EX-99.2

Published on June 3, 2024

BD RESTRICTED BD to Acquire Edwards Lifesciences Critical Care Product Group June 3, 2024

BD RESTRICTED Caution Concerning Forward-Looking Statements This presentation contains certain estimates and other forward-looking statements (as defined under Federal securities laws). Forward looking statements generally are accompanied by words such as "will", "expect", or similar words, phrases or expressions. These forward- looking statements include statements regarding the estimated or anticipated future results of BD and anticipated benefits of the proposed acquisition of Edwards Lifesciences’ Critical Care product group, the expected timing of completion of the transaction, future growth in Critical Care’s relevant market segments, and other statements that are not historical facts. These statements are based on the current expectations of BD management and are subject to a number of risks and uncertainties regarding (“Critical Care”) ’s business and the proposed acquisition, and actual results may differ materially from any anticipated results described, implied or projected in any forward-looking statement. These risks and uncertainties include, but are not limited to, the ability of the parties to successfully close the proposed acquisition, including the risk that the required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the transaction; risks relating to the integration of Critical Care’s operations, products and employees into BD and the time and resources required to do so and the possibility that the anticipated synergies and other benefits of the proposed acquisition will not be realized or will not be realized within the expected timeframe; the loss of key senior management or other associates; competitive factors, including the development of new technologies by other companies and pricing and market share pressures; changes in healthcare or other governmental regulation; risks relating to the ability to maintain favorable supplier arrangements and relationships; changes in regional, national or foreign economic conditions, as well as other factors discussed in BD's filings with the Securities Exchange Commission. BD does not intend to update any forward-looking statements to reflect events or circumstances after the date hereof, except as required by applicable laws or regulations. 2 Caution Concerning Non-GAAP Financial Measures This presentation includes forward-looking non-GAAP financial measures. BD does not attempt to provide reconciliations of forward- looking non-GAAP financial measures to the comparable GAAP measure because the impact and timing of these measures are inherently uncertain and difficult to predict and are unavailable without unreasonable efforts. In addition, BD believes such reconciliations would imply a degree of precision and certainty that could be confusing to investors. Such items could have a substantial impact on GAAP measures of BD's financial performance.

