425: Prospectuses and communications, business combinations

Published on July 14, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported) July 14, 2025

BECTON, DICKINSON AND COMPANY

(Exact Name of Registrant as Specified in Its Charter)

New Jersey

(State or Other Jurisdiction of Incorporation)

| 001-4802 | 22-0760120 | |

| (Commission File Number) |

(IRS Employer Identification No.) |

|

| 1 Becton Drive, Franklin Lakes, New Jersey | 07417-1880 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(201) 847-6800

(Registrants Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, If Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of Each Class |

Trading |

Name of Each exchange on Which Registered |

||

| Common stock, par value $1.00 | BDX | New York Stock Exchange | ||

| 1.900% Notes due December 15, 2026 | BDX26 | New York Stock Exchange | ||

| 1.208% Notes due June 4, 2026 | BDX/26A | New York Stock Exchange | ||

| 1.213% Notes due February 12, 2036 | BDX/36 | New York Stock Exchange | ||

| 0.034% Notes due August 13, 2025 | BDX25A | New York Stock Exchange | ||

| 3.519% Notes due February 8, 2031 | BDX31 | New York Stock Exchange | ||

| 3.828% Notes due June 7, 2032 | BDX32A | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

On July 14, 2025, Becton, Dickinson and Company, a New Jersey corporation (the Company or BD), issued a joint press release with Waters Corporation, a Delaware corporation (Waters), announcing entry into definitive agreements pursuant to which the Companys Biosciences and Diagnostic Solutions business will be combined with Waters in a Reverse Morris Trust transaction. The press release also announced that the Company and Waters will be hosting a joint conference call and webcast at 8:00 a.m., Eastern Time, on July 14, 2025, to discuss the transaction. A copy of the joint press release is attached hereto as Exhibit 99.1 and incorporated into this Item 7.01 by reference. The presentation to be used during the joint conference call and webcast is attached hereto as Exhibit 99.2 and incorporated into this Item 7.01 by reference.

Also on July 14, 2025, the Company published an investor presentation in connection with the transaction. A copy of the investor presentation is attached hereto as Exhibit 99.3 and incorporated into this Item 7.01 by reference. The Company is also furnishing certain information which is attached hereto as Exhibit 99.4 and incorporated into this Item 7.01 by reference.

The information in this Item 7.01, including Exhibits 99.1, 99.2, 99.3 and 99.4, shall neither be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the Securities Act), or the Exchange Act.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements as that term is defined in the Securities Act and Section 21E of the Exchange Act, including statements regarding the proposed transaction among Waters, BD and Augusta SpinCo Corporation, a Delaware corporation and a wholly owned subsidiary of the Company (SpinCo). These forward-looking statements generally are identified by the words believe, feel, project, expect, anticipate, appear, estimate, forecast, outlook, target, endeavor, seek, predict, intend, suggest, strategy, plan, may, could, should, will, would, will be, will continue, will likely result, or the negative thereof or variations thereon or similar terminology generally intended to identify forward-looking statements. All statements, other than historical facts, including, but not limited to, statements regarding the expected timing and structure of the proposed transaction, the ability of the parties to complete the proposed transaction, the expected benefits of the proposed transaction, including the amount and timing of synergies from the proposed transaction, the tax consequences of the proposed transaction, the terms and scope of the expected financing in connection with the proposed transaction, the aggregate amount of indebtedness of the combined company following the closing of the proposed transaction, the combined companys plans, objectives, expectations and intentions, legal, economic and regulatory conditions, and any assumptions underlying any of the foregoing, are forward-looking statements.

These forward-looking statements are based on Waters and BDs current expectations and are subject to risks and uncertainties surrounding future expectations generally. Actual results could differ materially from those currently anticipated due to a number of risks and uncertainties, many of which are beyond Waters and BDs control. None of Waters, BD, SpinCo or any of their respective directors, executive officers, or advisors make any representation or provide any assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur, or if any of them do occur, what impact they will have on the business, results of operations or financial condition of Waters or BD. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, these developments could have a material adverse effect on Waters and BDs businesses and the ability to successfully complete the proposed transaction and realize its benefits. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) that one or more closing conditions to the

2

transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the proposed transaction, may require conditions, limitations or restrictions in connection with such approvals or that the required approval by the stockholders of Waters may not be obtained; (2) the risk that the proposed transaction may not be completed on the terms or in the time frame expected by Waters, BD and SpinCo, or at all; (3) unexpected costs, charges or expenses resulting from the proposed transaction; (4) uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; (5) failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the proposed transaction or integrating the businesses of Waters and SpinCo, on the expected timeframe or at all; (6) the ability of the combined company to implement its business strategy; (7) difficulties and delays in the combined company achieving revenue and cost synergies; (8) inability of the combined company to retain and hire key personnel; (9) the occurrence of any event that could give rise to termination of the proposed transaction; (10) the risk that stockholder litigation in connection with the proposed transaction or other litigation, settlements or investigations may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability; (11) evolving legal, regulatory and tax regimes; (12) changes in general economic and/or industry specific conditions or any volatility resulting from the imposition of and changing policies around tariffs; (13) actions by third parties, including government agencies; (14) the risk that the anticipated tax treatment of the proposed transaction is not obtained; (15) the risk of greater than expected difficulty in separating the business of SpinCo from the other businesses of BD; (16) risks related to the disruption of management time from ongoing business operations due to the pendency of the proposed transaction, or other effects of the pendency of the proposed transaction on the relationship of any of the parties to the transaction with their employees, customers, suppliers, or other counterparties; and (17) other risk factors detailed from time to time in Waters and BDs reports filed with the U.S. Securities and Exchange Commission (the SEC), including Waters and BDs annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC, including documents that will be filed with the SEC in connection with the proposed transaction. The foregoing list of important factors is not exclusive.

Any forward-looking statements speak only as of the date of this Current Report on Form 8-K. None of Waters, BD or SpinCo undertakes, and each party expressly disclaims, any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements.

Additional Information and Where to Find It

This Current Report on Form 8-K is not intended to and does not constitute an offer to sell or the solicitation of an offer to buy or exchange any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. It does not constitute a prospectus or prospectus equivalent document. No offering or sale of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, and otherwise in accordance with applicable law.

In connection with the proposed transaction between Waters, SpinCo and BD, the parties intend to file relevant materials with the SEC, including, among other filings, a registration statement on Form S-4 to be filed by Waters (the Form S-4) that will include a preliminary proxy statement/prospectus of Waters and a definitive proxy statement/prospectus of Waters, the latter of which will be mailed to stockholders of Waters, and a registration statement on Form 10 to be filed by SpinCo that will incorporate by reference certain portions of the Form S-4 and will serve as an information statement/prospectus in connection with the spin-off of SpinCo from BD. INVESTORS AND SECURITY HOLDERS OF WATERS AND BD ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, THE INFORMATION STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS,

3

CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Form S-4 and the proxy statement/prospectus (when available) and other documents filed with the SEC by Waters, SpinCo or BD through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Waters will be available free of charge on Waters website at waters.com under the tab About Waters and under the heading Investor Relations and subheading FinancialsSEC Filings. Copies of the documents filed with the SEC by BD and SpinCo will be available free of charge on BDs website at bd.com under the tab About BD and under the heading Investors and subheading SEC Filings.

Participants in the Solicitation

Waters and BD and their respective directors and executive officers may be considered participants in the solicitation of proxies from Waters stockholders in connection with the proposed transaction. Information about the directors and executive officers of Waters is set forth in its Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the SEC on February 25, 2025, and its proxy statement for its 2025 annual meeting, which was filed with the SEC on April 9, 2025. To the extent holdings of Waters securities by its directors or executive officers have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. Information about the directors and executive officers of Waters and other information regarding the potential participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction. Information about the directors and executive officers of BD is set forth in its Annual Report on Form 10-K for the year ended September 30, 2024, which was filed with the SEC on November 27, 2024, and its proxy statement for its 2025 annual meeting, which was filed with the SEC on December 19, 2024. To the extent holdings of BDs securities by its directors or executive officers have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. You may obtain these documents (when they become available) free of charge through the website maintained by the SEC at www.sec.gov and from Waters website and BDs website as described above.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit |

Description |

|

| 99.1 | Press Release, dated as of July 14, 2025 | |

| 99.2 | Investor Presentation, dated as of July 14, 2025 | |

| 99.3 | Investor Presentation, dated as of July 14, 2025 | |

| 99.4 | New BD Overview, dated as of July 14, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BECTON, DICKINSON AND COMPANY | ||

| (Registrant) | ||

| By: | /s/ Stephanie M. Kelly |

|

| Stephanie M. Kelly | ||

| Chief Securities and Governance Counsel, Corporate Secretary | ||

Date: July 14, 2025

Exhibit 99.1

Waters and BDs Biosciences & Diagnostic Solutions Business to Combine,

Creating a Life Science and Diagnostics Leader Focused on Regulated, High-Volume Testing

| | Strong strategic fit that increases presence in multiple high-growth adjacencies and offers immediate commercial impact from Waters proven execution model |

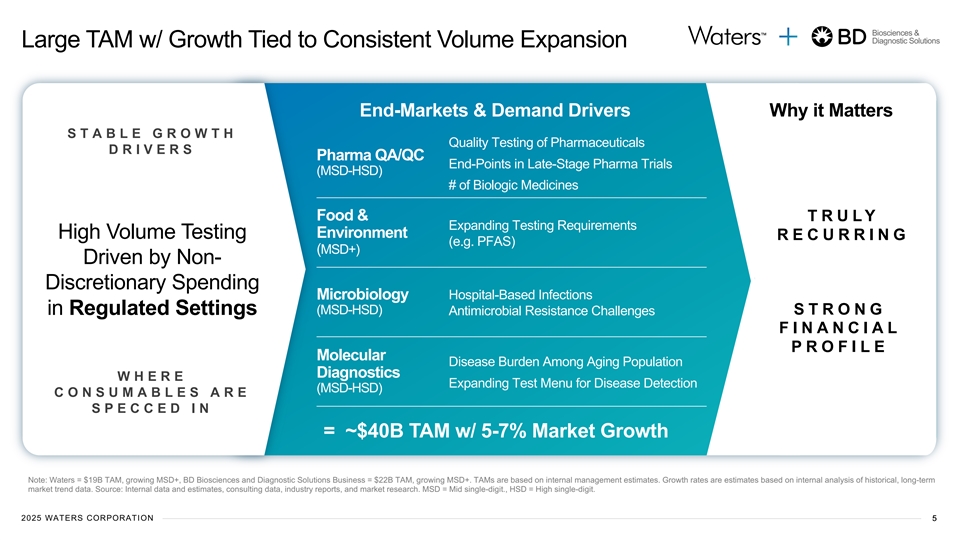

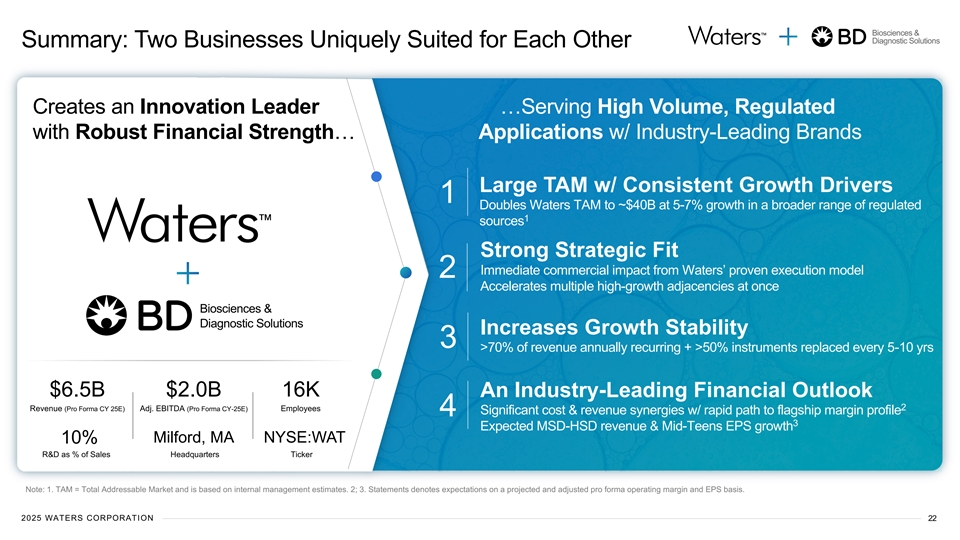

| | Doubles Waters total addressable market to approximately $40 billion, with 5-7% annual growth |

