| |

|

| |

Becton, Dickinson and Company |

| Financials |

|

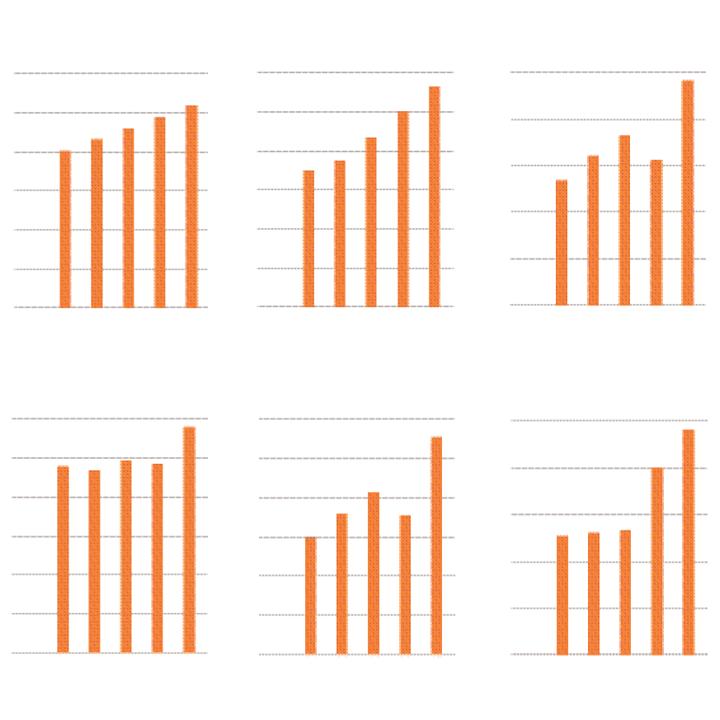

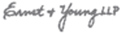

U.S. Revenues

(Millions of Dollars)

Non-U.S. Revenues

(Millions of Dollars)

Net Income

(Millions of Dollars)

Return on Invested Capital

(Percent)

Earning Per Share-Diluted

(Dollars)

Dividends Per Common Share

(Dollars)

3000

2500

2000

1500

1000

500

0

3000

2500

2000

1500

1000

500

0

750

600

450

300

150

0

30

25

20

15

10

5

0

3.0

2.5

2.0

1.5

1.0

0.5

0.0

0.75

0.60

0.45

0.30

0.15

0.0

01

02

03

04

05

01

02

03

04

05

01

02

03

04

05

01

02

03

04

05

01

02

03

04

05

01

02

03

04

05

17

| |

|

| |

Becton, Dickinson and Company |

| Summary |

|

| |

Ten-Year Summary of Selected Financial Data

Years Ended September 30

Dollars in millions, except per-share amounts |

| |

| |

2005 |

|

2004 |

|

2003 |

|

2002 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operations |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

$ |

5,414.7 |

|

$ |

4,934.7 |

|

$ |

4,463.5 |

|

$ |

3,960.4 |

|

| Research and Development Expense |

|

271.6 |

|

|

235.6 |

|

|

224.2 |

|

|

207.2 |

|

| Operating Income |

|

1,031.2 |

|

|

787.3 |

|

|

761.2 |

|

|

674.5 |

|

| Interest Expense, Net |

|

19.3 |

|

|

29.6 |

|

|

36.5 |

|

|

33.2 |

|

| Income From Continuing Operations |

|

|

|

|

|

|

|

|

|

|

|

|

| Before Income Taxes |

|

1,004.9 |

|

|

752.9 |

|

|

722.0 |

|

|

627.5 |

|

| Income Tax Provision |

|

312.6 |

|

|

170.4 |

|

|

167.0 |

|

|

148.1 |

|

| Net Income |

|

722.3 |

|

|

467.4 |

|

|

547.1 |

|

|

480.0 |

|

| Basic Earnings Per Share |

|

2.87 |

|

|

1.85 |

|

|

2.14 |

|

|

1.85 |

|

| Diluted Earnings Per Share |

|

2.77 |

|

|

1.77 |

|

|

2.07 |

|

|

1.79 |

|

| Dividends Per Common Share |

|

.72 |

|

|

.60 |

|

|

.40 |

|

|

.39 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Position |

|

|

|

|

|

|

|

|

|

|

|

|

| Current Assets |

$ |

2,975.3 |

|

$ |

2,641.3 |

|

$ |

2,503.5 |

|

$ |

2,091.4 |

|

| Current Liabilities |

|

1,299.4 |

|

|

1,050.1 |

|

|

1,059.4 |

|

|

1,271.5 |

|

| Property, Plant and Equipment, Net |

|

1,933.7 |

|

|

1,881.0 |

|

|

1,831.8 |

|

|

1,750.4 |

|

| Total Assets |

|

6,072.0 |

|

|

5,752.6 |

|

|

5,572.3 |

|

|

5,029.0 |

|

| Long-Term Debt |

|

1,060.8 |

|

|

1,171.5 |

|

|

1,184.0 |

|

|

803.0 |

|

| Shareholders Equity |

|

3,284.0 |

|

|

3,067.9 |

|

|

2,897.0 |

|

|

2,480.9 |

|

| Book Value Per Common Share |

|

13.26 |

|

|

12.30 |

|

|

11.54 |

|

|

9.71 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Relationships |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit Margin |

|

50.8 |

% |

|

49.3 |

% |

|

48.5 |

% |

|

48.3 |

% |

| Return on Revenues(E) |

|

12.8 |

% |

|

11.8 |

% |

|

12.4 |

% |

|

12.1 |

% |

| Return on Total Assets(B)(E) |

|

17.9 |

% |

|

14.1 |

% |

|

14.4 |

% |

|

13.6 |

% |

| Return on Equity(E) |

|

21.8 |

% |

|

19.5 |

% |

|

20.6 |

% |

|

20.0 |

% |

| Debt to Capitalization(D)(E) |

|

27.3 |

% |

|

28.1 |

% |

|

30.5 |

% |

|

32.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Additional Data |

|

|

|

|

|

|

|

|

|

|

|

|

| Number of Employees |

|

25,600 |

|

|

25,000 |

|

|

24,800 |

|

|

25,200 |

|

| Number of Shareholders |

|

9,442 |

|

|

9,654 |

|

|

9,868 |

|

|

10,050 |

|

| Average Common and Common |

|

|

|

|

|

|

|

|

|

|

|

|

| Equivalent Shares Outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

| Assuming Dilution (millions) |

|

260.7 |

|

|

263.3 |

|

|

263.6 |

|

|

268.2 |

|

| Depreciation and Amortization |

$ |

387.5 |

|

$ |

357.2 |

|

$ |

335.8 |

|

$ |

296.6 |

|

| Capital Expenditures |

|

317.6 |

|

|

265.7 |

|

|

259.2 |

|

|

255.7 |

|

| |

|

| (A) |

Includes cumulative effect of accounting change of $36.8 ($.14 per basic and diluted share). |

| |

|

| (B) |

Earnings before interest expense, taxes and cumulative effect of accounting changes as a percent of average total assets. |

| |

|

| (C) |

Excludes the cumulative effect of accounting changes. |

| |

|

| (D) |

Total debt as a percent of the sum of total debt, shareholders equity and net non-current deferred income tax liabilities. |

