EX-99.3

Published on July 14, 2025

Accelerating the New BD Strategy July 14, 2025 Exhibit 99.3

Cautionary Statement Regarding Forward-Looking Statements This communication includes “forward-looking statements” as that term is defined in Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the proposed transaction among Waters, BD and SpinCo. These forward-looking statements generally are identified by the words “believe,” “feel,” “project,” “expect,” “anticipate,” “appear,” “estimate,” “forecast,” “outlook,” “target,” “endeavor,” “seek,” “predict,” “intend,” “suggest,” “strategy,” “plan,” “may,” “could,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” or the negative thereof or variations thereon or similar terminology generally intended to identify forward-looking statements. All statements, other than historical facts, including, but not limited to, statements regarding the expected timing and structure of the proposed transaction, the ability of the parties to complete the proposed transaction, the expected benefits of the proposed transaction, including the amount and timing of synergies from the proposed transaction, the tax consequences of the proposed transaction, the terms and scope of the expected financing in connection with the proposed transaction, the aggregate amount of indebtedness of the combined company following the closing of the proposed transaction, the combined company’s plans, objectives, expectations and intentions, legal, economic and regulatory conditions, and any assumptions underlying any of the foregoing, are forward looking statements. These forward-looking statements are based on Waters’ and BD’s current expectations and are subject to risks and uncertainties surrounding future expectations generally. Actual results could differ materially from those currently anticipated due to a number of risks and uncertainties, many of which are beyond Waters’ and BD’s control. None of Waters, BD, SpinCo or any of their respective directors, executive officers, or advisors make any representation or provide any assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur, or if any of them do occur, what impact they will have on the business, results of operations or financial condition of Waters or BD. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, these developments could have a material adverse effect on Waters’ and BD’s businesses and the ability to successfully complete the proposed transaction and realize its benefits. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) that one or more closing conditions to the transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the proposed transaction, may require conditions, limitations or restrictions in connection with such approvals or that the required approval by the stockholders of Waters may not be obtained; (2) the risk that the proposed transaction may not be completed on the terms or in the time frame expected by Waters, BD and SpinCo, or at all; (3) unexpected costs, charges or expenses resulting from the proposed transaction; (4) uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; (5) failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the proposed transaction or integrating the businesses of Waters and SpinCo, on the expected timeframe or at all; (6) the ability of the combined company to implement its business strategy; (7) difficulties and delays in the combined company achieving revenue and cost synergies; (8) inability of the combined company to retain and hire key personnel; (9) the occurrence of any event that could give rise to termination of the proposed transaction; (10) the risk that stockholder litigation in connection with the proposed transaction or other litigation, settlements or investigations may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability; (11) evolving legal, regulatory and tax regimes; (12) changes in general economic and/or industry specific conditions or any volatility resulting from the imposition of and changing policies around tariffs; (13) actions by third parties, including government agencies; (14) the risk that the anticipated tax treatment of the proposed transaction is not obtained; (15) the risk of greater than expected difficulty in separating the business of SpinCo from the other businesses of BD; (16) risks related to the disruption of management time from ongoing business operations due to the pendency of the proposed transaction, or other effects of the pendency of the proposed transaction on the relationship of any of the parties to the transaction with their employees, customers, suppliers, or other counterparties; and (17) other risk factors detailed from time to time in Waters’ and BD’s reports filed with the SEC, including Waters’ and BD’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC, including documents that will be filed with the SEC in connection with the proposed transaction. The foregoing list of important factors is not exclusive. It should also be noted that projected financial information for the combined businesses of Waters and SpinCo is based on management’s estimates, assumptions and projections and has not been prepared in conformance with the applicable accounting requirements of Regulation S-X relating to pro forma financial information, and the required pro forma adjustments have not been applied and are not reflected therein. None of this information should be considered in isolation from, or as a substitute for, the historical financial statements of Waters or SpinCo. Important risk factors could cause actual future results and other future events to differ materially from those currently estimated by management, including, but not limited to, the risks that: a condition to the closing of the proposed transaction may not be satisfied; a regulatory approval that may be required for the proposed transaction is delayed, is not obtained or is obtained subject to conditions that are not anticipated; Waters is unable to achieve the synergies and value creation contemplated by the proposed transaction; Waters is unable to promptly and effectively integrate SpinCo’s businesses; management’s time and attention is diverted on transaction related issues; disruption from the transaction makes it more difficult to maintain business, contractual and operational relationships; the credit ratings of the combined company declines following the proposed transaction; legal proceedings are instituted against Waters, BD or the combined company; Waters, SpinCo or the combined company is unable to retain key personnel; and the announcement or the consummation of the proposed transaction has a negative effect on the market price of the capital stock of Waters and BD or on Waters’ and BD’s operating results. Any forward-looking statements speak only as of the date of this communication. None of Waters, BD or SpinCo undertakes, and each party expressly disclaims, any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements. ACCELERATING THE NEW BD STRATEGY JULY 14, 2025