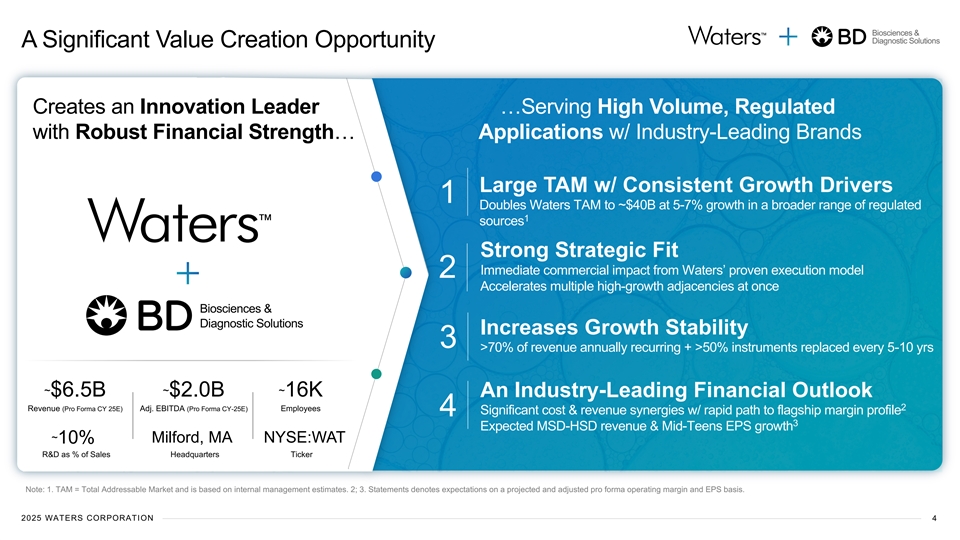

| | Creates a combined company with pro forma expected 2025 sales of approximately $6.5 billion and adjusted EBITDA of approximately $2.0 billion |

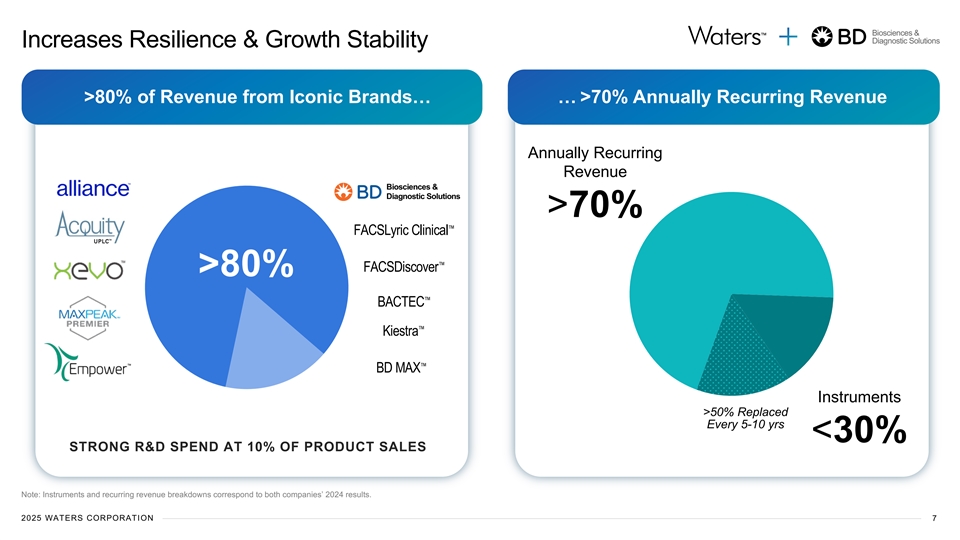

| | Increases annual recurring revenue to over 70% with over 80% of revenue coming from iconic market-leading brands |

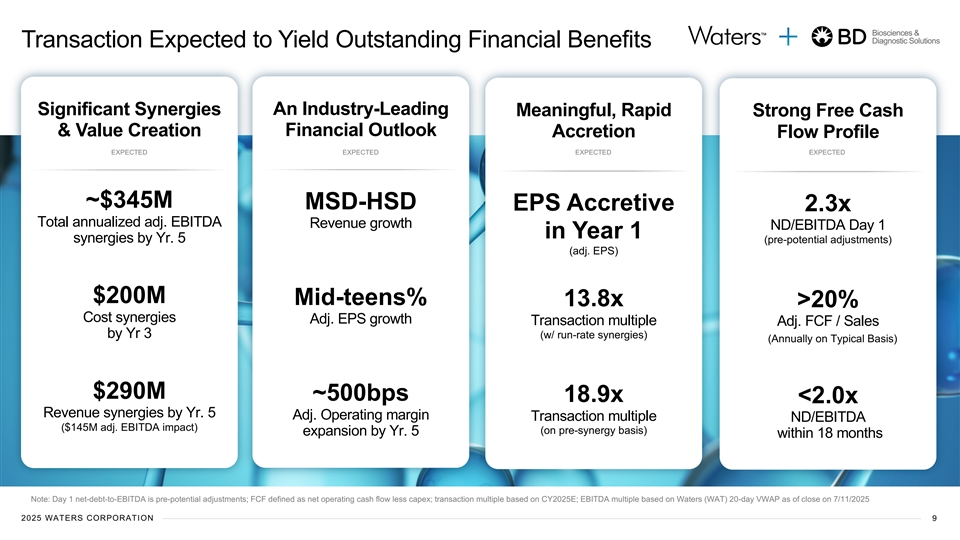

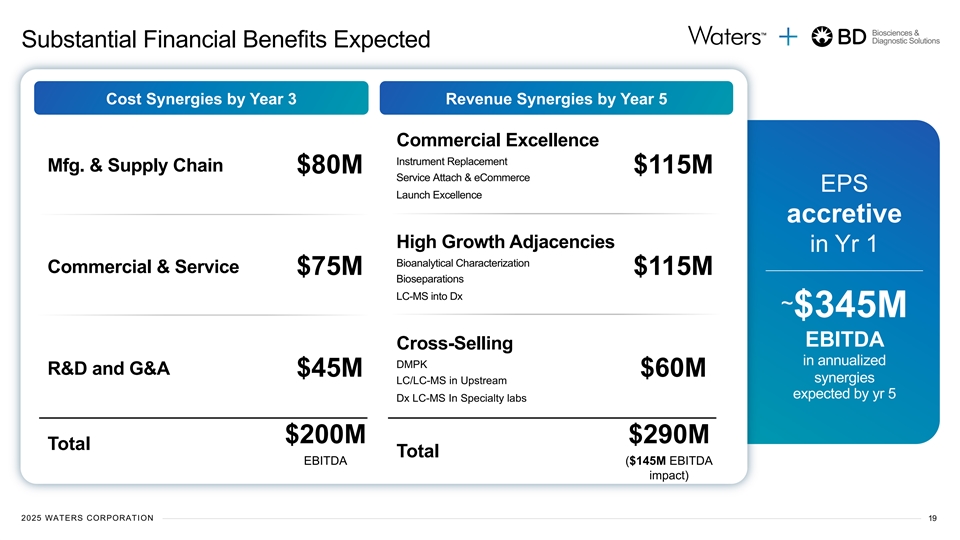

| | Anticipate approximately $345 million in annualized EBITDA synergies by 2030, including $200 million of cost synergies by year three, and $290 million of revenue synergies by year five |

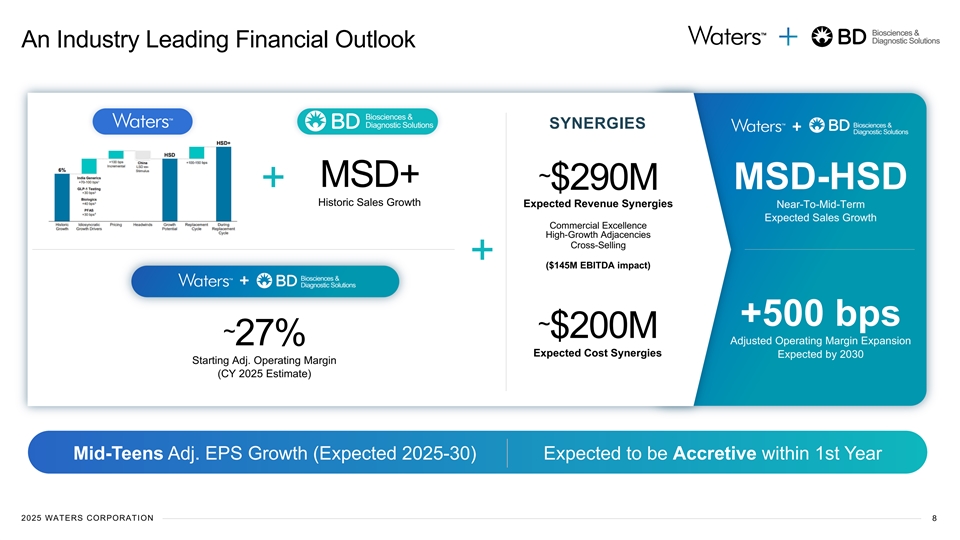

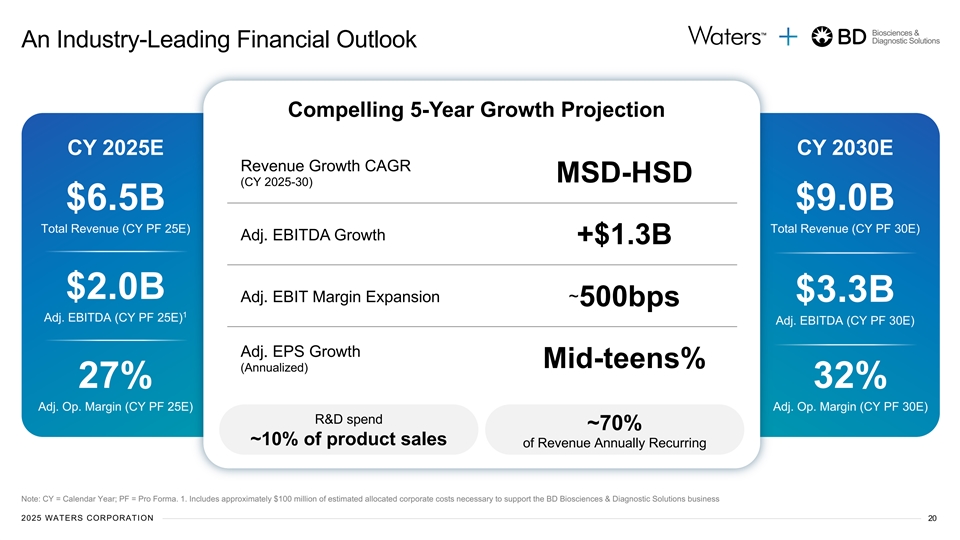

| | Delivers an industry-leading financial outlook with mid-to-high single-digit revenue growth, approximately 500 basis points of adjusted operating margin expansion, and mid-teens annualized adjusted EPS growth expected over five years |