| |

|

| (E) |

Excludes discontinued operations in 1999 to 2005. |

18

| |

|

| |

Becton, Dickinson and Company |

| |

|

| |

|

| |

2001 |

|

2000 |

|

1999 |

|

1998 |

|

1997 |

|

1996 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

$ |

3,667.6 |

|

$ |

3,544.7 |

|

$ |

3,412.6 |

|

$ |

3,116.9 |

|

$ |

2,810.5 |

|

$ |

2,769.8 |

|

| Research and Development Expense |

|

199.6 |

|

|

212.8 |

|

|

220.7 |

|

|

217.9 |

|

|

180.6 |

|

|

154.2 |

|

| Operating Income |

|

632.5 |

|

|

507.4 |

|

|

477.3 |

|

|

405.4 |

|

|

450.5 |

|

|

431.2 |

|

| Interest Expense, Net |

|

55.3 |

|

|

74.2 |

|

|

72.0 |

|

|

56.3 |

|

|

39.4 |

|

|

37.4 |

|

| Income From Continuing Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Before Income Taxes |

|

535.2 |

(A) |

|

512.7 |

|

|

404.8 |

|

|

340.9 |

|

|

422.6 |

|

|

393.7 |

|

| Income Tax Provision |

|

134.2 |

|

|

122.0 |

|

|

96.9 |

|

|

104.3 |

|

|

122.6 |

|

|

110.2 |

|

| Net Income |

|

401.7 |

(A) |

|

392.9 |

|

|

275.7 |

|

|

236.6 |

|

|

300.1 |

|

|

283.4 |

|

| Basic Earnings Per Share |

|

1.55 |

(A) |

|

1.54 |

|

|

1.09 |

|

|

.95 |

|

|

1.21 |

|

|

1.10 |

|

| Diluted Earnings Per Share |

|

1.49 |

(A) |

|

1.49 |

|

|

1.04 |

|

|

.90 |

|

|

1.15 |

|

|

1.05 |

|

| Dividends Per Common Share |

|

.38 |

|

|

.37 |

|

|

.34 |

|

|

.29 |

|

|

.26 |

|

|

.23 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Position |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current Assets |

$ |

1,930.1 |

|

$ |

1,847.6 |

|

$ |

1,843.0 |

|

$ |

1,542.8 |

|

$ |

1,312.6 |

|

$ |

1,276.8 |

|

| Current Liabilities |

|

1,285.4 |

|

|

1,382.4 |

|

|

1,358.6 |

|

|

1,091.9 |

|

|

678.2 |

|

|

766.1 |

|

| Property, Plant and Equipment, Net |

|

1,701.3 |

|

|

1,565.5 |

|

|

1,423.9 |

|

|

1,302.7 |

|

|

1,250.7 |

|

|

1,244.1 |

|

| Total Assets |

|

4,790.8 |

|

|

4,505.1 |

|

|

4,437.0 |

|

|

3,846.0 |

|

|

3,080.3 |

|

|

2,889.8 |

|

| Long-Term Debt |

|

782.8 |

|

|

778.5 |

|

|

954.0 |

|

|

765.2 |

|

|

665.4 |

|

|

468.2 |

|

| Shareholders Equity |

|

2,321.7 |

|

|

1,956.0 |

|

|

1,768.7 |

|

|

1,613.8 |

|

|

1,385.4 |

|

|

1,325.2 |

|

| Book Value Per Common Share |

|

8.96 |

|

|

7.72 |

|

|

7.05 |

|

|

6.51 |

|

|

5.68 |

|

|

5.36 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Relationships |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit Margin |

|

48.7 |

% |

|

48.6 |

% |

|

49.9 |

% |

|

50.6 |

% |

|

49.7 |

% |

|

48.4 |

% |

| Return on Revenues(E) |

|

11.9 |

%(C) |

|

11.0 |

% |

|

9.0 |

% |

|

7.6 |

% |

|

10.7 |

% |

|

10.2 |

% |

| Return on Total Assets(B)(E) |

|

13.6 |

% |

|

13.4 |

% |

|

11.6 |

% |

|

11.7 |

% |

|

15.9 |

% |

|

15.2 |

% |

| Return on Equity(E) |

|

20.3 |

%(C) |

|

21.0 |

% |

|

18.2 |

% |

|

15.8 |

% |

|

22.1 |

% |

|

20.8 |

% |

| Debt to Capitalization(D)(E) |

|

34.0 |

% |

|

41.7 |

% |

|

47.6 |

% |

|

41.4 |

% |

|

36.3 |

% |

|

34.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Additional Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Number of Employees |

|

24,800 |

|

|

25,000 |

|

|

24,000 |

|

|

21,700 |

|

|

18,900 |

|

|

17,900 |

|

| Number of Shareholders |

|

10,329 |

|

|

10,822 |

|

|

11,433 |

|

|

9,784 |

|

|

8,944 |

|

|

8,027 |

|

| Average Common and Common |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equivalent Shares Outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assuming Dilution (millions) |

|

268.8 |

|

|

263.2 |

|

|

264.6 |

|

|

262.1 |

|

|

259.6 |

|

|

267.6 |

|

| Depreciation and Amortization |

$ |

293.2 |

|

$ |

273.7 |

|

$ |

257.8 |

|

$ |

228.7 |

|

$ |

209.8 |

|

$ |

200.5 |

|

| Capital Expenditures |

|

364.1 |

|

|

371.0 |

|

|

311.4 |

|

|

181.4 |

|

|

170.3 |

|

|

145.9 |

|

19

| |

|

| |

Becton, Dickinson and Company |

| Financial Review |

|

Company Overview

Becton, Dickinson and Company (BD) is a medical technology company engaged principally

in the manufacture and sale of a broad range of medical supplies, devices, laboratory equipment and

diagnostic products used by healthcare institutions, life science researchers, clinical laboratories,

industry and the general public. Our business consists of three worldwide business segmentsBD

Medical (Medical), BD Diagnostics (Diagnostics) and BD Biosciences (Biosciences).

Our products are marketed in the United States and internationally through independent distribution

channels, directly to end-users and by independent sales representatives. References to years throughout

this discussion relate to our fiscal years, which end on September 30.

BD management operates the business consistent with the following core strategies:

| |

To increase revenue growth by focusing on products that deliver greater benefits to patients, healthcare

workers and researchers; |

| |

To improve operating effectiveness and balance sheet productivity; and, |

| |

To strengthen organizational and associate capabilities in the ever-changing healthcare environment. |

In assessing the outcomes of these strategies and BDs financial condition and operating performance,

management generally reviews quarterly forecast data, monthly actual results, segment sales and other

similar information. We also consider trends related to certain key financial data, including gross

profit margin, selling and administrative expense, investment in research and development, and cash

flows.

The results of our strategies are reflected in our fiscal 2005 financial and operational performance.

Worldwide revenues in 2005 of $5.4 billion increased 10% from the prior year and reflected estimated

volume increases of 6%, an estimated increase due to favorable foreign currency translation of 3%,

and estimated price increases of less than 1%. U.S. revenues increased 6% to $2.6 billion. International

revenues increased 13% to $2.8 billion. For a discussion of the financial impact of exchange rate

fluctuations and the ways and extent to which we attempt to mitigate such impact, see Financial

Instrument Market Risk below.

Consistent with our strategy to provide products that deliver greater benefits to healthcare workers,

and recognizing the issues surrounding sharps-related injuries, BD has developed a wide array of

safety-engineered devices that are designed to reduce the incidence of needlestick injuries and exposure

to bloodborne pathogens. These products are offered through our Medical and Diagnostics segments.

Sales in the United States of safety-engineered devices grew 9% to $842 million in 2005, compared

with $775 million in 2004. International sales of safety-engineered devices were approximately $273

million in 2005 compared with $203 million in 2004. In 2006, we expect U.S. sales of safety-engineered

devices to increase about 8%. We are also anticipating growth of international safety sales of about 20%.

