EX-99.2

Published on April 24, 2017

WE BELIEVE We have a POWERFUL OPPORTUNITY to make healthcare BETTER TOGETHER. April 24, 2017 Exhibit 99.2

IMPORTANT INFORMATION FOR INVESTORS In connection with the proposed transaction, Becton Dickinson and Company (“BD”) will file with the SEC a registration statement on Form S−4 that will constitute a prospectus of BD and include a proxy statement of C.R. Bard, Inc. (“Bard”). BD and Bard also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by BD and Bard with the SEC at the SEC’s website at www.sec.gov. In addition, you will be able to obtain free copies of these documents by phone, e−mail or written request by contacting the investor relations department of BD or Bard at the following: Becton, Dickinson and Company C.R. Bard, Inc. 1 Becton Drive730 Central Avenue Franklin Lakes, New Jersey 07417Murray Hill, New Jersey 07974 Attn: Investor RelationsAttn: Investor Relations 1-(800)-284-68451-(800)-367-2273 PARTICIPANTS IN THE SOLICITATION BD and Bard and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about BD’s directors and executive officers is available in BD’s proxy statement dated December 15, 2016, for its 2017 Annual Meeting of Shareholders. Information about Bard’s directors and executive officers is available in Bard’s proxy statement dated March 15, 2017, for its 2017 Annual Meeting of Stockholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the acquisition when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from BD or Bard as indicated above. This slide presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

This slide presentation contains certain estimates and other "forward-looking statements" within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward looking statements generally are accompanied by words such as “will”, "expect", "outlook" “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” or other similar words, phrases or expressions and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements regarding the estimated or anticipated future results of BD, and of the combined company following BD’s proposed acquisition of Bard, the anticipated benefits of the proposed combination, including estimated synergies, the expected timing of completion of the transaction and other statements that are not historical facts. These statements are based on the current expectations of BD and Bard management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties regarding BD and Bard’s respective businesses and the proposed acquisition, and actual results may differ materially. These risks and uncertainties include, but are not limited to, (i) the ability of the parties to successfully complete the proposed acquisition on anticipated terms and timing, including obtaining required shareholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the new combined company’s operations and other conditions to the completion of the acquisition, (ii) risks relating to the integration of Bard’s operations, products and employees into BD and the possibility that the anticipated synergies and other benefits of the proposed acquisition will not be realized or will not be realized within the expected timeframe, (iii) the outcome of any legal proceedings related to the proposed acquisition, (iv) access to available financing for the refinancing of BD’s or Bard’s debt on a timely basis and reasonable terms, (v) the ability to market and sell Bard’s products in new markets, including the ability to obtain necessary regulatory product registrations and clearances, (vi) the loss of key senior management or other associates; the anticipated demand for BD’s and Bard’s products, including the risk of future reductions in government healthcare funding, changes in reimbursement rates or changes in healthcare practices that could result in lower utilization rates or pricing pressures, (vii) the impact of competition in the medical device industry, (viii) the risks of fluctuations in interest or foreign currency exchange rates, (ix) product liability claims, (x) difficulties inherent in product development, including the timing or outcome of product development efforts, the ability to obtain regulatory approvals and clearances and the timing and market success of product launches, (xi) risks relating to fluctuations in the cost and availability of raw materials and other sourced products and the ability to maintain favorable supplier arrangements and relationships, (xii) successful compliance with governmental regulations applicable to BD, Bard and the combined company, (xiii) changes in regional, national or foreign economic conditions, (xiv) uncertainties of litigation, and (xv) other factors discussed in BD’s and Bard’s respective filings with the Securities Exchange Commission. The forward-looking statements in this document speak only as of date of this document. BD and Bard undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date hereof, except as required by applicable laws or regulations.

Speakers on today’s call 1 Vince Forlenza Chairman & CEO Becton, Dickinson & Co. Tim Ring Chairman & CEO C.R. Bard, Inc. Christopher Reidy EVP, CFO and CAO Becton, Dickinson & Co.

