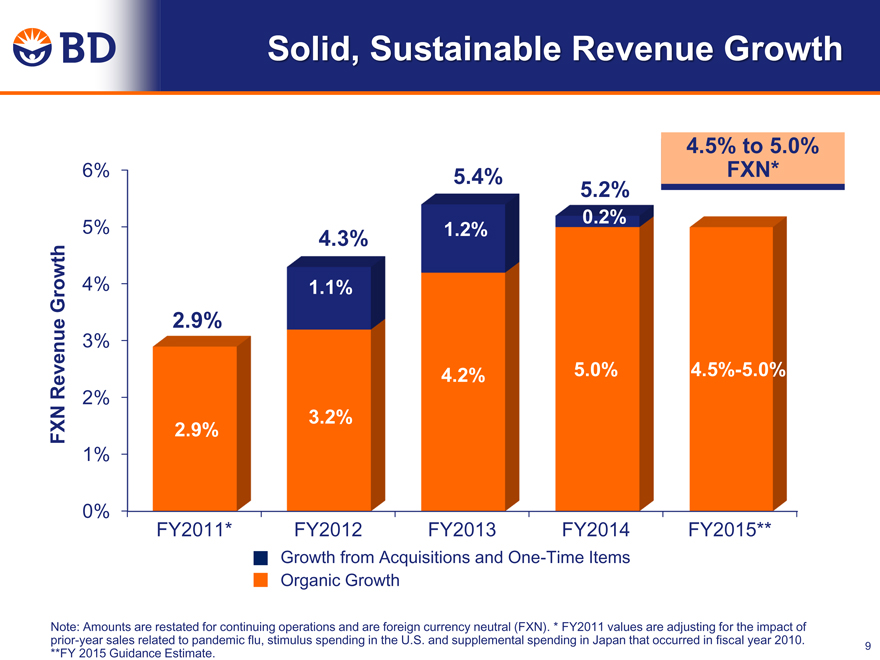

Solid, Sustainable Revenue Growth

4.5% to 5.0%

6% 5.4% FXN*

5.2%

5% 1.2% 0.2%

4.3%

Growth 4% 1.1%

2.9%

3%

Revenue 4.2% 5.0% 4.5%-5.0%

2%

FXN 2.9% 3.2%

1%

0%

FY2011* FY2012 FY2013 FY2014 FY2015**

Growth from Acquisitions and One-Time Items

Organic Growth

Note: Amounts are restated for continuing operations and are foreign currency neutral (FXN). * FY2011 values are adjusting for the impact of

prior-year sales related to pandemic flu, stimulus spending in the U.S. and supplemental spending in Japan that occurred in fiscal year 2010.