| | Transaction expected to be accretive to adjusted EPS in the first year |

| | Companies to host joint conference call at 8:00 a.m. ET today |

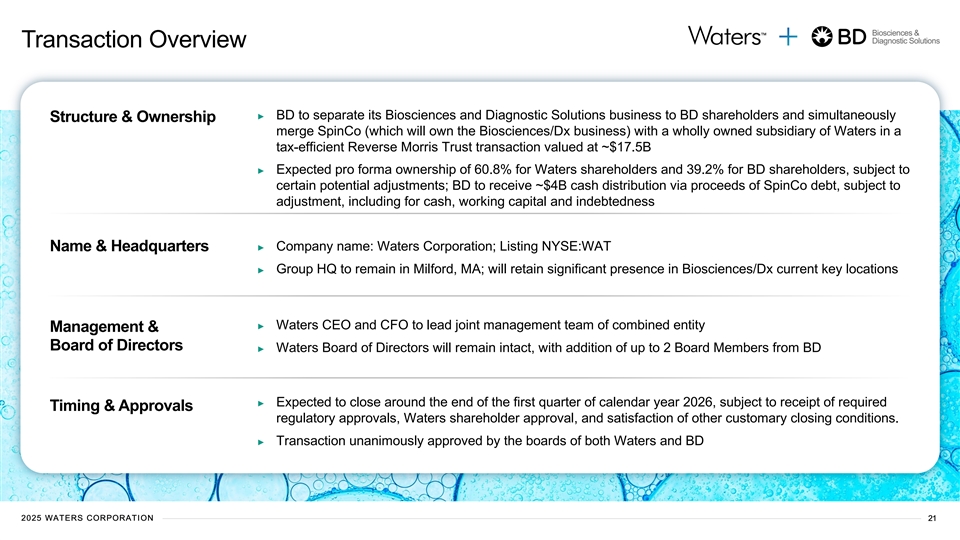

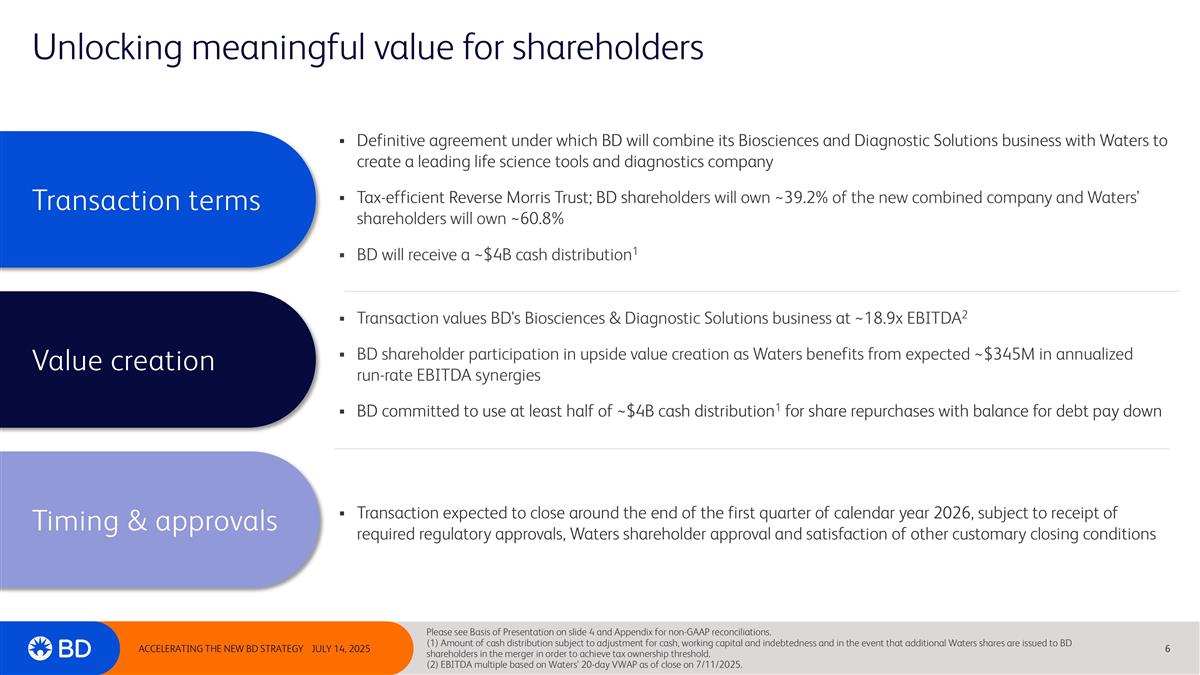

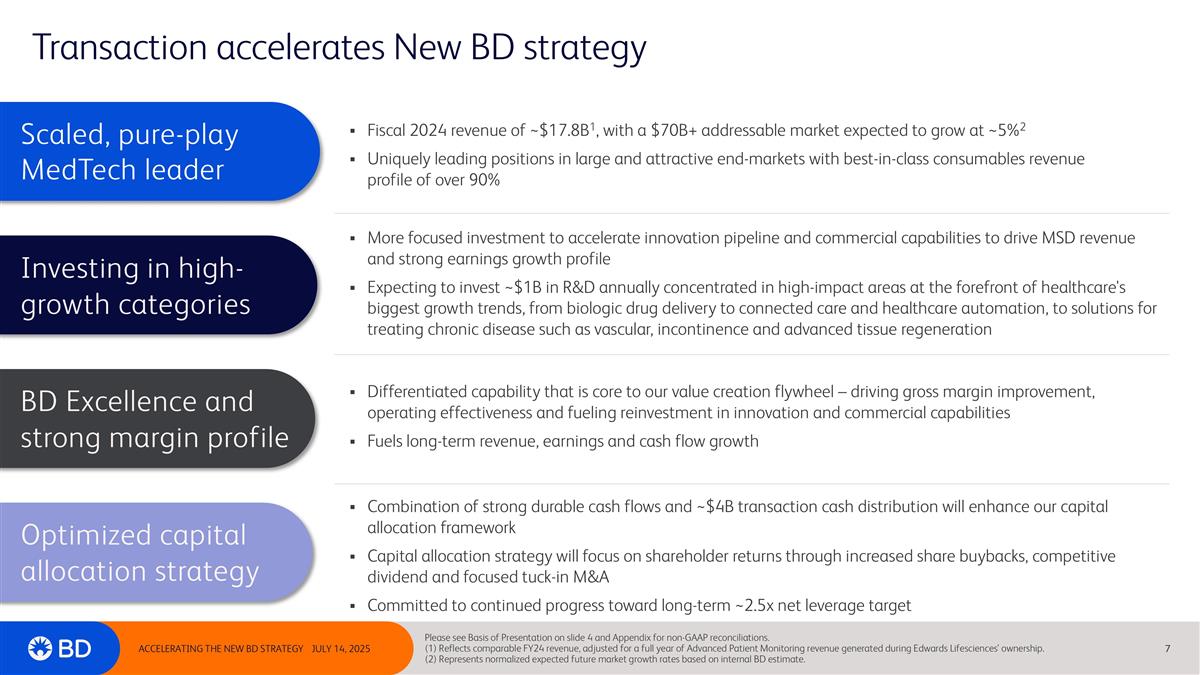

MILFORD, Mass., and FRANKLIN LAKES, N.J., July 14, 2025 Waters Corporation (NYSE: WAT) and BD (Becton, Dickinson and Company) (NYSE: BDX) today announced a definitive agreement to combine BDs Biosciences & Diagnostic Solutions business with Waters, creating an innovative life science and diagnostics leader with pioneering technologies and an industry-leading financial outlook. The agreement is structured as a tax-efficient Reverse Morris Trust transaction valued at approximately $17.5 billion.

Compelling Strategic and Financial Benefits

The companies expect that the transaction will create substantial shareholder value by:

| | Bringing together complementary technologies to serve high-volume testing in attractive and regulated end-markets: The combined company will have best-in-class liquid chromatography, mass spectrometry, flow cytometry, and diagnostic solutions, doubling Waters total addressable market to approximately $40 billion. |

| | Increasing annual recurring revenue in high-quality applications: Over 70% of the combined companys revenue is expected to be recurring annually and over half of instrument revenue is expected to be recurring within a typical five- to ten-year replacement cycle. |

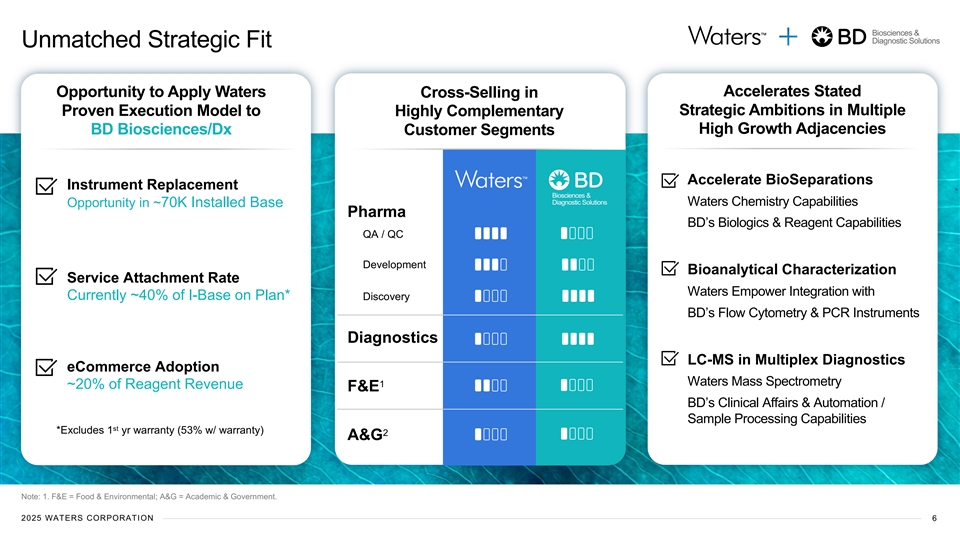

| | Accelerating Waters expansion into multiple high-growth adjacent end-markets: |

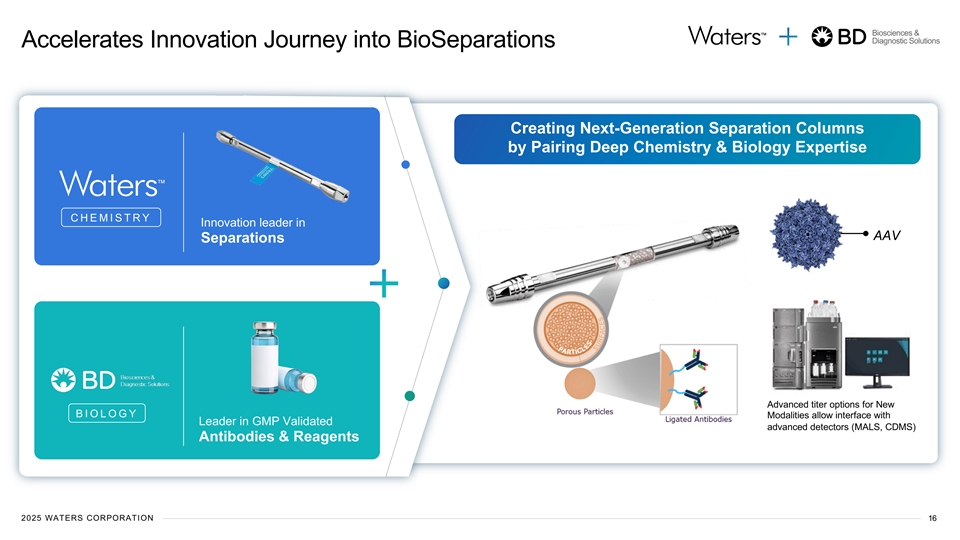

| | The bioseparations portfolio will expand by combining Waters chemistry expertise and BDs biologics expertise to unlock new ways to separate large molecules and to drive growth in biologics and novel modalities with next-generation consumables. |

