EX-19

Published on November 27, 2024

Exhibit 19 | ||

Global Insider Trading and Securities Transactions Policy

Effective: 31 July 2024

Purpose

All employees and directors should pay particularly close attention to the laws against buy or selling (“trading”) securities (e.g., stock) based on “inside” information. These laws are based on the belief that all persons trading in a company’s securities should have equal access to all “material” information about that company. Employees and directors are not allowed to buy or sell BD stock or other BD securities (“BD Securities”) while aware of material information about BD until that information has been adequately disclosed to the public.

The purchase or sale of securities (including, for purposes of this policy, gifts of securities) while aware of material non-public information, or the disclosure of material non-public information to others who then trade, are prohibited by U.S. federal and state securities laws. This conduct is referred to as “insider trading” and may result in severe civil or criminal penalties. The purpose of this policy is to promote compliance with securities laws and to provide directors and employees with procedures and guidelines with respect to transactions in BD Securities.

Insider trading violations are pursued vigorously by the Securities and Exchange Commission (the “SEC”) and the Department of Justice. A breach of insider trading laws could expose the insider or anyone who trades on the information to criminal fines up to three times the profits earned and imprisonment up to ten years. It is the personal obligation and responsibility of each director and employee to follow the policy. Any failure to comply may result in sanctions, including termination.

Scope

This policy applies to Becton, Dickinson and Company and its majority-owned or controlled subsidiaries (“BD”).

The BD Code of Conduct prohibits insider trading for all BD directors and BD employees worldwide. All BD directors and employees must adhere to this policy.

1

Exhibit 19 | ||

Global Insider Trading and Securities Transactions Policy

Effective: 31 July 2024

No director or employee of BD shall knowingly permit persons under his or her supervision to act inconsistently with this policy. BD may decide that other persons should be subject to this policy, such as contractors or consultants who have access to material non-public information.

These limitations do not apply to transactions under written plans for trading securities that comply with Rule 10b5-1 under the Securities Act of 1934, but the entry into, amendment or termination of such trading plan is subject to pre-approval requirements and other limitations.

Family Members and Others

This policy applies to (a) your family members (each, a “Family Member”) who reside with you, even if financially independent (including a spouse, a domestic partner, children, stepchildren, grandchildren, parents, stepparents, grandparents, siblings and in-laws), (b) anyone else who lives in your household, and (c) any Family Members who do not live in your household but whose transactions in BD Securities are directed by you or are subject to your influence or control, such as parents or children who consult with you before they trade in BD Securities or whose investments you control or influence.

If you are responsible for the transactions of these other persons, you should make them aware of the need to confer with you before they trade in BD Securities, and you should treat all such transactions for the purposes of this policy and applicable securities laws as if the transactions were for your own account. Further, this policy applies to any other accounts over which you have, or share the power, directly or indirectly, to make investment decisions about BD Securities in the account.

This policy does not apply to personal securities transactions of Family Members where the purchase or sale decision about BD Securities is made by a third party not controlled by, influenced by or related to you or your Family Members.

Transactions by Entities that You Control

This policy applies to any entities that you control, including any corporations, partnerships or trusts (collectively referred to as “Controlled Entities”), and transactions by these Controlled Entities should be treated for the purposes of this policy and applicable securities laws as if they were for your own account. Controlled Entities include any account that you may share with others, in which you also share direct or indirect power to make investment decisions.

2

Exhibit 19 | ||

Global Insider Trading and Securities Transactions Policy

Effective: 31 July 2024

|

Restricted Group

| ||

The persons listed in Appendix A, which may be updated from time to time at the discretion of the General Counsel, are part of a “Restricted Group” subject to additional processes and procedures. | ||

Policy

General requirements

No director or employee of BD may (either directly or indirectly through Family Members, Controlled Entities or other persons or entities), except as otherwise provided in this policy:

•Engage in any transaction involving BD Securities while in possession of material non-public information regarding BD. This includes (i) purchases and sales of stock, convertible securities and other securities such as bonds, (ii) gifts of stock, and (iii) increasing or decreasing investment in BD Securities through a retirement account. This applies to BD Securities wherever held, including in your personal brokerage account;

•Disclose any material non-public information about BD (known as “tipping”) to any persons within BD whose jobs do not require them to have that information, or outside of BD to any other persons. This includes but is not limited to Family Members, Controlled Entities, friends, business associates, investors and expert consulting firms but does not include persons who have confidentiality agreements with BD or a duty of confidentiality to BD; or

•Give any advice or make recommendations regarding the purchase or sale of BD Securities.