**FY 2015 Guidance Estimate.

9

|

|

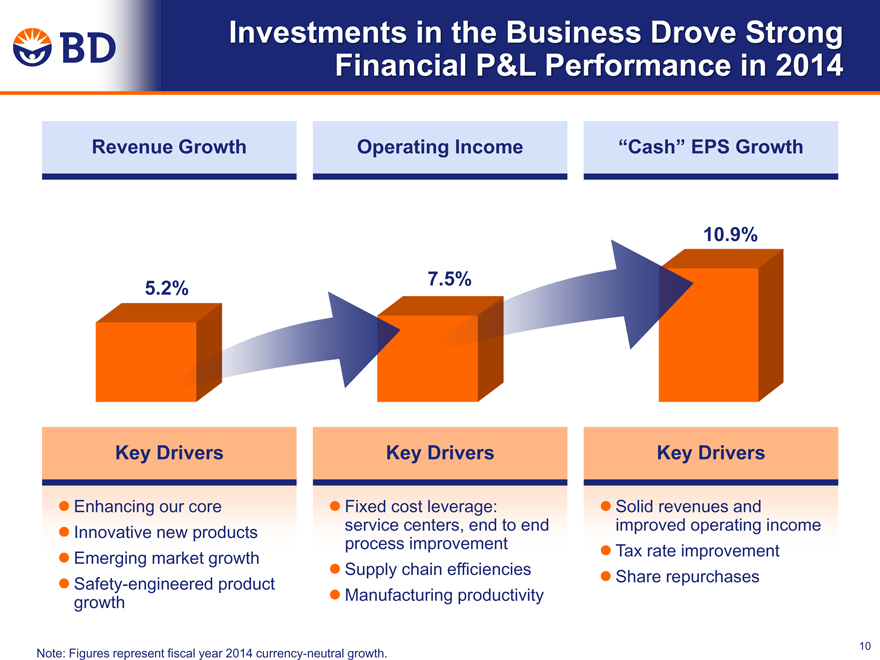

Investments in the Business Drove Strong Financial P&L Performance in 2014

Revenue Growth Operating Income Cash EPS Growth

10.9%

5.2%

Key Drivers Key Drivers Key Drivers

Enhancing our core Fixed cost leverage: Solid revenues and Innovative new products service centers, end to end improved operating income process improvement Tax rate improvement Emerging market growth Supply chain efficiencies Share repurchases Safety-engineered product growth Manufacturing productivity

10

Note: Figures represent fiscal year 2014 currency-neutral growth.

10

|

|

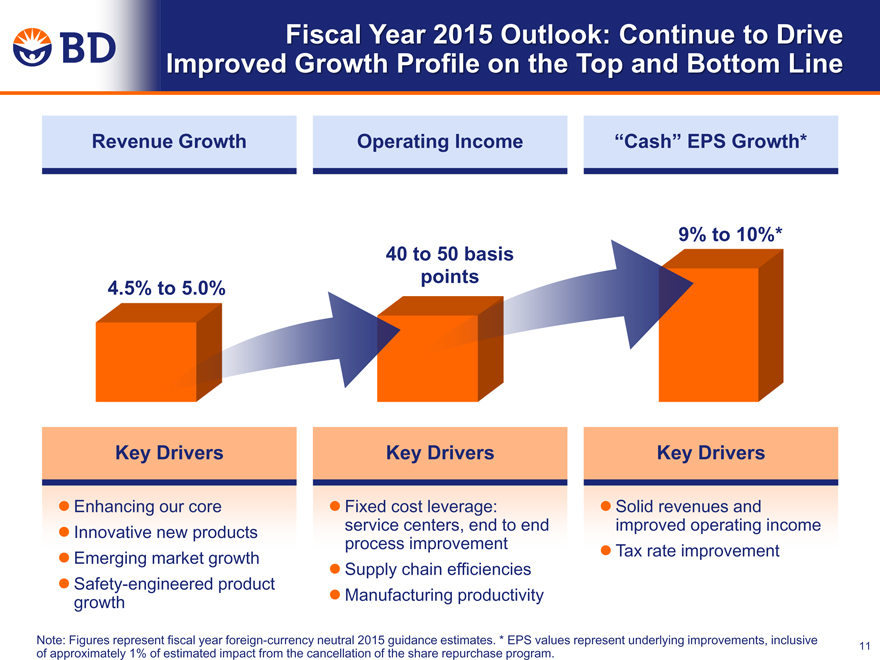

Fiscal Year 2015 Outlook: Continue to Drive

Improved Growth Profile on the Top and Bottom Line

Revenue Growth Operating Income Cash EPS Growth*

9% to 10%*

40

4.5% to 5.0%

Key Drivers Key Drivers Key Drivers

Enhancing our core Fixed cost leverage: Solid revenues and

Innovative new products service centers, end to end improved operating income

process improvement Tax rate improvement

Emerging market growth Supply chain efficiencies

Safety-engineered product

growth Manufacturing productivity

Note: Figures represent fiscal year foreign-currency neutral 2015 guidance estimates. * EPS values represent underlying improvements, inclusive

of approximately 1% of estimated impact from the cancellation of the share repurchase program.