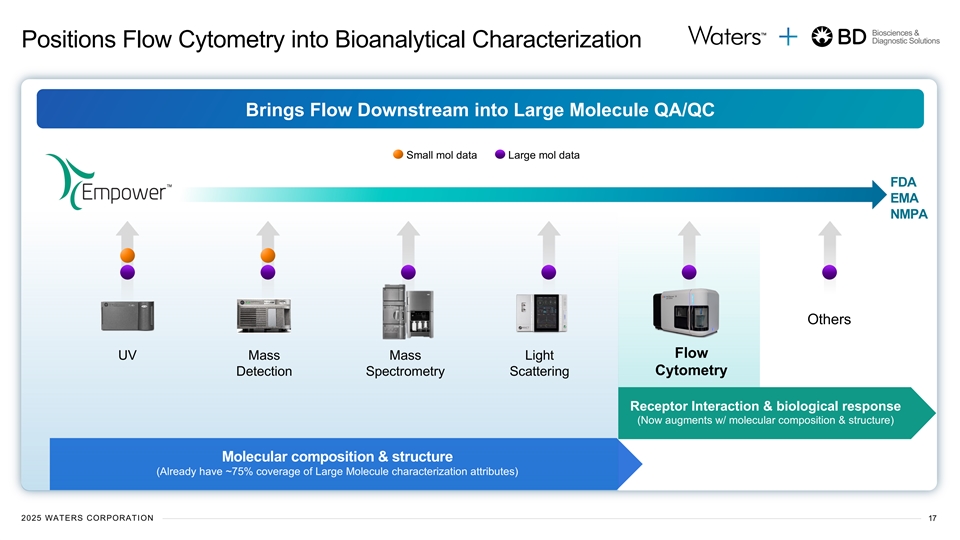

| | In bioanalytical characterization, Waters expertise in downstream high-volume applications and its established Empower informatics platform are well-positioned to deploy BDs flow cytometry and PCR technologies into large molecule QA/QC. |

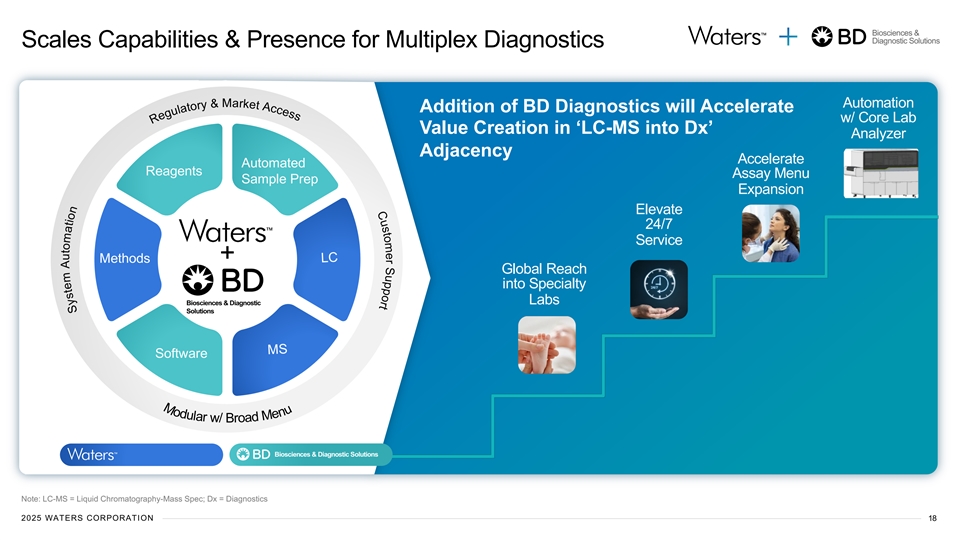

| | BDs regulatory expertise and established presence in clinical and diagnostic settings is expected to drive enhanced market access, improved service support, accelerated menu expansion, and automation for multiplex diagnostics using LC-MS technologies from Waters. |

| | Applying Waters proven execution model to unlock the full potential of BDs Biosciences & Diagnostic Solutions business: Waters will systematize execution across instrument replacement, service plan attachment, e-commerce adoption, and new product launches. |

| | Delivering substantial cost and revenue synergies: The transaction is expected to create approximately $200 million of cost synergies by year three post-closing, and approximately $290 million of revenue synergies by year five, resulting in approximately $345 million of annualized EBITDA synergies by 2030. |

| | Cost synergies are expected to be driven primarily by optimization in manufacturing, supply chain, and SG&A, while maintaining a strong commitment to R&D and commercial investments. |

| | Revenue synergies are expected to be derived from commercial excellence, accelerating expansion into high-growth adjacencies, and realizing cross-selling opportunities. |

| | Providing an industry-leading pro forma growth outlook with rapid adjusted EPS accretion: The combined company is expected to generate pro forma revenue of approximately $6.5 billion and approximately $2.0 billion in pro forma adjusted EBITDA for calendar year 2025. On a pro forma basis, the combination is expected to deliver mid-to-high single-digit revenue growth and mid-teens adjusted EPS growth on an annualized basis between 2025 and 2030. By 2030, the pro forma combined company is expected to have an industry-leading financial outlook with approximately $9 billion in revenue, $3.3 billion in adjusted EBITDA, and an adjusted operating margin of 32%. The transaction is expected to be accretive to adjusted EPS in the first year post-closing. |

Executive Commentary

Flemming Ornskov, M.D., M.P.H., Chairman, Waters, said:

This transaction marks a pivotal milestone in Waters transformation journey as we embark on a new chapter of growth and value creation. As the Board of Directors evaluated this opportunity throughout the process, it became evident that combining with BDs Biosciences & Diagnostic Solutions business is an excellent strategic fit with complementary strengths. We are confident that this combination will accelerate our strategy in multiple high-growth markets and deliver substantial near- and long-term value to our shareholders.

Udit Batra, Ph.D., President and Chief Executive Officer, Waters, said:

Waters transformation, marked by strong commercial execution and revitalized innovation, positions us well for this exciting next chapter. We see tremendous opportunity to immediately apply our expertise in instrument replacement, service plan attachment, and eCommerce expansion, and realize the full potential of the flow cytometry and specialty diagnostics portfolios. The combination doubles our accessible market to approximately $40 billion and allows us to accelerate value creation in multiple high-growth adjacencies such as bioseparations, bioanalytical characterization, and multiplex diagnostics, while increasing the ratio of our annually recurring revenues.

We are bringing together two pioneering organizations with a rich history of delivering breakthrough innovations driven by strong R&D investment and a common customer-centric culture. I look forward to welcoming our talented and like-minded colleagues from BDs Biosciences & Diagnostic Solutions business and leading the collective organization. Together, we will work to make this combination a resounding success for our stakeholders and deliver significant value for shareholders.

2

Tom Polen, Chairman, CEO and President, BD, said:

We are bringing together complementary portfolios and channels that create an industry-leading life science and diagnostics company. We see an incredible opportunity to leverage both companies commitments to unparalleled innovation, technology, and commercial presence to serve attractive high-growth end-markets, while simultaneously unlocking multiple new growth vectors. We couldnt be more confident that the combined company, under Udits leadership, represents the best path to create substantial value for shareholders. Waters offers the right cultural fit for our Biosciences & Diagnostic Solutions associates to flourish and continue their legacy of developing new-to-world, innovative solutions that make a meaningful impact on global healthcare.

This transaction is an important milestone for BD, as it enhances our strategic focus as a leading medical technology company. BD is committed to unlocking long-term value through continued investment in our strong innovation pipeline, and operational and commercial excellence that will drive durable and profitable growth. BD will also receive a cash distribution of approximately $4 billion, which enhances our capital allocation framework, including a commitment to use at least half of the cash proceeds to repurchase shares, with the remaining balance allocated to debt repayment.

Additional Transaction Details

The transaction, which has been unanimously approved by the Boards of Directors of both Waters and BD, is structured as a Reverse Morris Trust, where BDs Biosciences & Diagnostic Solutions business will be spun-off to BD shareholders and simultaneously merged with a wholly owned subsidiary of Waters. BDs shareholders are expected to own approximately 39.2% of the combined company, and existing Waters shareholders are expected to own approximately 60.8% of the combined company. BD will also receive a cash distribution of approximately $4 billion prior to completion of the combination, subject to adjustment for cash, working capital, and indebtedness. The transaction is expected to be generally tax-free for U.S. federal income tax purposes to BD and BDs shareholders. Waters is expected to assume approximately $4 billion of incremental debt, which would result in a net-debt-to-adjusted EBITDA leverage ratio for the combined company of 2.3x at closing. The transaction is expected to close around the end of the first quarter of calendar year 2026, subject to receipt of required regulatory approvals, Waters shareholder approval, and satisfaction of other customary closing conditions.

Management, Governance, and Headquarters

Upon closing of the transaction, Udit Batra, Ph.D., Waters President and Chief Executive Officer, will lead the new entity, and Amol Chaubal will serve as SVP and Chief Financial Officer. Executives from both companies will serve in key leadership roles to be announced at a later date. Up to two BD designees will join the Waters Board of Directors upon closing.

The combined company will continue to operate under the Waters name and retain its listing on the New York Stock Exchange under the ticker symbol WAT. Waters headquarters will remain in Milford, Mass., and the combined company will maintain a significant presence where the BD Biosciences & Diagnostic Solutions business currently operates.

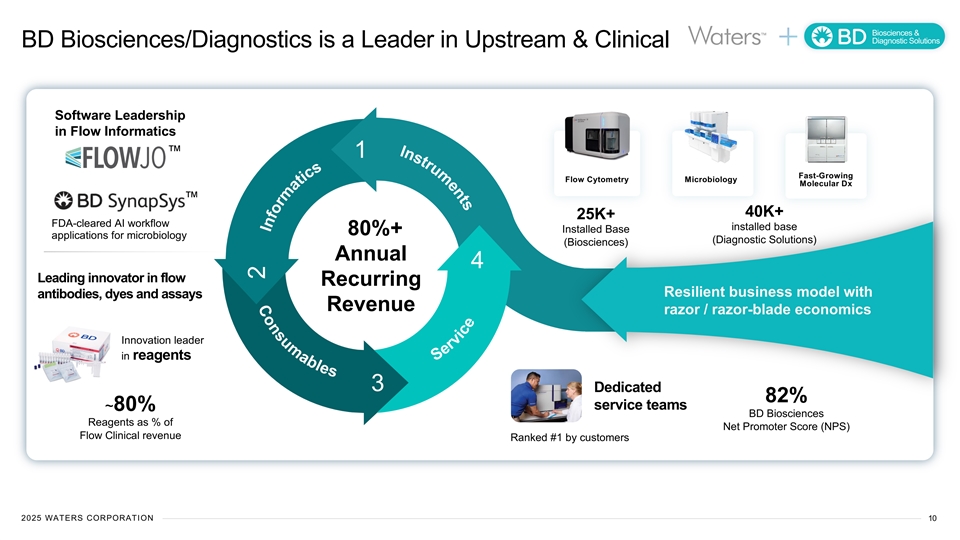

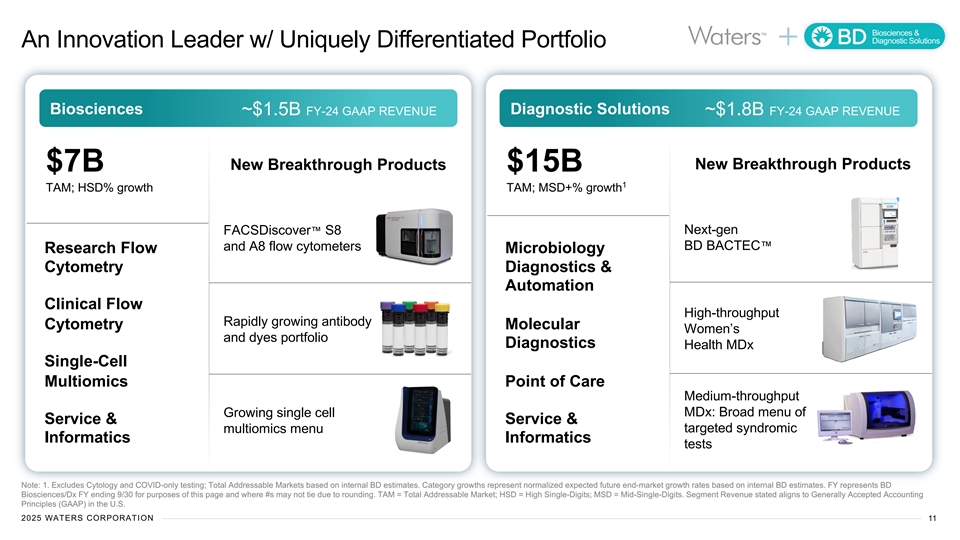

Overview of BD Biosciences & Diagnostic Solutions

Biosciences is a leader in immunology and cancer research solutions and related clinical diagnostics, including flow cytometry instruments and reagents, and innovative multiomics tools. Diagnostic Solutions is a leader in microbiology and infectious disease diagnostics, including molecular diagnostics, cervical cancer screening, microbiology automation, and point-of-care offerings. Both businesses have strong leadership teams with unparalleled commercial, manufacturing, engineering, and R&D expertise, and are dedicated to bringing the next generation of breakthrough innovations to researchers, clinicians, and patients.