Accelerating and broadening BD’s strategy There are clear strategic benefits of a combination: ~$16 billion in combined annualized revenues Increases BD’s addressable opportunity by $20B 65,000 employees worldwide Presence in almost every country around the world Better Together: A Dynamic and Differentiated Company Advances the strategies of both companies and accelerates end-to-end medication management and infection prevention 1 Creates new growth opportunities across a range of clinically impactful segments 2 Leverages BD’s leading global capabilities and creates new opportunities around the world to benefit from the combined company’s product technology 3

1 BD is a Company with a compelling mission, strong values and a track record of success Key highlights from Bard’s perspective 2 Our strategy has been focused on specific clinical improvements and therapy innovations 3 Combination offers: Unmatched solutions for customers and their patients Leading portfolio of solutions across continuum of care New growth opportunities 4 Unique value creation for shareholders 5 We would like to recognize the hard work of all Bard employees, which created a world-class company

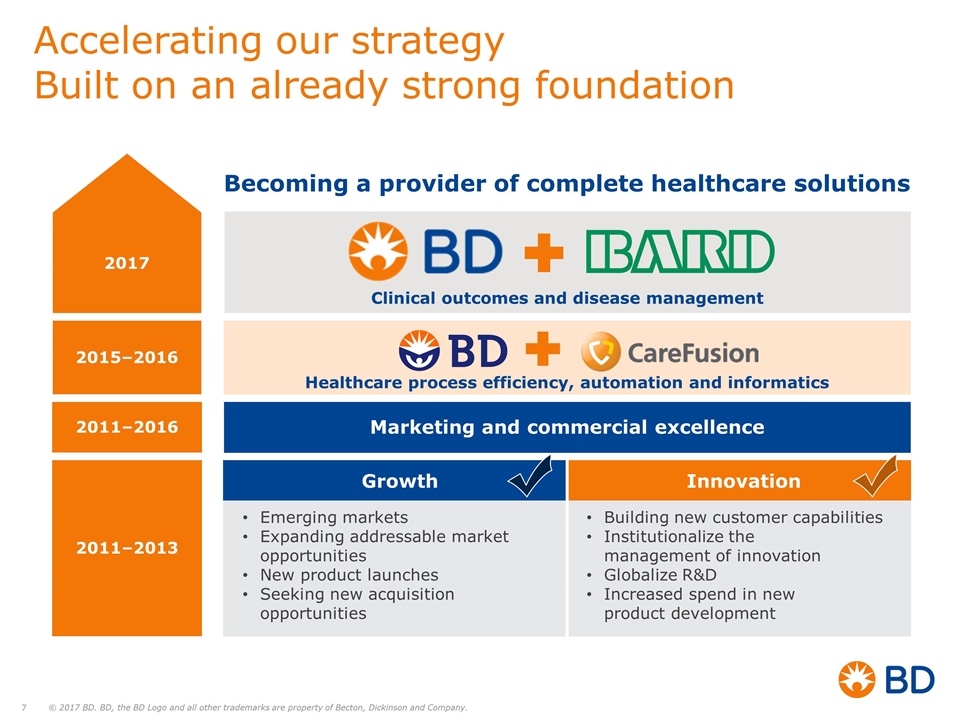

Clinical outcomes and disease management Accelerating our strategy Built on an already strong foundation Growth Innovation Emerging markets Expanding addressable market opportunities New product launches Seeking new acquisition opportunities Building new customer capabilities Institutionalize the management of innovation Globalize R&D Increased spend in new product development Marketing and commercial excellence Healthcare process efficiency, automation and informatics Becoming a provider of complete healthcare solutions 2017 2011–2013 2011–2016 2015–2016

