EX-4.3

Published on November 25, 2020

BD CARIBE LTD SAVINGS INCENTIVE PLAN (SIP) FOR EMPLOYEES OF BECTON DICKINSON CARIBE LTD Amended and Restated as of January 1, 2020 EXHIBIT 4.3

i BD CARIBE LTD SAVINGS INCENTIVE PLAN (SIP) FOR EMPLOYEES OF BECTON DICKINSON CARIBE LTD Amended and Restated as of January 1, 2020 INDEX Contents ARTICLE I. DEFINITIONS ........................................................................................ 3 1.01 “Account” ............................................................................................................... 3 1.02 “Additional Deferred Contributions” .................................................................. 3 1.03 “Additional Employee Contributions” ................................................................ 3 1.04 “Administrative Committee” ................................................................................ 3 1.05 “Average Actual Deferral Percentage” ................................................................ 3 1.06 “Basic Deferred Contributions” ........................................................................... 4 1.07 “Basic Employee Contributions” ......................................................................... 4 1.08 “Beneficiary” .......................................................................................................... 4 1.09 “Benefit Commencement Date”............................................................................ 5 1.10 “Board” ................................................................................................................... 5 1.11 “Cash Reserves” ..................................................................................................... 5 1.12 “Catch-up Contributions” .................................................................................... 5 1.13 “Catch-up Contribution Account” ....................................................................... 5 1.14 “Change in Control” .............................................................................................. 5 1.15 “Company Matching Contributions” .................................................................. 6 1.16 “Company Non-Elective Contributions” ............................................................. 6 1.17 “Company Stock” .................................................................................................. 6 1.18 “Compensation” ..................................................................................................... 6 1.19 “Corporation” or “Company” .............................................................................. 7 1.20 “Deferral Election” ................................................................................................ 7 1.21 “Deferred Contributions” ..................................................................................... 7 1.22 “Disability” ............................................................................................................. 7 1.23 “Earnings” .............................................................................................................. 7 1.24 “Effective Date” ..................................................................................................... 7 1.25 “Eligible Employee”............................................................................................... 7 1.26 “Employee” ............................................................................................................. 8 1.27 “Employee Contributions” .................................................................................... 8

ii 1.28 “Enrollment Date” ................................................................................................. 8 1.29 “Enrollment Forms” ........................................................................................................ 8 1.30 “ERISA” ................................................................................................................. 8 1.31 “Fiduciary” ............................................................................................................. 8 1.32 “GAP Period” ......................................................................................................... 9 1.33 “Group” .................................................................................................................. 9 1.34 “Highly Compensated Employee” ........................................................................ 9 1.35 “Hours of Service” ............................................................................................... 10 1.36 “Investment Committee” ..................................................................................... 11 1.37 “Investment Manager” ........................................................................................ 11 1.38 “Non-Elective Contributions”............................................................................. 11 1.39 “Participant” ........................................................................................................ 11 1.40 “Plan” .................................................................................................................... 11 1.41 “Plan Administrator” .......................................................................................... 11 1.42 “Plan Year” .......................................................................................................... 11 1.43 “Profits” ................................................................................................................ 12 1.44 “Retirement Plan” ............................................................................................... 12 1.45 “Retirement Plan Participating Employer” ...................................................... 12 1.46 “Rollover Contributions” .................................................................................... 12 1.47 “Share Transaction Date” ................................................................................... 12 1.48 “Special Deposit” ................................................................................................. 12 1.49 “Spouse”................................................................................................................ 12 1.50 “Trust” .................................................................................................................. 12 1.51 “Trustee” .............................................................................................................. 12 1.52 “US Code”............................................................................................................. 12 1.53 “Valuation Date” .................................................................................................. 12 1.54 “1994 PR Code” ................................................................................................... 13 1.55 “2011 PR Code” ................................................................................................... 13 ARTICLE II. ELIGIBILITY AND PARTICIPATION......................................... 14 2.01 Eligibility. .............................................................................................................. 14 2.02 Participation. .......................................................................................................... 14 2.03 Termination of Participation .................................................................................. 14 ARTICLE III. CONTRIBUTIONS ........................................................................... 15 3.01 Deferred Contributions .......................................................................................... 15

iii 3.02 Limitations of Deferred Contributions................................................................... 16 3.03 Provision for Distribution of Excess Deferred Contributions on Behalf of Highly Compensated Employees. ................................................................................................. 17 3.04 (a) Company Matching Contributions ................................................................... 19 (b) Profit Sharing Contributions .................................................................................. 20 (c) Company Non-Elective Contributions ................................................................... 20 3.05 (a) Employee Contributions ................................................................................... 21 (b) Special Deposit ...................................................................................................... 22 (c) Catch-up Contributions .......................................................................................... 23 3.06 Limitation Based on Average Actual Deferral Percentage .................................... 24 3.07 Limitation on Annual Contributions ...................................................................... 25 3.08 Vesting ................................................................................................................... 25 ARTICLE IV. ROLLOVER CONTRIBUTIONS ................................................... 28 4.01 Rollover Contributions........................................................................................... 28 ARTICLE V. INVESTMENT OF FUNDS ............................................................. 29 5.01 Investment Funds ................................................................................................... 29 5.02 Cash Reserves ........................................................................................................ 29 5.03 Purchase of Shares ................................................................................................. 29 5.04 Limits on Investment in the Company Stock Fund ...................................................... 29 ARTICLE VI. MAINTENANCE AND VALUATION OF PARTICIPANTS’ ACCOUNTS 33 6.01 Account .................................................................................................................. 33 6.02 Valuation of Participant Account........................................................................... 33 ARTICLE VII. WITHDRAWALS DURING EMPLOYMENT ............................. 34 7.01 Withdrawals ........................................................................................................... 34 7.02 Hardship Withdrawal ............................................................................................. 35 7.03 Method of Payment of Withdrawal........................................................................ 37 7.04 Eligible Distribution under AD 17-29 ................................................................... 37 ARTICLE VIII. DISTRIBUTIONS UPON TERMINATION OF EMPLOYMENT 42 8.01 Termination of Employment .................................................................................. 42 8.02 Distributions ........................................................................................................... 42 8.03 Direct Rollover Distributions ................................................................................. 43 ARTICLE IX. CUSTODY AND INVESTMENT OF CONTRIBUTIONS........... 44 9.01 Establishment of Trust ........................................................................................... 44

iv 9.02 Investment of Funds ............................................................................................... 44 9.03 Non-Reversion ....................................................................................................... 45 9.04 Participant Directed Investments ........................................................................... 46 9.05 Section 404(c) Compliance .................................................................................... 47 9.06 Appointment of Investment Committee................................................................. 48 9.07 General Powers, Rights and Duties of the Investment Committee ........................ 48 ARTICLE X. ADMINISTRATION OF PLAN ...................................................... 51 10.01 Administrative Committee ................................................................................. 51 10.02 Appointment of Subcommittees ......................................................................... 51 10.03 Meetings of ......................................................................................................... 51 10.04 Quorum............................................................................................................... 51 10.05 Compensation to ................................................................................................. 52 10.06 Rules of Administration ..................................................................................... 52 10.07 Insurance ............................................................................................................ 52 10.08 Resignation ......................................................................................................... 53 10.09 Plan Administrator ............................................................................................. 53 10.10 Responsibilities of Plan Administrator .............................................................. 53 10.12 Named Fiduciaries.............................................................................................. 55 10.13 Records and Reports........................................................................................... 55 ARTICLE XI. AMENDMENT, TERMINATION OR PERMANENT DISCONTINUANCE OF CONTRIBUTIONS ............................................................ 56 11.01 Amendment ........................................................................................................ 56 11.02 Termination ........................................................................................................ 56 ARTICLE XII. GENERAL PROVISIONS ............................................................... 57 12.01 Trust ................................................................................................................... 57 12.02 Written Statement ............................................................................................... 57 12.03 Market Price ....................................................................................................... 57 12.04 Cost and Expenses .............................................................................................. 57 12.05 Inability of Participant to Receive Distribution ................................................. 57 12.06 Participant’s Rights ............................................................................................ 57 12.07 Participant’s Information.................................................................................... 58 12.08 Alienation ........................................................................................................... 58 12.09 Company Records .............................................................................................. 59 12.10 Transfer to Another Plan .................................................................................... 59 12.11 Merger or Consolidation .................................................................................... 59

v 12.12 Governmental Approval ..................................................................................... 60 12.13 Gender ................................................................................................................ 60 ARTICLE XIII. RIGHTS AND RESTRICTIONS APPLICABLE TO SHARES 61 13.01 Voting of Shares ................................................................................................. 61 13.02 Tender Offer ....................................................................................................... 62 13.03 Shares of Company Stock .................................................................................. 64 13.04 Accuracy of Participant Information .................................................................. 64 13.05 Adjustment to Participant Account .................................................................... 64 13.06 Rights of Becton, Dickinson and Company ....................................................... 65 ARTICLE XIV. CONSTRUCTION ........................................................................... 66