Income from Continuing Operations was $692 million, or $2.66 per diluted share, in 2005 as compared

with $583 million, or $2.21 per diluted share, in 2004. Comparisons of Income from Continuing Operations

between 2005 and 2004 are affected by the following significant items that are reflected in our financial

results:

| 2005 |

| |

We recorded share-based compensation expense of $70 million ($50 million after taxes), or $.19 per

diluted share, in connection with the adoption of Statement of Financial Accounting Standards No.

123 (revised 2004), Share Based Payment (SFAS No. 123 (R)). Prior periods

were not restated. |

| |

We recorded a one-time tax charge of $77 million, or $.30 per diluted share, attributable to the planned

repatriation of foreign earnings under the American Jobs Creation Act of 2004. |

| |

|

| 2004 |

| |

We recorded a charge of $100 million ($63 million after taxes), or $.24 per diluted share, related

to a litigation settlement. |

| |

We recorded a charge of $45 million ($28 million after taxes), or $.11 per diluted share, related to

the voluntary recall and writeoff of certain blood glucose strip inventory and other actions taken

with respect to our blood glucose monitoring (BGM) products. |

20

Financial Review Becton, Dickinson and Company

Our financial position remains strong with net cash provided by continuing operating activities of

approximately $1.2 billion for 2005 and our debt-to-capitalization ratio from continuing operations

(total debt as a percentage of the sum of shareholders equity, net non-current deferred income

tax liabilities and total debt) having improved to 27.3% at September 30, 2005, from 28.1% at September

30, 2004.

Our ability to sustain our long-term growth will depend on a number of factors, including our ability

to expand our core business (including geographical expansion), develop innovative new products with

higher gross profit margins across our business segments, and continue to improve operating efficiency

and organizational effectiveness. Numerous factors can affect our ability to achieve these goals,

including without limitation, U.S. and global economic conditions, increased competition and healthcare

cost containment initiatives. We believe that there are several important factors relating to our

business that tend to reduce the impact on BD of any potential economic or political events in countries

in which we do business, including the effects of possible healthcare system reforms. These include

the non-discretionary nature of the demand for many of our core products, which reduces the impact

of economic downturns, our international diversification and our ability to meet the needs of the

worldwide healthcare industry with cost-effective and innovative products.

In 2005, general inflation did not have a material impact on our overall operations. However, it is

possible that general inflation rates will rise in 2006 and beyond, and could have a greater impact

on worldwide economies and consequently, on BD. In 2005, we experienced higher resin purchase costs,

primarily due to recent increases in world oil prices and shortages of supply. BD currently expends

approximately $150 to $170 million per year to purchase supplies of resins, which are oil-based components

used in the manufacture of certain BD products. However, we continue to strive to improve our profit

margins through increased sales of products with higher margins, cost reduction programs, productivity

improvements and, to a lesser extent, periodic price increases and adjustments. For example, in 2006,

we expect our gross profit margin to improve by 30 to 40 basis points over 2005.

Our anticipated revenue growth over the next three years is expected to come from the following:

| |

Core business growth and expansion; |

| |

Expanding the sale of our high-quality products around the globe; and, |

| |

Development in each business segment of new products and services that provide increased benefits to

patients, healthcare workers and researchers. |

Accounting Change

Effective October 1, 2004, we adopted SFAS No. 123 (R). This statement requires compensation cost relating

to share-based payment transactions to be recognized in net income using a fair-value measurement

method. In November 2004, equity-based awards were granted to employees under a new long-term incentive

program, which consisted of stock options and restricted stock awards. See Note 13 of the Notes Consolidated

Financial Statements for a discussion of the valuation methodology used in estimating the fair value

of these equity-based awards.

In previous years, we had used stock options as our primary form of incentive compensation and such

stock options were accounted for under the intrinsic value method under Accounting Principles Board

(APB) Opinion No. 25, Accounting for Stock Issued to Employees. This method measured

share-based compensation expense as the amount by which the market price of the stock on the date

of grant exceeded the exercise price. Under APB No. 25, no share-based compensation expense was recognized

for stock options since the exercise price equaled the market price of the underlying stock on the

date of grant. We elected the modified prospective transition method for adopting SFAS No. 123(R)

and therefore, prior periods were not restated. Under this method, the provisions of SFAS No. 123(R)

were applied to new awards granted after the time of adoption, as well as to the unvested portion

of previously granted equity-based awards for which the requisite service had not been rendered as

of October 1, 2004. See Note 2 of the Notes to Consolidated Financial Statements for additional discussion.

As a result of the adoption of SFAS No. 123(R) and the granting of restricted stock unit awards in

November 2004, we recorded share-based compensation expense in 2005 as follows:

| (millions of dollars) |

2005 |

|

|

| Selling and administrative expense |

$ |

54 |

|

|

| Cost of products sold |

|

10 |

|

|

| Research and development expense |

|

6 |

|

|

| Total |

$ |

70 |

|

|

Share-based compensation expense was recorded in corporate unallocated expense for segment reporting

purposes. For 2006, we estimate share-based compensation expense will reduce diluted earnings per

share from continuing operations by about $.23, as compared with $.19 in 2005.

21

Financial Review Becton, Dickinson and Company

Results of Continuing Operations

Medical Segment

Medical revenues in 2005 of $3.0 billion increased $278 million, or 10%, over 2004, which includes

an estimated impact of favorable foreign currency translation of 3%.

The following is a summary of revenues by organizational unit:

| (millions of dollars) |

2005 |

|

|

2004 |

|

Total

Change |

|

Foreign

Exchange

Impact |

|

| Medical Surgical Systems |

$ |

1,661 |

|

|

$ |

1,541 |

|

|

8 |

% |

|

3 |

% |

| Diabetes Care |

|

674 |

|

|

|

586 |

|

|

15 |

% |

|

2 |

% |

| Pharmaceutical Systems |

|

563 |

|

|

|

497 |

|

|

13 |

% |

|

4 |

% |

| Ophthalmic Systems |

|

60 |

|

|

|

56 |

|

|

7 |

% |

|

3 |

% |

| Total Revenues |

$ |

2,958 |

|

|

$ |

2,680 |

|

|

10 |

% |

|

3 |

% |

Medical revenues reflect the continued conversion in the United States to safety-engineered products,

which accounted for sales of $490 million, as compared with $459 million in the prior year. Included

in Medical revenues were international sales of safety-engineered products of $81 million, as compared

with $63 million in the prior year. Revenue growth in the Medical Surgical Systems unit of this segment

was primarily driven by the growth in safety-engineered products and prefilled flush syringes. The

Diabetes Care units revenue growth reflected strong sales of BGM products in the United States

and pen needles worldwide. Sales of BGM meters, test strips and related disposables in the United

States and Canada were $76 million, as compared with $42 million in 2004. BGM products were introduced

into the European market through the launch in Germany during the fourth quarter of 2005. We expect

revenues of BGM products to be about $115 million in 2006. Revenue growth in the Pharmaceutical Systems

unit was primarily attributable to a 19% increase in international sales. For 2006, we expect the

full year revenue growth for the Medical Segment to be about 5% to 6%, which includes an estimated

unfavorable impact of foreign currency of about 2%.

Medical operating income was $711 million, or 24.0% of Medical revenues, in 2005, as compared with

$567 million, or 21.1% in 2004, which included $45 million of BGM charges as further discussed below.

Operating income as a percentage of revenues reflects gross margin improvement from increased sales

of products that have higher overall gross profit margins, in particular, safety-engineered products

and pen needles. See further discussion on gross profit margin improvement below.