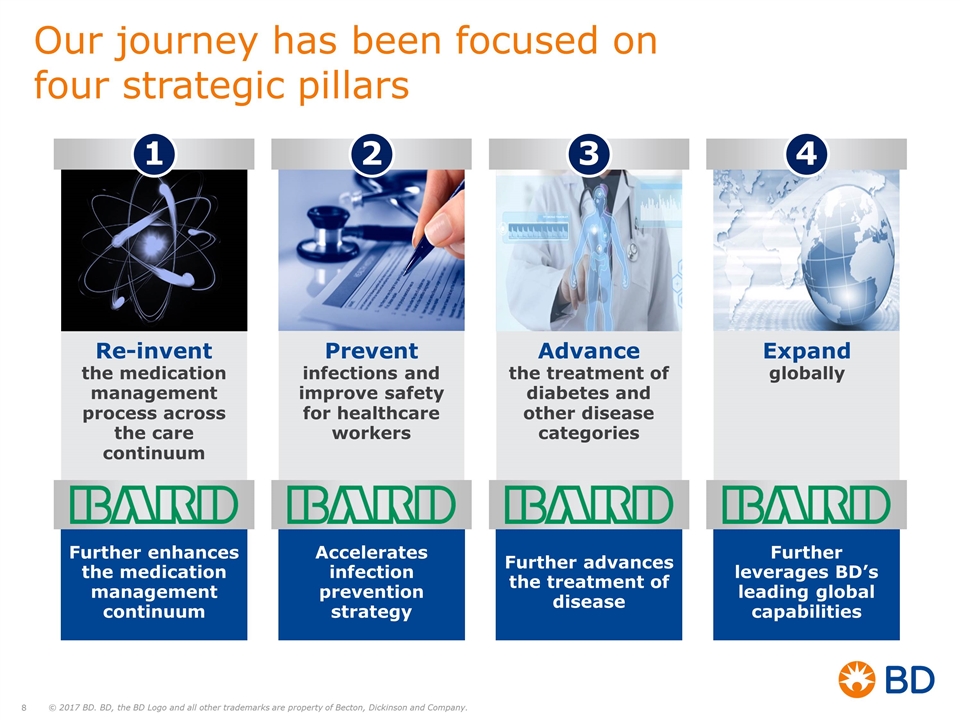

Our journey has been focused on four strategic pillars Re-invent the medication management process across the care continuum 1 Prevent infections and improve safety for healthcare workers 2 Advance the treatment of diabetes and other disease categories 3 Expand globally 4 Further enhances the medication management continuum Accelerates infection prevention strategy Further advances the treatment of disease Further leverages BD’s leading global capabilities

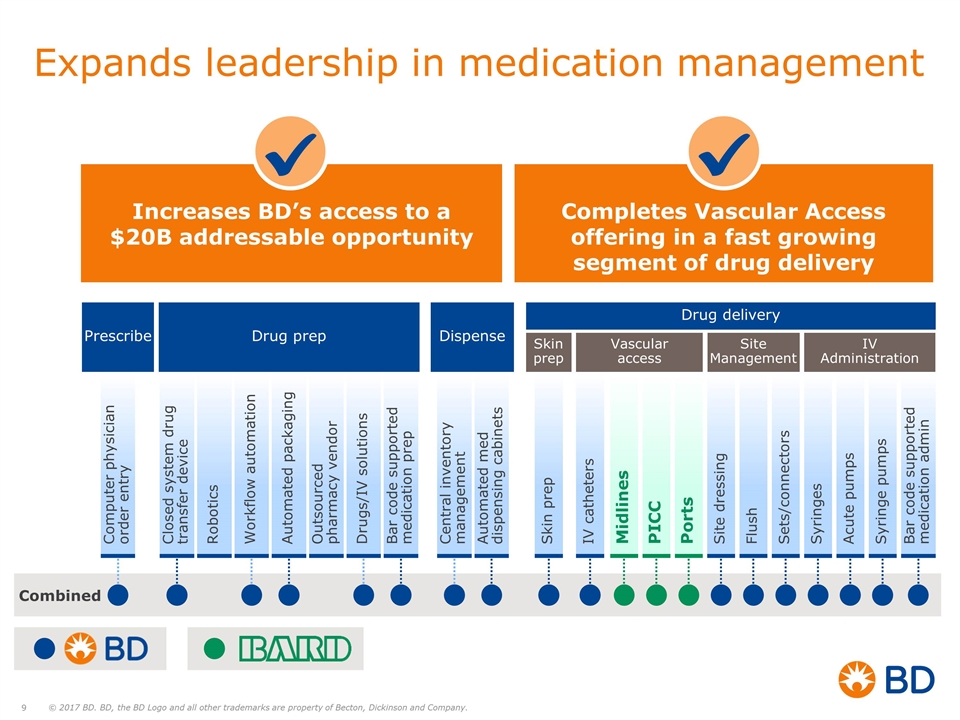

Increases BD’s access to a $20B addressable opportunity Completes Vascular Access offering in a fast growing segment of drug delivery Expands leadership in medication management Combined Prescribe Drug prep Drug delivery Dispense Skin prep Vascular access Site Management IV Administration Computer physician order entry Closed system drug transfer device Workflow automation Automated packaging Outsourced pharmacy vendor Bar code supported medication prep Robotics Drugs/IV solutions Central inventory management Automated med dispensing cabinets Skin prep Midlines PICC Ports Sets/connectors Syringes IV catheters Flush Site dressing Acute pumps Syringe pumps Bar code supported medication admin