11

|

|

Growth Drivers

12

|

|

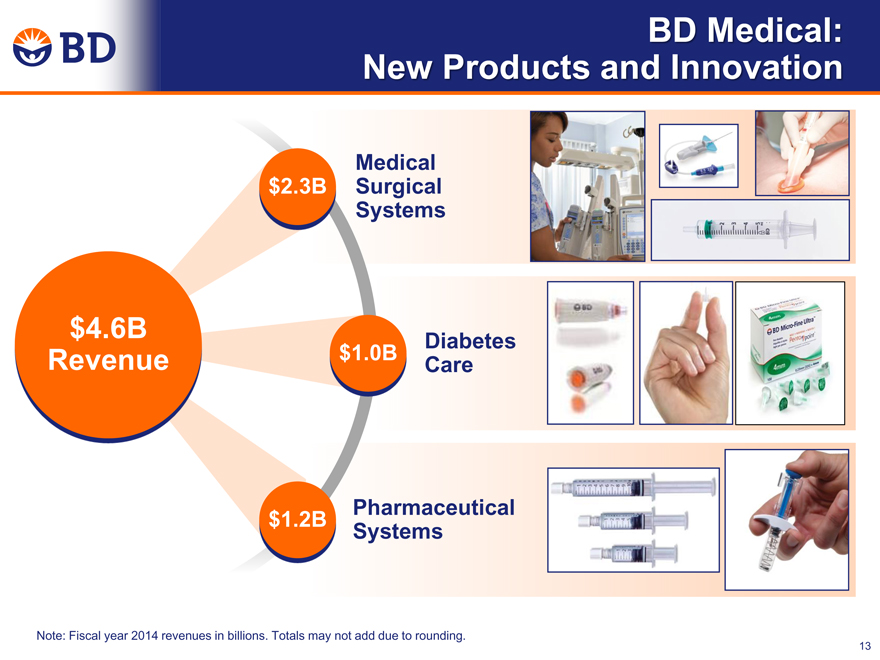

BD Medical:

New Products and Innovation

Medical

$2.3B Surgical

Systems

$4.6B Diabetes

Revenue $1.0B Care

Pharmaceutical

$1.2B Systems

Note: Fiscal year 2014 revenues in billions. Totals may not add due to rounding.

13

|

|

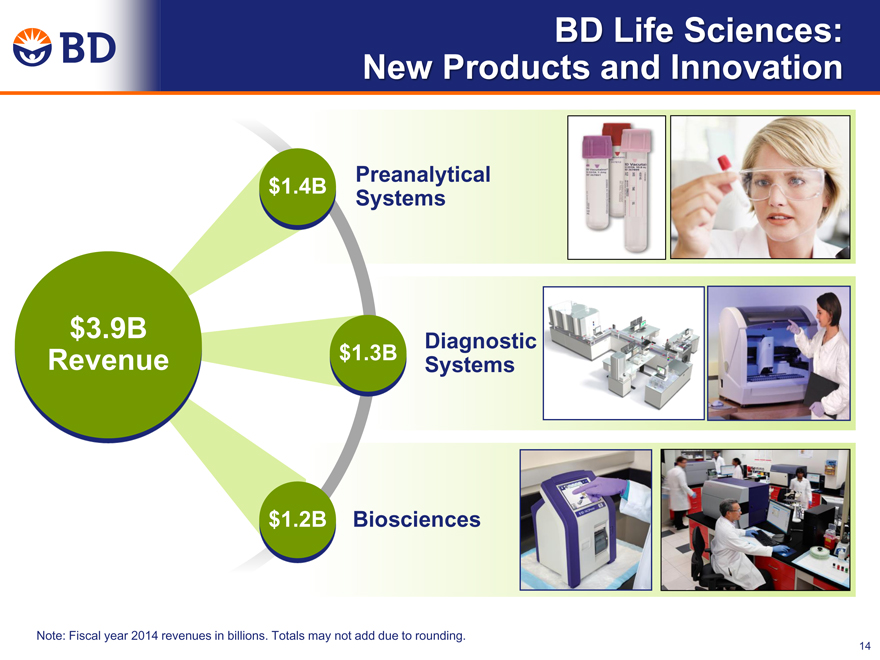

BD Life Sciences:

New Products and Innovation

$1.4B Preanalytical

Systems

$3.9B Diagnostic

Revenue $1.3B Systems

$1.2B Biosciences

Note: Fiscal year 2014 revenues in billions. Totals may not add due to rounding.

14

|

|

Emerging Markets and Safety Continue

to Drive Significant Growth

Global Leader in Safety with a Robust Emerging Market Footprint

26%

Revenues from

needle-stick

safety products

18.6%

Growth in

emerging market

safety revenues

25.1%

Revenues from emerging

markets, including over

| 1 |

|

billion BD EmeraldTM |

syringes sold

Note: Percentages based on fiscal year 2014 revenues.