1 BD CARIBE LTD SAVINGS INCENTIVE PLAN (SIP) FOR EMPLOYEES OF BECTON DICKINSON CARIBE LTD Amended and Restated as of January 1, 2020 Effective February 1, 1997, Becton Dickinson Diagnostics, Inc., Micropette, Inc. and Bauer & Black, Inc. established the Becton, Dickinson and Company Global Share Investment Program for their employees in Puerto Rico (the “Plan”). Effective April 1, 2009, the Becton Dickinson Caribe LTD became the sponsor of the Plan and the Plan was renamed the BD Caribe LTD Savings Incentive Plan (SIP) for Employees of Becton Dickinson Caribe LTD. The Plan is a profit sharing plan, which includes a cash or deferred contribution arrangement and employer matching contributions. The objectives of the Plan are to provide participating employees with a convenient way to obtain a beneficial interest in Becton, Dickinson and Company resulting in greater personal interest in the success of the enterprise, to encourage retirement savings on the part of these employees, and to afford additional financial security for such employees both before and after their retirement and, in the event of their death, for their beneficiaries. The Plan is hereby amended and restated effective as of January 1, 2020 to include the amendments made to the Plan over the years and to include recent amendments made to comply with the Internal Revenue Code for a New Puerto Rico, as amended (the “2011 PR Code”). The Plan is intended to be qualified under Sections 1165(a) and (e) of the Puerto Rico Internal Revenue Code of 1994, as amended (the “1994 PR Code”) and under Sections 1081.01(a) and (d) of the 2011 PR Code. The trust forming part hereof is intended to be exempt from taxation under Section 1165(a) of the 1994 PR Code and 2011 PR Code Section 1081.01(a) and pursuant to ERISA Section 1022(i)(1), under Section 501(a) of the Internal Revenue Code of 1986.

2 The rights to benefits of any Participant whose employment terminated prior to any amendment to the Plan shall be determined solely by the provisions of the Plan under which the Participant was covered, if any, as in effect at the time of such termination of employment, unless otherwise specifically provided herein.

3 BD CARIBE LTD SAVINGS INCENTIVE PLAN (SIP) FOR EMPLOYEES OF BECTON DICKINSON CARIBE LTD Amended and Restated as of January 1, 2020 ARTICLE I. DEFINITIONS 1.01 “Account” means the separate account of each Participant established in accordance with Article VI. 1.02 “Additional Deferred Contributions” means amounts deferred pursuant to Section 3.01(b). 1.03 “Additional Employee Contributions” means amounts contributed pursuant to Section 3.05(a)(ii). 1.04 “Administrative Committee” means the Committee provided for in Article X. 1.05 “Average Actual Deferral Percentage” means, with respect to a specified group of Employees, the average of the ratios for a Plan Year, calculated separately for each Employee in that group, of (a) the amount of Deferred Contributions made pursuant to Section 3.01 for a Plan Year to (b) the Employee’s Compensation for that entire Plan Year (provided that upon direction of the Administrative Committee, Compensation shall only be counted if received during the period an Employee is a Participant or eligible to become a Participant). The Actual Deferral Percentage for each group and the ratio determined for each Employee in the group shall be calculated to the nearest one-hundredth of 1 percent. For purposes of computing Average Actual Deferral Percentage, an Employee who would be a Participant but for the failure to make Basic Deferred Contributions shall be treated as a Participant on whose behalf zero (0) Basic Deferred Contributions are made. Also, for purposes of determining the Average Actual Deferral Percentage for a Plan Year, Deferred Contributions may be taken into account for a Plan Year only if they:

4 (a) Relate to compensation that either would have been received by the Employee in the Plan Year but for the deferral election, or are attributable to services performed by the Employee in the Plan Year and would have been received by the Employee within 2 ½ months after the close of the Plan Year but for the deferral election; (b) Are allocated to the Employee as of a date within that Plan Year, and the allocation is not contingent on the participation or performance of service after such date; and (c) Are actually paid to the Trustee within a reasonable period after the end of the Plan Year to which the contributions relate. 1.06 “Basic Deferred Contributions” means amounts deferred pursuant to Section 3.01(a). 1.07 “Basic Employee Contributions” means amounts contributed pursuant to Section 3.05(a)(i). 1.08 “Beneficiary” means the person or persons entitled to receive benefits under the Plan upon the death of the Participant designated from time to time in written or electronic format as provided by and filed with the Plan Administrator by a Participant to receive benefits under the Plan after his death, which designation shall not have been revoked by written or electronic notice filed with the Plan Administrator by the Participant prior to the date of death; provided, however, that the Beneficiary of a Participant shall be his Spouse, if any, unless the spouse consents to the designation of someone else as Beneficiary in a document filed with the Plan Administrator that acknowledges the effect of such election and is witnessed by a representative of the Plan or a notary public. The Spouse’s consent to the designation of someone else as the Participant’s Beneficiary shall not be required if it is established to the satisfaction of the Plan Administrator that the consent cannot be obtained because there is no Spouse, the Spouse cannot be located, or because of such other circumstances as may be prescribed in regulations issued by the United States Secretary of Labor. In the event that a Participant or former Participant dies without a surviving spouse and without having in effect at

5 the time of his death a designation of a Beneficiary made as aforesaid, his beneficiary shall be his estate. 1.09 “Benefit Commencement Date” means the first day of the first period for which an amount is paid in a lump sum. 1.10 “Board” means the Board of Directors of Becton Dickinson Caribe LTD. 1.11 “Cash Reserves” means the cash or cash equivalent investments held by the Trust in accordance with Article V. 1.12 “Catch-up Contributions” means a contribution to the Plan on a pre-tax basis in excess of the limitations of 2011 PR Code Section 1081.01(d)(7)(A), by a Participant who has attained not less than age 50 by the close of the Plan Year for which the contribution is made, subject to the limitations of 2011 PR Code Section 1081.01(d)(7)(C). 1.13 “Catch-up Contribution Account” with respect to a Participant, shall mean the account established under the Plan for such Participant representing the Catch-up Contributions plus any gains or losses allocated to such account in accordance with the provisions of the Plan, as adjusted to reflect distributions therefrom. Such account will be fully vested and non-forfeitable at all times. 1.14 “Change in Control” means the occurrence of an event described in either of the following: (a) any “person” (as such term is used in Sections 13(d) and 14(d) of the Exchange Act), other than Becton, Dickinson and Company, any trustee or other fiduciary holding securities under an employee benefit plan of Becton, Dickinson and Company or a corporation owned, directly or indirectly, by the stockholders of Becton, Dickinson and Company in substantially the same proportions as their ownership of stock of Becton, Dickinson and Company is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly