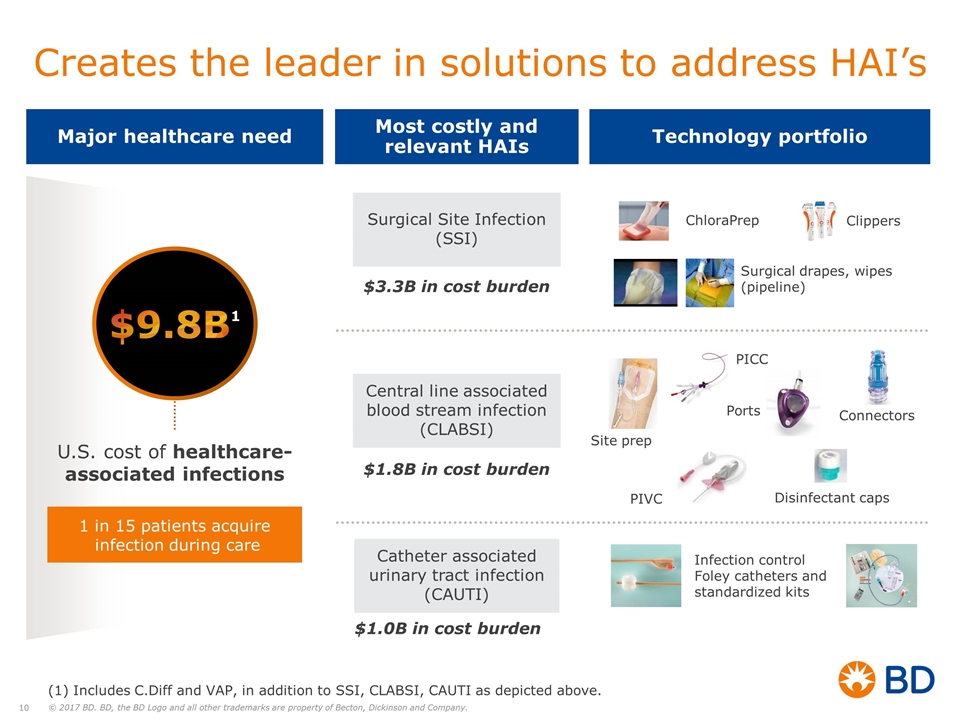

$9.8B1 U.S. cost of healthcare-associated infections 1 in 15 patients acquire infection during care Surgical Site Infection (SSI) Central line associated blood stream infection (CLABSI) Catheter associated urinary tract infection (CAUTI) $3.3B in cost burden $1.8B in cost burden $1.0B in cost burden PIVC PICC Connectors Ports ChloraPrep Infection control Foley catheters and standardized kits Clippers Surgical drapes, wipes (pipeline) Disinfectant caps Site prep Creates the leader in solutions to address HAI’s Most costly and relevant HAIs Technology portfolio Major healthcare need (1) Includes C.Diff and VAP, in addition to SSI, CLABSI, CAUTI as depicted above.