No director or employee of BD may engage in any transaction in the securities of another company while in possession of material non-public information about that company that they received in the course of performing their duties with BD (or tip other persons about such information). For example, it would be a violation of the securities laws if an employee or director learned through a BD employee that BD intended to purchase the assets of another company, and then placed an order to buy or sell stock in that other company because of the expected increase or decrease in the value of that company’s securities.

3

Exhibit 19 | ||

Global Insider Trading and Securities Transactions Policy

Effective: 31 July 2024

Financial emergencies and other similar types of mitigating circumstances are not a defense to insider trading and do not excuse non-compliance with this policy.

If material non-public information is inadvertently disclosed, the person making or discovering the disclosure should report the matter immediately to the General Counsel.

It is also the policy of BD that BD will not trade in BD Securities, or adopt any repurchase plan in respect of BD Securities, while aware of material nonpublic information about BD, other than in compliance with applicable law.

Material non-public information

Material information is any quantitative or qualitative information, either positive or negative to BD, which a reasonable investor would likely consider important in deciding whether to buy, hold or sell BD Securities.

Any information that is likely to affect the price of BD Common Stock should be considered material.

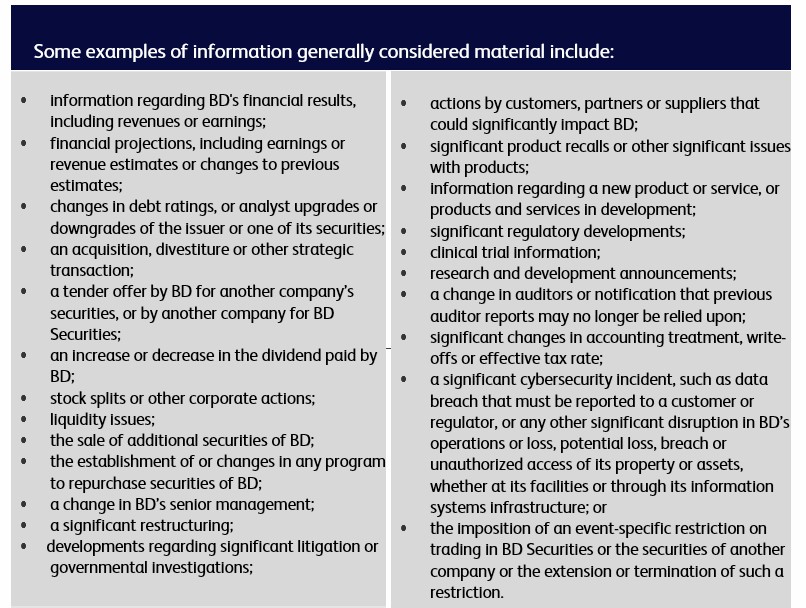

This includes a range of subjects, such as BD’s financial results; acquisitions, divestitures and other strategic transactions; significant regulatory developments; communications with regulators; clinical trial information; research and development announcements; new products; issues affecting BD’s products and changes in senior management. There is no bright-line test for determining materiality, since materiality is based on an assessment of the relevant facts and circumstances. Materiality is often decided by enforcement authorities with the benefit of hindsight. Whether information is material will depend on the particular facts and circumstances. When doubt exists as to whether information is material, you should not trade in BD Securities.

Various categories of information are particularly sensitive and, as a general rule, should always be considered material.

4

Exhibit 19 | ||

Global Insider Trading and Securities Transactions Policy

Effective: 31 July 2024

Any rumors or speculative information concerning BD that, if true, would be material non-public information, are deemed material non-public information for purposes of this policy, and you should not trade on the basis of them.

Information is non-public if BD has not widely disseminated the information to the public through (a) a press release over a national wire service, (b) a previously-announced publicly accessible webcast or (c) BD’s reports filed with the SEC. The information must be disseminated in a way that makes it generally available to investors on a broad-based, non-exclusionary basis.

5

Exhibit 19 | ||

Global Insider Trading and Securities Transactions Policy

Effective: 31 July 2024

Information is not considered widely disseminated if it is available only to BD directors or employees, or if it is only available to a select group of analysts, brokers and institutional investors.