6 or indirectly, of securities of Becton, Dickinson and Company representing 30% or more of the combined voting power of Becton, Dickinson and Company then outstanding securities, unless through a transaction arranged by, or consummated with the approval of, the Board of Directors of Becton, Dickinson and Company; or (b) during any period of twenty-four (24) consecutive months, individuals who at the beginning of such period constitute the Board of Directors of Becton, Dickinson and Company and any new director (other than a director designated by a person who has entered into an agreement with Becton, Dickinson and Company to effect a transaction described in subsection (a) of this Section 1.14) whose election by such Board or nomination for election by the stockholders of Becton, Dickinson and Company was approved by a vote of at least two-thirds (2/3) of the directors then still in office who either were directors at the beginning of such period or whose election or nomination for election was previously so approved, cease for any reason to constitute a majority thereof. 1.15 “Company Matching Contributions” means the amounts contributed by the Company (other than Deferred Contributions) in respect of a Participant under Section 3.04(a). 1.16 “Company Non-Elective Contributions” means contributions to the Plan made by the Company pursuant to Section 3.04(c) of the Plan. 1.17 “Company Stock” means the Common Stock of Becton, Dickinson and Company, par value $0.01 per share. 1.18 “Compensation” means the wages, salaries, and other amounts paid in respect of an employee for services actually rendered to the Company, including, by way of example, overtime, bonuses, awards and commissions, but excluding deferred compensation, stock options, and other distributions which receive special tax

7 benefits under the 2011 PR Code [and legal settle tax]. Compensation shall include Deferred Contributions. Effective for Plan Years commencing on or after January 1, 2012, the Compensation taken into account for any Plan Year for purposes of determining contributions under the Plan or the application of the nondiscrimination tests and limits under Section 3.02 of the Plan shall not exceed the limits provided under Section 401(a)(17) of the US Code (as adjusted from time to time by the United States Internal Revenue Service) and Section 1081.01(a)(12) of the 2011 PR Code. 1.19 “Corporation” or “Company” means Becton Dickinson Caribe LTD. 1.20 “Deferral Election” means an election filed by a Participant with the Plan Administrator by which the Participant agrees to have his Compensation reduced by a specified percentage and to have the commensurate amount contributed to the Plan on his behalf as a Deferred Contribution. 1.21 “Deferred Contributions” means the money contributed to a Participant’s Account by the Company, pursuant to the Participant’s Deferral Election. Deferral Contributions include Basic Deferred Contributions and Additional Deferred Contributions stated in Section 3.01. 1.22 “Disability” means a disability which has been continuous for at least six months and for which a benefit is payable under Federal Social Security Disability. 1.23 “Earnings” means the amount of earnings to be returned with an excess deferrals under Section 3.02 or excess contributions under Section 3.06, as determined in accordance with regulations prescribed under the provisions of Section 1081.01 of the 2011 PR Code or its predecessor Section 1165 of the 1994 PR Code. 1.24 “Effective Date” means February 1, 1997. 1.25 “Eligible Employee” means any Employee employed by the Company, provided that there shall be excluded (i) any person who is represented by a recognized

8 collective bargaining agent unless there is a written agreement with such bargaining agent providing for his inclusion in the Plan; (ii) independent contractors; (iii) leased employees; and (iv) non-residents of Puerto Rico. 1.26 “Employee” means any person employed by the Company, but excluding any employee who by reason of Section 16 of the United States Securities and Exchange Act of 1934, is required to report his or her trading in Shares under such Act. 1.27 “Employee Contributions” means the amount of money that a Participant elected to contribute to the Plan on an after-tax basis while an Eligible Employee, pursuant to Section 3.05(a) of the Plan. 1.28 “Enrollment Date” means the Effective Date and the first day of each month thereafter. 1.29 “Enrollment Forms” means the administrative form, either in written or electronic format, furnished by the Plan Administrator or recordkeeper designated by the Plan Administrator and completed by the Eligible Employee by which he elects to participate in the Plan, agrees to be bound by its terms, authorizes deductions from his Compensation of Deferred Contributions, authorizes Employee Contributions and designates a Beneficiary. 1.30 “ERISA” means the Employee Retirement Income Security Act of 1974, as it may be amended from time to time. 1.31 “Fiduciary” means the Fiduciary holding the Trust or any successor. 1.32 “Furlough” means a total cessation of work or a partial cessation of work for the Company, that is initiated by the Company as a result of COVID-19, and is identified by the Company as “Furlough”. A partial cessation of work that is a Furlough may include, without limitation, a reduction in hours during the week, cycling of on and off work weeks, or some variation thereof. For purposes of clarity, a Participant who is on Furlough who otherwise meets the definition of

9 Employee remains an Employee until such time as he or she incurs a termination of employment. 1.33 “GAP Period” means the period between the last day of the Plan Year and the date of distribution of any excess Deferred Contributions. 1.34 “Group” means Becton, Dickinson and Company and any other company which is related to the Corporation as a member of a controlled group of corporations in accordance with Section 414(b) of the US Code, or as a trade or business under common control in accordance with Section 414(c) of the US Code, or any other entity to the extent it is required to be treated as part of the Group in accordance with Section 414(o) of the US Code and any regulations thereunder, or any organization which is part of an affiliated service group in accordance with Section 414(m) of the US Code. For the purposes under the Plan of determining whether or not a person is an employee and the period of employment of such person, each such company shall be included in the “Group” only for such period or periods during which such other company is a member of the controlled group or under common control. 1.35 “Highly Compensated Employee” means an individual who (a) owns more than five percent (5%) of the stock entitled to vote or of the total value of all classes of stock of the Employer; (b) owns more than five percent (5%) of the capital or of the interest in the profits of the Employer; or (c) had compensation from the Employer for the preceding taxable year in excess of the applicable limits for specific taxable year under Section 414(a)(1)(B) of the US Code, or any successor legal provision as adjusted by the Federal Internal Revenue Service (“IRS”), or as such other amount as amended from time to time in the 2011 PR Code, or as adjusted by the Secretary of the Treasury, or such other definition for highly compensated employee as provided from time to time in the 2011 PR Code. To determine whether an Employee owns more than five percent (5%) of the stock, capital or interest in the profits of the Employer, the provisions of 2011 PR Code Section 1010.04, 1010.05 and 1081.01(a)(14)(B), respectively shall apply. The

10 definition of Highly Compensated Employee shall be interpreted consistently with 2011 PR Code Section 1081.01(d)(3)(E)(iii) and any optional rules permitted by the 2011 PR Code or applicable regulations identifying Highly Compensated Employees shall be incorporated into this definition. 1.36 “Hours of Service” means, with respect to any applicable computation period: (a) The number of hours recorded on the Employee’s time sheets or other records used to record an Employee’s time for which he is directly or indirectly compensated by the Company or any member of the Group; provided that eight hours shall be credited for each calendar day which is a scheduled workday for the Company or Group member, up to a total of 501 Hours of Service on account of any single continuous period during which the Employee performs no duties, and for which the Employee is on: (1) Temporary layoff, (2) An unpaid personal leave of absence, parental leave, vacation leave, sick leave or disability leave approved by the Administrative Committee, provided he returns to employment upon the expiration of such leave, (3) Unpaid jury duty, or (4) Unpaid military leave of absence in the Armed Forces of the United States arising from a compulsory military service law or a declared national emergency and as may be approved by the Company or Group member, provided the Employee returns to the employment of the Company or Group member within 90 days (or such longer period as may be provided by law for the protection of re-employment rights) after his discharge or release from active military duty.

11 The term Hours of Service shall also include such hour for which back pay, irrespective of mitigation of damages, has been awarded or agreed by the Company or Group member. Such Hours of Service shall be credited to the Employee for the Plan Year or years to which the award pertains. (b) Hours of Service as defined above shall be computed and credited in accordance with paragraphs (b) and (c) of Section 2530.200b-2 of the Department of Labor Regulations. 1.37 “Investment Committee” means the committee appointed in accordance with Section 9.06. 1.38 “Investment Manager” means any person, firm, or corporation who is a registered investment adviser under the Investment Advisers Act of nineteen hundred forty (1940), a bank or an insurance company, who: (a) has the power to manage, acquire, or dispose of Trust’s assets; and (b) acknowledges in writing its fiduciary responsibility to the Plan. 1.39 “Non-Elective Contributions” means the non-elective contributions made by the Company in respect of a Participant under Section 4.04(c). 1.40 “Participant” means a person who has become a participant in the Plan in accordance with Section 2.01 and whose participation has not ended in accordance with Section 2.02. 1.41 “Plan” means the BD Caribe LTD Savings Incentive Plan (SIP) for Employees of Becton Dickinson Caribe LTD. 1.42 “Plan Administrator” means the person appointed as plan administrator pursuant to Section 10.09. 1.43 “Plan Year” means the calendar year.

