425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on April 25, 2017

FILED BY BECTON, DICKINSON AND COMPANY

PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933

AND DEEMED FILED PURSUANT TO RULE 14A-12

UNDER THE SECURITIES AND EXCHANGE ACT OF 1934

SUBJECT COMPANY: C.R. BARD, INC.

SEC FILE NO.: 001-06926

DATE: APRIL 25, 2017

The following slides were made available by Becton, Dickinson and Company (BD) to employees of BD and C.R. Bard, Inc. (Bard) in connection with BDs pending acquisition of Bard pursuant to the Agreement and Plan of Merger, dated as of April 23, 2017.

We have a POWERFUL OPPORTUNITY to make healthcare BETTER TOGETHER. April 2017 Bard Town Hall Meeting

Together, we are well positioned to improve both the process of care and the treatment of disease Advances the strategies of both companies and accelerates end-to-end medication management and infection prevention There are clear strategic benefits of a combination: ~$16 billion in combined annualized revenues Increases BD’s addressable opportunity by $20B 65,000 employees worldwide Presence in almost every country around the world One of the largest players in med-tech Better Together: A Dynamic and Differentiated Company 1 Creates new growth opportunities across a range of clinically impactful segments 2 Leverages BD’s leading global capabilities and creates new opportunities around the world to benefit from the combined company’s product technology 3

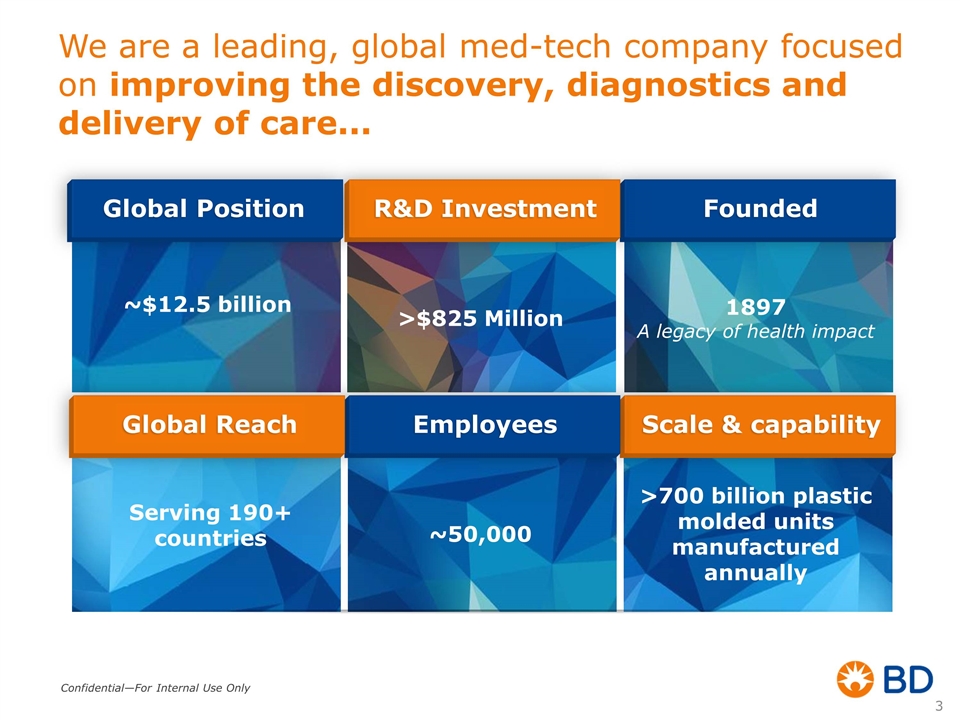

We are a leading, global med-tech company focused on improving the discovery, diagnostics and delivery of care... 1897 A legacy of health impact Founded >$825 Million R&D Investment >700 billion plastic molded units manufactured annually Scale & capability ~50,000 Employees Serving 190+ countries Global Reach Global Position ~$12.5 billion