For calendar year 2025, BDs Biosciences & Diagnostic Solutions business is expected to generate revenue of approximately $3.4 billion and adjusted EBITDA of approximately $925 million.

3

Advisors

Barclays is serving as financial advisor to Waters, and Kirkland & Ellis LLP is serving as legal counsel.

Citi is acting as lead financial advisor to BD, with Evercore also serving as a financial advisor. Wachtell, Lipton, Rosen & Katz is serving as lead legal counsel to BD.

Investor Call

Waters and BD will hold a joint conference call today, July 14, 2025, at 8:00 a.m. ET. The webcast of the call and the related materials will be available on Waters and BDs investor relations websites at ir.waters.com and investors.bd.com.

Additional information and materials related to the transaction can be found at combination.waters.com/.

About Waters Corporation

Waters Corporation (NYSE:WAT), is a global leader in analytical instruments, separations technologies, and software, serving the life, materials, food, and environmental sciences for over 65 years. Our Company helps ensure the efficacy of medicines, the safety of food and the purity of water, and the quality and sustainability of products used every day. In over 100 countries, our 7,600+ passionate employees collaborate with customers in laboratories, manufacturing sites, and hospitals to accelerate the benefits of pioneering science.

About BD

BD is one of the largest global medical technology companies in the world and is advancing the world of health by improving medical discovery, diagnostics and the delivery of care. The company supports the heroes on the frontlines of health care by developing innovative technology, services and solutions that help advance both clinical therapy for patients and clinical process for health care providers. BD and its more than 70,000 employees have a passion and commitment to help enhance the safety and efficiency of clinicians care delivery process, enable laboratory scientists to accurately detect disease and advance researchers capabilities to develop the next generation of diagnostics and therapeutics. BD has a presence in virtually every country and partners with organizations around the world to address some of the most challenging global health issues. By working in close collaboration with customers, BD can help enhance outcomes, lower costs, increase efficiencies, improve safety and expand access to health care. For more information on BD, please visit bd.com or connect with us on LinkedIn at www.linkedin.com/company/bd1/, X (formerly Twitter) @BDandCo or Instagram @becton_dickinson.

Additional Information and Where to Find It:

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to buy or exchange any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. It does not constitute a prospectus or prospectus equivalent document. No offering or sale of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the Securities Act), and otherwise in accordance with applicable law.

In connection with the proposed transaction between Waters, Augusta SpinCo Corporation (SpinCo) and BD, the parties intend to file relevant materials with the U.S. Securities and Exchange Commission (the SEC), including, among other filings, a registration statement on Form S-4 to be filed by Waters (the Form S-4) that will include a preliminary proxy statement/prospectus of Waters and a definitive proxy statement/prospectus of Waters, the

4

latter of which will be mailed to stockholders of Waters, and a registration statement on Form 10 to be filed by SpinCo that will incorporate by reference certain portions of the Form S-4 and will serve as an information statement/prospectus in connection with the spin-off of SpinCo from BD. INVESTORS AND SECURITY HOLDERS OF WATERS AND BD ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, THE INFORMATION STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Form S-4 and the proxy statement/prospectus (when available) and other documents filed with the SEC by Waters, SpinCo or BD through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Waters will be available free of charge on Waters website at waters.com under the tab About Waters and under the heading Investor Relations and subheading FinancialsSEC Filings. Copies of the documents filed with the SEC by BD and SpinCo will be available free of charge on BDs website at bd.com under the tab About BD and under the heading Investors and subheading SEC Filings.

Participants in the Solicitation

Waters and BD and their respective directors and executive officers may be considered participants in the solicitation of proxies from Waters stockholders in connection with the proposed transaction. Information about the directors and executive officers of Waters is set forth in its Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the SEC on February 25, 2025, and its proxy statement for its 2025 annual meeting, which was filed with the SEC on April 9, 2025. To the extent holdings of Waters securities by its directors or executive officers have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. Information about the directors and executive officers of Waters and other information regarding the potential participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction. Information about the directors and executive officers of BD is set forth in its Annual Report on Form 10-K for the year ended September 30, 2024, which was filed with the SEC on November 27, 2024, and its proxy statement for its 2025 annual meeting, which was filed with the SEC on December 19, 2024. To the extent holdings of BDs securities by its directors or executive officers have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. You may obtain these documents (when they become available) free of charge through the website maintained by the SEC at www.sec.gov and from Waters website and BDs website as described above.

Cautionary Statement Regarding Forward-Looking Statements

This communication includes forward-looking statements as that term is defined in Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the proposed transaction among Waters, BD and SpinCo. These forward-looking statements generally are identified by the words believe, feel, project, expect, anticipate, appear, estimate, forecast, outlook, target, endeavor, seek, predict, intend, suggest, strategy, plan, may, could, should, will, would, will be, will continue, will likely result, or the negative thereof or variations thereon or similar terminology generally intended to identify forward-looking statements. All statements, other than historical facts, including, but not limited to, statements regarding the expected timing and structure of the proposed transaction, the ability of the parties to complete the proposed transaction, the expected benefits of the proposed transaction, including the amount and timing of synergies from the proposed transaction, the tax consequences of the proposed transaction, the terms and scope of the expected financing in connection with the proposed transaction, the aggregate amount

5

of indebtedness of the combined company following the closing of the proposed transaction, the combined companys plans, objectives, expectations and intentions, legal, economic and regulatory conditions, and any assumptions underlying any of the foregoing, are forward looking statements.

These forward-looking statements are based on Waters and BDs current expectations and are subject to risks and uncertainties surrounding future expectations generally. Actual results could differ materially from those currently anticipated due to a number of risks and uncertainties, many of which are beyond Waters and BDs control. None of Waters, BD, SpinCo or any of their respective directors, executive officers, or advisors make any representation or provide any assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur, or if any of them do occur, what impact they will have on the business, results of operations or financial condition of Waters or BD. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, these developments could have a material adverse effect on Waters and BDs businesses and the ability to successfully complete the proposed transaction and realize its benefits. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) that one or more closing conditions to the transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the proposed transaction, may require conditions, limitations or restrictions in connection with such approvals or that the required approval by the stockholders of Waters may not be obtained; (2) the risk that the proposed transaction may not be completed on the terms or in the time frame expected by Waters, BD and SpinCo, or at all; (3) unexpected costs, charges or expenses resulting from the proposed transaction; (4) uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; (5) failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the proposed transaction or integrating the businesses of Waters and SpinCo, on the expected timeframe or at all; (6) the ability of the combined company to implement its business strategy; (7) difficulties and delays in the combined company achieving revenue and cost synergies; (8) inability of the combined company to retain and hire key personnel; (9) the occurrence of any event that could give rise to termination of the proposed transaction; (10) the risk that stockholder litigation in connection with the proposed transaction or other litigation, settlements or investigations may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability; (11) evolving legal, regulatory and tax regimes; (12) changes in general economic and/or industry specific conditions or any volatility resulting from the imposition of and changing policies around tariffs; (13) actions by third parties, including government agencies; (14) the risk that the anticipated tax treatment of the proposed transaction is not obtained; (15) the risk of greater than expected difficulty in separating the business of SpinCo from the other businesses of BD; (16) risks related to the disruption of management time from ongoing business operations due to the pendency of the proposed transaction, or other effects of the pendency of the proposed transaction on the relationship of any of the parties to the transaction with their employees, customers, suppliers, or other counterparties; and (17) other risk factors detailed from time to time in Waters and BDs reports filed with the SEC, including Waters and BDs annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC, including documents that will be filed with the SEC in connection with the proposed transaction. The foregoing list of important factors is not exclusive.

It should also be noted that projected financial information for the combined businesses of Waters and SpinCo is based on managements estimates, assumptions and projections and has not been prepared in conformance with the applicable accounting requirements of Regulation S-X relating to pro forma financial information, and the required pro forma adjustments have not been applied and are not reflected therein. None of this information should be considered in isolation from, or as a substitute for, the historical financial statements of Waters or SpinCo. Important risk factors could cause actual future results and other future events to differ materially from

6

those currently estimated by management, including, but not limited to, the risks that: a condition to the closing of the proposed transaction may not be satisfied; a regulatory approval that may be required for the proposed transaction is delayed, is not obtained or is obtained subject to conditions that are not anticipated; Waters is unable to achieve the synergies and value creation contemplated by the proposed transaction; Waters is unable to promptly and effectively integrate SpinCos businesses; managements time and attention is diverted on transaction related issues; disruption from the transaction makes it more difficult to maintain business, contractual and operational relationships; the credit ratings of the combined company declines following the proposed transaction; legal proceedings are instituted against Waters, BD or the combined company; Waters, SpinCo or the combined company is unable to retain key personnel; and the announcement or the consummation of the proposed transaction has a negative effect on the market price of the capital stock of Waters and BD or on Waters and BDs operating results.

Any forward-looking statements speak only as of the date of this communication. None of Waters, BD or SpinCo undertakes, and each party expressly disclaims, any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements.

Note Regarding Use of Non-GAAP Financial Measures

In addition to the financial measures presented in accordance with U.S. generally accepted accounting principles (U.S. GAAP), this communication includes certain non-GAAP financial measures (collectively, the Non-GAAP Measures), such as adjusted EBITDA, adjusted EPS and adjusted operating margin. These Non-GAAP Measures should not be used in isolation or as a substitute or alternative to results determined in accordance with U.S. GAAP. In addition, Waters and BDs definitions of these Non-GAAP Measures may not be comparable to similarly titled non-GAAP financial measures reported by other companies. For Calendar Year 2025, Waters projected adjusted EBITDA for BDs Biosciences & Diagnostic Solutions business is approximately $925 million. Due to the SEC methodology that requires allocating BDs corporate overhead costs (approximately $200 million), which are not required to operate the Bioscience & Diagnostic Solutions business and will not transfer post-spin, as well as approximately $100 million in one-time, non-recurring costs related to the spin-off, transaction, and restructuring, EBITDA for BDs Biosciences & Diagnostic Solutions business in BDs carveout financial statements for the same period would be expected to be approximately $300 million lower.