12 1.44 “Profits” means both accumulated earnings and profits and current net taxable income of the Company before deduction for income taxes and before any contributions by the Company to this or any other employee benefits plan, as determined by their independent public accountants, in accordance with generally accepted accounting principles. 1.45 “Retirement Plan” means the BD Retirement Plan, as it may be amended and restated from time to time. 1.46 “Retirement Plan Participating Employer” means the Company or a member of the Group that has adopted the Retirement Plan. 1.47 “Rollover Contributions” means the money transferred to a Participant’s Account, pursuant to Article IV. 1.48 “Share Transaction Date” means the Valuation Date. 1.49 “Special Deposit” means amounts contributed pursuant to Section 3.05(b). 1.50 “Spouse” means any individuals who are legally married under any state law, including individuals married to a person of the same sex who were legally married in a state that recognizes such marriages, but who are domiciled in a state that does not recognize such marriages. 1.51 “Trust” means the trust where the funds are held pursuant to Article V. 1.52 “Trustee” means the respective trustee or trustees by whom the assets of the Plan are held, as provided in Article IX. 1.53 “US Code” means the United States Internal Revenue Code of 1986, as amended from time to time. 1.54 “Valuation Date” means any day on which the New York Stock Exchange or any successor to its business is open for trading or any other date designated from time

13 to time by the Administrative Committee or its delegate for determining the value of a Participant’s Accounts. The Investment Funds described in Section 5.01 shall be valued at Fair Market Value on each Valuation Date in accordance with rules established by the Administrative Committee. Whenever a withdrawal or distribution by a Participant is made, the amount paid to the Participant shall be based on the Value of the Participant’s Accounts determined as of the Valuation Date set forth in Articles VII and VIII. 1.55 “1994 PR Code” means the Puerto Rico Internal Revenue Code of 1994, as it may be amended from time to time. 1.56 “2011 PR Code” means the Puerto Rico Internal Revenue Code, as amended from time to time.

14 ARTICLE II. ELIGIBILITY AND PARTICIPATION 2.01 Eligibility. (a) Each Employee shall be eligible to become an Eligible Employee in the Plan on the Enrollment Date. (b) In the case of a Participant who had ceased to be an Employee and who is reemployed by the Company, eligibility to participate in the Plan shall commence on the Enrollment Date following the filing of an Enrollment Form with the Plan Administrator, provided said Enrollment Form is filed at least one month before the Enrollment Date. 2.02 Participation. (a) An Eligible Employee may become a Participant on any Enrollment Date by filing an Enrollment Form with the Plan Administrator at least one calendar month before the Enrollment Date. (b) Any eligible Employee may elect to make Rollover Contributions under Article IV after his Enrollment Date. 2.03 Termination of Participation. A Participant whose employment with the Company terminates shall cease to be a Participant unless the Participant is entitled to benefits under the Plan, in which event his participation shall terminate when those benefits are distributed to him.

15 ARTICLE III. CONTRIBUTIONS 3.01 Deferred Contributions. Subject to the limitation on Deferred Contributions described in Section 3.02, the Company shall contribute to the Plan during any Plan Year, in respect of each Participant in its employ, a Deferred Contribution equal to that percentage of each Participant’s Compensation that such Participant authorized in his Deferral Election for such month. A Participant may authorize in his Deferral Election that his Compensation shall be reduced by not less than 1 percent and not more than 10 percent in multiples of 1 percent, as elected by the Participant. Deferred Contributions shall be made in accordance with the following: (a) Basic Deferred Contributions. A Participant’s Compensation shall be reduced by the percentage specified in his Deferral Election as a Basic Deferred Contribution, which shall not exceed 3 percent of Compensation during the Plan Year. (b) Additional Deferred Contributions. Amounts in excess of the Basic Deferred Contribution may be contributed to the Plan as Additional Deferred Contributions. Notwithstanding the foregoing, a Participant who has currently authorized Basic Deferred Contributions on his behalf shall be limited to a maximum of 10 percent of Deferred Contributions. Deferred Contributions shall be paid to the Trustee as soon as practicable after the deduction is made from the Participant’s Compensation in accordance with ERISA. (c) A Participant may, upon not less than one month’s prior written or electronic notice to the Plan Administrator, suspend or change the rate of his Deferred Contributions. Such suspension or change will be effective as of the first day of the calendar month next following the end of the one month notice period.

16 (d) The amount of contributions so suspended may not subsequently be made up. (e) A Participant who has suspended his Deferred Contributions may, upon one month’s prior written or electronic notice to the Plan Administrator, resume such contributions as soon as practicable after the notice is received by the Plan Administrator. (f) Effective as of the pay period payable on May 1, 2020 and notwithstanding any provision of the Plan to the contrary, the rate of a Participant’s Deferred Contributions and Deferral Election pursuant to Section 3.01 shall be reduced to 0 percent automatically upon commencement of Furlough; provided, however, that such Participant may affirmatively elect to increase the rate of his Deferred Contributions and Deferral Elections under Section 3.01, within the limits specified in Section 3.01, following the date he begins Furlough by giving written or electronic notice to the Plan Administrator in accordance with Section 3.01. The Participant’s Deferred Contributions and Deferral Election pursuant to Section 3.01 in place while on Furlough will continue once the Participant ceases Furlough and returns to active employment unless he increases or decreases the rate of his Deferred Contributions and Deferral Elections in accordance with Section 3.01. 3.02 Limitations of Deferred Contributions. In no event shall the Participant’s reduction in Compensation and the corresponding Deferred Contributions made on his behalf by the Company in any calendar year exceed $15,000 for taxable year beginning on January 1, 2013 or taxable years thereafter, or any other limit established by the 2011 PR Code or the Secretary of Treasury. If a Participant’s Deferred Contributions in a calendar year reach that dollar limitation, his election of Deferred Contributions for the remainder of the calendar year will be suspended. As of the first pay period of the following calendar year, the Participant’s election of Deferred Contributions shall again become effective in accordance with his previous election.

17 3.03 Provision for Distribution of Excess Deferred Contributions on Behalf of Highly Compensated Employees. (a) The Plan Administrator shall determine, as soon as is reasonably possible following the close of each Plan Year, the extent (if any) to which Deferred Contributions by or on behalf of Highly Compensated Employees may cause the Plan to exceed the limitations of Section 3.02 for such Plan Year. If, pursuant to the determination by the Plan Administrator, and as required by the leveling method described in paragraph (b) below, such contributions may cause the Plan to exceed such limitations, then the Plan Administrator shall return to the Highly Compensated Employees any excess Deferred Contributions, together with any Earnings (determined in accordance with (c) below). If, administratively feasible, any amounts distributed shall be returned within two and one-half (2 ½) months following the close of the Plan Year for which such excess Deferred Contributions were made, but in any event no later than the end of the first Plan Year following the Plan Year for which the excess Deferred Contributions were made. (b) For purposes of satisfying the Average Actual Deferral Percentage test, the amount of any excess Deferred Contributions for a Plan Year under Section 3.02 shall be determined by application of a leveling method under which the Actual Deferral Percentage of the Highly Compensated Employee who has the highest such percentage for such Plan Year is reduced to the extent required (i) to enable the Plan to satisfy the Average Actual Deferral Percentage test, or (ii) to cause such Highly Compensated Employee’s Actual Deferral Percentage to equal the Actual Deferral Percentage of the Highly Compensated Employee with the next highest Actual Deferral Percentage. This process shall be repeated until the Plan satisfies the Average Actual Deferral Percentage test. For each Highly Compensated Employee, the amount of excess Deferred Contributions shall be equal to