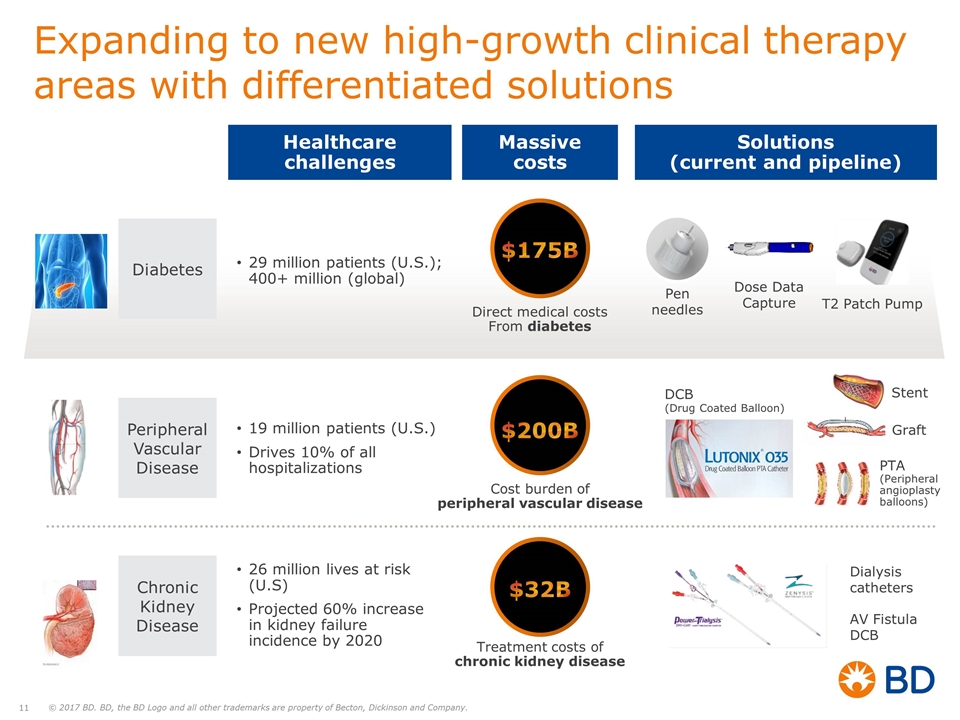

Expanding to new high-growth clinical therapy areas with differentiated solutions Diabetes Peripheral Vascular Disease Chronic Kidney Disease 19 million patients (U.S.) Drives 10% of all hospitalizations 26 million lives at risk (U.S) Projected 60% increase in kidney failure incidence by 2020 29 million patients (U.S.); 400+ million (global) T2 Patch Pump Dose Data Capture Pen needles Dialysis catheters DCB (Drug Coated Balloon) Graft PTA (Peripheral angioplasty balloons) $175B Direct medical costs From diabetes $200B Cost burden of peripheral vascular disease $32B Treatment costs of chronic kidney disease Healthcare challenges Massive costs Solutions (current and pipeline) Stent AV Fistula DCB

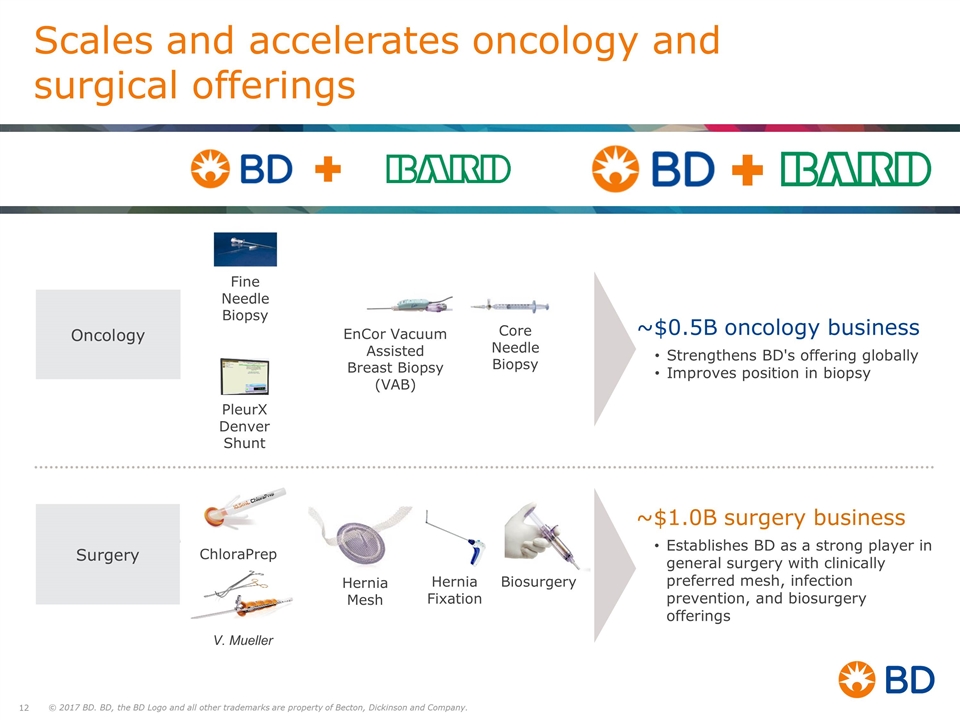

EnCor Vacuum Assisted Breast Biopsy (VAB) Core Needle Biopsy PleurX Denver Shunt Fine Needle Biopsy Scales and accelerates oncology and surgical offerings ~$0.5B oncology business Strengthens BD's offering globally Improves position in biopsy ~$1.0B surgery business Establishes BD as a strong player in general surgery with clinically preferred mesh, infection prevention, and biosurgery offerings Hernia Mesh ChloraPrep V. Mueller Hernia Fixation Biosurgery Oncology Surgery V. Mueller

