EX-99.7

Published on October 6, 2014

Exhibit 99.7

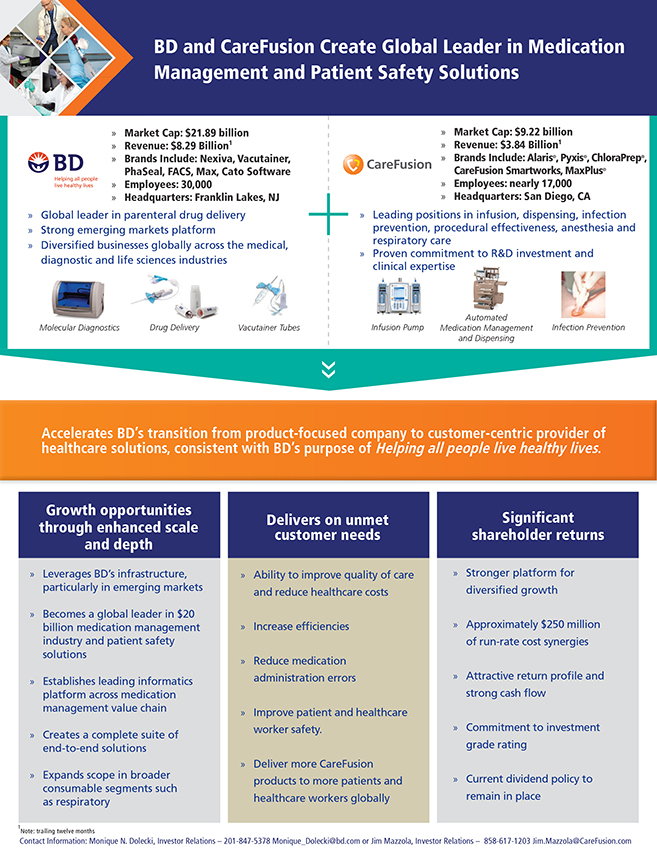

BD and CareFusion Create Global Leader in Medication Management and Patient Safety Solutions

» Market Cap: $21.89 billion

» Revenue: $8.29 Billion1

» Brands Include: Nexiva, Vacutainer, PhaSeal, FACS, Max, Cato Software

»

Employees: 30,000

» Headquarters: Franklin Lakes, NJ

CareFusion

+I

» Market Cap: $9.22 billion

» Revenue: $3.84 Billion1

» Brands Include: Alaris®, Pyxis®,

ChloraPrep®, Carefusion Smartworks, MaxPius®

» Employees: nearly 17,000

» Headquarters: San Diego, CA

» Global leader in parenteral drug delivery

» Strong emerging markets platform

» Diversified businesses

globally across the medical, diagnostic and life sciences industries

» Leading positions in infusion, dispensing, infection

prevention, procedural effectiveness, anesthesia and respiratory care

» Proven

commitment to R&D investment and

clinical expertise

Molecular Diagnostics

Drug Delivery

Vacutainer Tubes

Automated

Infusion Pump Medication Management

and Dispensing

Infection Prevention

Accelerates BDs transition from product-focused company to

customer-centric provider of healthcare solutions, consistent with BDs. purpose of helping all people live healthy lives

Growth opportunities through

enhanced scale and depth

» Leverages BDs infrastructure, particularly in emerging markets

» Becomes a global leader in $20 billion medication management industry and patient safety solutions

» Establishes leading informatics platform across medication management value chain

» Creates a complete suite of end-to-end solutions

» Expands

scope in broader consumable segments such

as respiratory

Delivers on unmet

customer needs

» Ability to improve quality of care and reduce healthcare costs

» Increase efficiencies

» Reduce medication administration errors

» Improve patient and healthcare worker safety.