Contacts

| Waters Corporation | BD | |

| Molly Gluck Head of External Communications Waters Corporation 617.833.8166 Molly_Gluck@waters.com |

Troy Kirkpatrick VP, Public Relations BD 858.617.2361 troy.kirkpatrick@bd.com |

|

| Caspar Tudor Head of Investor Relations Waters Corporation 508.482.3448 Investor_relations@waters.com |

Adam Reiffe Sr. Director, Investor Relations BD 201.847.6927 adam.reiffe@bd.com |

|

7

Exhibit 99.2 Biosciences & Diagnostic Solutions CREATING A Life Science Tools & Diagnostics Leader Focused on Regulated, High-Volume Testing July 14, 2025

Biosciences & Diagnostic Solutions Disclaimer Additional Information and Where to Find It: This communication is not intended to and does not constitute an offer to sell or the solicitation of an materialize, or should underlying assumptions prove incorrect, these developments could have a material adverse effect on Waters’ and BD’s businesses and the ability to successfully complete the proposed transaction and realize its benefits. The inclusion of such statements should not be regarded as a offer to buy or exchange any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of estimates or expectations include, among others, (1) that one or more closing conditions to the transaction, including certain regulatory approvals, may not be any such jurisdiction. It does not constitute a prospectus or prospectus equivalent document. No offering or sale of securities shall be made except satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”), and otherwise in the proposed transaction, may require conditions, limitations or restrictions in connection with such approvals or that the required approval by the stockholders of accordance with applicable law. Waters may not be obtained; (2) the risk that the proposed transaction may not be completed on the terms or in the time frame expected by Waters, BD and SpinCo, or at all; (3) unexpected costs, charges or expenses resulting from the proposed transaction; (4) uncertainty of the expected financial performance of the In connection with the proposed transaction between Waters, Augusta SpinCo Corporation (“SpinCo”) and BD, the parties intend to file relevant materials with combined company following completion of the proposed transaction; (5) failure to realize the anticipated benefits of the proposed transaction, including as a the U.S. Securities and Exchange Commission (the “SEC”), including, among other filings, a registration statement on Form S-4 to be filed by Waters (the “Form result of delay in completing the proposed transaction or integrating the businesses of Waters and SpinCo, on the expected timeframe or at all; (6) the ability of S-4”) that will include a preliminary proxy statement/prospectus of Waters and a definitive proxy statement/prospectus of Waters, the latter of which will be mailed the combined company to implement its business strategy; (7) difficulties and delays in the combined company achieving revenue and cost synergies; (8) to stockholders of Waters, and a registration statement on Form 10 to be filed by SpinCo that will incorporate by reference certain portions of the Form S-4 and inability of the combined company to retain and hire key personnel; (9) the occurrence of any event that could give rise to termination of the proposed will serve as an information statement/prospectus in connection with the spin-off of SpinCo from BD. INVESTORS AND SECURITY HOLDERS OF WATERS transaction; (10) the risk that stockholder litigation in connection with the proposed transaction or other litigation, settlements or investigations may affect the AND BD ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, THE INFORMATION STATEMENT/PROSPECTUS AND ANY OTHER timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability; (11) evolving legal, regulatory and tax DOCUMENTS THAT WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY regimes; (12) changes in general economic and/or industry specific conditions or any volatility resulting from the imposition of and changing policies around AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED tariffs; (13) actions by third parties, including government agencies; (14) the risk that the anticipated tax treatment of the proposed transaction is not obtained; TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Form S-4 and the proxy (15) the risk of greater than expected difficulty in separating the business of SpinCo from the other businesses of BD; (16) risks related to the disruption of statement/prospectus (when available) and other documents filed with the SEC by Waters, SpinCo or BD through the website maintained by the SEC at management time from ongoing business operations due to the pendency of the proposed transaction, or other effects of the pendency of the proposed www.sec.gov. Copies of the documents filed with the SEC by Waters will be available free of charge on Waters’ website at waters.com under the tab “About transaction on the relationship of any of the parties to the transaction with their employees, customers, suppliers, or other counterparties; and (17) other risk Waters” and under the heading “Investor Relations” and subheading “Financials—SEC Filings.” Copies of the documents filed with the SEC by BD and SpinCo factors detailed from time to time in Waters’ and BD’s reports filed with the SEC, including Waters’ and BD’s annual reports on Form 10-K, quarterly reports on will be available free of charge on BD’s website at bd.com under the tab “About BD” and under the heading “Investors” and subheading “SEC Filings.” Form 10-Q, current reports on Form 8-K and other documents filed with the SEC, including documents that will be filed with the SEC in connection with the proposed transaction. The foregoing list of important factors is not exclusive. Participants in the Solicitation Waters and BD and their respective directors and executive officers may be considered participants in the solicitation of proxies from Waters’ stockholders in connection with the proposed transaction. Information about the directors and executive officers of It should also be noted that projected financial information for the combined businesses of Waters and SpinCo is based on management’s estimates, Waters is set forth in its Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the SEC on February 25, 2025, assumptions and projections and has not been prepared in conformance with the applicable accounting requirements of Regulation S-X relating to and its proxy statement for its 2025 annual meeting, which was filed with the SEC on April 9, 2025. To the extent holdings of Waters’ securities by its pro forma financial information, and the required pro forma adjustments have not been applied and are not reflected therein. None of this information directors or executive officers have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial should be considered in isolation from, or as a substitute for, the historical financial statements of Waters or SpinCo. Important risk factors could Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. Information about the directors cause actual future results and other future events to differ materially from those currently estimated by management, including, but not limited to, the and executive officers of Waters and other information regarding the potential participants in the proxy solicitations and a description of their direct risks that: a condition to the closing of the proposed transaction may not be satisfied; a regulatory approval that may be required for the proposed and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed transaction is delayed, is not obtained or is obtained subject to conditions that are not anticipated; Waters is unable to achieve the synergies and with the SEC regarding the proposed transaction. Information about the directors and executive officers of BD is set forth in its Annual Report on value creation contemplated by the proposed transaction; Waters is unable to promptly and effectively integrate SpinCo’s businesses; Form 10-K for the year ended September 30, 2024, which was filed with the SEC on November 27, 2024, and its proxy statement for its 2025 management’s time and attention is diverted on transaction related issues; disruption from the transaction makes it more difficult to maintain annual meeting, which was filed with the SEC on December 19, 2024. To the extent holdings of BD’s securities by its directors or executive officers business, contractual and operational relationships; the credit ratings of the combined company declines following the proposed transaction; legal have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial Ownership proceedings are instituted against Waters, BD or the combined company; Waters, SpinCo or the combined company is unable to retain key on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. You may obtain these documents (when they become available) personnel; and the announcement or the consummation of the proposed transaction has a negative effect on the market price of the capital stock of free of charge through the website maintained by the SEC at www.sec.gov and from Waters’ website and BD’s website as described above. Waters and BD or on Waters’ and BD’s operating results. Cautionary Statement Regarding Forward-Looking Statements This communication includes “forward-looking statements” as that term is Any forward-looking statements speak only as of the date of this communication. None of Waters, BD or SpinCo undertakes, and each party expressly defined in Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding disclaims, any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as the proposed transaction among Waters, BD and SpinCo. These forward-looking statements generally are identified by the words “believe,” “feel,” required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements. “project,” “expect,” “anticipate,” “appear,” “estimate,” “forecast,” “outlook,” “target,” “endeavor,” “seek,” “predict,” “intend,” “suggest,” “strategy,” “plan,” “may,” “could,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” or the negative thereof or variations thereon or similar terminology Note Regarding Use of Non-GAAP Financial Measures In addition to the financial measures presented in accordance with U.S. generally accepted generally intended to identify forward-looking statements. All statements, other than historical facts, including, but not limited to, statements regarding accounting principles (“U.S. GAAP”), this communication includes certain non-GAAP financial measures (collectively, the “Non-GAAP Measures”), such as the expected timing and structure of the proposed transaction, the ability of the parties to complete the proposed transaction, the expected benefits adjusted EBITDA, free cash flow, adjusted EBITDA margin, adjusted EPS and adjusted operating margin. These Non-GAAP Measures should not be used in of the proposed transaction, including the amount and timing of synergies from the proposed transaction, the tax consequences of the proposed isolation or as a substitute or alternative to results determined in accordance with U.S. GAAP. In addition, Waters’ and BD’s definitions of these Non-GAAP transaction, the terms and scope of the expected financing in connection with the proposed transaction, the aggregate amount of indebtedness of Measures may not be comparable to similarly titled non-GAAP financial measures reported by other companies. For Calendar Year 2025, Waters’ projected adjusted EBITDA for BD’s Biosciences & Diagnostic Solutions business is approximately $925 million. Due to the SEC methodology that requires allocating the combined company following the closing of the proposed transaction, the combined company’s plans, objectives, expectations and intentions, BD’s corporate overhead costs (approximately $200 million), which are not required to operate the Bioscience & Diagnostic Solutions business and will not legal, economic and regulatory conditions, and any assumptions underlying any of the foregoing, are forward looking statements. transfer post-spin, as well as approximately $100 million in one-time, non-recurring costs related to the spin-off, transaction, and restructuring, EBITDA for BD’s Biosciences & Diagnostic Solutions business in BD’s carveout financial statements for the same period would be expected to be approximately $300 million These forward-looking statements are based on Waters’ and BD’s current expectations and are subject to risks and uncertainties surrounding future expectations lower. generally. Actual results could differ materially from those currently anticipated due to a number of risks and uncertainties, many of which are beyond Waters’ and BD’s control. None of Waters, BD, SpinCo or any of their respective directors, executive officers, or advisors make any representation or provide any assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur, or if any of them do occur, what impact they will have on the business, results of operations or financial condition of Waters or BD. Should one or more of these risks or uncertainties 2025 WATERS CORPORATION 1

Biosciences & Diagnostic Solutions Today’s Speakers Dr. Udit Batra Tom Polen Amol Chaubal Christopher DelOrefice Waters President BD Chairman, Waters SVP, BD EVP, & Chief Executive Officer CEO & President Chief Financial Officer Chief Financial Officer 2025 WATERS CORPORATION 2

Biosciences & Diagnostic Solutions A Strong, Shared Culture of Pioneering Science 50+ Years 50+ Years Defining Separations Advancing the Field Science with Liquid of Biology with Chromatography Best-in-Class Innovators Flow Cytometry Biosciences & Diagnostic Solutions 1965 2019 R. B. Woodward Kaelin Jr., Ratcliffe, & Semenza Nobel Prize in Chemistry Nobel Prize for Medicine Nobel Laureate R. B. Woodward Cover Story of Science (Jan. 2022) Used first commercial HPLC Acknowledging Landmark Innovation Nobel Prize in B12 synthesis w/ Jim Waters of BD CellView in Flow Cytometry 2025 WATERS CORPORATION 3

Biosciences & Diagnostic Solutions A Significant Value Creation Opportunity Creates an Innovation Leader …Serving High Volume, Regulated with Robust Financial Strength… Applications w/ Industry-Leading Brands Large TAM w/ Consistent Growth Drivers 1 Doubles Waters TAM to ~$40B at 5-7% growth in a broader range of regulated 1 sources Strong Strategic Fit Immediate commercial impact from Waters’ proven execution model 2 Accelerates multiple high-growth adjacencies at once Biosciences & Diagnostic Solutions Increases Growth Stability 3 >70% of revenue annually recurring + >50% instruments replaced every 5-10 yrs ~ ~ ~ $6.5B $2.0B 16K An Industry-Leading Financial Outlook 2 Revenue (Pro Forma CY 25E) Adj. EBITDA (Pro Forma CY-25E) Employees Significant cost & revenue synergies w/ rapid path to flagship margin profile 4 3 Expected MSD-HSD revenue & Mid-Teens EPS growth ~ Milford, MA NYSE:WAT 10% R&D as % of Sales Headquarters Ticker Note: 1. TAM = Total Addressable Market and is based on internal management estimates. 2; 3. Statements denotes expectations on a projected and adjusted pro forma operating margin and EPS basis. 2025 WATERS CORPORATION 4