Selling and administrative

expense as a percent of Medical revenues in 2005 was slightly lower compared with 2004, primarily

due to the favorable effects from a weaker U.S. dollar along with tight controls on base spending.

Incremental investments to support the BGM initiative were about $14 million. Research and development

expenses in 2005 increased $14 million, or 17%, reflecting continued investment in the development

of new products.

Diagnostics Segment

Diagnostics revenues in 2005 of $1.7 billion increased $125 million, or 8%, over 2004, which includes

an estimated favorable impact of foreign currency translation of 2%.

The

following is a summary of revenues by organizational unit:

| (millions of dollars) |

2005 |

|

|

2004 |

|

Total

Change |

|

Foreign

Exchange

Impact |

|

| Preanalytical Systems |

$ |

855 |

|

|

$ |

788 |

|

|

8 |

% |

|

2 |

% |

| Diagnostic Systems |

|

802 |

|

|

|

744 |

|

|

8 |

% |

|

2 |

% |

| Total Revenues |

$ |

1,657 |

|

|

$ |

1,532 |

|

|

8 |

% |

|

2 |

% |

Revenue growth in the Preanalytical Systems unit reflected the continued conversion in the United States

to safety-engineered products and accounted for sales of $352 million, compared with $317 million

in 2004. Sales of the BD Vacutainer Push Button Collection Sets were key to this trend. Preanalytical Systems revenues included international

sales of safety-engineered products of $192 million, compared with $140 million in 2004. Geographic

expansion in the Middle East and Asia Pacific regions, particularly in China, also contributed to

the growth in the Preanalytical Systems unit. The Diagnostic Systems unit experienced solid worldwide

sales of its automated diagnostic platforms, including the molecular BD ProbeTec ET, and the BD Phoenix Automated Microbiology System. These platforms reported combined incremental sales of $17 million

over 2004. For 2006, we expect the full year revenue growth for the Diagnostics Segment to be about

5% to 6%, which includes an estimated unfavorable impact of foreign currency of about 2%.

Diagnostics operating income was $414 million, or 25.0% of Diagnostics revenues, in 2005, compared

with $359 million, or 23.5%, in 2004. The increase in operating income as a percentage of revenues

reflects gross profit improvement from increased sales of products that have higher overall gross

profit margins, in particular, safety-engineered products and the BD ProbeTec ET platform. See further discussion on gross profit margin improvement below. Selling and administrative

expense as a percent of Diagnostics revenues in 2005 was slightly lower

22

Financial Review Becton, Dickinson and Company

compared with 2004 primarily due to the favorable impact from a weaker U.S. dollar along with tight

controls on spending. Research and development expenses in 2005 increased $6 million, or 8%, reflecting

spending on new programs, and were partially offset by lower spending of $3 million, as a result

of the completion of our cancer biomarker discovery program in 2004.

Biosciences Segment

Biosciences revenues in 2005 of $800 million increased $77 million, or 11%, over 2004, which includes

an estimated impact of favorable foreign currency translation of 2%.

The following is a summary of revenues by organizational unit:

| (millions of dollars) |

2005 |

|

|

2004 |

|

Total

Change |

|

Foreign

Exchange

Impact |

|

| Immunocytometry Systems |

$ |

452 |

|

|

$ |

397 |

|

|

14 |

% |

|

3 |

% |

| Pharmingen |

|

141 |

|

|

|

136 |

|

|

4 |

% |

|

2 |

% |

| Discovery Labware |

|

207 |

|

|

|

190 |

|

|

9 |

% |

|

3 |

% |

| Total Revenues |

$ |

800 |

|

|

$ |

723 |

|

|

11 |

% |

|

3 |

% |

Revenue growth in the Immunocytometry Systems unit reflects strong sales of instruments and flow cytometry

reagents, driven by increased demand for research and clinical analyzers. Revenue growth in the Immunocytometry

Systems and Pharmingen units was adversely impacted by $1.8 million and $4.5 million, respectively,

as a result of terminating a distribution agreement in 2005. Revenue growth in the Discovery Labware

unit resulted primarily from market share gains. For 2006, we expect the full year revenue growth

for the Biosciences Segment to be about 8% to 9%, which includes an estimated unfavorable impact

of foreign currency of about 2%.

Biosciences operating income was $175 million, or 21.9% of Biosciences revenues in 2005, compared with

$156 million, or 21.6% in 2004. The increase in operating income as a percentage of revenues reflects

gross profit improvement from increased sales of products that have higher overall gross profit margins,

in particular, research instruments and reagents. See further discussion of gross profit margin improvement

below. Selling and administrative expense as a percent of Biosciences revenues in 2005 was comparable

with 2004. The favorable effects from a weaker U.S. dollar and tight controls on spending were offset

by one-time costs of $8 million incurred in connection with the termination of a distribution agreement.

Research and development expenses in 2005 increased $5 million, or 10%, reflecting spending on new

product development and advanced technology, particularly in the Immunocytometry Systems unit.

Geographic Revenues

On a geographic basis, revenues outside the United States in 2005 increased 13% to $2.8 billion. This

increase includes an estimated impact of favorable foreign currency translation of 5%. International

sales of safety-engineered devices were approximately $273 million in 2005, compared with $203 million

in 2004. Our Asia Pacific/Japan, Canada, Europe, and Latin American regions contributed double-digit

revenue growth in 2005.

Revenues in the United States in 2005 of $2.6 billion increased 6%, primarily from strong sales of

safety-engineered devices, prefilled flush syringes and diabetes care products, including BGM products.

Revenues of immunocytometry instruments and reagents also demonstrated good growth.

Gross Profit Margin

Gross profit margin was 50.8% in 2005, compared with 49.3% in 2004. Gross profit margin in the current

year included share-based compensation expense of $9.7 million, which reduced gross profit margin

by 0.2%. Gross profit margin in 2004 included BGM charges of $45 million, as discussed below,

which reduced gross profit margin by 0.9%. Gross profit margin in the current year reflected an estimated

0.6% improvement resulting from a weaker U.S. dollar, an estimated 0.6% improvement relating to increased

sales of products with higher margins, with the remaining 0.5% improvement primarily related

to productivity gains. These improvements more than offset an estimated 0.8% unfavor-able impact

of higher raw material costs and intangible asset writedowns of 0.1%. We expect gross profit margin

to improve by 30 to 40 basis points for fiscal 2006.

Operating Expenses

Selling and administrative expense (SSG&A) of $1.4 billion in 2005 was 26.8% of revenues,

compared with $1.3 billion or 26.6% of revenues, in 2004. SSG&A in 2005 included $54 million

of share-based compensation expense, which amounted to 1.0%. Aggregate expenses for 2005 reflect

base spending increases of $49 million, in line with inflation. In 2006, SSG&A as a percentage

of revenues is expected to decrease by 40 to 50 basis points.

Research and development (R&D) in 2005 was $272 million, or 5.0% of revenues, compared

with $236 million, or 4.8% of revenues, in 2004. R&D in 2005 included $6 million of share-based

compensation expense, which amounted to 0.1% of revenues. The increase in R&D expenditures also

reflects spending for new programs in each of our segments, partially offset by reduced spending

from molecular oncology diagnostics following the completion of our cancer biomarker discovery program

in the third quarter of 2004. In 2006, we expect R&D to grow about 12%.

23

Financial Review Becton, Dickinson and Company

Operating Income

Operating margin in 2005 was 19.0% of revenues, compared with 16.0% in 2004. Operating income of $1.0

billion in 2005 included $70 million of share-based compensation expense. Operating income of $787

million in 2004 included the $45 million of BGM charges and the $100 million litigation settlement,

both discussed further below.