ACCELERATING THE NEW BD STRATEGY JULY 14, 2025 This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to buy or exchange any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. It does not constitute a prospectus or prospectus equivalent document. No offering or sale of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”), and otherwise in accordance with applicable law. In connection with the proposed transaction between Waters, Augusta SpinCo Corporation (“SpinCo”) and BD, the parties intend to file relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including, among other filings, a registration statement on Form S-4 to be filed by Waters (the “Form S-4”) that will include a preliminary proxy statement/prospectus of Waters and a definitive proxy statement/prospectus of Waters, the latter of which will be mailed to stockholders of Waters, and a registration statement on Form 10 to be filed by SpinCo that will incorporate by reference certain portions of the Form S-4 and will serve as an information statement/prospectus in connection with the spin-off of SpinCo from BD. INVESTORS AND SECURITY HOLDERS OF WATERS AND BD ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, THE INFORMATION STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Form S-4 and the proxy statement/prospectus (when available) and other documents filed with the SEC by Waters, SpinCo or BD through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Waters will be available free of charge on Waters website at waters.com under the tab “About Waters” and under the heading “Investor Relations” and subheading “Financials—SEC Filings.” Copies of the documents filed with the SEC by BD and SpinCo will be available free of charge on BD’s website at bd.com under the tab “About BD” and under the heading “Investors” and subheading “SEC Filings.” Additional Information and Where to Find It Participants in the Solicitation Waters and BD and their respective directors and executive officers may be considered participants in the solicitation of proxies from Waters stockholders in connection with the proposed transaction. Information about the directors and executive officers of Waters is set forth in its Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the SEC on February 25, 2025, and its proxy statement for its 2025 annual meeting, which was filed with the SEC on April 9, 2025. To the extent holdings of Waters’ securities by its directors or executive officers have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. Information about the directors and executive officers of Waters and other information regarding the potential participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction. Information about the directors and executive officers of BD is set forth in its Annual Report on Form 10-K for the year ended September 30, 2024, which was filed with the SEC on November 27, 2024, and its proxy statement for its 2025 annual meeting, which was filed with the SEC on December 19, 2024. To the extent holdings of BD’s securities by its directors or executive officers have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. You may obtain these documents (when they become available) free of charge through the website maintained by the SEC at www.sec.gov and from Waters’ website and BD’s website as described above.