» Deliver more CareFusion products

to more patients and

healthcare workers globally

» Stronger platform

for diversified growth

» Approximately $250 million of annual run-rate cost synergies

» Attractive return profile and strong cash flow

» Commitment to investment grade

rating

» Current dividend policy to remain in place

Note: trailing

twelve months

Contact Information: Monique N. Dolecki, Investor Relations- 201-847-5378 Monique_Dolecki@bd.com or Jim Mazzola, Investor Relations- 858-617-1203

Jim.Mazzola@CareFusion.com

Significant shareholder returns

Forward Looking Statements

This fact sheet

contains certain estimates and other forward-looking statements (as defined under Federal securities laws). Forward looking statements generally are accompanied by words such as will, expect, outlook or other

similar words, phrases or expressions. These forward-looking statements include statements regarding the estimated or anticipated future results of BD, and of the combined company following BDs proposed acquisition of CareFusion, the

anticipated benefits of the proposed combination, including estimated synergies, the expected timing of completion of the transaction and other statements that are not historical facts. These statements are based on the current expectations of BD

and CareFusion management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties regarding BD and CareFusions respective businesses and the proposed acquisition, and actual results

may differ materially. These risks and uncertainties include, but are not limited to, the ability of the parties to successfully close the proposed acquisition, including the risk that the required regulatory approvals are not obtained, are delayed

or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the transaction; risks relating to the integration of CareFusions operations, products and employees into BD and the

possibility that

the anticipated synergies and other benefits of the proposed acquisition will not be realized or will not be realized within the expected

timeframe; the outcome of any legal proceedings related to the proposed merger; access to available financing for the refinancing of BDs or CareFusions debt on a timely basis and reasonable terms; the ability to market and sell

CareFusions products in new markets, including the ability to obtain necessary regulatory product registrations and clearances; the loss of key senior management or other associates; the anticipated demand for BDs and CareFusions

products, including the risk of future reductions in government health-care funding, changes in reimbursement rates or changes in healthcare practices that could result in lower utilization rates or pricing pressures; the impact of competition in

the medical device industry; the risks of fluctuations in interest or foreign currency exchange rates; product liability claims; difficulties inherent in product development, including the timing or outcome of product development efforts, the

ability to obtain regulatory approvals and clearances and the timing and market success of product launches; risks relating to fluctuations in the cost and availability of raw materials and other sourced products and the ability to maintain

favorable supplier arrangements and relationships; successful compliance with governmental regulations applicable to BD, CareFusion and the combined company; changes in regional, national or foreign economic conditions; uncertainties of litigation,

as well as other factors discussed in BDs and CareFusions respective filings with the Securities Exchange Commission. BD and CareFusion do not intend to update any forward-looking statements to reflect events or circumstances after the

date hereof, except as required by applicable laws or regulations.

Important Information for Investors

In connection with the proposed transaction, BD will file with the SEC a registration statement on Form S-4 that will constitute a pro- spectus of BD and include a proxy statement

of CareFusion. BD and CareFusion also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY

BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the proxy statement/prospectus (if and when it becomes available) and other relevant documents filed

by BD and CareFusion with the SEC at the SECs website at www.sec.gov. In addition, you will be able to obtain free copies of these documents by phone, email or written

request by contacting the investor relations department of BD or CareFusion at the following: Monique N. Dolecki, Investor Relations 201-847-5378 Monique_Dolecki@bd.com or Jim Mazzola, Investor Relations 858-617-1203

Jim.Mazzola@CareFusion.com.

Participants in the Solicitation

BD and CareFusion and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of

proxies in respect of the proposed transaction. Information about BDs directors and executive officers is available in BDs proxy statement dated December 19, 2013 for its 2014 Annual Meeting of Shareholders and in subsequent SEC

filings. Information about CareFusions directors and executive officers is available in CareFusions proxy statement dated September 25, 2014, for its 2014 Annual Meeting of Stockholders. Other information regarding the participants

in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the merger

when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from BD or CareFusion as indicated

above. This fact sheet shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.