Non-Operating Expense and Income

Interest expense was $56 million in 2005 compared with $45 million in 2004 and reflects higher interest

rates on floating rate debt and on fixed-to-floating interest rate swap transactions. Interest income

was $36 million in 2005 compared with $15 million in 2004 and reflects increased interest income

due to higher interest rates and cash balances.

Income Taxes

The effective tax rate in 2005 was 31.1% and reflected a 7.7% increase relating to the one-time charge

in the fourth quarter of 2005 attributable to the planned repatriation of earnings in 2006 under

the American Jobs Creation Act of 2004. In addition, the effective tax rate in 2005 reflected a 0.2%

benefit relating to share-based compensation and a 1.0% benefit due to the reversal of tax accruals

in connection with the conclusion of tax examinations in four non-U.S. jurisdictions. In 2004, the

effective tax rate was 22.6% and reflected a 1.0% benefit relating to the BGM charges, and a 1.5%

benefit relating to the litigation settlement. In 2006, we expect our effective tax rate to be about 26%.

Income and Diluted Earnings per

Share from Continuing Operations

Income from continuing operations and diluted earnings per share from continuing operations in 2005

were $692 million and $2.66, respectively. Share-based compensation expense and the tax repatriation

charge decreased income from continuing operations in the aggregate by $127 million and diluted earnings

per share from continuing operations by $.49 in 2005. Income from continuing operations and diluted

earnings per share from continuing operations in 2004 were $583 million and $2.21, respectively.

The BGM charges and the litigation settlement reduced income from continuing operations in the aggregate

by $91 million and diluted earnings per share from continuing operations by $.35 in 2004.

Discontinued Operations

On August 31, 2005, we completed the sale of the Clontech unit of the Biosciences segment for $62 million.

Clontechs results of operations are reported as discontinued operations for all periods presented

in the Consolidated Statements of Income. Income from discontinued operations in 2005 reflected a

gain on sale of $13 million ($29 million after taxes). The loss from discontinued operations in 2004

reflected an after-tax charge of approximately $116 million to write down the net assets of Clontech

to their estimated fair value. See Note 17 of the Notes to Consolidated Financial Statements for

additional discussion.

Financial Instrument Market Risk

We selectively use financial instruments to manage the impact of foreign exchange rate and interest

rate fluctuations on earnings. The counterparties to these contracts are highly rated financial institutions.

We do not enter into financial instruments for trading or speculative purposes.

We have foreign currency exposures throughout Europe, Asia Pacific, Canada, Japan and Latin America.

We face transactional currency exposures that arise when we enter into transactions in non-hyperinflationary

countries, generally on an intercompany basis, that are denominated in currencies other than our

functional currency. We hedge substantially all such foreign exchange exposures primarily through

the use of forward contracts and currency options. We also face currency exposure that arises from

translating the results of our worldwide operations to the U.S. dollar at exchange rates that have

fluctuated from the beginning of a reporting period. We purchase option and forward contracts to

partially protect against adverse foreign exchange rate movements. Gains or losses on our derivative

instruments are largely offset by the gains or losses on the underlying hedged transactions. For

foreign currency derivative instruments, market risk is determined by calculating the impact on fair

value of an assumed change in foreign exchange rates relative to the U.S. dollar. Fair values were

estimated based on market prices, when available, or dealer quotes. The reduction in fair value of

our purchased option contracts is limited to the options fair value. With respect to the derivative

instruments outstanding at September 30, 2005, a 10% appreciation of the U.S. dollar over a one-year

period would increase pre-tax earnings by $29 million, while a 10% depreciation of the U.S. dollar

would increase pre-tax earnings by $15 million. Comparatively, considering our derivative instruments

outstanding at September 30, 2004, a

24

Financial Review Becton, Dickinson and Company

10% appreciation of the U.S. dollar over a one-year period would have increased pre-tax earnings by

$39 million, while a 10% depreciation of the U.S. dollar would have decreased pre-tax earnings by

$6 million. These calculations do not reflect the impact of exchange gains or losses on the underlying

positions that would substantially offset the results of the derivative instruments.

Our primary interest rate exposure results from changes in short-term U.S. dollar interest rates. Our

debt and interest-bearing investments at September 30, 2005 are substantially all U.S. dollar-denominated.

Therefore, transaction and translation exposure relating to such instruments is minimal. When managing

interest rate exposures, we strive to achieve an acceptable balance between fixed and floating rate

instruments. We may enter into interest rate swaps to help maintain this balance and manage debt

and interest-bearing investments in tandem, since these items have an offsetting impact on interest

rate exposure. For interest rate derivative instruments, market risk is determined by calculating

the impact to fair value of an assumed change in interest rates across all maturities. Fair values

are estimated based on dealer quotes. A change in interest rates on short-term debt and interest-bearing

investments is assumed to impact earnings and cash flow, but not fair value because of the short

maturities of these instruments. A change in interest rates on long-term debt is assumed to impact

fair value but not earnings or cash flow because the interest on such obligations is fixed. Based

on our overall interest rate exposure at September 30, 2005 and 2004, a change of 10% in interest

rates would not have a material effect on our earnings or cash flows over a one-year period. An increase

of 10% in interest rates would decrease the fair value of our long-term debt and interest rate swaps

at September 30, 2005 and 2004 by approximately $40 million and $42 million, respectively. A 10%

decrease in interest rates would increase the fair value of our long-term debt and interest rate

swaps at September 30, 2005 and 2004 by approximately $34 million and $46 million, respectively.

Liquidity and Capital Resources

Cash Flows from Continuing Operating Activities

Cash provided by continuing operating activities, which continues to be our primary source of funds

to finance operating needs and capital expenditures, was $1.2 billion in 2005 compared with $1.1

billion in 2004.

Cash Flows from Continuing Investing Activities

Capital expenditures were $318 million in 2005, compared with $266 million in 2004. Medical capital

spending of $185 million related primarily to various capacity expansions. Diagnostics capital spending,

which totaled $100 million, included spending for various capacity expansions as well as for safety

devices. Biosciences capital spending of $22 million included spending on manufacturing capacity

expansions. In 2006, capital expenditures are expected to be in the $400 million range.

Cash Flows from Continuing Financing Activities

Net cash used for financing activities was $525 million in 2005, as

compared with $507 million in 2004 and included the repurchase of shares of

our common stock for approximately $550 million, compared to approximately

$450 million in 2004. At September 30, 2005, 4.3 million common shares remained

available for purchase under a November 2004 Board of Directors authorization

to repurchase up to 10 million common shares. For 2006, we expect that cash

used to repurchase common shares will be about $450 million. In 2005, the

Company exercised the early redemption option available under the terms of

our 8.7% Debentures, due January 15, 2025. Redemption, which is reflected

in payments of long-term debt, was for the full $100 million in outstanding

principal at a price of 103.949%. Total debt at September 30, 2005, was $1.3

billion compared with $1.2 billion at September 30, 2004. Short-term debt

increased to 16% of total debt at year-end, from 4% at the end of 2004. Floating

rate debt was 41% of total debt at the end of 2005 and 55% at the end of 2004.

Our weighted average cost of total debt at the end of 2005 was 5.3%, up from

4.3% at the end of 2004 due to higher short-term interest rates. Debt-to-capitalization

at year-end improved to 27.3% from 28.1% last year. Cash and equivalents were

$1,043 million and $719 million at September 30, 2005 and 2004, respectively.