Information should not be considered “public” until twenty-four hours after the information has been disseminated to the market. For example, if BD issues an earnings release on a Monday before the opening of the market, the information contained in the release would be considered “public” upon the opening of the market the following Tuesday. In certain circumstances, BD may determine that a longer period is required with respect to the release of certain information.

Posting information on BD’s website or through social media, or the inclusion of information in media reports, is not sufficient to make it public.

Non-Disclosure of Material Non-Public Information

Material non-public information should not be disclosed to anyone, except to other BD employees whose positions require them to know it. You should not discuss material inside information in public places where it may be overheard, including in common areas of BD.

Non-Disclosure of Material Non-Public Information About Other Companies

During the course of performing your duties with BD, you may have access to material, non-public information regarding other companies. You should not disclose to third parties any non-public information you learn about any other companies in the course of performing your duties, or use such information for your own personal gain, such as trading on that information or providing the information to third parties for any reason. Enforcement cases have been brought by regulators against individuals who use or tip information about other companies obtained during their employment.

Additional Restrictions Regarding Specific Types of Transactions

Prohibition on Short Sales and Derivatives. Trading in options or other derivatives is generally highly speculative and very risky. People who buy options are betting that the stock price will move in a particular direction. For that reason, when a person trades in options in his or her employer’s stock, it will arouse suspicion from regulators that the person was trading on the basis of inside information, particularly if the trading happens to occur before a company announcement or major event. It may be

6

Exhibit 19 | ||

Global Insider Trading and Securities Transactions Policy

Effective: 31 July 2024

difficult for an employee or director to prove that he or she did not know about the announcement or event.

Because of heightened legal risk, the potential misalignment of your interests and those of BD and its shareholders, and the inappropriateness of engaging in speculative transactions involving BD Securities, all directors and employees of BD are prohibited from engaging in:

•short sales of BD Common Stock (that is, selling BD Common Stock that you do not own and borrowing shares to complete the sale); or

•hedging or other transactions involving options* (including exchange-traded options), puts, calls, forward contracts equity swaps, collars or other derivatives involving BD Securities.

*This does not include stock options, stock appreciation rights (SARs) or other awards granted under any BD incentive plan which have not vested.

Prohibition on Margin Accounts and Pledges. Securities held in a margin account as collateral for a margin loan may be sold by the broker without the customer’s consent if the customer fails to meet a margin call. Similarly, securities pledged (or hypothecated) as collateral for a loan may be sold in foreclosure if the borrower defaults on the loan. Because a margin sale or foreclosure sale may occur at a time when the pledgor is aware of material non-public information or otherwise is not permitted to trade in BD Securities, directors and employees are prohibited from holding BD Securities in a margin account or otherwise pledging BD Securities as collateral for a loan.

Churning

To avoid any appearance of impropriety, BD strongly discourages you from repeatedly trading into and out of holdings of BD Securities. Such “churning” can create an appearance of wrongdoing, even if not based on material non-public information.

Restricted Periods and Other Restrictions on Trading

In addition to the general prohibition on transacting in BD Securities while in possession of material non-public information, the following restrictions also apply:

7

Exhibit 19 | ||

Global Insider Trading and Securities Transactions Policy

Effective: 31 July 2024

|

Restricted Periods

| ||

Directors and employees may not engage in transactions involving BD Securities during any “Restricted Period.” A Regular Restricted Period is the period beginning two weeks prior to the end of a fiscal quarter and ending on the date on which the release of BD's financial results for such fiscal quarter becomes “public,” as discussed above. | ||

Event-Specific Restricted Periods. In addition to Regular Restricted Periods, the General Counsel may, without explanation, impose restrictions on trading (including the imposition of a pre-clearance requirement) (an “Event-Specific Restricted Period”). This restriction could cover all BD employees, or only a specific group of BD employees. The imposition of an Event-Specific Restricted Period may itself be material non-public information that should not be shared with anyone.

Restricted Group Only – Pre-Clearance Requirements

The Restricted Group may only engage in transactions involving BD Securities, including gifts of BD Securities, after obtaining pre-clearance from the Corporate Secretary, even during an open trading window. The Corporate Secretary will only pre-clear any such trade with the approval of the General Counsel and Chief Financial Officer of BD. When making a request for pre-clearance, you should carefully consider whether you may be aware of any material non-public information about BD. You will need to provide written confirmation that you are not aware of any material non-public information as part of your request for pre-clearance.