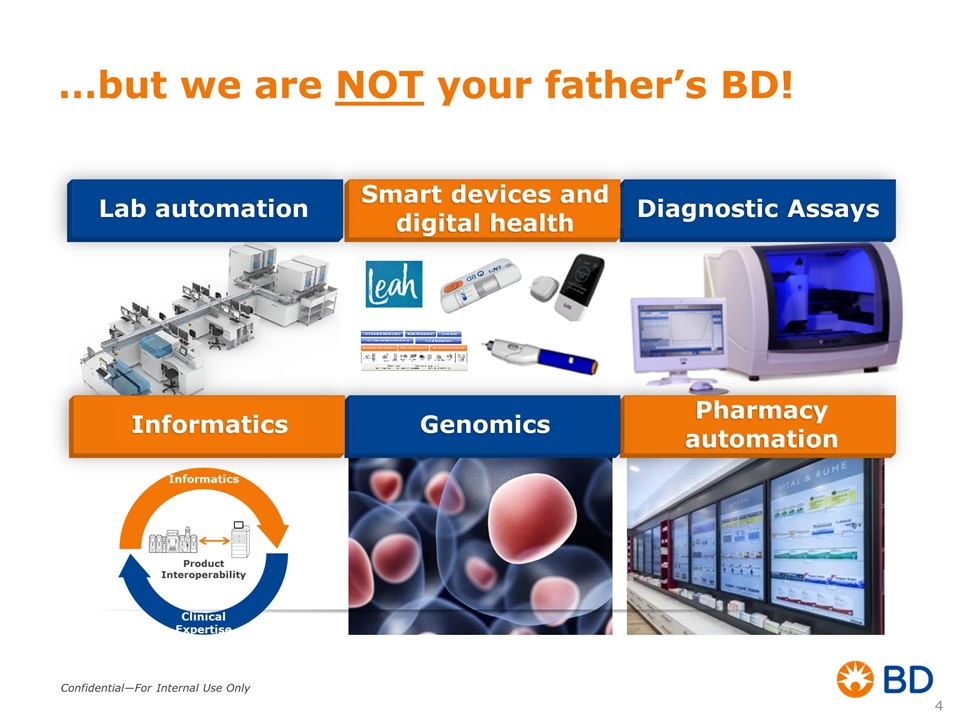

…but we are NOT your father’s BD! Diagnostic Assays >$825 Million Smart devices and digital health Pharmacy automation Genomics Informatics Lab automation

The combination will bring together two companies with aligned purposes, values and leadership standards Founded in 1897 Founded in 1907 Purpose: Advancing Lives and the Delivery of Health Care Purpose: Advancing the World of Health

Our lasting impact Disposable syringes for Salk Polio campaign Flow cytometer for HIV/AIDS Our commitments Creating Shared Value Caring for communities Volunteer Service Trips Sustainability Values and culture Leadership development Inclusion and diversity Our purpose 1 of 10 companies on Fortune’s Change the World list two years in a row! What I’m most proud about: Advancing the World of Health