We have in place a commercial paper borrowing program that is available to meet our short-term financing

needs, including working capital requirements. Borrowings outstanding under this program were $200

million at September 30, 2005. We maintain a syndicated credit facility totaling $900 million in

order to provide backup support for our commercial paper program and for other general corporate

purposes. This credit facility expires in August 2009 and includes a single financial

25

Financial Review Becton, Dickinson and Company

covenant that requires BD to maintain an interest expense coverage ratio (ratio of earnings before

income taxes, depreciation and amortization to interest expense) of not less than 5-to-1 for the

most recent four consecutive fiscal quarters. On the last eight measurement dates, this ratio had

ranged from 18-to-1 to 21-to-1. The facility, under which there were no borrowings outstanding at

September 30, 2005, can be used to support the commercial paper program or for general corporate

purposes. In addition, we have informal lines of credit outside the United States.

At September 30, 2005, our long-term debt was rated A2 by Moodys and A+

by Standard and Poors, and our commercial paper ratings were P-1 by Moodys

and A-1 by Standard and Poors. Given the availability of the various credit facilities

and our strong credit ratings, we continue to have a high degree of confidence in our ability to

refinance maturing short-term and long-term debt, as well as to incur substantial additional debt,

if required.

BDs ability to generate cash flow from operations, issue debt, enter into other financing arrangements

and attract long-term capital on acceptable terms could be adversely affected in the event there

was a material decline in the demand for BDs products, deterioration in BDs key financial

ratios or credit ratings or other significantly unfavorable changes in conditions. While a deterioration

in the Companys credit ratings would increase the costs associated with maintaining and borrowing

under its existing credit arrangements, such a downgrade would not affect the Companys ability

to draw on these credit facilities, nor would it result in an acceleration of the scheduled maturities

of any outstanding debt.

The American Jobs Creation Act of 2004 (the AJCA) was signed into law in October 2004.

The AJCA creates a temporary incentive for U.S. multinationals to repatriate accumulated income earned

outside the United States. As a result of the passage of the AJCA, we revisited our policy of indefinite

reinvestment of foreign earnings and determined that we will repatriate approximately $1.3 billion

in fiscal 2006. As a result, we recorded a one-time tax charge of $77 million in the fourth quarter

of 2005 attributable to the planned repatriation of these earnings. Uses of the repatriated funds

include cash expenditures for compensation and benefits to existing and newly hired U.S. workers,

U.S. infrastructure and capital investments and other activities as permitted under the AJCA.

Contractual Obligations

In the normal course of business, we enter into contracts and commitments that obligate us to make

payments in the future. The table below sets forth BDs significant contractual obligations

and related scheduled payments:

| (millions of dollars) |

Total |

|

2006 |

|

2007

to 2008 |

|

2009

to 2010 |

|

2011 and

Thereafter |

|

| Short-term debt |

$ |

207 |

|

$ |

207 |

|

$ |

|

|

$ |

|

|

$ |

|

|

| Long-term debt(A) |

|

1,819 |

|

|

60 |

|

|

208 |

|

|

307 |

|

|

1,244 |

|

| Operating leases |

|

142 |

|

|

42 |

|

|

59 |

|

|

26 |

|

|

15 |

|

| Purchase obligations(B) |

|

216 |

|

|

183 |

|

|

28 |

|

|

5 |

|

|

|

|

| Total(C) |

$ |

2,384 |

|

$ |

492 |

|

$ |

295 |

|

$ |

338 |

|

$ |

1,259 |

|

| |

|

| (A) |

Long-term debt obligations include expected principal and interest obligations, including interest rate swaps. The interest rate forward curve at September 30, 2005 was used to compute the amount of the contractual obligation for variable rate debt instruments and swaps. |

| |

|

| (B) |

Purchase obligations are for purchases made in the normal course of business to meet operational and capital requirements. |

| |

|

| (C) |

Required funding obligations for 2006 relating to pension plans are not expected to be material. |

2004 Compared With 2003

Worldwide revenues in 2004 were $4.9 billion, an increase of 11% over 2003, and included the estimated

favorable impact of foreign currency translation of 5%. The remainder of the growth resulted primarily

from volume increases in all segments.

Medical Segment

Medical revenues in 2004 of $2.7 billion increased 9% over 2003, which includes an estimated impact

of favorable foreign currency translation of 5%.

The following is a summary of revenues by organizational unit:

| (millions of dollars) |

2004 |

|

2003 |

|

Total

Change |

|

Foreign

Exchange

Impact |

|

| Medical Surgical Systems |

$ |

1,541 |

|

$ |

1,426 |

|

|

8 |

% |

|

4 |

% |

| Diabetes Care |

|

586 |

|

|

542 |

|

|

8 |

% |

|

4 |

% |

| Pharmaceutical Systems |

|

497 |

|

|

436 |

|

|

14 |

% |

|

9 |

% |

| Ophthalmic Systems |

|

56 |

|

|

53 |

|

|

6 |

% |

|

6 |

% |

| Total Revenues |

$ |

2,680 |

|

$ |

2,457 |

|

|

9 |

% |

|

5 |

% |

26

Financial Review Becton, Dickinson and Company

Revenue growth in the Medical Surgical Systems unit of this segment included U.S. safety-engineered

product sales of $459 million compared with $412 million in 2003. Revenue growth in the Diabetes

Care unit included sales of BGM meters, test strips, and related disposables in the United States

and Canada of $42 million compared with $15 million in 2003. Growth in the Diabetes Care unit was

negatively affected by the decline in the home healthcare product area. Revenue growth in the Pharmaceutical

Systems unit reflects the adverse impact of customer buying patterns to support product launches

in 2003. Revenue growth in the Medical Surgical Systems unit and Pharmaceutical Systems unit reflected

lower sales of BD Bifurcated Needles used in the administration of smallpox vaccines, which were $2 million and $26

million in 2004 and 2003, respectively.

Medical operating income was $567 million in 2004, which included $45 million of BGM charges, as discussed

further below, compared with $556 million in 2003. Medical operating income in 2004 also reflected

gross profit margin improvement resulting from the continued conversion to safety-engineered devices

from conventional products and $15 million of benefits of the 2002 manufacturing restructuring program,

partially offset by higher research and development spending to support several new product initiatives.

Diagnostics Segment

Diagnostics revenues in 2004 of $1.5 billion increased 12% over 2003, which includes an estimated impact

of favorable foreign currency translation of 4%.

The following is a summary of revenues by organizational unit:

| (millions of dollars) |

2004 |

|

2003 |

|

Total

Change |

|

Foreign

Exchange

Impact |

|

| Preanalytical Systems |

$ |

788 |

|

$ |

707 |

|

|

11 |

% |

|

4 |

% |

| Diagnostic Systems |

|

744 |

|

|

667 |

|

|

12 |

% |

|

4 |

% |

| Total Revenues |

$ |

1,532 |

|

$ |

1,374 |

|

|

12 |

% |

|

4 |

% |

Revenues in the Preanalytical Systems unit included U.S. safety-engineered device sales of $317 million

compared with $272 million in 2003. Revenues in the Diagnostic Systems unit reflected strong worldwide

sales of its respiratory and flu diagnostic tests in Japan and the United States over 2003. This

unit also experienced strong worldwide sales of its molecular

diagnostic platform, BD ProbeTec ET, which reported incremental sales of $18 million over 2003, and good worldwide performance

in the more traditional infectious disease categories.

Diagnostics operating income was $359 million in 2004 compared with $302 million in 2003. This increase

primarily reflected gross profit margin improvement resulting from increased sales of products that

have higher overall gross profit margins, including safety-engineered products and the BD ProbeTec ET platform.

Biosciences Segment

Biosciences revenues in 2004 of $723 million increased 14% over 2003, which includes an estimated impact

of favorable foreign currency translation of 5%.