18 the total Deferred Contributions made on behalf of such Highly Compensated Employee (determined prior to the application of the foregoing provisions of this paragraph (b)) minus the amount determined by multiplying the Highly Compensated Employee’s actual Deferral Percentage (determined after the application of the foregoing provisions of this paragraph (b)) by his [Compensation]. In the event that any excess Deferred Contributions were matched by the Company Contributions under Section 3.04, those Company Matching Contributions, together with earnings, shall be forfeited and used to reduce Company Contributions. (c) The amount of income or loss attributable to any excess Deferred Contributions, as determined under Section 3.03(a) (the “Excess Aggregate Deferral”) by a Highly Compensated Employee for a Plan Year shall be equal to the sum of the following: (i) The income or loss allocable to the Highly Compensated Employee’s Deferred Contributions Account for the Plan Year multiplied by a fraction, the numerator of which is the excess Deferred Contributions the denominator of which is the sum of the balance of the Highly Compensated Employee’s Deferred Contributions account as of the last day of the Plan Year reduced by income allocable to such account and increased by losses allocable to such account during the Plan Year; and (ii) The amount of allocable income or loss for the Gap Period using the “safe harbor” method set forth herein. Under the “safe harbor” method, such allocable income or loss is equal to 10% of the amount calculated under Section 3.02(c)(i) above, multiplied by the number of calendar months from the last day of the Plan Year until the date of distribution of the Participant’s excess Deferred Contributions. A distribution on or before the 15th day of the month is treated as made

19 on the last day of the preceding month, a distribution after the 15th of the month is treated as made on the first day of the next month. (d) The Plan Administrator shall not be liable to any Participant (or his/her Beneficiary, if applicable) for any losses caused by a mistake in calculating the amount of any excess Deferred Contributions by or on behalf of a Highly Compensated Employee and the income or loss allocable thereto. (e) Notwithstanding any other provision of the Plan, excess Deferred Contributions of Participants on whose behalf such excess Deferred Contributions were made for the preceding Plan Year would be recharacterized as Employee Contributions. Any such recharacterization shall be made in accordance with applicable rules and regulations under the 2011 PR Code and to the extent permitted by law shall not result in the forfeiture of any Company Matching Contribution that would have otherwise been made on such excess Deferred Contributions. 3.04 (a) Company Matching Contributions. In addition to any Deferred Contributions made on a Participant’s behalf pursuant to Section 3.01, the Company shall contribute to the Plan for each month during any Plan Year an amount equal to 100 percent of the sum of the Basic Deferred Contributions and Basic Employee Contributions made on behalf of or by the Participant during the month. The amount of Company Matching Contributions for each month shall be paid to the Trustee as soon as practicable after the end of such month. Notwithstanding any provision of the Plan to the contrary, the Company shall not make any contribution to the Plan under this Section 3.04(a) with respect to a Participant’s Basic Deferred Contributions and Basic Employee Contributions on account of payroll periods paid on or after May 1, 2020 through the end of the 2020 Plan Year.

20 (b) Profit Sharing Contributions. The Company may make special contributions to the Plan on account of any Plan Year, in an amount to be determined by the Company as of the last day of that Plan Year, on behalf of each Participant who is an Eligible Employee on the last day of that Plan Year and who has made either Deferred Contributions or Employee Contributions during that Plan Year. In no event, however, shall the sum of the contributions under Section 3.04(a) and Section 3.04(b) for any Plan Year exceed the maximum amount deductible from the Company’s income for that Plan Year under Section 1033.09(a)(1)(c) of the 2011 PR Code or any statute limiting those deductions. The special contributions shall be made from the Profits of the Company. The special contributions, if any, for each Plan Year shall be allocated among the eligible Participants in proportion to the Company’s contribution under paragraph (a) hereof. (c) Company Non-Elective Contributions. (1) Effective January 1, 2019, each Eligible Employee who is an Eligible Non-Pension Employee shall receive a Company Non-Elective Contribution credited to the Employee’s Company Non-Elective Contributions Account for each Plan Year if the Employee is employed by a Retirement Plan Participating Employer on the last business day of the Plan Year, unless not employed on such date due to death, Disability, or retirement from active employment. For purposes of this Section 3.4(c), a Participant “retires from active employment” if the Participant: (i) terminates employment after having attained age 65; or (ii) terminates employment after having attained age 55 with ten or more years of service (2) The annual Company Non-Elective Contribution shall equal 3% of the Eligible Non-Pension Employee’s Compensation attributable to the

21 portion of the Plan Year during which the Employee qualified as an Eligible Non-Pension Employee for such Plan Year. (3) Company Non-Elective Contributions shall be contributed to the Eligible Non-Pension Employee’s Company Non-Elective Contributions Account as soon as practicable after the end of each Plan Year to which the Company Non-Elective Contributions relate. (4) An “Eligible Non-Pension Employee” is an individual who satisfies the eligibility requirements in this Section 3.04 and who is hired or rehired by, or transferred to, a Retirement Plan Participating Employer on or after January 1, 2019. 3.05 (a) Employee Contributions. Any Participant may make after-tax Employee Contributions under this Section whether or not he has elected to have Deferred Contributions made on his behalf pursuant to Section 3.01. Employee Contributions shall be made in the following manner. (i) Basic Employee Contribution. A Participant may contribute up to 3 percent of his Compensation as a Basic Employee Contribution. (ii) Additional Employee Contribution. A Participant may contribute an additional 11 percent of his Compensation as an Additional Employee Contribution. Notwithstanding the foregoing, however, if the Participant has made an election under Section 3.01, the maximum percentage of Compensation which the Participant may elect to contribute under this Section 3.05 shall be equal to the excess of 14 percent over the percentage elected by the Participant under Section 3.01. Further, the maximum Basic Employee Contributions which a Participant may elect to contribute shall be equal to

22 3 percent over the Basic Deferred Contributions elected by the Participant under Section 3.01. The Employee Contributions shall be made through payroll deductions and shall be paid to the Trustee as soon as practicable after the deduction is made in accordance with ERISA. In no event shall such contribution plus the amount of any Special Deposit made pursuant to Section 3.05(b) exceed ten percent (10%) of a Participant’s aggregate Compensation since becoming a Participant in the Plan or any other limits prescribed by Section 1081.01(a)(15) of the 2011 PR Code or the regulations issued thereunder. Effective as of the pay period payable on May 1, 2020 and notwithstanding any provision of the Plan to the contrary, the rate of a Participant’s Employee Contribution pursuant to this Section 3.05(a) shall be reduced to 0 percent automatically upon commencement of Furlough; provided, however, that such Participant may affirmatively elect to increase the rate of his Employee Contributions under this Section 3.05(a), within the limits specified in this Section 3.05(a), following the date he begins Furlough by giving written or electronic notice to the Plan Administrator. The Participant’s Employee Contributions in place while on Furlough will continue once the Participant ceases Furlough and returns to active employment unless he increases or decreases the rate of his Employee Contributions in accordance with Section 3.05(a). (b) Special Deposit. In addition to or in lieu of the Employee Contributions set forth in Section 3.05(a), a Participant whose contributions pursuant to Section 3.01 and Section 3.05(a) total at least 3 percent of Compensation may make a Special Deposit under this Section 3.05(b) in the form of a personal check, cashier’s check or money order. The amount of this Special Deposit plus the amount of any Employee Contributions made pursuant to Section 3.05(a) may not exceed ten percent (10%) of the Participant’s aggregate Compensation since becoming a Participant in the Plan or any other limits prescribed by 2011 PR Code Section 1081.01(a)(15) or the regulations issued thereunder. The