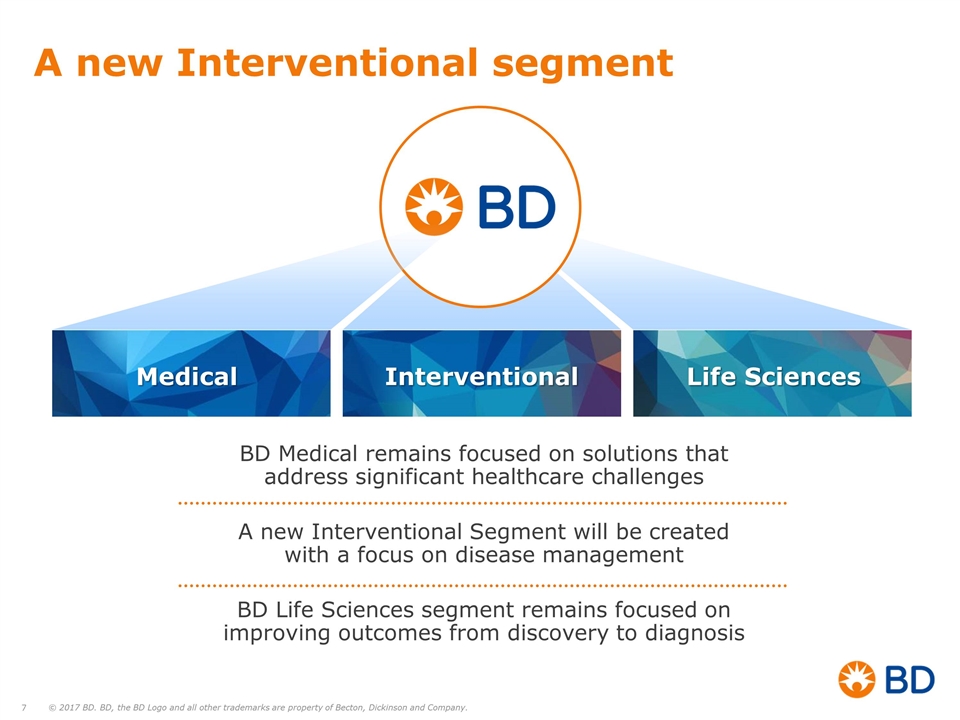

A new Interventional segment Medical Interventional Life Sciences BD Medical remains focused on solutions that address significant healthcare challenges A new Interventional Segment will be created with a focus on disease management BD Life Sciences segment remains focused on improving outcomes from discovery to diagnosis

Advancing The World of Health: BD + Bard Better together: For customers and patients Tom Polen President, BD April 2017

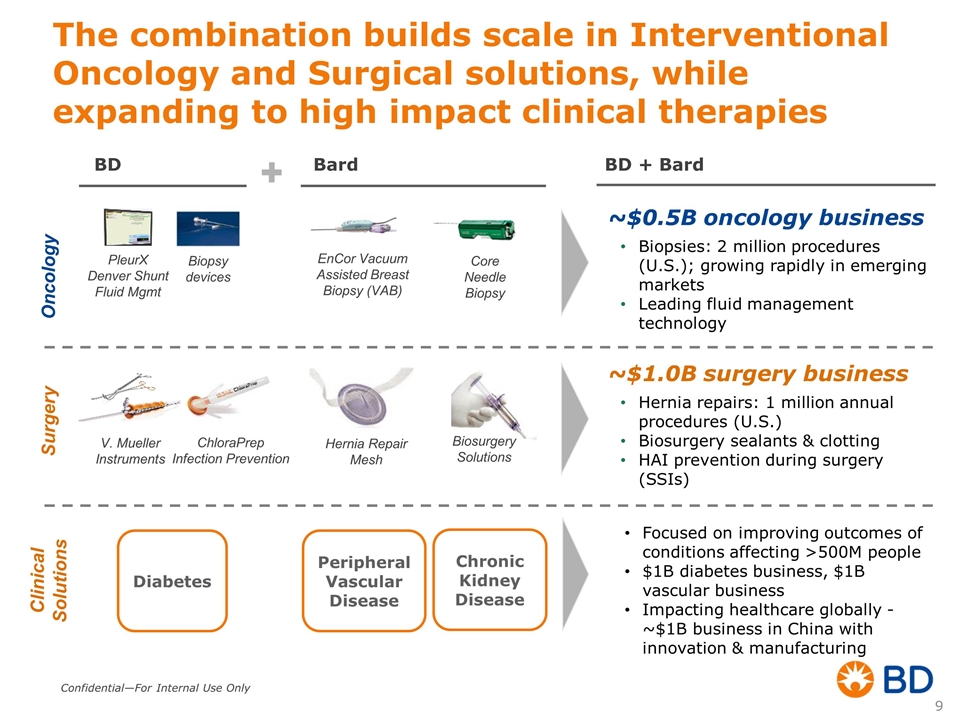

The combination builds scale in Interventional Oncology and Surgical solutions, while expanding to high impact clinical therapies Oncology Surgery EnCor Vacuum Assisted Breast Biopsy (VAB) Core Needle Biopsy PleurX Denver Shunt Fluid Mgmt Biopsy devices ~$0.5B oncology business Biopsies: 2 million procedures (U.S.); growing rapidly in emerging markets Leading fluid management technology ~$1.0B surgery business Hernia repairs: 1 million annual procedures (U.S.) Biosurgery sealants & clotting HAI prevention during surgery (SSIs) Hernia Repair Mesh ChloraPrep Infection Prevention V. Mueller Instruments Biosurgery Solutions Bard BD + Bard BD Clinical Solutions Diabetes Peripheral Vascular Disease Chronic Kidney Disease Focused on improving outcomes of conditions affecting >500M people $1B diabetes business, $1B vascular business Impacting healthcare globally - ~$1B business in China with innovation & manufacturing

