425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on August 3, 2017

FILED BY BECTON, DICKINSON AND COMPANY

PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933

AND DEEMED FILED PURSUANT TO RULE 14A-12

UNDER THE SECURITIES AND EXCHANGE ACT OF 1934

SUBJECT COMPANY: C.R. BARD, INC.

SEC FILE NO.: 001-06926

DATE: AUGUST 3, 2017

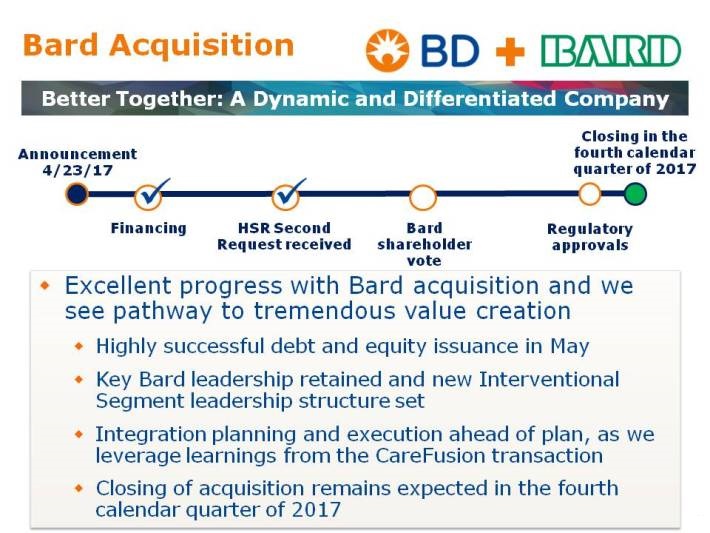

The following slide was filed with the Securities and Exchange Commission by Becton, Dickinson and Company on August 3, 2017.

***

FORWARD-LOOKING STATEMENTS

This communication contains certain estimates and other forward-looking statements within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward looking statements generally are accompanied by words such as will, expect, outlook anticipate, intend, plan, believe, seek, see, will, would, target, or other similar words, phrases or expressions and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements regarding the estimated or anticipated future results of BD, and of the combined company following BDs proposed acquisition of Bard, the anticipated benefits of the proposed combination, including estimated synergies, the expected timing of completion of the transaction and other statements that are not historical facts. These statements are based on the current expectations of BD and Bard management and are not predictions of actual performance.

These statements are subject to a number of risks and uncertainties regarding BD and Bards respective businesses and the proposed acquisition, and actual results may differ materially. These risks and uncertainties include, but are not limited to, (i) the ability of the parties to successfully complete the proposed acquisition on anticipated terms and timing, including obtaining required shareholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the new combined companys operations and other conditions to the completion of the acquisition, (ii) risks relating to the integration of Bards operations, products and employees into BD and the possibility that the anticipated synergies and other benefits of the proposed acquisition will not be realized or will not be realized within the expected timeframe, (iii) the outcome of any legal proceedings related to the proposed acquisition, (iv) access to available financing for the refinancing of BDs or Bards debt on a timely basis and reasonable terms, (v) the ability to market and sell Bards products in new markets, including the ability to obtain necessary regulatory product registrations and clearances, (vi) the loss of key senior management or other associates, (vii) the anticipated demand for BDs and Bards products, including the risk of future reductions in government healthcare funding, changes in reimbursement rates or changes in healthcare practices that could result in lower utilization rates or pricing pressures, (viii) the impact of competition in the medical device industry, (ix) the risks of fluctuations in interest or foreign currency exchange rates, (x) product liability claims, (xi) difficulties inherent in product development, including the timing or outcome of product development efforts, the ability to obtain regulatory approvals and clearances and the timing and market success of product launches, (xii) risks relating to fluctuations in the cost and availability of raw materials and other sourced products and the ability to maintain favorable supplier arrangements and relationships, (xiii) successful compliance with governmental regulations applicable to BD, Bard and the combined company, (xiv) changes in regional, national or foreign economic conditions, (xv) uncertainties of litigation, and (xvi) other factors discussed in BDs and Bards respective filings with the Securities and Exchange Commission.

The forward-looking statements in this document speak only as of date of this document. BD and Bard undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date hereof, except as required by applicable laws or regulations.

IMPORTANT INFORMATION FOR INVESTORS

In connection with the proposed transaction, BD has filed, and the Securities and Exchange Commission has declared effective, a registration statement on Form S-4 that constitutes a prospectus of BD and includes a proxy statement of Bard. The proxy statement/prospectus has been mailed to shareholders of Bard. BD and Bard may also file other relevant documents with the Securities and Exchange Commission regarding the proposed transaction. This document is

2

not a substitute for the proxy statement/prospectus or any other document that BD or Bard may file with the SEC in connection with the proposed transaction. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the proxy statement/prospectus and other relevant documents filed by BD and Bard with the Securities and Exchange Commission at the Securities and Exchange Commissions website at www.sec.gov. In addition, you will be able to obtain free copies of these documents by phone, e-mail or written request by contacting the investor relations department of BD or Bard at the following:

| Becton, Dickinson and Company | C.R. Bard, Inc. | |||

| 1 Becton Drive | 730 Central Avenue | |||

| Franklin Lakes, New Jersey 07417 | Murray Hill, New Jersey 07974 | |||

| Attn: Investor Relations | Attn: Investor Relations | |||

| 1-(800)-284-6845 | 1-(800)-367-2273 |

NO OFFER OR SOLICITATION

This Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

3