15

|

|

CareFusion Acquisition

16

|

|

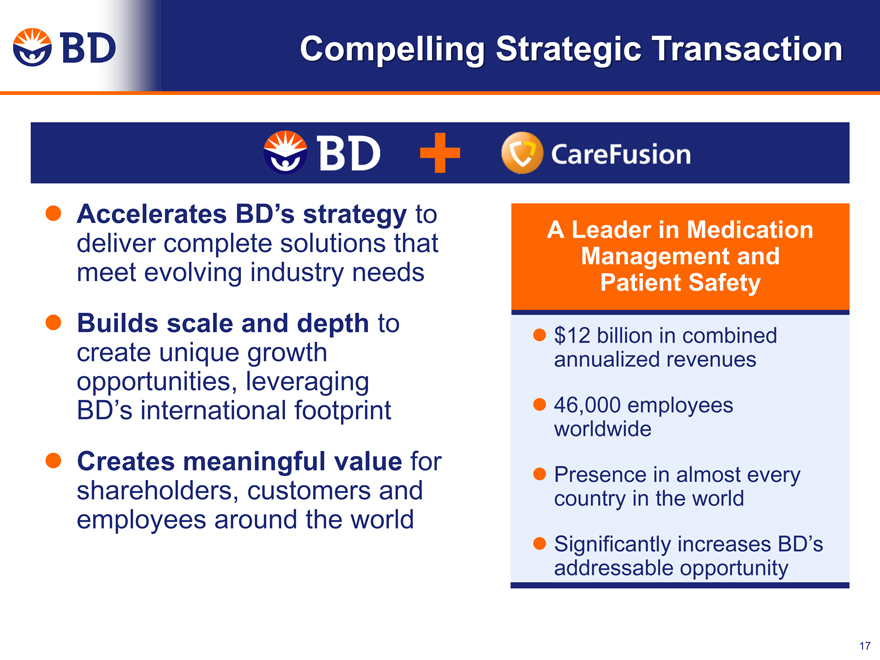

Compelling Strategic Transaction

Accelerates BDs strategy to deliver complete solutions that meet evolving industry needs

Builds scale and depth to create unique growth opportunities, leveraging BDs international footprint

Creates meaningful value for shareholders, customers and employees around the world

Leader in Medication Management and Patient Safety

$12 billion in combined annualized revenues

46,000 employees worldwide

Presence in almost every country in the world

Significantly increases BDs addressable opportunity

17

|

|

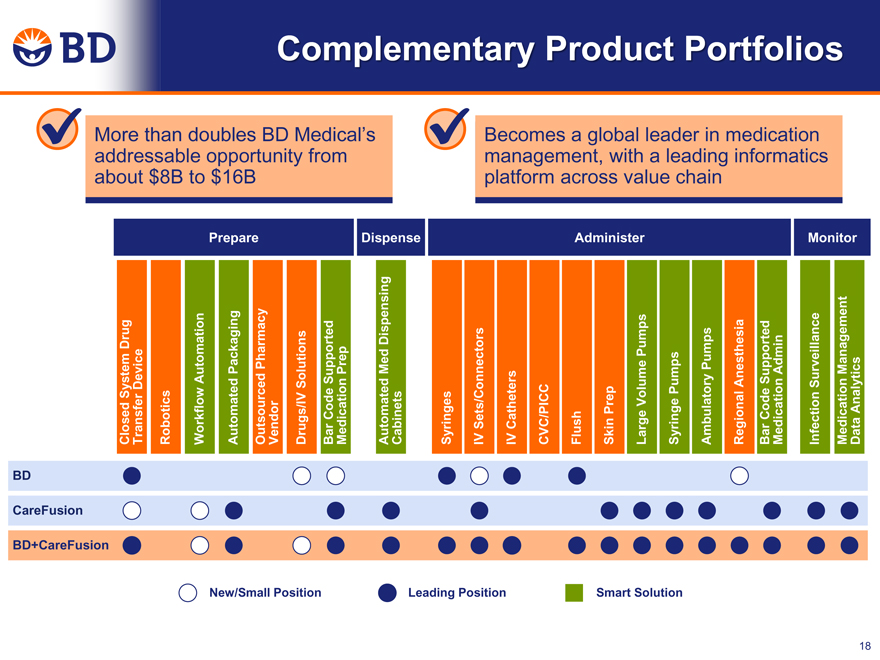

Complementary Product Portfolios

More than doubles BD Medicals addressable opportunity from about $8B to $16B

Becomes a global leader in medication management, with a leading informatics platform across value chain