If a request for pre-clearance is approved, you will have two (2) business days to execute the transaction. If the trade is not executed within the two (2) business day period, you must request an additional pre-clearance. A pre-clearance may be revoked prior to the time the transaction is executed. Pre-clearance does not constitute legal advice and does not relieve you of your obligations under this policy or your responsibility for complying with applicable securities laws. If your request for pre-clearance is denied, you should refrain from any transaction in BD Securities and should not inform any other person of the denial.

8

Exhibit 19 | ||

Global Insider Trading and Securities Transactions Policy

Effective: 31 July 2024

Rule 10b5-1 Trading Plans

Rule 10b5-1 Trading Plans | ||

All employees who are Section 16 filers may only trade in BD Securities pursuant to Rule 10b5-1 trading plans (each, a “Rule 10b5-1 Plan”), in accordance with the guidelines set forth by the Corporate Secretary for the establishment of such plans by those officers. | ||

Other employees may also wish to enter into such plans. Any Rule 10b5-1 Plan must be reviewed and approved by the General Counsel or a designee of the General Counsel in his or her sole discretion, before it is adopted. A Rule 10b5-1 Plan must be entered into, or amended at a time when the person entering into the plan is not aware of material non-public information and may not be entered into, or amended during a Regular Restricted Period or any Event-Specific Restricted Period to which the person is subject. Trades can only commence under the Rule 10b5-1 Plan following a “cooling-off” period, as set forth in the guidelines for Rule 10b5-1 Plans. Once the plan is adopted, the person must not exercise any influence over the securities to be traded, the price at which they are to be traded or the dates of the trades. The plan must either specify the amount, pricing and timing of transactions in advance or delegate discretion on these matters to an independent third party. Once adopted, a Rule 10b5-1 Plan may not be terminated or amended without the approval of the General Counsel, in consultation with outside securities counsel and, in the case of a Section 16 filer, the Chair of the Audit Committee.

Other Transactions Involving BD Securities

Savings Incentive Plan and Other Plans. The acquisition of BD Common Stock pursuant to regular, pre-determined contributions to any of BD’s stock-based benefit plans, including the BD 401(k) plan and any deferred compensation plan, is exempt from this policy.

For example, if you invest a certain amount of your paycheck in the BD Common Stock Fund of the BD 401(k) plan pursuant to pre-existing instructions, you may continue to do so, even if you come into possession of material, non-public information. However, you may not establish or change any instructions while you are aware of material, non-public information or during a Regular Restricted period or an Even-Specific Restricted Period that you are subject to. In addition, the policy applies to:

9

Exhibit 19 | ||

Global Insider Trading and Securities Transactions Policy

Effective: 31 July 2024

•transfers of funds into or out of the BD Common Stock Fund under the 401(k) plan, any deferred compensation plan or other stock-based plans; and

•in-service withdrawals or loans from your 401(k) plan account, or pre-payments of any 401(k) plan loan, if doing so would result in either a liquidation of some or all of your account balance allocated to the BD Common Stock Fund or an allocation of additional funds to the BD Common Stock Fund.

Equity-Based Compensation. Generally, the exercise of stock options or SARs is permitted at any time if you hold the shares acquired upon exercise and do not sell shares on the open market. However, a cashless exercise that results in a sale to the market in connection with the exercise may not be executed during Regular Restricted Periods or any Event-Specific Restricted Period to which you are subject. The shares you acquire upon exercise are always subject to the policy and you may only sell them when permitted under the policy.

Post-Employment Transactions

If you leave BD for any reason, including termination of your employment, you will remain subject to the terms of this policy for the duration of any Regular Restricted Period or any Event-Specific Restricted Period that you are subject to at the time of your separation from BD. If you are aware of material non-public information at the time you end your employment with BD, you may not trade in BD Securities or disclose such information at any time following your termination until such information has been made “public” by BD (or it is no longer material). This section is also applicable to directors who end their board service at BD.