ACCELERATING THE NEW BD STRATEGY JULY 14, 2025 In addition to the financial measures presented in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), this communication includes certain non-GAAP financial measures (collectively, the “Non-GAAP Measures”), such as adjusted EBITDA, adjusted EPS and adjusted operating margin. These Non-GAAP Measures should not be used in isolation or as a substitute or alternative to results determined in accordance with U.S. GAAP. In addition, Waters’ and BD’s definitions of these Non-GAAP Measures may not be comparable to similarly titled non-GAAP financial measures reported by other companies. For Calendar Year 2025, Waters’ projected adjusted EBITDA for BD’s Biosciences & Diagnostic Solutions business is approximately $925 million. Due to the SEC methodology that requires allocating BD’s corporate overhead costs (approximately $200 million), which are not required to operate the Bioscience & Diagnostic Solutions business and will not transfer post-spin, as well as approximately $100 million in one-time, non-recurring costs related to the spin-off, transaction, and restructuring, EBITDA for BD’s Biosciences & Diagnostic Solutions business in BD’s carveout financial statements for the same period would be expected to be approximately $300 million lower. Note Regarding Use of Non-GAAP Financial Measures Market and Industry Data This presentation includes estimates regarding market and industry data that BD prepared based on management’s knowledge and experience in the industry in which BD operates, together with information obtained from various sources, including publicly available information, industry reports and publications. In presenting this information, BD has made certain assumptions that BD believes to be reasonable based on such data and other similar sources and on BD’s knowledge of, and BD’s experience to date in, the industry in which BD operates. While such information is believed to be reliable for the purposes used herein, no representations are made as to the accuracy or completeness thereof and BD takes no responsibility for such information. Basis of Presentation References to “FY” refer to BD’s fiscal year, which ends September 30. Biosciences and Diagnostic Solutions refers to the Biosciences and Diagnostics Solutions business unit as a standalone business post the separation from BD. New BD refers to BD post the separation of the Biosciences and Diagnostic Solutions business unit from BD and adjusted for a full year of Advanced Patient Monitoring revenue generated during Edwards Lifesciences' ownership. Glossary AI (Artificial Intelligence); B (Billion); DCB (Drug-Coated Ballon); EBITDA (Earnings Before Interest, Taxes, Depreciation, Amortization); GLP-1 (Glucagon-Like Peptide-1); IV (Intravenous); M&A (Mergers & Acquisitions); mL (Milliliter); MSD (Mid-single-digits); M (Million); R&D (Research & Development); TIPS (Transjugular Intrahepatic Portosystemic Shunt); VAB (Vacuum Assisted Biopsy)

New Scaled pure-play medical technology company with uniquely leading positions in large, attractive end-markets, track record of innovation, and strong long-term cash generation and earnings growth fueled by BD Excellence Disciplined and balanced capital allocation framework with emphasis on shareholder returns as well as concentrated investments in high-impact innovation and commercial capabilities to deliver differentiated and durable returns Transaction creates a life science and diagnostics leader focused on high-volume testing with a leading financial outlook Maximizes BD shareholder value through ownership of combined company including upside of transaction synergies and growth opportunities, as well as capturing additional value of New BD transformation Transaction cash distribution of ~$4B will enhance BD’s capital allocation, including commitment to use at least half of cash proceeds for share repurchases Waters Transaction Unlocks Value & Accelerates New BD Strategy New BD’s MSD revenue growth profile is supported by attractive and growing end-markets and best-in-class consumables revenue ACCELERATING THE NEW BD STRATEGY JULY 14, 2025