The following is a summary of revenues by organizational unit:

|

|

|

|

|

|

|

|

|

|

| (millions of dollars) |

2004 |

|

2003 |

|

Total

Change |

|

Foreign

Exchange

Impact |

|

| Immunocytometry Systems |

$ |

397 |

|

$ |

332 |

|

|

20 |

% |

|

6 |

% |

| Pharmingen |

|

136 |

|

|

121 |

|

|

12 |

% |

|

5 |

% |

| Discovery Labware |

|

190 |

|

|

180 |

|

|

6 |

% |

|

4 |

% |

| Total Revenues |

$ |

723 |

|

$ |

633 |

|

|

14 |

% |

|

5 |

% |

Revenue growth in the Immunocytometry Systems unit was driven by sales of the newly introduced BD FACSCanto and BD FACSArray analyzers and continued strong market acceptance of the BD FACSAria cell sorter, as well as strong growth of cell analysis reagents.

Biosciences operating income was $156 million in 2004 compared with $101 million in 2003, which included

non-cash charges of $27 million, as discussed below. Biosciences 2004 operating income reflected

sales growth resulting from new instrument introductions and increased sales of cell analysis reagents.

Geographic Revenues

On a geographic basis, revenues outside the United States in 2004 increased 15% over 2003 to $2.5 billion.

This increase includes an estimated impact of favorable foreign currency translation of 9%. International

sales of safety-engineered devices were approximately $200 million in 2004. International sales growth

was led by strong sales of immunocytometry systems reagents and instruments as well as prefillable

syringes in Europe. Also contributing to the growth were strong sales of respiratory and flu diagnostic

tests in the Diagnostic Systems unit in Japan.

27

Financial Review Becton, Dickinson and Company

Revenues in the United States in 2004 of $2.4 billion increased 6% over 2003, primarily from strong

sales of safety-engineered devices and prefillable syringes. Sales in the Diabetes Care unit included

$40 million related to BGM meters, test strips and related disposables. The Diagnostic Systems unit

reported incremental sales of $10 million over 2003 of the BD ProbeTec ET in the United States.

BGM Charges

We recorded a pre-tax charge of $45 million to Cost of prod-ucts sold in 2004 related to our BGM products.

The charge included a reserve of $6 million in connection with the voluntary product recall of certain

lots of BGM test strips and the write-off of $30 million of certain test strip inventories. In addition,

the charge reflected our decision to focus sales and marketing efforts on the BD Logic and Paradigm Link® blood glucose meters in the United States and to discontinue support of the BD Latitude system product offering in the United States, which decision resulted in a write-off of $9 million

of related blood glucose meters and fixed assets. See Note 19 of the Notes to Consolidated Financial

Statements for further discussion.

Non-Cash Charges

We recorded non-cash charges of $27 million in 2003 in Cost of products sold. These charges resulted

from the decision to discontinue the development of certain products and product applications associated

with the BD IMAGN instrument platform in the Biosciences segment. As a result, we recorded an impairment charge of $27

million for the related intangible assets and inventory. See Note 3 of the Notes to Consolidated

Financial Statements for further discussion.

Gross Profit Margin

Gross profit margin was 49.3% in 2004, which included $45 million of BGM charges, compared with 48.5%

in 2003, which included $27 million of non-cash charges. Gross profit margin primarily reflected

increased sales of products with higher gross profit margins, including safety-engineered products,

BGM products and the BD ProbeTec ET instrument platform. In addition, gross profit margin benefited from approximately $15 million

of savings achieved from the 2002 Medical restructuring plan.

Operating Expenses

SSG&A expense of $1.3 billion in 2004 was 26.6% of revenues, compared to $1.2 billion in 2003,

or 26.5% of revenues. This increase was primarily the result of increased investment in various strategic

initiatives, in particular, blood glucose monitoring products, as well as a weaker U.S. dollar.

R&D in 2004 was $236 million, or 4.8% of revenues, compared with $224 million, or 5% of revenues,

in 2003. Substantially all R&D efforts are in the United States and therefore are not impacted

by foreign currency translation. However, the revenue increase attributable to foreign currency translation

had the effect of decreasing R&D expenses as a percentage of sales.

The litigation settlement of $100 million in 2004, as discussed in Note 16 of the Notes to Consolidated

Financial Statements, related to the pre-tax charge to record the settlement of the litigation brought

by Retractable Technologies, Inc.

Non-Operating Expense and Income

Interest expense was $45 million in 2004, compared with $43 million in 2003. Interest income was $15

million in 2004, compared with $7 million in 2003. This increase was due primarily to interest income

arising from tax refunds received in connection with the conclusion of certain tax examinations during

2004, as well as higher levels of interest-bearing investments.

Income Taxes

The effective tax rate in 2004 was 22.6%, and reflected a 1% benefit relating to the BGM charges and

a 1.5% benefit relating to the litigation settlement. The effective tax rate in 2003 was 23.1%, which

included the impact from the 2003 non-cash charges.

Income and Diluted Earnings per Share

from Continuing Operations

Income from continuing operations and diluted earnings per share from continuing operations in 2004

were $583 million and $2.21, respectively, and included the impact of the BGM charges and litigation

settlement in 2004, which reduced income from continuing operations in the aggregate by $91 million

and diluted earnings per share from continuing operations in 2004 by $.35. Income from continuing

operations and diluted earnings per share from continuing operations in 2003 were $555 million and

$2.10, respectively. Non-cash charges in 2003 reduced income from continuing operations by $16 million

and diluted earnings per share from continuing operations in 2003 by $.06.

28

Financial Review Becton, Dickinson and Company

Liquidity and Capital Resources

Cash Flows from Continuing Operating Activities

Cash provided by continuing operations was $1.1 billion in 2004, compared to $903 million in 2003.

Cash Flows from Continuing Investing Activities

Capital expenditures were $266 million in 2004, compared to $259 million in 2003. Medical and Diagnostics

capital spending, which totaled $159 million and $80 million, respectively, in 2004, included spending

for various capacity expansions as well as for safety devices. Biosciences capital spending, which

totaled $17 million in 2004, included spending on manufacturing capacity expansions.

In the fourth quarter of 2004, we spent approximately $24 million, net of cash acquired, to purchase

Atto Bioscience, Inc. See Note 5 of the Notes to Consolidated Financial Statements for additional

discussion.

Cash Flows from Continuing Financing Activities

Net cash used for financing activities was $507 million in 2004, as compared with $289 million during

2003, and included the repurchase of shares of our common stock for approximately $450 million, compared

with approximately $350 million in 2003. Total debt at September 30, 2004, was $1.2 billion compared

with $1.3 billion at September 30, 2003. Short-term debt declined to 4% of total debt at the end

of 2004, from 9% at the end of 2003. Floating rate debt was 55% of total debt at the end of both

2004 and 2003. Our weighted average cost of total debt at the end of 2004 was 4.3%, up from 3.8%

at the end of 2003 due to higher short-term interest rates. Debt-to-capitalization at September 30,

2004 improved to 28.1% from 30.5% in 2003. Cash and equivalents were $719 million and $520 million

at September 30, 2004 and 2003, respectively.