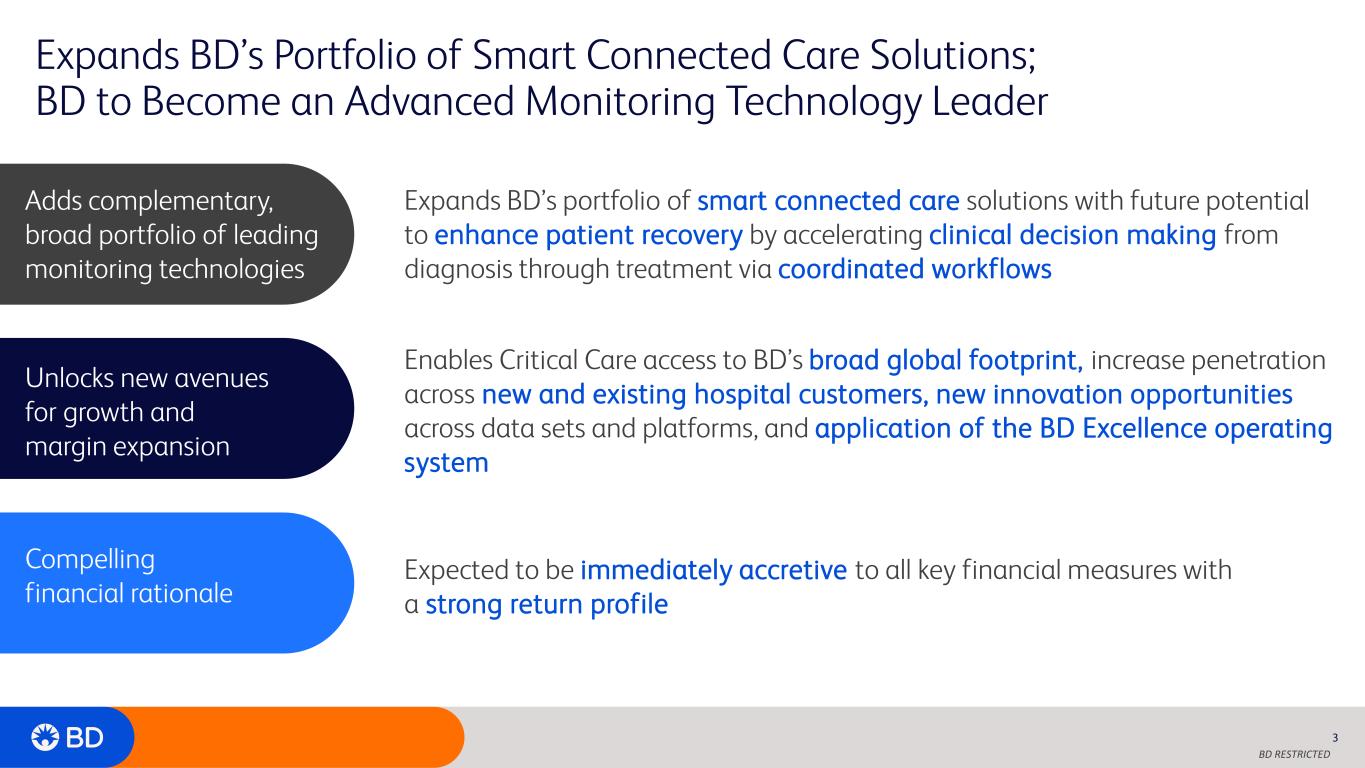

BD RESTRICTED Expands BD’s Portfolio of Smart Connected Care Solutions; BD to Become an Advanced Monitoring Technology Leader 3 Expands BD’s portfolio of smart connected care solutions with future potential to enhance patient recovery by accelerating clinical decision making from diagnosis through treatment via coordinated workflows Enables Critical Care access to BD’s broad global footprint, increase penetration across new and existing hospital customers, new innovation opportunities across data sets and platforms, and application of the BD Excellence operating system Expected to be immediately accretive to all key financial measures with a strong return profile Adds complementary, broad portfolio of leading monitoring technologies Unlocks new avenues for growth and margin expansion Compelling financial rationale