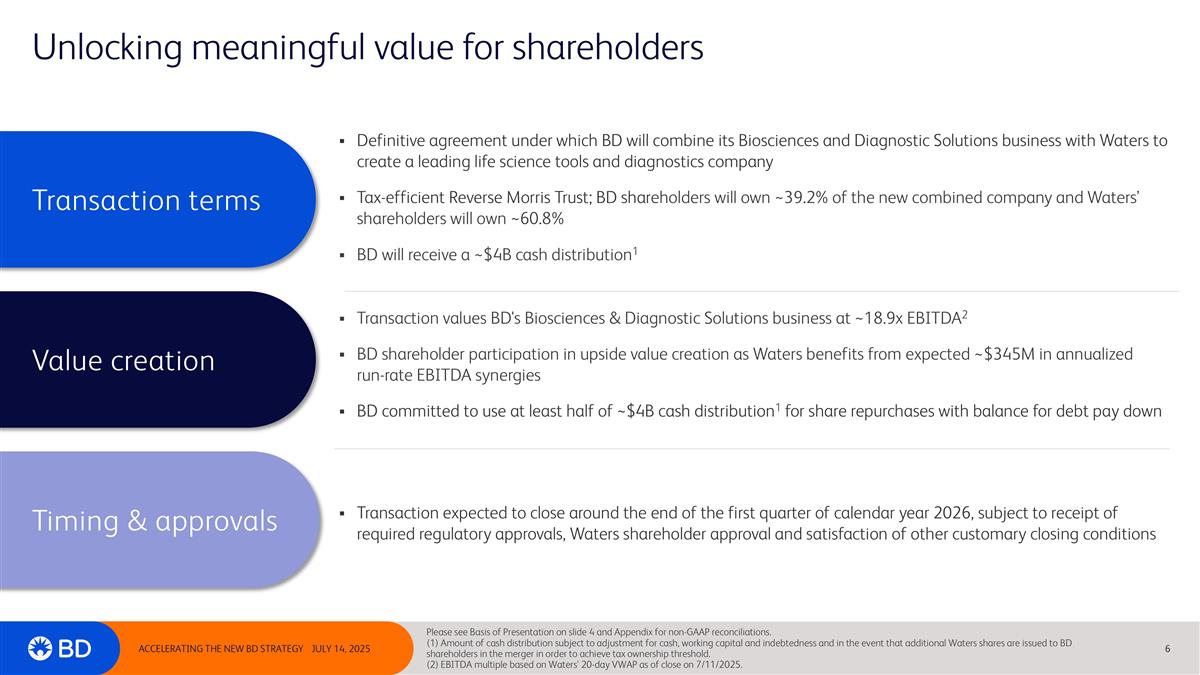

Unlocking meaningful value for shareholders Definitive agreement under which BD will combine its Biosciences and Diagnostic Solutions business with Waters to create a leading life science tools and diagnostics company Tax-efficient Reverse Morris Trust; BD shareholders will own ~39.2% of the new combined company and Waters’ shareholders will own ~60.8% BD will receive a ~$4B cash distribution1 Transaction values BD's Biosciences & Diagnostic Solutions business at ~18.9x EBITDA2 BD shareholder participation in upside value creation as Waters benefits from expected ~$345M in annualized run-rate EBITDA synergies BD committed to use at least half of ~$4B cash distribution1 for share repurchases with balance for debt pay down Transaction expected to close around the end of the first quarter of calendar year 2026, subject to receipt of required regulatory approvals, Waters shareholder approval and satisfaction of other customary closing conditions Transaction terms Value creation Timing & approvals Please see Basis of Presentation on slide 4 and Appendix for non-GAAP reconciliations. (1) Amount of cash distribution subject to adjustment for cash, working capital and indebtedness and in the event that additional Waters shares are issued to BD shareholders in the merger in order to achieve tax ownership threshold. (2) EBITDA multiple based on Waters’ 20-day VWAP as of close on 7/11/2025. ACCELERATING THE NEW BD STRATEGY JULY 14, 2025