BD and Bard will expand leadership in medication management with comprehensive vascular access solutions

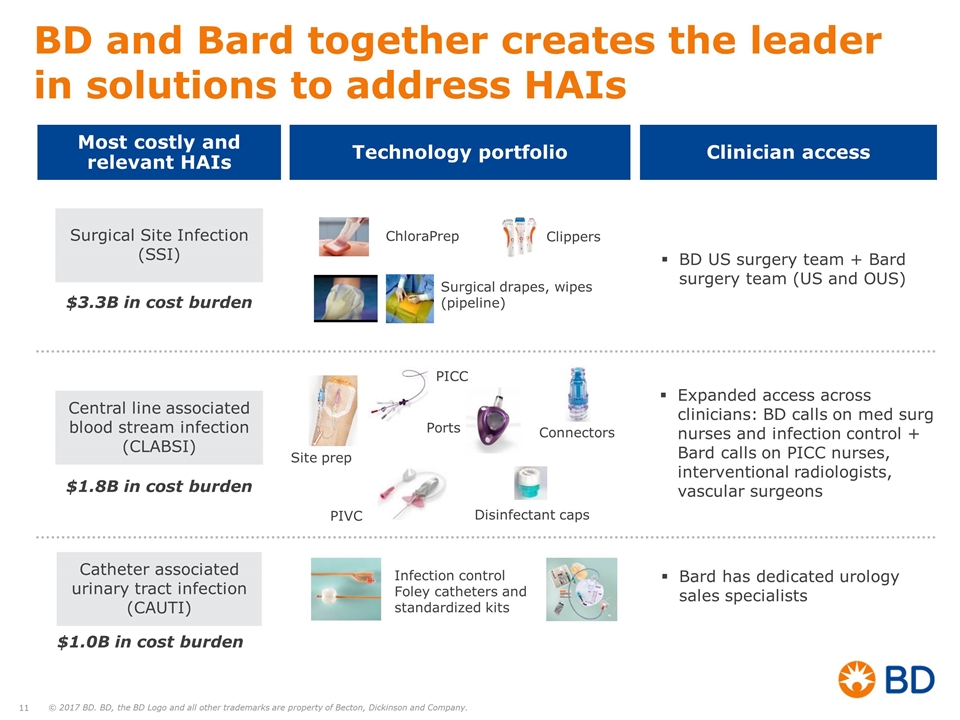

Surgical Site Infection (SSI) Central line associated blood stream infection (CLABSI) Catheter associated urinary tract infection (CAUTI) $3.3B in cost burden $1.8B in cost burden $1.0B in cost burden PIVC PICC Connectors Ports ChloraPrep Infection control Foley catheters and standardized kits Clippers Surgical drapes, wipes (pipeline) Disinfectant caps Site prep BD and Bard together creates the leader in solutions to address HAIs Most costly and relevant HAIs Technology portfolio Clinician access BD US surgery team + Bard surgery team (US and OUS) Expanded access across clinicians: BD calls on med surg nurses and infection control + Bard calls on PICC nurses, interventional radiologists, vascular surgeons Bard has dedicated urology sales specialists

Advancing The World of Health: BD + Bard Better together: Our approach to integration Linda Tharby CHRO April 2017