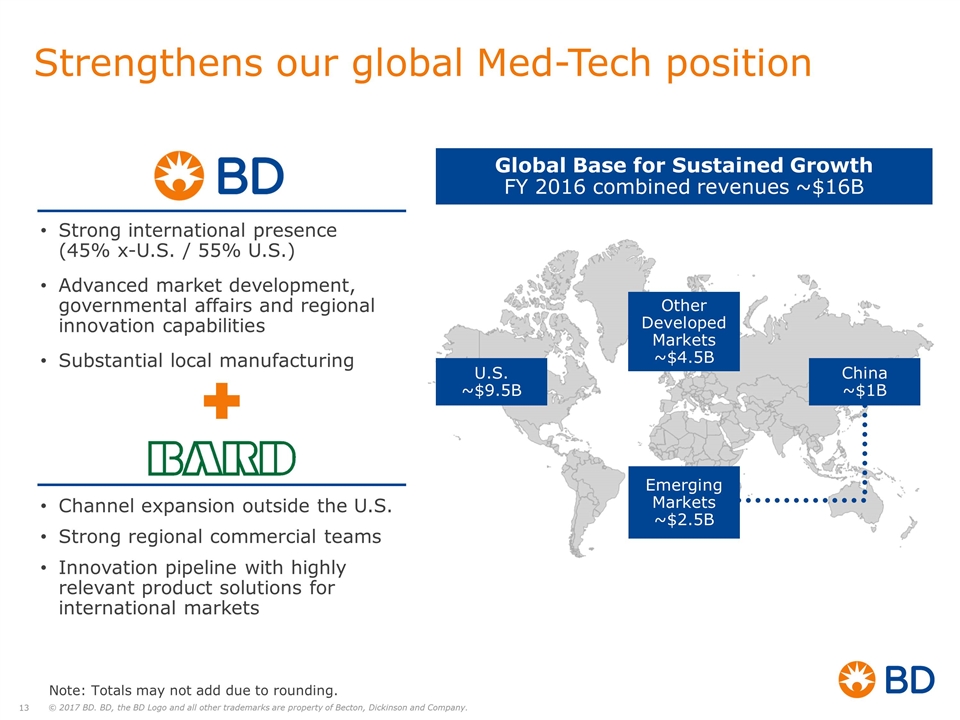

Strengthens our global Med-Tech position Global Base for Sustained Growth FY 2016 combined revenues ~$16B U.S. ~$9.5B China ~$1B Emerging Markets ~$2.5B Other Developed Markets ~$4.5B Strong international presence (45% x-U.S. / 55% U.S.) Advanced market development, governmental affairs and regional innovation capabilities Substantial local manufacturing Channel expansion outside the U.S. Strong regional commercial teams Innovation pipeline with highly relevant product solutions for international markets Note: Totals may not add due to rounding.

Combination strengthens our growth profile Revenue Growth Operating Margin Expansion Earnings Growth 5%+ ~100 bps per year 10%+ FY 2017 to FY 2019 BD Analyst Day November 2016 FY 2018 to FY 2020 Bard Announcement April 2017 Revenue Growth Operating Margin Expansion Earnings Growth 5-6% ~200 bps per year mid- teens