Prepare

Dispense Administer Monitor

Closed System Drug Transfer Device

Closed System Drug Transfer Device

Robotics

Workflow Automation

Automated Packaging

Outsourced Pharmacy Vendor

Drugs/IV Solutions

Bar Code Supported Medication Prep

Automated Med Dispensing Cabinets

Syringes

IV Sets/Connectors IV Catheters CVC/PICC

Flush

Skin Prep

Large Volume Pumps Syringe Pumps Ambulatory Pumps Regional Anesthesia

Bar Code Supported Medication Admin

Infection Surveillance

Medication Management Data Analytics

BD

CareFusion

BD+CareFusion

New/Small Position Leading Position Smart Solution

18

|

|

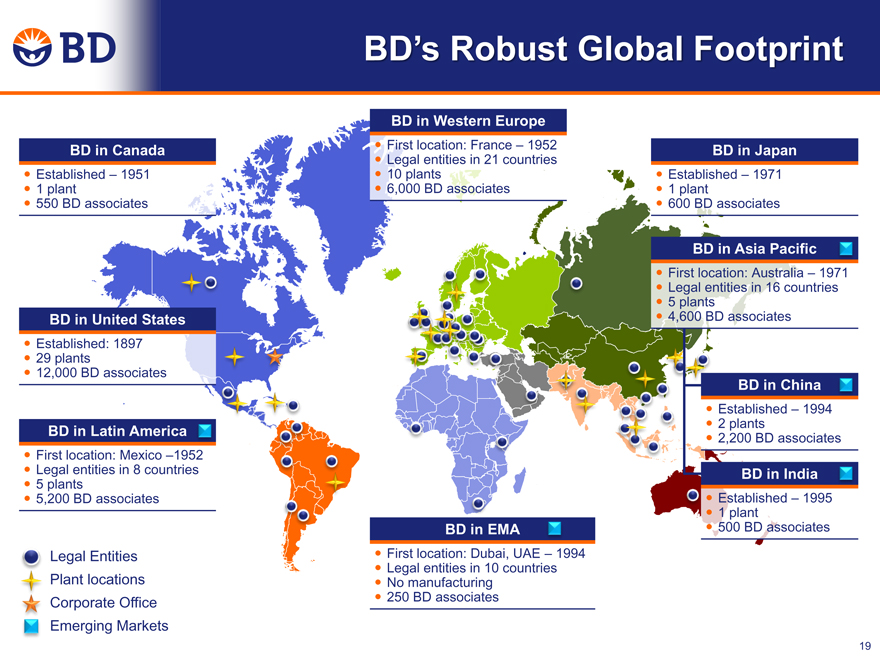

BD in Canada

Established 1951

1 plant

550 BD associates

BD in Western Europe

First location: France 1952

Legal entities in 21 countries

10 plants

6,000 BD associates

BD in Japan

Established 1971 1 plant 600 BD associates

BD in Asia Pacific

First location: Australia 1971 Legal entities in 16 countries 5 plants 4,600 BD associates

BD in China

Established 1994 2 plants 2,200 BD associates

BD in India

Established 1995 1 plant 500 BD associates

BD in United States

Established: 1897

29 plants

12,000 BD associates

BD in Latin America

First location: Mexico 1952

Legal entities in 8 countries

5 plants

5,200 BD associates

Legal Entities

Plant locations

Corporate Office

Emerging Markets

BD in EMA

First location: Dubai, UAE 1994 Legal entities in 10 countries No manufacturing 250 BD associates