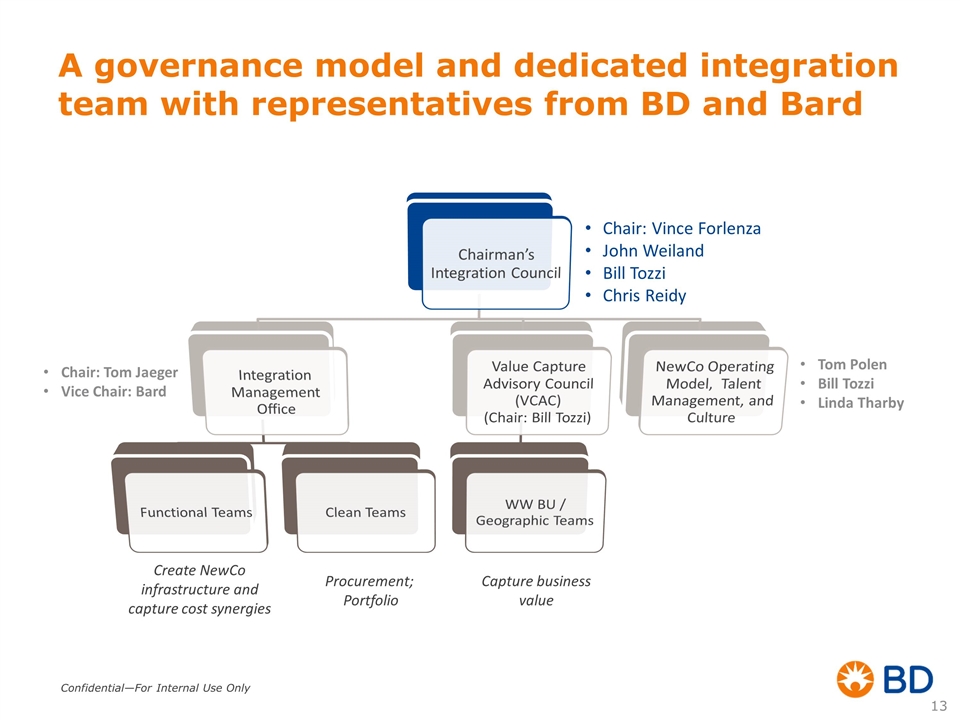

A governance model and dedicated integration team with representatives from BD and Bard Create NewCo infrastructure and capture cost synergies Capture business value Chair: Vince Forlenza John Weiland Bill Tozzi Chris Reidy Chair: Tom Jaeger Vice Chair: Bard Tom Polen Bill Tozzi Linda Tharby Procurement; Portfolio Chairman’s Integration Council Integration Management Office Functional Teams Clean Teams Value Capture Advisory Council (VCAC) (Chair: Bill Tozzi) WW BU / Geographic Teams NewCo Operating Model, Talent Management, and Culture