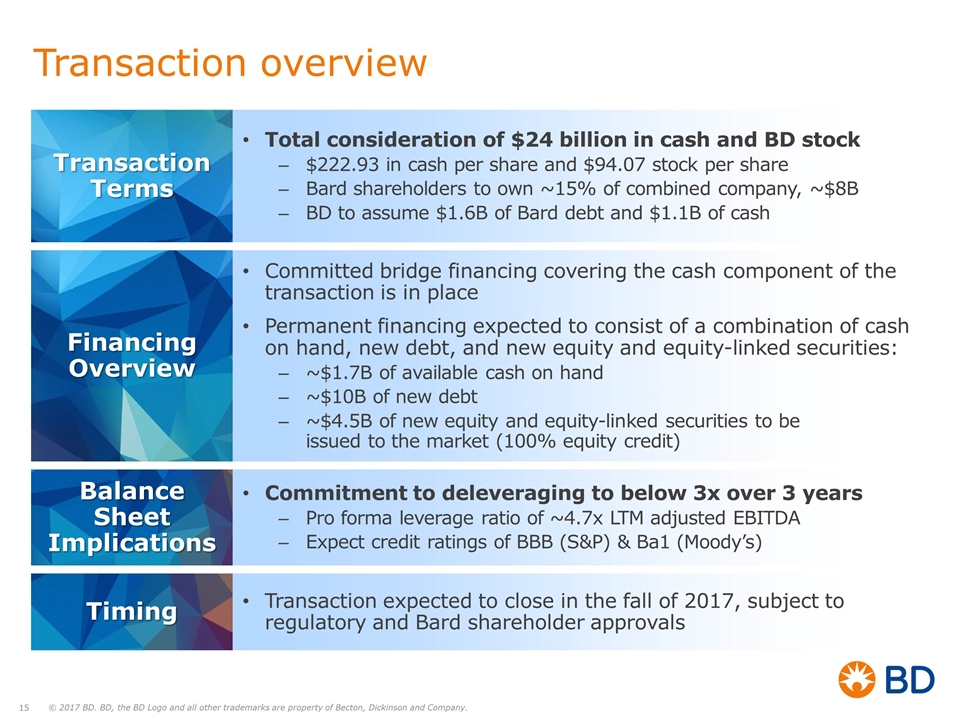

Transaction overview Transaction Terms Total consideration of $24 billion in cash and BD stock $222.93 in cash per share and $94.07 stock per share Bard shareholders to own ~15% of combined company, ~$8B BD to assume $1.6B of Bard debt and $1.1B of cash Committed bridge financing covering the cash component of the transaction is in place Permanent financing expected to consist of a combination of cash on hand, new debt, and new equity and equity-linked securities: ~$1.7B of available cash on hand ~$10B of new debt ~$4.5B of new equity and equity-linked securities to be issued to the market (100% equity credit) Financing Overview Commitment to deleveraging to below 3x over 3 years Pro forma leverage ratio of ~4.7x LTM adjusted EBITDA Expect credit ratings of BBB (S&P) & Ba1 (Moody’s) Balance Sheet Implications Transaction expected to close in the fall of 2017, subject to regulatory and Bard shareholder approvals Timing