23 Participant may make one Special Deposit per year in a lump sum to the Trustee at any time during the calendar year in accordance with procedures established by the Administrative Committee. A Special Deposit shall not be eligible for Company Matching Contributions pursuant to Section 3.04(a). (c) Catch-up Contributions. A Participant who has attained age fifty (50) by the end of the Plan Year may elect to have Catch-up Contributions made to the Plan on his behalf as described herein; provided, however, that a Participant may make Catch-up Contributions only if he is making Deferred Contributions in the maximum allowable under Article 3.02. Catch-up Contributions shall be made in the amount elected by the Participant up to the maximum amount elected by the Participant up to the maximum allowable under the 2011 PR Code for any Plan Year. The Participant may file a written election with the Plan Administrator electing to make Catch-up Contributions in such manner as the Plan Administrator may provide. A Catch-up Contribution shall not be eligible for Company Matching Contributions pursuant to Section 3.04(a). Effective as of the pay period payable on May 1, 2020 and notwithstanding any provision of the Plan to the contrary, the rate of a Participant’s Catch-up Contribution pursuant to this Section 3.05(c) shall be reduced to 0 percent automatically upon commencement of Furlough; provided, however, that such Participant may affirmatively elect to increase the rate of his Catch-up Contributions under this Section 3.05(c), within the limits specified in this Section 3.05(c), following the date he begins Furlough by giving written or electronic notice to the Plan Administrator. The Participant’s Catch-up Contributions in place while on Furlough will continue once the Participant ceases Furlough and returns to active employment unless he increases or decreases the rate of his Catch-up Contributions in accordance with Section 3.05(c).

24 3.06 Limitation Based on Average Actual Deferral Percentage. The following provisions shall be applied to determine the maximum amount of contributions that may be made by or on behalf of Highly Compensated Employees under the Plan: (a) The Actual Deferral Percentage for Highly Compensated Employees who are Participants or eligible to become Participants shall not exceed the Actual Deferral Percentage for all other employees who are Participants or eligible to become Participants, multiplied by 1.25. Alternatively, if the Actual Deferral Percentage does not meet the foregoing test, the Actual Deferral Percentage for Highly Compensated Employees may not exceed the Actual Deferral Percentage for all other Employees who are Participants or eligible to become Participants, plus two percentage points and such Actual Deferral Percentage multiplied by 2.0. The Administrative Committee may implement rules limiting the Deferred Contributions which may be made on behalf of some or all Highly Compensated Employees so that this limitation is satisfied. If the Administrative Committee determines that the limitation under this paragraph (a) has been exceeded in any Plan Year, the amount of Deferred Contributions made on behalf of some or all active Highly Compensated Employees shall be reduced until the provisions of this Section are satisfied. (b) For purposes of this Section 3.06, effective January 1, 2012, the plans of controlled group of companies as defined under 2011 PR Code Section 1010.04, group of related entities as defined under 2011 PR Code 1010.05 or affiliated service group as defined under Section 1081.01(14) with Puerto Rico resident participants shall be aggregated for purposes of the Average Actual Deferred Percentage of Participants. (c) Deferred Contributions subject to reduction under this Section, together with Earnings thereon, shall be paid to the Participant in accordance with Section 3.03. However, any excess Deferred Contributions for any Plan Year shall be reduced by any Deferred Contributions previously returned to the Participant

25 under Section 3.02 for that Plan Year. In the event any Deferred Contributions returned under this Section were Company Matching Contributions, such corresponding Company Matching Contributions shall be forfeited and used to reduce Company Matching Contributions. Corrections of excess Deferred Contributions shall be made on or before the last day for the filing of the income tax return of the Company (April 15 for calendar year taxpayer) including extensions granted to file the same (July 1st for calendar year taxpayer). 3.07 Limitation on Annual Contributions. Notwithstanding any other provisions of the Plan, effective for Plan Years commencing on or after January 1, 2012, the amount of contributions allocated to a Participant’s Account (excluding Rollover Contributions) under the Plan for any Plan Year will not cause annual contributions to the Plan (including contributions under all defined contribution plans maintained by the Company or affiliated companies as defined under 2011 PR Code Section 1081.01(a)(14)) to exceed the lesser of the applicable limit under US Code Section 415(c), as adjusted by the Internal Revenue Service or 100% of the Participant’s Compensation paid by the Company during the calendar year or the Plan Year, as selected by the Employer, or such other amount as may be determined from time to time in accordance with Section 1081.01(a)(11) of the 2011 PR Code. The Compensation of the Participant includes the Employer Contribution. 3.08 Vesting. (a) Vesting of Contributions. Except as provided below, the Participant shall be 100% vested in all Company and Employee Contributions. (b) Vesting of Company Non-elective Contributions. (i) A Participant’s interest in his Company Non-Elective Contributions Account (if any) shall become fully vested in him on the date of his termination of employment by reason of death, retirement or Disability,