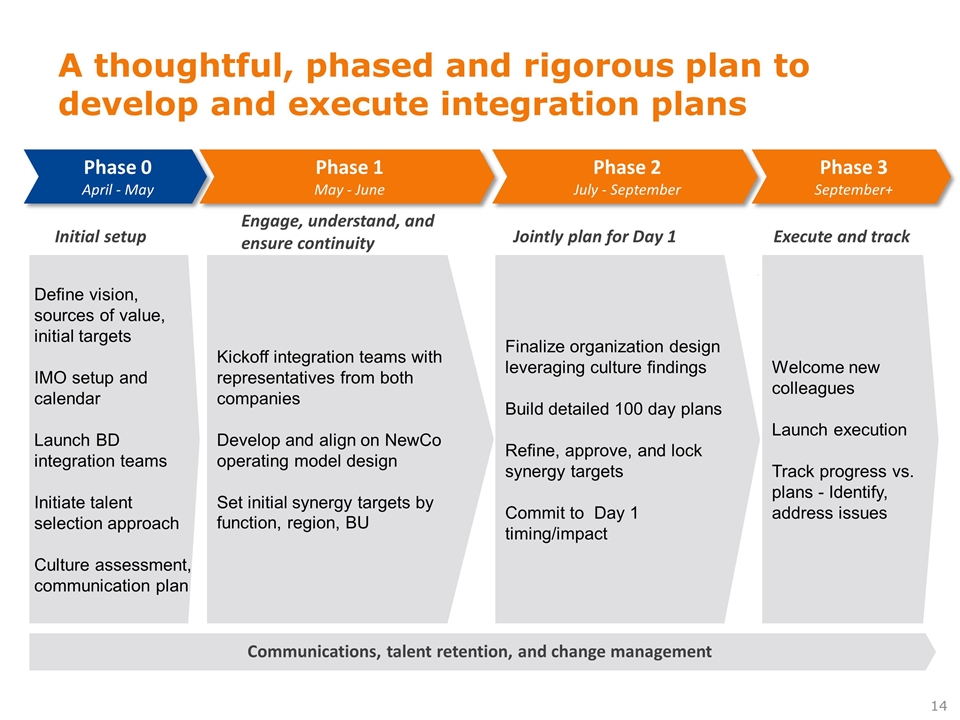

A thoughtful, phased and rigorous plan to develop and execute integration plans First 30 days Next 60 days Final 60 days to close Sept close to ~2019 Finalize organization design leveraging culture findings Build detailed 100 day plans Refine, approve, and lock synergy targets Commit to Day 1 timing/impact Communications, talent retention, and change management Define vision, sources of value, initial targets IMO setup and calendar Launch BD integration teams Initiate talent selection approach Culture assessment, communication plan Kickoff integration teams with representatives from both companies Develop and align on NewCo operating model design Set initial synergy targets by function, region, BU Welcome new colleagues Launch execution Track progress vs. plans - Identify, address issues Initial setup Engage, understand, and ensure continuity Jointly plan for Day 1 Execute and track Phase 0 April - May Phase 1 May - June Phase 2 July - September Phase 3 September+

Integration guiding principles Focus the work of integration on creating a new and better healthcare company. Maintain business momentum and deliver on current plans. Over deliver synergies to invest in growth. Announce decisions when made to ease anxiety and build trust. Staff enterprise-wide integration teams with dedicated and empowered team members from both companies. Use integration to accelerate enterprise-wide transformation in selected areas. Create “one team culture” for integration. Select “best of the best” talent and practices for the new company.

Thank you!

IMPORTANT INFORMATION FOR INVESTORS In connection with the proposed transaction, Becton Dickinson and Company (“BD”) will file with the SEC a registration statement on Form S−4 that will constitute a prospectus of BD and include a proxy statement of C.R. Bard, Inc. (“Bard”). BD and Bard also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by BD and Bard with the SEC at the SEC’s website at www.sec.gov. In addition, you will be able to obtain free copies of these documents by phone, e−mail or written request by contacting the investor relations department of BD or Bard at the following: Becton, Dickinson and Company C.R. Bard, Inc. 1 Becton Drive730 Central Avenue Franklin Lakes, New Jersey 07417Murray Hill, New Jersey 07974 Attn: Investor RelationsAttn: Investor Relations 1-(800)-284-68451-(800)-367-2273 PARTICIPANTS IN THE SOLICITATION BD and Bard and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about BD’s directors and executive officers is available in BD’s proxy statement dated December 15, 2016, for its 2017 Annual Meeting of Shareholders. Information about Bard’s directors and executive officers is available in Bard’s proxy statement dated March 15, 2017, for its 2017 Annual Meeting of Stockholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the acquisition when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from BD or Bard as indicated above.

This slide presentation contains certain estimates and other "forward-looking statements" within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward looking statements generally are accompanied by words such as “will”, "expect", "outlook" “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” or other similar words, phrases or expressions and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements regarding the estimated or anticipated future results of BD, and of the combined company following BD’s proposed acquisition of Bard, the anticipated benefits of the proposed combination, including estimated synergies, the expected timing of completion of the transaction and other statements that are not historical facts. These statements are based on the current expectations of BD and Bard management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties regarding BD and Bard’s respective businesses and the proposed acquisition, and actual results may differ materially. These risks and uncertainties include, but are not limited to, (i) the ability of the parties to successfully complete the proposed acquisition on anticipated terms and timing, including obtaining required shareholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the new combined company’s operations and other conditions to the completion of the acquisition, (ii) risks relating to the integration of Bard’s operations, products and employees into BD and the possibility that the anticipated synergies and other benefits of the proposed acquisition will not be realized or will not be realized within the expected timeframe, (iii) the outcome of any legal proceedings related to the proposed acquisition, (iv) access to available financing for the refinancing of BD’s or Bard’s debt on a timely basis and reasonable terms, (v) the ability to market and sell Bard’s products in new markets, including the ability to obtain necessary regulatory product registrations and clearances, (vi) the loss of key senior management or other associates; the anticipated demand for BD’s and Bard’s products, including the risk of future reductions in government healthcare funding, changes in reimbursement rates or changes in healthcare practices that could result in lower utilization rates or pricing pressures, (vii) the impact of competition in the medical device industry, (viii) the risks of fluctuations in interest or foreign currency exchange rates, (ix) product liability claims, (x) difficulties inherent in product development, including the timing or outcome of product development efforts, the ability to obtain regulatory approvals and clearances and the timing and market success of product launches, (xi) risks relating to fluctuations in the cost and availability of raw materials and other sourced products and the ability to maintain favorable supplier arrangements and relationships, (xii) successful compliance with governmental regulations applicable to BD, Bard and the combined company, (xiii) changes in regional, national or foreign economic conditions, (xiv) uncertainties of litigation, and (xv) other factors discussed in BD’s and Bard’s respective filings with the Securities Exchange Commission. The forward-looking statements in this document speak only as of date of this document. BD and Bard undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date hereof, except as required by applicable laws or regulations.