Biosciences & Diagnostic Solutions Large TAM w/ Growth Tied to Consistent Volume Expansion End-Markets & Demand Drivers Why it Matters ST A B L E G R O W T H Quality Testing of Pharmaceuticals DRI V E RS Pharma QA/QC End-Points in Late-Stage Pharma Trials (MSD-HSD) # of Biologic Medicines Food & TRULY Expanding Testing Requirements High Volume Testing Environment RECURRING (e.g. PFAS) (MSD+) Driven by Non- Discretionary Spending Microbiology Hospital-Based Infections in Regulated Settings (MSD-HSD) STRONG Antimicrobial Resistance Challenges FINANCIAL PROFILE Molecular Disease Burden Among Aging Population Diagnostics WH E R E Expanding Test Menu for Disease Detection (MSD-HSD) CO NS UM ABL E S ARE SPEC C ED I N = ~$40B TAM w/ 5-7% Market Growth Note: Waters = $19B TAM, growing MSD+, BD Biosciences and Diagnostic Solutions Business = $22B TAM, growing MSD+. TAMs are based on internal management estimates. Growth rates are estimates based on internal analysis of historical, long-term market trend data. Source: Internal data and estimates, consulting data, industry reports, and market research. MSD = Mid single-digit., HSD = High single-digit. 2025 WATERS CORPORATION 5 5

Biosciences & Diagnostic Solutions Unmatched Strategic Fit Accelerates Stated Opportunity to Apply Waters Cross-Selling in Proven Execution Model to Highly Complementary Strategic Ambitions in Multiple BD Biosciences/Dx High Growth Adjacencies Customer Segments Accelerate BioSeparations Instrument Replacement Biosciences & Diagnostic Solutions Waters Chemistry Capabilities Opportunity in ~70K Installed Base Pharma BD’s Biologics & Reagent Capabilities QA / QC Development Bioanalytical Characterization Service Attachment Rate Waters Empower Integration with Currently ~40% of I-Base on Plan* Discovery BD’s Flow Cytometry & PCR Instruments Diagnostics LC-MS in Multiplex Diagnostics eCommerce Adoption Waters Mass Spectrometry 1 ~20% of Reagent Revenue F&E BD’s Clinical Affairs & Automation / Sample Processing Capabilities st *Excludes 1 yr warranty (53% w/ warranty) 2 A&G Note: 1. F&E = Food & Environmental; A&G = Academic & Government. 2025 WATERS CORPORATION 6

Biosciences & Diagnostic Solutions Increases Resilience & Growth Stability >80% of Revenue from Iconic Brands… … >70% Annually Recurring Revenue Annually Recurring Revenue Biosciences & Diagnostic Solutions >70% ™ FACSLyric Clinical ™ FACSDiscover >80% ™ BACTEC ™ Kiestra ™ BD MAX Instruments >50% Replaced Every 5-10 yrs <30% STRONG R&D SPEND AT 10% OF PRODUCT SALES Note: Instruments and recurring revenue breakdowns correspond to both companies’ 2024 results. 2025 WATERS CORPORATION 7

Bi Bio osci scie en nce ces s & & Dia Diag gn no os st tic ic S So olu lut tio ion ns s An Industry Leading Financial Outlook Biosciences & Diagnostic Solutions Biosciences & SYNERGIES Diagnostic Solutions ~ MSD+ MSD-HSD $290M + Historic Sales Growth Expected Revenue Synergies Near-To-Mid-Term Expected Sales Growth Commercial Excellence High-Growth Adjacencies Cross-Selling + ($145M EBITDA impact) Biosciences & Diagnostic Solutions +500 bps ~ ~ $200M 27% Adjusted Operating Margin Expansion Expected Cost Synergies Expected by 2030 Starting Adj. Operating Margin (CY 2025 Estimate) Mid-Teens Adj. EPS Growth (Expected 2025-30) Expected to be Accretive within 1st Year 2025 WATERS CORPORATION 8

Biosciences & Diagnostic Solutions Transaction Expected to Yield Outstanding Financial Benefits An Industry-Leading Significant Synergies Meaningful, Rapid Strong Free Cash & Value Creation Financial Outlook Accretion Flow Profile EXPECTED EXPECTED EXPECTED EXPECTED ~$345M MSD-HSD EPS Accretive 2.3x Total annualized adj. EBITDA Revenue growth ND/EBITDA Day 1 in Year 1 synergies by Yr. 5 (pre-potential adjustments) (adj. EPS) $200M Mid-teens% 13.8x >20% Cost synergies Adj. EPS growth Transaction multiple Adj. FCF / Sales by Yr 3 (w/ run-rate synergies) (Annually on Typical Basis) $290M ~500bps 18.9x <2.0x Revenue synergies by Yr. 5 Adj. Operating margin Transaction multiple ND/EBITDA ($145M adj. EBITDA impact) (on pre-synergy basis) expansion by Yr. 5 within 18 months Note: Day 1 net-debt-to-EBITDA is pre-potential adjustments; FCF defined as net operating cash flow less capex; transaction multiple based on CY2025E; EBITDA multiple based on Waters (WAT) 20-day VWAP as of close on 7/11/2025 2025 WATERS CORPORATION 9

Biosciences & Diagnostic Solutions BD Biosciences/Diagnostics is a Leader in Upstream & Clinical Software Leadership in Flow Informatics ™ 1 Fast-Growing Flow Cytometry Microbiology Molecular Dx ™ 40K+ 25K+ FDA-cleared AI workflow installed base Installed Base 80%+ applications for microbiology (Diagnostic Solutions) (Biosciences) Annual 4 Leading innovator in flow Recurring Resilient business model with antibodies, dyes and assays Revenue razor / razor-blade economics Innovation leader in reagents 3 Dedicated 82% service teams ~80% BD Biosciences Reagents as % of Net Promoter Score (NPS) Flow Clinical revenue Ranked #1 by customers 2025 WATERS CORPORATION 10 3 2

Biosciences & Diagnostic Solutions An Innovation Leader w/ Uniquely Differentiated Portfolio Biosciences Diagnostic Solutions ~$1.5B FY-24 GAAP REVENUE ~$1.8B FY-24 GAAP REVENUE New Breakthrough Products New Breakthrough Products $7B $15B 1 TAM; HSD% growth TAM; MSD+% growth FACSDiscover™ S8 Next-gen and A8 flow cytometers BD BACTEC™ Research Flow Microbiology Cytometry Diagnostics & Automation Clinical Flow High-throughput Rapidly growing antibody Cytometry Molecular Women’s and dyes portfolio Diagnostics Health MDx Single-Cell Multiomics Point of Care Medium-throughput Growing single cell MDx: Broad menu of Service & Service & multiomics menu targeted syndromic Informatics Informatics tests Note: 1. Excludes Cytology and COVID-only testing; Total Addressable Markets based on internal BD estimates. Category growths represent normalized expected future end-market growth rates based on internal BD estimates. FY represents BD Biosciences/Dx FY ending 9/30 for purposes of this page and where #s may not tie due to rounding. TAM = Total Addressable Market; HSD = High Single-Digits; MSD = Mid-Single-Digits. Segment Revenue stated aligns to Generally Accepted Accounting Principles (GAAP) in the U.S. 2025 WATERS CORPORATION 11

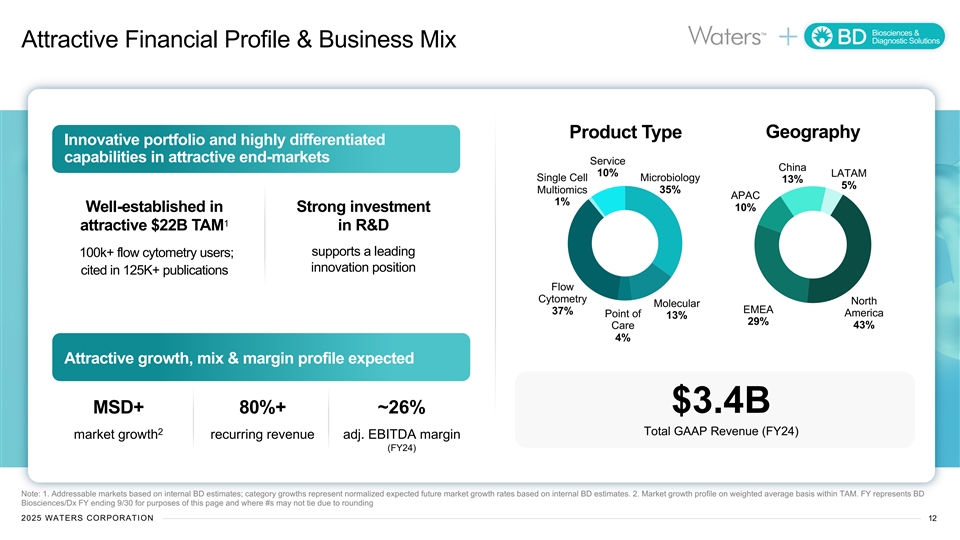

Biosciences & Diagnostic Solutions Attractive Financial Profile & Business Mix Product Type Geography Innovative portfolio and highly differentiated capabilities in attractive end-markets Service China 10% LATAM Single Cell Microbiology 13% 5% Multiomics 35% APAC 1% 10% Well-established in Strong investment 1 attractive $22B TAM in R&D supports a leading 100k+ flow cytometry users; innovation position cited in 125K+ publications Flow Cytometry North Molecular EMEA 37% Point of America 13% 29% Care 43% 4% Attractive growth, mix & margin profile expected MSD+ 80%+ ~26% $3.4B 2 Total GAAP Revenue (FY24) market growth recurring revenue adj. EBITDA margin (FY24) Note: 1. Addressable markets based on internal BD estimates; category growths represent normalized expected future market growth rates based on internal BD estimates. 2. Market growth profile on weighted average basis within TAM. FY represents BD Biosciences/Dx FY ending 9/30 for purposes of this page and where #s may not tie due to rounding 2025 WATERS CORPORATION 12

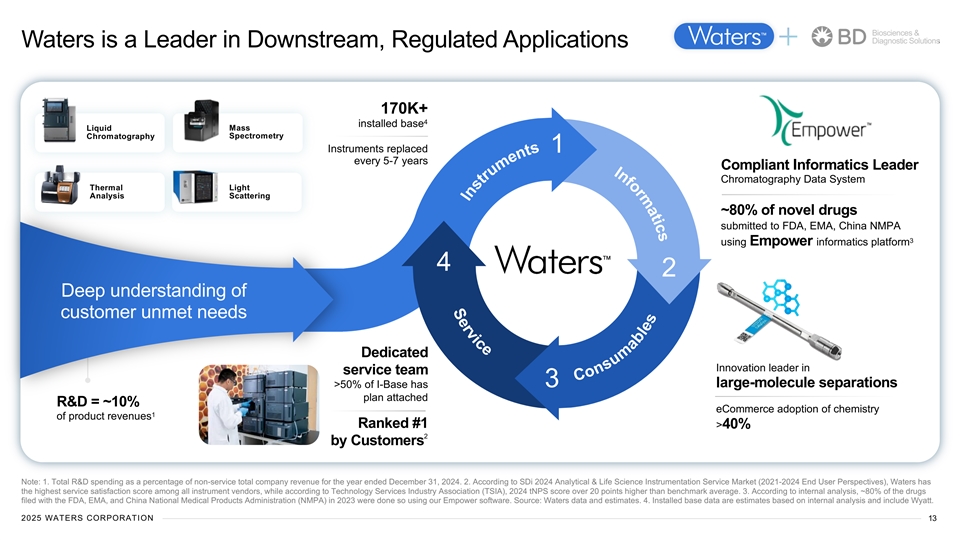

Biosciences & Diagnostic Solutions Waters is a Leader in Downstream, Regulated Applications 170K+ 4 installed base Liquid Mass Chromatography Spectrometry Instruments replaced 1 every 5-7 years Compliant Informatics Leader Chromatography Data System Thermal Light Analysis Scattering ~80% of novel drugs submitted to FDA, EMA, China NMPA 3 using Empower informatics platform 4 2 Deep understanding of customer unmet needs Dedicated Innovation leader in service team >50% of I-Base has 3 large-molecule separations plan attached R&D = ~10% eCommerce adoption of chemistry 1 of product revenues Ranked #1 >40% 2 by Customers Note: 1. Total R&D spending as a percentage of non-service total company revenue for the year ended December 31, 2024. 2. According to SDi 2024 Analytical & Life Science Instrumentation Service Market (2021-2024 End User Perspectives), Waters has the highest service satisfaction score among all instrument vendors, while according to Technology Services Industry Association (TSIA), 2024 tNPS score over 20 points higher than benchmark average. 3. According to internal analysis, ~80% of the drugs filed with the FDA, EMA, and China National Medical Products Administration (NMPA) in 2023 were done so using our Empower software. Source: Waters data and estimates. 4. Installed base data are estimates based on internal analysis and include Wyatt. 2025 WATERS CORPORATION 13