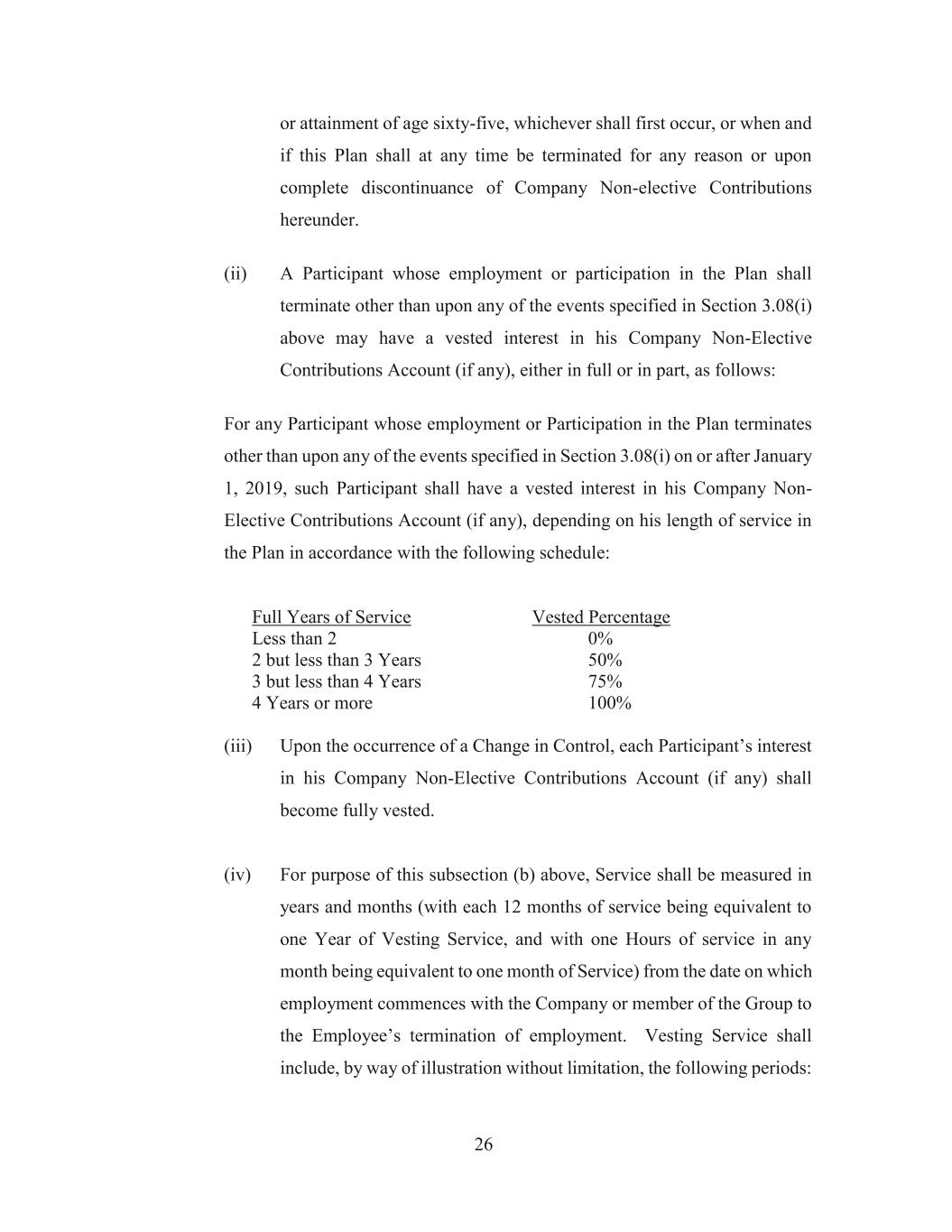

26 or attainment of age sixty-five, whichever shall first occur, or when and if this Plan shall at any time be terminated for any reason or upon complete discontinuance of Company Non-elective Contributions hereunder. (ii) A Participant whose employment or participation in the Plan shall terminate other than upon any of the events specified in Section 3.08(i) above may have a vested interest in his Company Non-Elective Contributions Account (if any), either in full or in part, as follows: For any Participant whose employment or Participation in the Plan terminates other than upon any of the events specified in Section 3.08(i) on or after January 1, 2019, such Participant shall have a vested interest in his Company Non- Elective Contributions Account (if any), depending on his length of service in the Plan in accordance with the following schedule: Full Years of Service Vested Percentage Less than 2 0% 2 but less than 3 Years 50% 3 but less than 4 Years 75% 4 Years or more 100% (iii) Upon the occurrence of a Change in Control, each Participant’s interest in his Company Non-Elective Contributions Account (if any) shall become fully vested. (iv) For purpose of this subsection (b) above, Service shall be measured in years and months (with each 12 months of service being equivalent to one Year of Vesting Service, and with one Hours of service in any month being equivalent to one month of Service) from the date on which employment commences with the Company or member of the Group to the Employee’s termination of employment. Vesting Service shall include, by way of illustration without limitation, the following periods:

27 (1) Any leave of absence from employment which is authorized by the Company, a member of the Group, or predecessor or a corporation merged, consolidated or liquidated into the Corporation or a predecessor of the Company, or a corporation, substantially all of the assets of which have been acquired by the Company, if the Company maintains a plan of such a predecessor corporation, in accordance with uniform rules applied on a nondiscriminatory manner; and (2) Any period of military service in the Armed Forces of the United States required to be credited by law; provided, however, that the Employee returns to the employment of the Company or any member of the Group within the period his reemployment rights are protected by law. Fractional years shall be disregarded: provided, however, that all Years of Vesting Service prior to and subsequent to any termination of employment shall be aggregated for purposes of determining the Employee’s vested interest in his entire remaining Account balance. Notwithstanding the foregoing, if an Employee’s Vesting Service is severed but his is reemployed within the 12 consecutive month period commencing on his termination of employment, the period of severance shall constitute Vesting Service. (v) Notwithstanding any provision of this Plan to the contrary, contributions, benefits and Service with respect to qualified military service will be provided in accordance with US Code Section 414(u).

28 ARTICLE IV. ROLLOVER CONTRIBUTIONS 4.01 Rollover Contributions. Pursuant to the procedures established by the Administrative Committee and without regard to any limitations on contributions set forth in Article 3, the Plan may receive from a Participant, in cash, any amount previously received by him from a qualified plan within sixty (60) days after the date such distributions are received by the Participant. The Plan may receive such amount either directly from the Participant or from a qualified plan in a trust-to- trust transfer. The Plan shall not accept any amount unless such amount is eligible to be rolled over to a qualified trust in accordance with the 2011 PR Code, the regulations promulgated thereunder and any other applicable law and the Participant provides evidence satisfactory to the Administrative Committee that such amount qualifies for rollover treatment under the 2011 PR Code and that the spousal consent requirement of ERISA Section 205 were complied with, if applicable.

29 ARTICLE V. INVESTMENT OF FUNDS 5.01 Investment Funds. Except as otherwise provided in this Article V, all amounts of money, securities, or other property received under the Plan shall be delivered to the Trustee to be invested and reinvested in (1) Company Stock and/or (2) the investment options available from time to time as in accordance with the Plan and the Trust. 5.02 Cash Reserves. The Trustee may maintain Cash Reserves in the Trust to provide funds for (i) investment in Company Stock, (ii) investment in the other investment options available under the Plan, (iii) payment of expenses or taxes of the Plan and the Trust, or (iv) cash withdrawals or distributions. Cash Reserves shall be invested in a short-term interest bearing account maintained by the Trustee, all in accordance with the terms of the Plan and the Trust. 5.03 Purchase of Shares. If the Trustee shall advise Becton Dickinson Caribe LTD, the Administrative Committee or the Plan Administrator that it is not reasonably able to prudently purchase or liquidate the necessary number of shares of Company Stock on any Share Transaction Date, the number of shares of Company Stock purchased or liquidated with respect to any Participant who timely filed an election requesting the purchase or liquidation of shares of Company Stock on the Participant’s behalf, shall be reduced in proportion to the ratio which aggregate number of shares of Company Stock that the Trustee determines may prudently be purchased or liquidated on the Share Transaction Date, bears to the aggregate number of shares of Company Stock which are otherwise to be purchased or liquidated on behalf of all Participants in all jurisdictions on the Share Transaction Date. 5.04 Limits on Investment in the Company Stock Fund. Effective June 1, 2020, the provisions of this Section 5.04 shall govern a Participant’s elections with respect to the investment of his or her future contributions to the Plan or any portion of his

30 or her Accounts held under the Plan in the shares of Company Stock. Unless otherwise expressly stated, if a provision of this Section 5.04 conflicts with another provision of the Plan, the provision of this Section 5.04 shall govern. (a) On and after June 1, 2020, a Participant may not elect to invest any future contributions (including a Participant’s contributions made pursuant to Sections 3.01, 3.02 and 3.05, and any transfers to this Plan from any other tax-qualified retirement plan in shares of Company Stock if, at the time of the election, more than 10% of the balance of the Participant’s Accounts is invested in shares of Company Stock. For purposes of administering this rule and subject to the Administrative Committee’s right to adopt administrative procedures pursuant to Section 5.04(e) below, the following additional rules apply: (i) Any investment election that is in effect on June 1, 2020 that would require future contributions to be invested in shares of Company Stock and that would otherwise violate the 10% limitation set forth above shall be void and of no effect. In the absence of a Participant’s amending such investment election on or before June 1, 2020 pursuant to procedures implemented by the Administrative Committee, the Participant’s future contributions that would otherwise have been invested in the shares of Company Stock will be invested in a qualified default investment alternative selected by the Administrative Committee for this purpose. (ii) Any investment election made after June 1, 2020 that would otherwise violate the 10% limitation set forth above shall be void and of no effect. In the absence of a Participant amending such investment election or otherwise making a new investment election that complies with this Section 5.04(a), the Participant’s investment election on record with the Plan immediately prior to the Participant’s submission of the voided investment election shall

31 continue to govern the investment of the Participant’s Accounts under the Plan. (b) If the restrictions of Section 5.04(a) do not apply (such that the Participant may otherwise elect to have contributions invested in shares of Company Stock), in no event may a Participant elect to invest in shares of Company Stock more than 10% of future contributions to the Plan made by or on behalf of the Participant. In addition, regardless of whether the restrictions in Section 5.04(a) apply, a Participant may elect to invest an amount not in excess of 10% of any Rollover Contribution made pursuant to Section 4.01 in shares of Company Stock. Any investment election that would otherwise violate the provisions of this Section 5.04(b) shall be void and of no effect. In the absence of a Participant amending such investment election or otherwise making a new investment election that complies with this Section 5.04(b), the Participant’s investment election on record with the Plan immediately prior to the Participant’s submission of the voided investment election shall continue to govern the investment of the Participant’s Accounts under the Plan. Notwithstanding the foregoing, if any investment election otherwise in effect on June 1, 2020 would violate the limitations of this Section 5.04(b), then, in the absence of a Participant amending that investment election on or before June 1, 2020, pursuant to procedures implemented by the Administrative Committee, the Participant’s investment election will be modified so that the election is reduced to invest 10% of future contributions in shares of Company Stock with the remaining contribution amounts invested in a qualified default investment alternative selected by the Administrative Committee for this purpose. (c) A Participant may not elect any investment fund transfers that would increase the Participant’s investment in shares of Company Stock if, at the time of the election or as a result thereof, more than 10% of the balance of the Participant’s Accounts is or would be invested in shares of Company Stock. Any investment