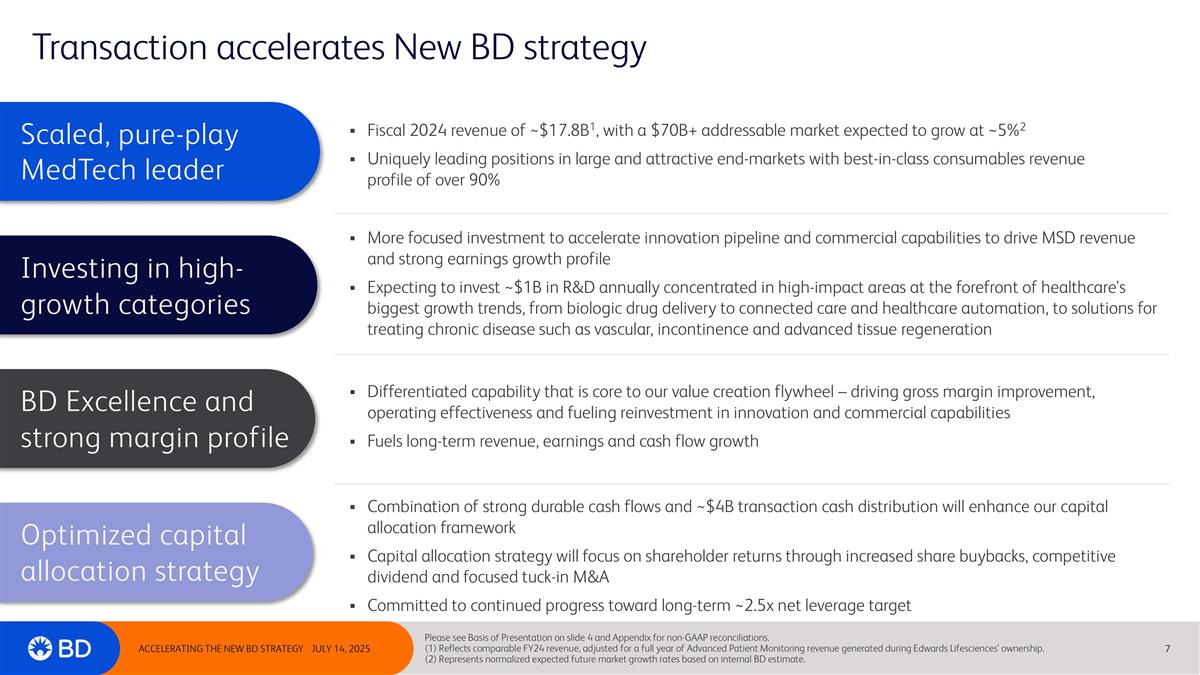

Transaction accelerates New BD strategy Fiscal 2024 revenue of ~$17.8B1, with a $70B+ addressable market expected to grow at ~5%2 Uniquely leading positions in large and attractive end-markets with best-in-class consumables revenue profile of over 90% More focused investment to accelerate innovation pipeline and commercial capabilities to drive MSD revenue and strong earnings growth profile Expecting to invest ~$1B in R&D annually concentrated in high-impact areas at the forefront of healthcare's biggest growth trends, from biologic drug delivery to connected care and healthcare automation, to solutions for treating chronic disease such as vascular, incontinence and advanced tissue regeneration Differentiated capability that is core to our value creation flywheel – driving gross margin improvement, operating effectiveness and fueling reinvestment in innovation and commercial capabilities Fuels long-term revenue, earnings and cash flow growth Combination of strong durable cash flows and ~$4B transaction cash distribution will enhance our capital allocation framework Capital allocation strategy will focus on shareholder returns through increased share buybacks, competitive dividend and focused tuck-in M&A Committed to continued progress toward long-term ~2.5x net leverage target Scaled, pure-play MedTech leader Investing in high-growth categories BD Excellence and strong margin profile Optimized capital allocation strategy Please see Basis of Presentation on slide 4 and Appendix for non-GAAP reconciliations. (1) Reflects comparable FY24 revenue, adjusted for a full year of Advanced Patient Monitoring revenue generated during Edwards Lifesciences' ownership. (2) Represents normalized expected future market growth rates based on internal BD estimate. ACCELERATING THE NEW BD STRATEGY JULY 14, 2025

Medication Management Solutions $3.3B Revenue Please see Basis of Presentation on slide 4 and Appendix for non-GAAP reconciliations. (1) BD information presented is for FY24. Numbers may not tie due to rounding. Addressable markets based on internal BD estimates. Category growths represent normalized expected future market growth rates based on internal BD estimates. (2) Reflects comparable FY24 revenue, adjusted for a full year of Advanced Patient Monitoring revenue generated during Edwards Lifesciences’ ownership. (3) Reflects FY24 revenue for the Pharmaceutical Systems business unit. New BD has leading positions in attractive end-markets expected to grow at ~5% BioPharma Systems ~$2.3B Connected Care2 ~$4.3B Specimen Management $1.8B Revenue Medication Delivery Solutions $4.4B Revenue BioPharma Systems $2.3B Revenue3 Advanced Patient Monitoring $1.0B Revenue2 $17B+ Addressable Market ~3-4% Category Growth $7B+ Addressable Market ~7-9% Category Growth $18B+ Addressable Market ~4-5% Category Growth Medical Essentials ~$6.2B Interventional ~$5.0B Urology & Critical Care $1.6B Revenue Surgery $1.5B Revenue Peripheral Intervention $1.9B Revenue $27B+ Addressable Market ~5-6% Category Growth #1 #1 #1 #1 #1 #1 #1 #1 ~$17.8B FY24 Annualized Revenue by Segment and Business Unit1 ACCELERATING THE NEW BD STRATEGY JULY 14, 2025 1