Critical Accounting Policies

The preparation of the consolidated financial statements requires management to use estimates and assumptions

that affect the reported amounts of assets, liabilities, revenues and expenses, as well as the disclosure

of contingent assets and liabilities at the date of the consolidated financial statements. Some of

those judgments can be subjective and complex and consequently, actual results could differ from

those estimates. Management bases its estimates and judgments on historical experience and on various

other factors that are believed to be

reasonable under the circumstances, the results of which form

the basis for making judgments about the carrying values of assets and liabilities that are not readily

apparent from other sources. For any given estimate or assumption made by management, there may also

be other estimates or assumptions that are reasonable. However, we believe that given the current

facts and circumstances, it is unlikely that applying any such alternative judgments would materially

impact our consolidated financial statements. Management believes the following critical accounting

policies reflect the more significant judgments and estimates used in the preparation of the consolidated

financial statements.

Revenue Recognition

Revenue from product sales is recognized when title and riskof loss pass to the customer. We recognize

revenue for certain instruments sold from the Biosciences segment upon installation at a customers

site. Based upon terms of the sales agreements, the Biosciences segment recognizes revenue in accordance

with Emerging Issues Task Force No. 00-21, Revenue Arrangements with Multiple Deliverables. These sales agreements have multiple deliverables, and as such are divided into separate units of

accounting. Revenue is recognized upon the completion of each deliverable based on the relative fair

values of items delivered.

BDs domestic businesses sell products primarily to distributors who resell the products to end-user

customers. We provide rebates to distributors that sell to end-user customers at prices determined

under a contract between BD and the end-user customer. Provisions for rebates, as well as sales discounts

and returns, are accounted for as a reduction of revenues when revenue is recognized.

Impairment of Assets

Pursuant to SFAS No. 142, Goodwill and Other Intangible Assets, goodwill and indefinite-lived

intangible assets are subject to impairment reviews at least annually, or whenever indicators of

impairment arise. Intangible assets other than goodwill and indefinite-lived intangible assets and

other long-lived assets are reviewed for impairment in accordance with SFAS No. 144, Accounting

for the Impairment or Disposal of Long-Lived Assets. Impairment reviews are based on a cash

flow approach that requires significant management judgment with respect to future volume, revenue

and expense growth rates, changes in working capital use, appropriate discount rates and other assumptions

and estimates. The estimates and assumptions used are consistent with BDs business plans. The

use of alternative estimates and assumptions could increase or decrease the estimated fair value

of the asset, and potentially result in different impacts to BDs results of operations. Actual

results may differ from managements estimates.

29

Financial Review Becton, Dickinson and Company

Investments

We hold equity interests in companies having operations or technology in areas within or adjacent to

BDs strategic focus. For some of these companies that are publicly traded, market prices are

available. However, for those companies that are not publicly traded, fair value is difficult to

determine. We write down an investment when management believes an investment has experienced a decline

in value that is other than temporary. Future adverse changes in market conditions or poor operating

results of the underlying investments could result in an inability to recover the carrying value

of the investments, thereby possibly requiring impairment charges in the future.

Tax Valuation Allowances

BD maintains valuation allowances where it is more likely than not that all or a portion of a deferred

tax asset will not be realized. Changes in valuation allowances are included in our tax provision

in the period of change. In determining whether a valuation allowance is warranted, management evaluates

factors such as prior earnings history, expected future earnings, carry-back and carry-forward periods,

and tax strategies that could potentially enhance the likelihood of realization of a deferred tax

asset.

Contingencies

We are involved, both as a plaintiff and a defendant, in various legal proceedings that arise in the

ordinary course of business, including, without limitation, product liability and environmental matters,

as further discussed in Note 12 of the Notes to Consolidated Financial Statements. We assess the

likelihood of any adverse judgments or outcomes to these matters as well as potential ranges of probable

losses. In accordance with U.S. generally accepted accounting principles, we establish accruals to

the extent probable future losses are estimable (in the case of environmental matters, without considering

possible third-party recoveries). A determination of the amount of accruals, if any, for these contingencies

is made after careful analysis of each individual issue and, when appropriate, is developed after

consultation with outside counsel. The accruals may change in the future due to new developments

in each matter or changes in our strategy in dealing with these matters.

Given the uncertain nature of litigation generally, we are not able in all cases to estimate the amount

or range of loss that could result from an unfavorable outcome of the litigation to which we are

a party. In view of these uncertainties, we could incur charges in excess of any currently established

accruals and, to the extent available, excess liability insurance.

Accordingly, in the opinion of

management, any such future charges, individually or in the aggregate, could have a material adverse

effect on BDs consolidated results of operations and consolidated net cash flows in the period

or periods in which they are recorded or paid.

Benefit Plans

We have significant net pension and postretirement benefit costs that are measured using actuarial

valuations. Inherent in these valuations are key assumptions including discount rates and expected

return on plan assets. We evaluate these key assumptions at least annually on a plan- and country-specific

basis. We consider current market conditions, including changes in interest rates and market returns,

in selecting these assumptions. Changes in the related net pension and postretirement benefits costs

may occur in the future due to changes in assumptions.

The discount rate is selected to reflect the prevailing market rate on September 30 based on investment

grade bonds and other factors. We reduced our discount rate for the U.S. pension and postretirement

plans at September 30, 2005 from 6.0% to 5.50% and at September 30, 2004 from 6.25% to 6.0%.

To determine the expected long-term rate of return on pension plan assets, we consider the historical

and expected returns on various plan asset classes, as well as current and expected asset allocations.

At September 30, 2005, the one-year rate of return on assets for our U.S. pension plans was 12.8%,

the five-year rate of return was 3.2%, and the ten-year rate of return was 8.3%. We believe that

these results, in connection with our current and expected asset allocation, support our assumed

long-term return of 8.0% on those assets.

Sensitivity to changes in key assumptions for our U.S. pension and postretirement plans are as follows:

| |

Discount rateA change of plus (minus) 25 basis points, with other assumptions held constant,

would have an estimated $7 million favorable (unfavorable) impact on the total U.S. net pension and

postretirement benefit plan cost. |

| |

Expected return on plan assetsA change of plus (minus) 25 basis points, with other assumptions

held constant, would have an estimated $2 million favorable (unfavorable) impact on U.S. pension

plan cost. |

Stock-Based Compensation

Effective October 1, 2004, we adopted SFAS No. 123(R). This statement requires compensation cost relating

to share-based payment transactions to be recognized in net income using a fair-value measurement

method.

30

Financial Review Becton, Dickinson and Company

Prior to October 1, 2004, we accounted for stock options using the intrinsic value method. This method

measures share-based compensation expense as the amount by which the market price of the stock on

the date of grant exceeds the exercise price. We had not recognized any share-based compensation

expense under this method in recent years because we granted stock options at the market price as

of the date of grant.

See discussion in Note 13 of the Notes to Consolidated Financial Statements concerning the Companys

methodology for determining fair value for its share-based awards.

Cautionary Statement Pursuant to Private Securities Litigation Reform Act of 1995Safe Harbor for Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 (the Act) provides a safe harbor for

forward-looking statements made by or on behalf of BD. BD and its representatives may from time to

time make certain forward-looking statements in publicly released materials, both written and oral,

including statements contained in this report and filings with the Securities and Exchange Commission

and in our other reports to shareholders. Forward-looking statements may be identified by the use

of words like plan, expect, believe, intend, will,

anticipate, estimate and other words of similar meaning in conjunction with,

among other things, discussions of future operations and financial performance, as well as our strategy

for growth, product development, regulatory approvals, market position and expenditures. All statements

that address operating performance or events or developments that we expect or anticipate will occur

in the futureincluding statements relating to volume growth, sales and earnings per share growth

and statements expressing views about future operating resultsare forward-looking statements

within the meaning of the Act.

Forward-looking statements are based on current expectations of future events. The forward-looking

statements are and will be based on managements then-current views and assumptions regarding

future events and operating performance, and speak only as of their dates. Investors should realize