***

FORWARD-LOOKING STATEMENTS

This communication contains certain estimates and other forward-looking statements within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward looking statements generally are accompanied by words such as will, expect, outlook anticipate, intend, plan, believe, seek, see, will, would, target, or other similar words, phrases or expressions and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements regarding the estimated or anticipated future results of BD, and of the combined company following BDs proposed acquisition of Bard, the anticipated benefits of the proposed combination, including estimated synergies, the expected timing of completion of the transaction and other statements that are not historical facts. These statements are based on the current expectations of BD and Bard management and are not predictions of actual performance.

These statements are subject to a number of risks and uncertainties regarding BD and Bards respective businesses and the proposed acquisition, and actual results may differ materially. These risks and uncertainties include, but are not limited to, (i) the ability of the parties to successfully complete the proposed acquisition on anticipated terms and timing, including obtaining required shareholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the new combined companys operations and other conditions to the completion of the acquisition, (ii) risks relating to the integration of Bards operations, products and employees into BD and the possibility that the anticipated synergies and other benefits of the proposed acquisition will not be realized or will not be realized within the expected timeframe, (iii) the outcome of any legal proceedings related to the proposed acquisition, (iv) access to available financing for the refinancing of BDs or Bards debt on a timely basis and reasonable terms, (v) the ability to market and sell Bards products in new markets, including the ability to obtain necessary regulatory product registrations and clearances, (vi) the loss of key senior management or other associates; the anticipated demand for BDs and Bards products, including the risk of future reductions in government healthcare funding, changes in reimbursement rates or changes in healthcare practices that could result in lower utilization rates or pricing pressures, (vii) the impact of competition in the medical device industry, (viii) the risks of fluctuations in interest or foreign currency exchange rates, (ix) product liability claims, (x) difficulties inherent in product development, including the timing or outcome of product development efforts, the ability to obtain regulatory approvals and clearances and the timing and market success of product launches, (xi) risks relating to fluctuations in the cost and availability of raw materials and other sourced products and the ability to maintain favorable supplier arrangements and relationships, (xii) successful compliance with governmental regulations applicable to BD, Bard and the combined company, (xiii) changes in regional, national or foreign economic conditions, (xiv) uncertainties of litigation, and (xv) other factors discussed in BDs and Bards respective filings with the Securities and Exchange Commission.

The forward-looking statements in this document speak only as of date of this document. BD and Bard undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date hereof, except as required by applicable laws or regulations.

IMPORTANT INFORMATION FOR INVESTORS

In connection with the proposed transaction, BD will file with the SEC a registration statement on Form S-4 that will constitute a prospectus of BD and include a proxy statement of Bard. BD and Bard also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY

19

BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by BD and Bard with the SEC at the SECs website at www.sec.gov. In addition, you will be able to obtain free copies of these documents by phone, e-mail or written request by contacting the investor relations department of BD or Bard at the following:

| Becton, Dickinson and Company | C.R. Bard, Inc. | |||

| 1 Becton Drive | 730 Central Avenue | |||

| Franklin Lakes, New Jersey 07417 | Murray Hill, New Jersey 07974 | |||

| Attn: Investor Relations | Attn: Investor Relations | |||

| 1-(800)-284-6845 | 1-(800)-367-2273 |

PARTICIPANTS IN THE SOLICITATION

BD and Bard and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about BDs directors and executive officers is available in BDs proxy statement dated December 15, 2016, for its 2017 Annual Meeting of Shareholders. Information about Bards directors and executive officers is available in Bards proxy statement dated March 15, 2017, for its 2017 Annual Meeting of Stockholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the acquisition when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from BD or Bard as indicated above.

NO OFFER OR SOLICITATION

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

20