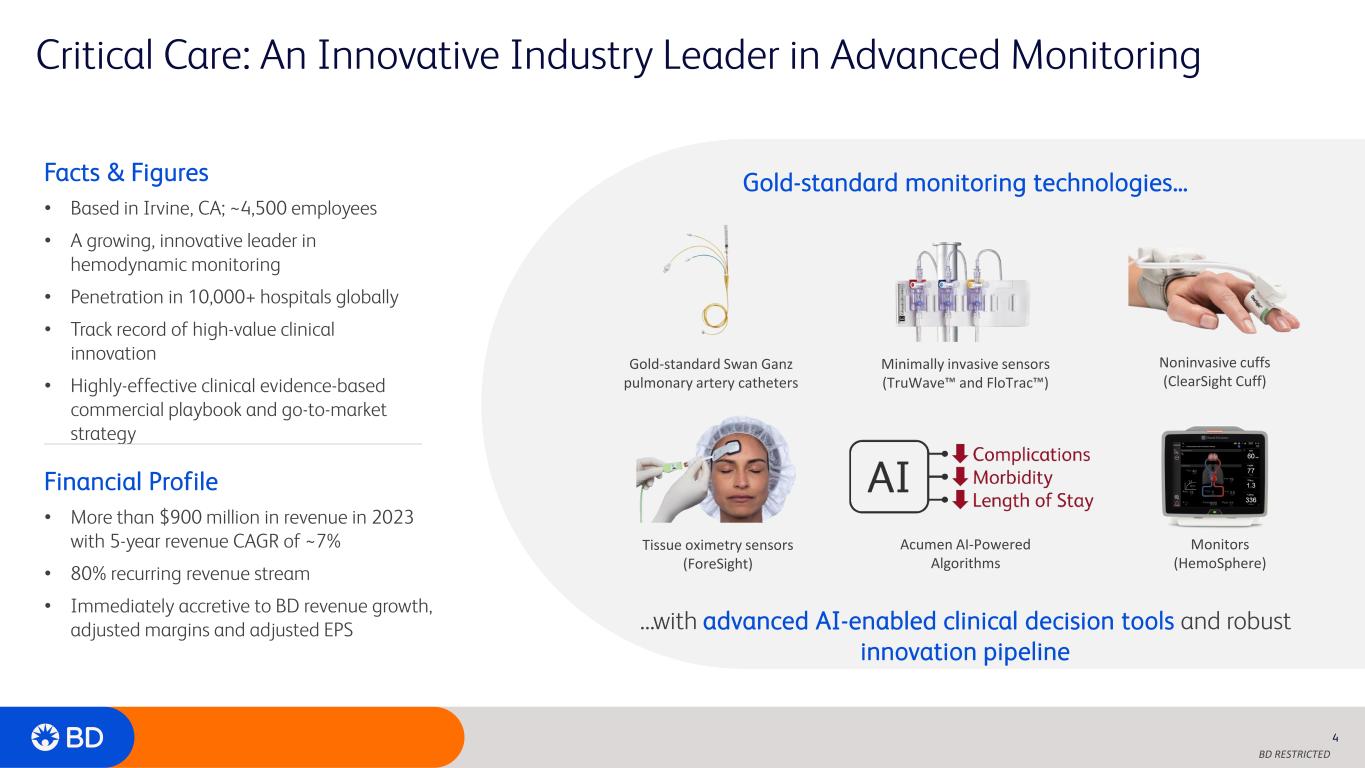

BD RESTRICTED Critical Care: An Innovative Industry Leader in Advanced Monitoring 4 Gold-standard monitoring technologies… …with advanced AI-enabled clinical decision tools and robust innovation pipeline Facts & Figures • Based in Irvine, CA; ~4,500 employees • A growing, innovative leader in hemodynamic monitoring • Penetration in 10,000+ hospitals globally • Track record of high-value clinical innovation • Highly-effective clinical evidence-based commercial playbook and go-to-market strategy Financial Profile • More than $900 million in revenue in 2023 with 5-year revenue CAGR of ~7% • 80% recurring revenue stream • Immediately accretive to BD revenue growth, adjusted margins and adjusted EPS Minimally invasive sensors (TruWave and FloTrac ) Acumen AI-Powered Algorithms Gold-standard Swan Ganz pulmonary artery catheters Noninvasive cuffs (ClearSight Cuff) Monitors (HemoSphere) Tissue oximetry sensors (ForeSight)

BD RESTRICTED BD + Critical Care Technologies Create Opportunity for Meaningful Innovation 5 • Hemodynamic monitoring and medication management technologies are often used simultaneously in operating rooms and intensive care units • Potential to enhance patient recovery by accelerating clinical decision making from diagnosis through treatment via coordinated workflows • Longer-term opportunities across interoperability, data sets and platforms • Engage with more venues of care and clinicians to drive Critical Care solution adoption • Deliver to new patient populations Smart Connected Care

BD RESTRICTED Transaction Summary 6 Transaction Details • $4.2 billion all-cash transaction expected to close before end of calendar year. (1) • Expects to fund transaction with ~$1 billion of cash and $3.2 billion of new debt • At closing, BD will have net leverage of ~3x and expects to de-lever to long-term target of ~2.5x within 12 to 18 months Financial Highlights • Expected to be immediately accretive to revenue growth, adjusted gross margin, adjusted operating margins • Immediate and meaningful adjusted EPS accretion in year one that accelerates to support very strong ROIC profile, exceeding our cost of capital well ahead of typical benchmarks • Long-term financial profile expected to deliver durable revenue growth of ~6% to 7%, with year-one adjusted gross margin of at least 60% and adjusted operating margins of at least 25% that increase over time • Consistent with the company’s BD2025 strategy, value-creating tuck-in M&A continues to be a key part of accelerating BD’s targeted financial profile Synergies • Additional value expected through implementation of the BD Excellence operating system, while preserving commercial and innovation resources • Moderate cost synergies primarily expected from cost of goods sold, supply chain efficiencies, and G&A Governance and Structure • Critical Care will operate as a separate business unit within BD’s Medical segment to align with its smart connected care approach • Katie Szyman, who has served as corporate vice president of Critical Care since 2015, will lead the business unit within BD (1) Subject to the satisfaction of customary closing conditions, including receipt of regulatory clearances