19

|

|

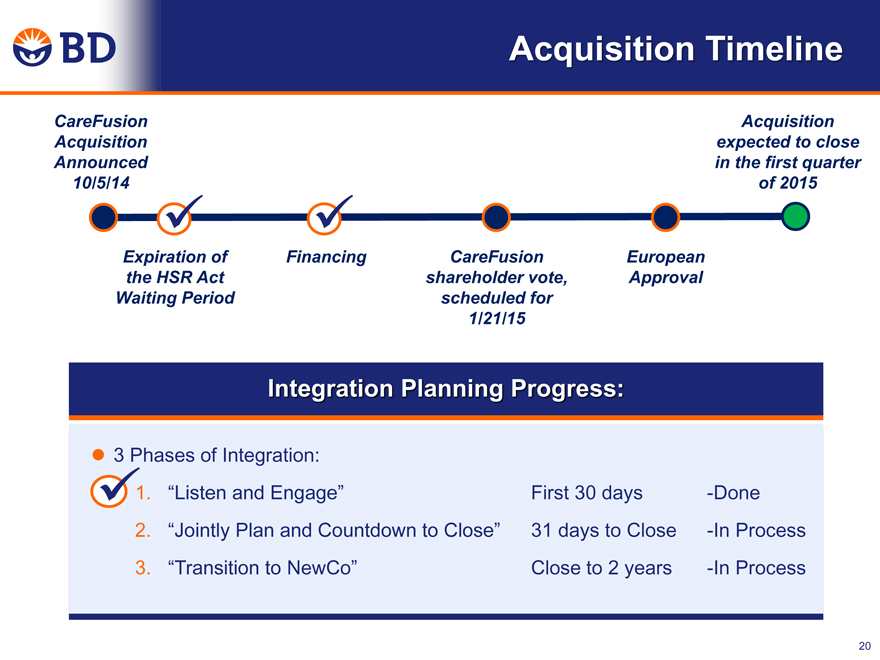

Acquisition Timeline

CareFusion Acquisition

Acquisition expected to close

Announced in the first quarter

10/5/14 of 2015

Expiration of Financing CareFusion European

the HSR Act shareholder vote, Approval

Waiting Period scheduled for

1/21/15

Integration Planning Progress:

3 Phases of Integration:

1. Listen and Engage First 30 days -Done

2. Jointly Plan and Countdown to Close 31 days to Close -In Process

3. Transition to NewCo Close to 2 years -In Process

20

|

|

Awards and Recognitions

21

|

|

Summary

Built a strong foundation for future growth

Delivered on our commitments in fiscal year 2014

BD together with CareFusion is a powerful combination that delivers value to customers

Looking to the future with confidence

22

|

|

BD, BD Logo and all other trademarks are the property of Becton, Dickinson and Company.

23

|

|

IMPORTANT INFORMATION FOR INVESTORS

In connection with the proposed transaction, BD will file with the SEC a registration statement on Form S-4 that will constitute a prospectus of BD and include a proxy statement of CareFusion. BD and CareFusion also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by BD and CareFusion with the SEC at the SECs website at www.sec.gov. In addition, you will be able to obtain free copies of these documents by phone, email or written request by contacting the investor relations department of BD or CareFusion at the following: Monique Dolecki, BD Investor Relations 201-847-5378 or Jim Mazzola, CareFusion Investor Relations 858-617-1203.

PARTICIPANTS IN THE SOLICITATION

BD and CareFusion and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction.

Information about BDs directors and executive officers is available in BDs proxy statement dated December 19, 2013, for its 2014 Annual Meeting of Shareholders and in its subsequent filings with the SEC. Information about CareFusions directors and executive officers is available in CareFusions proxy statement dated September 25, 2014, for its 2014 Annual Meeting of Stockholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the merger when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from BD or CareFusion as indicated above. This slide presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

24

|

|

This slide presentation contains certain estimates and other forward-looking statements (as defined under Federal securities laws). Forward looking statements generally are accompanied by words such as will, expect, outlook or other similar words, phrases or expressions. These forward-looking statements include statements regarding the estimated or anticipated future results of BD, and of the combined company following BDs proposed acquisition of CareFusion, the anticipated benefits of the proposed combination, including estimated synergies, the expected timing of completion of the transaction and other statements that are not historical facts. These statements are based on the current expectations of BD and CareFusion management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties regarding BD and CareFusions respective businesses and the proposed acquisition, and actual results may differ materially. These risks and uncertainties include, but are not limited to, the ability of the parties to successfully close the proposed acquisition, including the risk that the required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the transaction; risks relating to the integration of CareFusions operations, products and employees into BD and the possibility that the anticipated synergies and other benefits of the proposed acquisition will not be realized or will not be realized within the expected timeframe; the outcome of any legal proceedings related to the proposed merger; access to available financing for the refinancing of BDs or CareFusions debt on a timely basis and reasonable terms; the ability to market and sell CareFusions products in new markets, including the ability to obtain necessary regulatory product registrations and clearances; the loss of key senior management or other associates; the anticipated demand for BDs and CareFusions products, including the risk of future reductions in government healthcare funding, changes in reimbursement rates or changes in healthcare practices that could result in lower utilization rates or pricing pressures; the impact of competition in the medical device industry; the risks of fluctuations in interest or foreign currency exchange rates; product liability claims; difficulties inherent in product development, including the timing or outcome of product development efforts, the ability to obtain regulatory approvals and clearances and the timing and market success of product launches; risks relating to fluctuations in the cost and availability of raw materials and other sourced products and the ability to maintain favorable supplier arrangements and relationships; successful compliance with governmental regulations applicable to BD, CareFusion and the combined company; changes in regional, national or foreign economic conditions; uncertainties of litigation, as well as other factors discussed in BDs and CareFusions respective filings with the Securities Exchange Commission. BD and CareFusion do not intend to update any forward-looking statements to reflect events or circumstances after the date hereof, except as required by applicable laws or regulations.