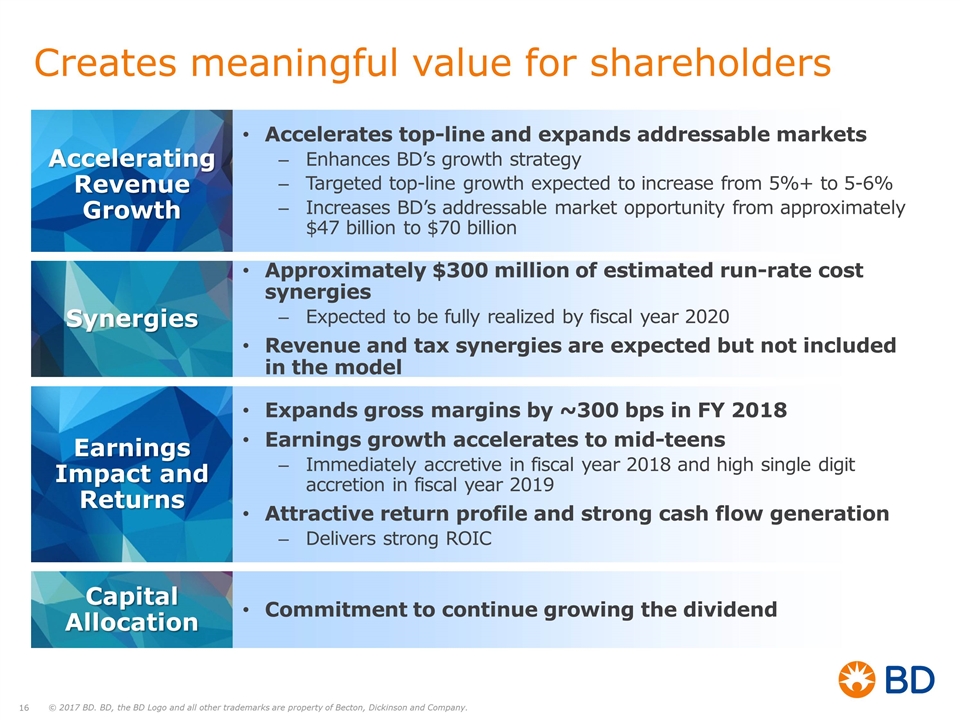

Creates meaningful value for shareholders Accelerating Revenue Growth Accelerates top-line and expands addressable markets Enhances BD’s growth strategy Targeted top-line growth expected to increase from 5%+ to 5-6% Increases BD’s addressable market opportunity from approximately $47 billion to $70 billion Expands gross margins by ~300 bps in FY 2018 Earnings growth accelerates to mid-teens Immediately accretive in fiscal year 2018 and high single digit accretion in fiscal year 2019 Attractive return profile and strong cash flow generation Delivers strong ROIC Earnings Impact and Returns Approximately $300 million of estimated run-rate cost synergies Expected to be fully realized by fiscal year 2020 Revenue and tax synergies are expected but not included in the model Synergies Commitment to continue growing the dividend Capital Allocation

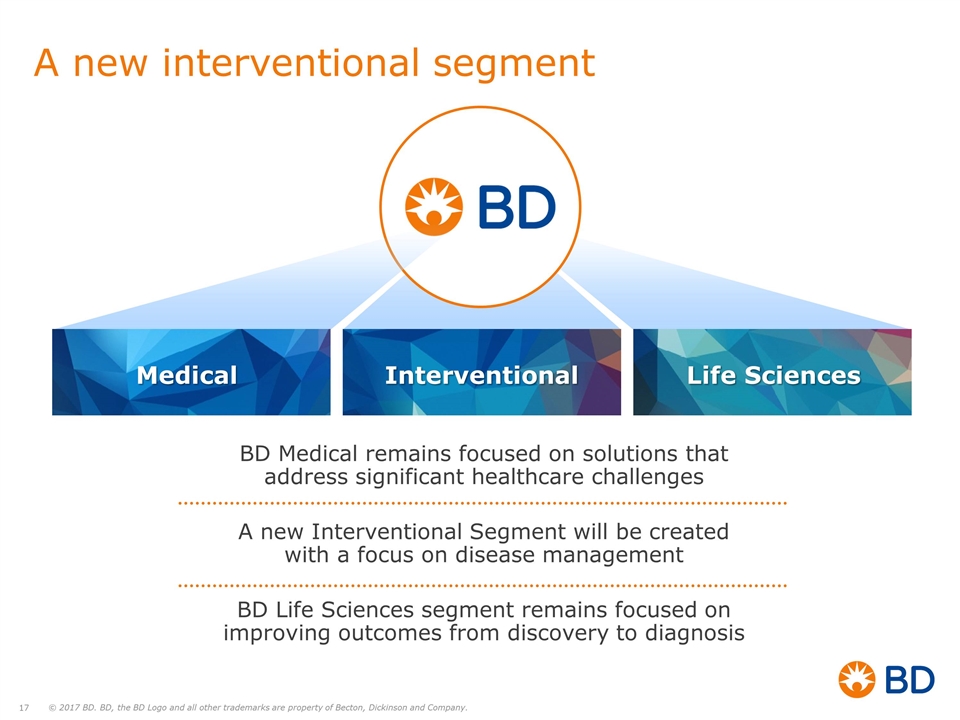

A new interventional segment BD Medical remains focused on solutions that address significant healthcare challenges A new Interventional Segment will be created with a focus on disease management BD Life Sciences segment remains focused on improving outcomes from discovery to diagnosis Medical Interventional Life Sciences

Accelerating and broadening BD’s strategy There are clear strategic benefits of a combination: ~$16 billion in combined annualized revenues Increases BD’s addressable opportunity by $20B 65,000 employees worldwide Presence in almost every country around the world Better Together: A Dynamic and Differentiated Company Advances the strategies of both companies and accelerates end-to-end medication management and infection prevention 1 Creates new growth opportunities across a range of clinically impactful segments 2 Leverages BD’s leading global capabilities and creates new opportunities around the world to benefit from the combined company’s product technology 3

Questions