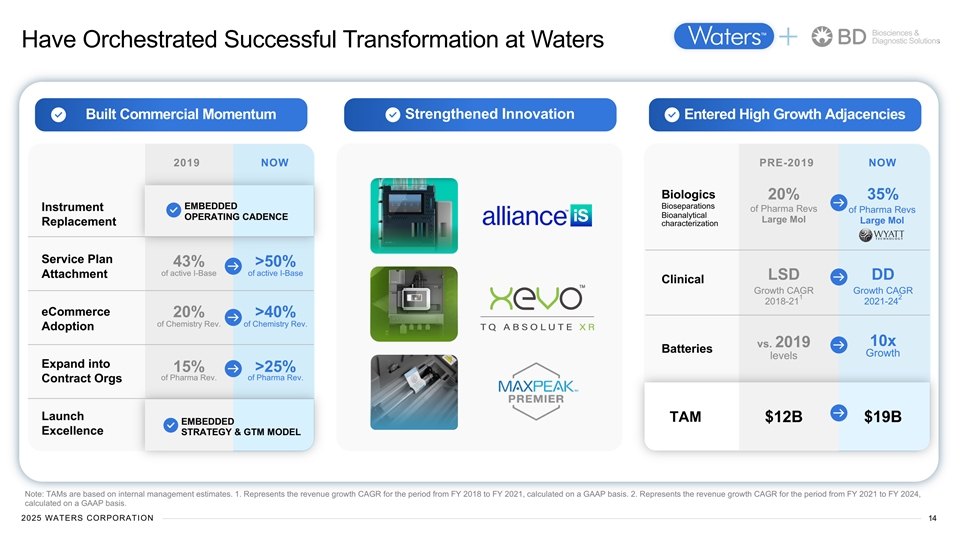

Biosciences & Diagnostic Solutions Have Orchestrated Successful Transformation at Waters Strengthened Innovation Built Commercial Momentum Entered High Growth Adjacencies 2019 NOW PRE-2019 NOW Biologics 20% 35% EMBEDDED Bioseparations Instrument of Pharma Revs of Pharma Revs Bioanalytical OPERATING CADENCE Large Mol Large Mol Replacement characterization Service Plan 43% >50% of active I-Base of active I-Base Attachment LSD DD Clinical Growth CAGR Growth CAGR 1 2 2018-21 2021-24 eCommerce 20% >40% of Chemistry Rev. of Chemistry Rev. Adoption 10x vs. 2019 Batteries Growth levels Expand into 15% >25% of Pharma Rev. of Pharma Rev. Contract Orgs Launch TAM $12B $19B EMBEDDED Excellence STRATEGY & GTM MODEL Note: TAMs are based on internal management estimates. 1. Represents the revenue growth CAGR for the period from FY 2018 to FY 2021, calculated on a GAAP basis. 2. Represents the revenue growth CAGR for the period from FY 2021 to FY 2024, calculated on a GAAP basis. 2025 WATERS CORPORATION 14

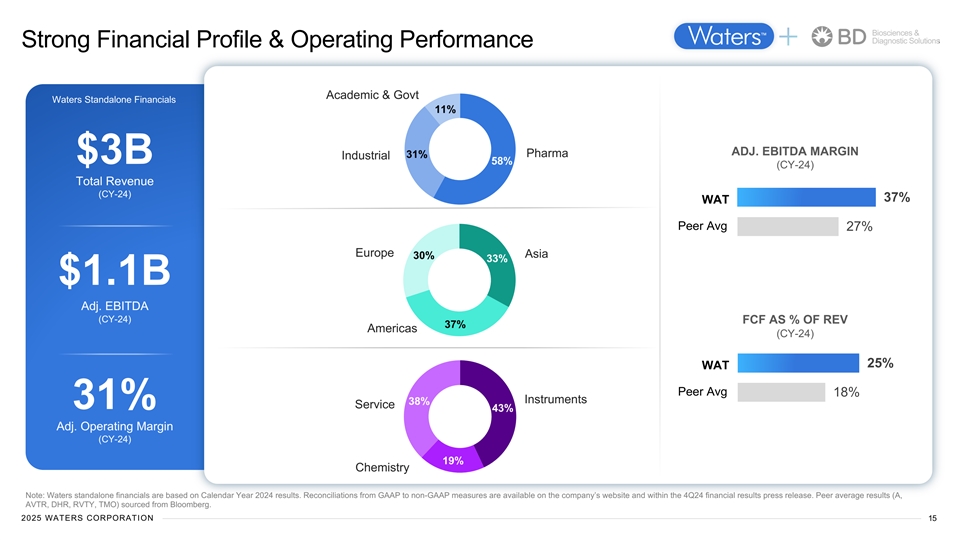

Biosciences & Diagnostic Solutions Strong Financial Profile & Operating Performance Academic & Govt Waters Standalone Financials 11% ADJ. EBITDA MARGIN Pharma 31% Industrial $3B 58% (CY-24) Total Revenue (CY-24) 37% WAT Peer Avg 27% Europe Asia 30% 33% $1.1B Adj. EBITDA (CY-24) FCF AS % OF REV 37% Americas (CY-24) 25% WAT Peer Avg 18% Instruments 38% 31% Service 43% Adj. Operating Margin (CY-24) 19% Chemistry Note: Waters standalone financials are based on Calendar Year 2024 results. Reconciliations from GAAP to non-GAAP measures are available on the company’s website and within the 4Q24 financial results press release. Peer average results (A, AVTR, DHR, RVTY, TMO) sourced from Bloomberg. 2025 WATERS CORPORATION 15

Biosciences & Diagnostic Solutions Accelerates Innovation Journey into BioSeparations to Create a Category-Defining Company Creating Next-Generation Separation Columns by Pairing Deep Chemistry & Biology Expertise CHEMISTRY CHEMISTRY Innovation leader in AAV Separations Advanced titer options for New BIOLOGY Modalities allow interface with Leader in GMP Validated advanced detectors (MALS, CDMS) Antibodies & Reagents 2025 WATERS CORPORATION 16

Biosciences & Diagnostic Solutions Positions Flow Cytometry into Bioanalytical Characterization Brings Flow Downstream into Large Molecule QA/QC Small mol data Large mol data FDA EMA NMPA Others Flow UV Mass Mass Light Detection Spectrometry Scattering Cytometry Receptor Interaction & biological response (Now augments w/ molecular composition & structure) Molecular composition & structure (Already have ~75% coverage of Large Molecule characterization attributes) 2025 WATERS CORPORATION 17

Biosciences & Diagnostic Solutions Scales Capabilities & Presence for Multiplex Diagnostics Automation Addition of BD Diagnostics will Accelerate w/ Core Lab Value Creation in ‘LC-MS into Dx’ Analyzer Adjacency Accelerate Automated Reagents Assay Menu Sample Prep Expansion Elevate 24/7 Service Methods + Global Reach into Specialty Biosciences & Diagnostic Labs Solutions Software Biosciences & Diagnostic Solutions Note: LC-MS = Liquid Chromatography-Mass Spec; Dx = Diagnostics 2025 WATERS CORPORATION 18 LC MS

Biosciences & Diagnostic Solutions Substantial Financial Benefits Expected Cost Synergies by Year 3 Revenue Synergies by Year 5 Commercial Excellence Instrument Replacement Mfg. & Supply Chain $80M $115M Service Attach & eCommerce EPS Launch Excellence accretive High Growth Adjacencies in Yr 1 Bioanalytical Characterization Commercial & Service $75M $115M Bioseparations LC-MS into Dx ~ $345M EBITDA Cross-Selling in annualized DMPK R&D and G&A $45M $60M synergies LC/LC-MS in Upstream expected by yr 5 Dx LC-MS In Specialty labs $200M $290M Total Total EBITDA ($145M EBITDA impact) 2025 WATERS CORPORATION 19

Biosciences & Diagnostic Solutions An Industry-Leading Financial Outlook Compelling 5-Year Growth Projection CY 2025E CY 2030E Revenue Growth CAGR MSD-HSD (CY 2025-30) $6.5B $9.0B Total Revenue (CY PF 25E) Total Revenue (CY PF 30E) Adj. EBITDA Growth +$1.3B $2.0B Adj. EBIT Margin Expansion ~ $3.3B 500bps 1 Adj. EBITDA (CY PF 25E) Adj. EBITDA (CY PF 30E) Adj. EPS Growth Mid-teens% (Annualized) 27% 32% Adj. Op. Margin (CY PF 25E) Adj. Op. Margin (CY PF 30E) R&D spend ~70% ~10% of product sales of Revenue Annually Recurring Note: CY = Calendar Year; PF = Pro Forma. 1. Includes approximately $100 million of estimated allocated corporate costs necessary to support the BD Biosciences & Diagnostic Solutions business 2025 WATERS CORPORATION 20

Biosciences & Diagnostic Solutions Transaction Overview ► BD to separate its Biosciences and Diagnostic Solutions business to BD shareholders and simultaneously Structure & Ownership merge SpinCo (which will own the Biosciences/Dx business) with a wholly owned subsidiary of Waters in a tax-efficient Reverse Morris Trust transaction valued at ~$17.5B ► Expected pro forma ownership of 60.8% for Waters shareholders and 39.2% for BD shareholders, subject to certain potential adjustments; BD to receive ~$4B cash distribution via proceeds of SpinCo debt, subject to adjustment, including for cash, working capital and indebtedness ► Company name: Waters Corporation; Listing NYSE:WAT Name & Headquarters ► Group HQ to remain in Milford, MA; will retain significant presence in Biosciences/Dx current key locations ► Waters CEO and CFO to lead joint management team of combined entity Management & Board of Directors ► Waters Board of Directors will remain intact, with addition of up to 2 Board Members from BD ► Expected to close around the end of the first quarter of calendar year 2026, subject to receipt of required Timing & Approvals regulatory approvals, Waters shareholder approval, and satisfaction of other customary closing conditions. ► Transaction unanimously approved by the boards of both Waters and BD 2025 2025 W WA AT TE ER RS S C CO OR RP PO OR RA AT TIIO ON N 21 21

Biosciences & Diagnostic Solutions Summary: Two Businesses Uniquely Suited for Each Other Creates an Innovation Leader …Serving High Volume, Regulated with Robust Financial Strength… Applications w/ Industry-Leading Brands Large TAM w/ Consistent Growth Drivers 1 Doubles Waters TAM to ~$40B at 5-7% growth in a broader range of regulated 1 sources Strong Strategic Fit Immediate commercial impact from Waters’ proven execution model 2 Accelerates multiple high-growth adjacencies at once Biosciences & Diagnostic Solutions Increases Growth Stability 3 >70% of revenue annually recurring + >50% instruments replaced every 5-10 yrs $6.5B $2.0B 16K An Industry-Leading Financial Outlook 2 Revenue (Pro Forma CY 25E) Adj. EBITDA (Pro Forma CY-25E) Employees Significant cost & revenue synergies w/ rapid path to flagship margin profile 4 3 Expected MSD-HSD revenue & Mid-Teens EPS growth Milford, MA NYSE:WAT 10% R&D as % of Sales Headquarters Ticker Note: 1. TAM = Total Addressable Market and is based on internal management estimates. 2; 3. Statements denotes expectations on a projected and adjusted pro forma operating margin and EPS basis. 2025 WATERS CORPORATION 22

CREATING A Life Science Tools & Diagnostics Leader Focused on Regulated, High-Volume Testing Q&A Session

Accelerating the New BD Strategy July 14, 2025 Exhibit 99.3