25

* * *

FORWARD-LOOKING STATEMENTS

This communication contains certain estimates and other forward-looking statements (as defined under Federal securities laws). Forward looking statements generally are accompanied by words such as will, expect, outlook or other similar words, phrases or expressions. These forward-looking statements include statements regarding the estimated or anticipated future results of BD, and of the combined company following BDs proposed acquisition of CareFusion, the anticipated benefits of the proposed combination, including estimated synergies, the expected timing of completion of the transaction and other statements that are not historical facts. These statements are based on the current expectations of BD and CareFusion management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties regarding BD and CareFusions respective businesses and the proposed acquisition, and actual results may differ materially. These risks and uncertainties include, but are not limited to, the ability of the parties to successfully close the proposed acquisition, including the risk that the required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the transaction; risks relating to the integration of CareFusions operations, products and employees into BD and the possibility that the anticipated synergies and other benefits of the proposed acquisition will not be realized or will not be realized within the expected timeframe; the outcome of any legal proceedings related to the proposed merger; access to available financing for the refinancing of BDs or CareFusions debt on a timely basis and reasonable terms; the ability to market and sell CareFusions products in new markets, including the ability to obtain necessary regulatory product registrations and clearances; the loss of key senior management or other associates; the anticipated demand for BDs and CareFusions products, including the risk of future reductions in government healthcare funding, changes in reimbursement rates or changes in healthcare practices that could result in lower utilization rates or pricing pressures; the impact of competition in the medical device industry; the risks of fluctuations in interest or foreign currency exchange rates; product liability claims; difficulties inherent in product development, including the timing or outcome of product development efforts, the ability to obtain regulatory approvals and clearances and the timing and market success of product launches; risks relating

26

to fluctuations in the cost and availability of raw materials and other sourced products and the ability to maintain favorable supplier arrangements and relationships; successful compliance with governmental regulations applicable to BD, CareFusion and the combined company; changes in regional, national or foreign economic conditions; uncertainties of litigation, as well as other factors discussed in BDs and CareFusions respective filings with the Securities Exchange Commission (SEC). BD and CareFusion do not intend to update any forward-looking statements to reflect events or circumstances after the date hereof, except as required by applicable laws or regulations.

IMPORTANT INFORMATION FOR INVESTORS

In connection with the proposed transaction, BD filed with the SEC a registration statement on Form S-4 that included a preliminary prospectus of BD and that also constitutes a preliminary proxy statement of CareFusion. The registration statement has been declared effective by the SEC, and the definitive proxy statement/prospectus was delivered to stockholders of CareFusion on or about December 19, 2014. BD and CareFusion also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE MERGER THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the registration statement and the definitive proxy statement/prospectus and other relevant documents filed by BD and CareFusion with the SEC at the SECs website at www.sec.gov. In addition, you will be able to obtain free copies of these documents by phone, e-mail or written request by contacting the investor relations department of BD or CareFusion at the following: Monique N. Dolecki, Investor Relations 201-847-5378 Monique_Dolecki@bd.com or Jim Mazzola, Investor Relations 858-617-1203 Jim.Mazzola@CareFusion.com

PARTICIPANTS IN THE SOLICITATION

BD and CareFusion and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about BDs directors and executive officers is available in BDs proxy statement dated December 18, 2014, for its 2015 Annual Meeting of Shareholders and subsequent SEC filings. Information about CareFusions directors and executive officers is available in CareFusions proxy statement dated September 25, 2014, for its 2014 Annual Meeting of Stockholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the merger when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from BD or CareFusion as indicated above. This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

27