32 fund transfer election that violates the provisions of this Section 5.04(c) shall be void and of no effect. (d) No investment fund reallocation election will be effective unless, after the reallocation, not more than 10% of the balance of the Participant’s Accounts is invested in shares of Company Stock. (e) The Administrative Committee may adopt administrative procedures to implement the provisions of Sections 5.04 (a)-(d). (f) Market Risk. Each Participant assumes all risk connected with any decrease in the market price of Company Stock. (g) Investment Responsibility in the Company Stock Fund. The Company Stock Fund shall at all times continue to be invested in shares of Company Stock as provided in the Plan unless the fiduciary to whom is allocated responsibility for such fund determines in its sole discretion that such investment is no longer consistent with ERISA and, if so, such fiduciary shall determine, in its sole discretion, how to liquidate the Company Stock Fund’s holdings in Company Stock. In addition, if the fiduciary to whom is allocated responsibility for the Company Stock Fund determines in its sole discretion that permitting new investments in such fund is no longer consistent with ERISA, taking into account the purpose of the fund, such fiduciary, in its sole discretion, may close the Company Stock Fund to new investments until such time as the fiduciary, in its sole discretion, determines that permitting new investments in the Company Stock Fund would be consistent with ERISA.

33 ARTICLE VI. MAINTENANCE AND VALUATION OF PARTICIPANTS’ ACCOUNTS 6.01 Account. An account shall be established for a Participant which shall reflect separately all amounts contributed by the Participant and by the Company on his behalf and the earnings thereon. The accounts and records of the Plan shall be maintained by the Plan Administrator and shall accurately disclose the status of the Account of each Participant or Beneficiary in the Plan. At least once each quarter, each Participant shall be furnished with the information required by ERISA, including but not limited to, a statement setting forth the value of his Account. 6.02 Valuation of Participant Account. The Plan Administrator shall revalue the Account and subaccounts of each Participant as of the applicable Valuation Date so as to reflect, among other things, a proportionate share in any increase or decrease in the fair market value of the assets in the Trust, as of that date as compared with the value of the assets in the Trust as of the immediately preceding Valuation Date.

34 ARTICLE VII. WITHDRAWALS DURING EMPLOYMENT 7.01 Withdrawals. As of any Valuation Date, but not more than twice in any Plan Year, a Participant may elect, upon one month’s prior written notice to the Plan Administrator, to withdraw all or any portion of the value of the units on his Account attributable to: (a) First, his Additional Employee Contributions made pursuant to Section 3.05(a)(ii), including earnings thereon; (b) Second, his Basic Employee Contributions made pursuant to Section 3.05(a)(i), including earnings thereon; (c) Third, his Rollover Contributions with earnings thereon; (d) Fourth, his Pre-April 1, 2009 Company Matching Contributions made pursuant to Section 3.04(a), including earnings thereon. No withdrawal may be made under any subsection above unless all amounts that may be withdrawn under all preceding subsections have been withdrawn. No withdrawal will be allowed by a Participant from amounts allocated to his/her Employer Profit Sharing Contribution Account or to his/her Company Non- Elective Contributions Accounts. If a Participant has attained the age of 59-1/2, a withdrawal will be allowed once in any Plan Year, upon one month’s prior written notice to the Plan Administrator. The amount of the distribution shall be withdrawn in the same order set forth in the paragraph above and from the additional accounts set forth below in the following order: (a) From his Catch-up Contributions made pursuant to Section 3.05(c), including earnings thereon;

35 (b) From his Additional Deferred Contributions made pursuant to Section 3.01(b), including earnings thereon; (c) From his Basic Deferred Contributions made pursuant to Section 3.01(a), including earnings thereon; and (d) From his Post-April 1, 2009 Company Matching Contributions made pursuant to Section 3.04(a), including earnings thereon. 7.02 Hardship Withdrawal. In the event a Participant incurs a financial hardship, he may, upon completing the appropriate forms and delivering them to the Plan Administrator at least one month prior to the proposed date of withdrawal, be permitted to withdraw, effective as of the Valuation Date next following the end of such one month notice period, all or a portion of the value of his Account attributable to his Employee Contributions, his Rollover Contributions, his Company Matching Contributions, his Catch-up Contributions and his Deferred Contributions. The amount of hardship distribution shall be withdrawn from a Participant’s Account in the following order: (a) First, his Additional Employee Contributions made pursuant to Section 3.05(a)(ii), including earnings thereon; (b) Second, his Pre-April 1, 2009 Company Matching Contributions made pursuant to Section 3.04(a), including earnings thereon; (c) Third, his Catch-up Contributions made pursuant to Section 3.05(c), including earnings thereon; (d) Fourth, his Additional Deferred Contributions made pursuant to Section 3.01(b), including earnings thereon, provided the Participant has attained age 59-1/2;

36 (e) Fifth, his Basic Deferred Contributions made pursuant to Section 3.01(a), including earnings thereon, provided the Participant has attained age 59- 1/2; A hardship withdrawal will be permitted only if the Plan Administrator or the Administrative Committee determines that the Participant has an immediate and heavy financial need and that a withdrawal from the Plan is necessary in order to satisfy such need in accordance with applicable regulations. The amount of the withdrawal may not be in excess of the amount of the financial need of the Participant, including any amounts necessary to pay any local income taxes and any amounts necessary to pay any penalties reasonably anticipated to result from the hardship distribution. For the purpose of this Section 7.02, the term “hardship” shall mean circumstances such that the participant is confronted with immediate and heavy financial need for any of the following expenses: (a) Unreimbursed medical expenses described in the 2011 PR Code incurred by the Participant, the Participant’s spouse, or any dependents of the Participant (as defined in Section 1033.18 of the 2011 PR Code); (b) Purchase (excluding mortgage payments) of a principal residence for the Participant; (c) Payment of tuition for the next 12 months of post-secondary education for the Participant, his or her spouse, children, or dependents; (d) The need to prevent eviction of the Participant from his principal residence or foreclosure on the mortgage of the Participant’s principal residence; or (e) Such other events or circumstances as the Secretary of the Treasury of Puerto Rico through regulations may permit. All of the following requirements must also be satisfied: (f) The distribution is not in excess of the amount of the immediate and heavy financial need of the Participant;

37 (g) The Participant has obtained all distributions, other than hardship distributions, and all non-taxable loans currently available under all plans maintained by the Company; (h) The Participant’s Deferred Contributions and Employee Contributions under this Plan and all other plans of the Company will be suspended for 12 months after receipt of the hardship distribution; and (i) The Participant may not make Deferred Contributions for the Participant’s taxable year immediately following the taxable year of the hardship distribution in excess of the limitation specified in Section 3.02 for such next taxable year reduced by the amount of such Participant’s Deferred Contributions for the taxable year of hardship distribution. For purposes of paragraph (h), all plans of the company shall include stock option plans, stock purchase plans, qualified and non-qualified deferred compensation plans, and such other plans as may be designated under regulations under the 2011 PR Code. 7.03 Method of Payment of Withdrawal. The amount of any payment to be made to a Participant who has made a withdrawal under this Article VII shall be made in a single sum cash payment as soon as practicable after the Valuation Date. All payments pursuant to this Article VII shall be valued as of the Valuation Date that coincides with the processing date of the Participant’s withdrawal request or such other Valuation Date prescribed by the Administrative Committee or its delegate in accordance with rules established by the Administrative Committee for the processing of in-service withdrawal requests. In no event may a Participant receive any portion of a withdrawal payment in Company Stock. 7.04 Eligible Distribution under AD 17-29. (a) A Participant who is a bona fide resident of Puerto Rico, as defined under the 2011 PR Code, will be eligible to make an Eligible Distribution from