Designated Persons for Questions and Responsibility for Interpretations | ||

All questions about this policy should be directed to the Corporate Secretary. The General Counsel is responsible for interpreting this policy and for establishing and implementing any procedures he or she deem appropriate to ensure compliance with this policy. | ||

10

Exhibit 19 | ||

Global Insider Trading and Securities Transactions Policy

Effective: 31 July 2024

Individual Responsibility

BD employees and directors have ethical and legal obligations to maintain the confidentiality of information about BD and to not engage in transactions in BD Securities while aware of material non-public information, regardless of whether a transaction is executed in an open trading window or is pre-cleared by BD. All directors and employees subject to this policy must refrain from engaging in illegal trading and must avoid the appearance of improper trading. Each individual is responsible for making sure that he or she complies with this policy, and that any Family Member or Controlled Entity also complies with this policy.

The responsibility for determining whether you are in possession of material non-public information rests solely with you.

Any action on the part of BD, the General Counsel, the Corporate Secretary or any other employee or director does not in any way constitute legal advice or insulate you from liability under applicable securities laws.

A director or employee may, from time to time, have to forego a proposed transaction in BD Securities even if he or she planned to make the transaction before learning of the material non-public information and even though he or she believes that he or he she may suffer an economic loss or forego anticipated profit by waiting.

Consequences of Violations

Insider trading violations are pursued vigorously by the SEC, U.S. Attorneys and state enforcement authorities as well as the laws of foreign jurisdictions.

Punishment for insider trading violations is severe and could include significant fines and imprisonment.

While the regulatory authorities concentrate their efforts on the individuals who trade, or who tip inside information to others who trade, the U.S. federal securities laws could also impose liability on companies and other “controlling persons” (e.g., directors and officers), who have the power to direct

11

Exhibit 19 | ||

Global Insider Trading and Securities Transactions Policy

Effective: 31 July 2024

the management and policies of companies, if they fail to take reasonable steps to prevent insider trading by company personnel.

Obligation to report non-compliance

Except as prohibited by applicable law, BD employees have an obligation to report non-compliance with BD policy, both their own non-compliance or the non-compliance of another BD employee or a third party, to their supervisors, Human Resources, the Law Group and/or the Ethics & Compliance Department. The BD Ethics Helpline allows for anonymous reporting of non-compliance except to the extent such anonymous reporting is not allowed by law. You can reach the Ethics Helpline through the phone numbers or website identified on the Ethics & Compliance page on the Maxwell intranet site. You can also report matters via email: ethicsoffice@bd.com.

Any BD employee who fails to meet the standards and expectations of this policy or the Code of Conduct, may be subject to discipline. Such discipline shall be reasonably designed to deter wrongdoing and to promote compliance with this policy and the Code of Conduct, and may include without limitation, corrective actions up to, and including, termination of the individual’s employment.

Discover more information on our

Ethics & Compliance Maxwell site.

You can reach the Ethics Helpline

via the phone numbers listed on the

Ethics & Compliance contact page

on our Maxwell Intranet site.

You can email the Ethics Office at:

ethicsoffice@bd.com

12

Exhibit 19 | ||

Global Insider Trading and Securities Transactions Policy

Effective: 31 July 2024

Exception Requirements

Employees may apply to the General Counsel for relief from the requirements of this policy, subject to all applicable legal requirements. Please note that such relief will be rarely granted and only granted in extraordinary circumstances, after consultation with outside securities counsel. Any requests granted under this provision shall be reported to the Audit Committee.

References

In addition to the issues addressed in this policy, other applicable policies on the disclosure of non-public information about BD is subject to applicable laws and regulations and other BD policies, including BD’s Code of Conduct and BD’s Regulation FD Policy.

Appendix A – Restricted Group

Directors

Section 16 Officers

All BD Employees in Job Groups 8 and above

Finance Leadership Team

13

Exhibit 19 | ||

Global Insider Trading and Securities Transactions Policy

Effective: 31 July 2024

Approval

|

Author:

By: Gary DeFazio

Name: /s/ Gary DeFazio

Title: SVP, Corporate Secretary &

Associate General Counsel

|

Approver:

By: Tom Polen

Name: /s/ Tom Polen

Title: Chief Executive Officer and President,

Chairman of the Board

By: Christopher DelOrefice

Name: /s/ Christopher DelOrefice

Title: EVP and Chief Financial Officer

By: Michelle Quinn

Name: /s/ Michelle Quinn

Title: EVP and General Counsel

|

||||

14