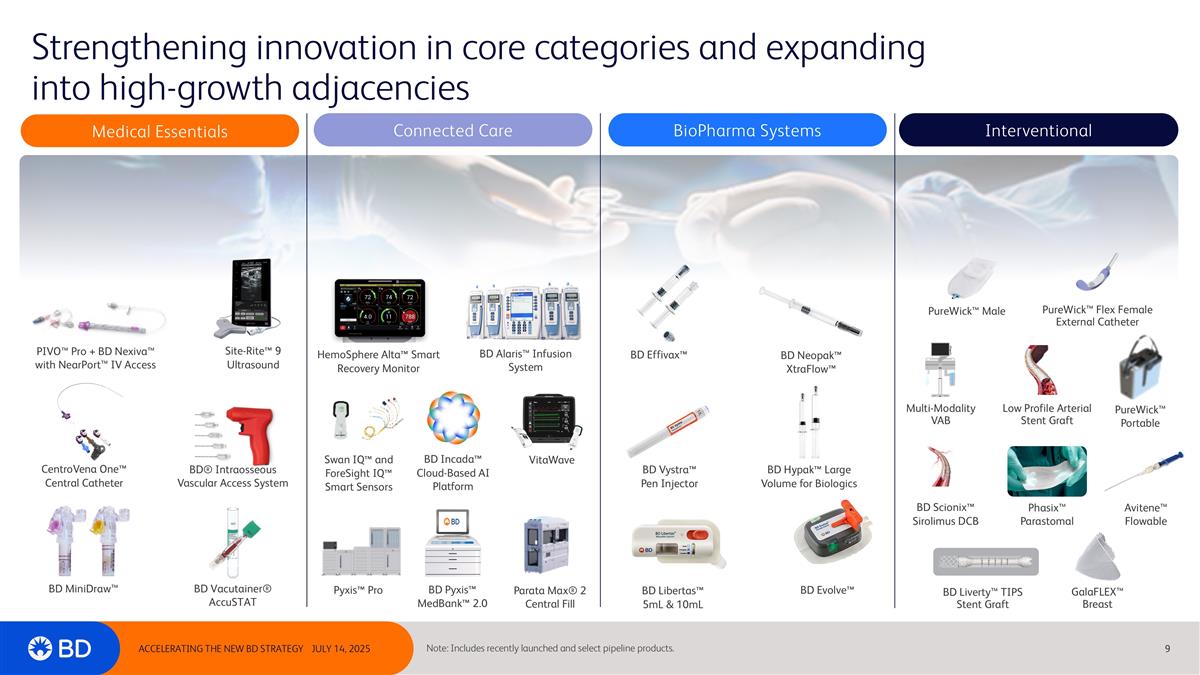

Strengthening innovation in core categories and expanding into high-growth adjacencies Note: Includes recently launched and select pipeline products. HemoSphere Alta™ Smart Recovery Monitor Parata Max® 2 Central Fill BD Alaris™ Infusion System Pyxis™ Pro Swan IQ™ and ForeSight IQ™ Smart Sensors BD Effivax™ BD Evolve™ BD Neopak™ XtraFlow™ PureWick™ Male BD Scionix™ Sirolimus DCB Avitene™ Flowable BD® Intraosseous Vascular Access System PIVO™ Pro + BD Nexiva™ with NearPort™ IV Access Site-Rite™ 9 Ultrasound BD Vacutainer® AccuSTAT BD Libertas™ 5mL & 10mL BD Hypak™ Large Volume for Biologics BD Incada™ Cloud-Based AI Platform BD Pyxis™ MedBank™ 2.0 VitaWave CentroVena One™ Central Catheter BD Vystra™ Pen Injector BD MiniDraw™ BioPharma Systems Connected Care Medical Essentials Interventional PureWick™ Flex Female External Catheter Low Profile Arterial Stent Graft Multi-Modality VAB BD Liverty™ TIPS Stent Graft PureWick™ Portable Phasix™ Parastomal GalaFLEX™ Breast ACCELERATING THE NEW BD STRATEGY JULY 14, 2025

Unlocking long-term shareholder value New Waters transaction creates a life science and diagnostics leader focused on high-volume testing with a leading financial profile Maximizes BD shareholder value through ownership of combined company including upside of transaction synergies and growth opportunities, as well as capturing the additional value of New BD Refined value creation strategy driven by focused investments in innovation and commercial capabilities, operational excellence, and enhanced capital allocation with an emphasis on shareholder returns New BD will be a unique pure-play medical technology company with MSD growth profile supported by attractive and growing end-markets and best-in-class consumables revenue ACCELERATING THE NEW BD STRATEGY JULY 14, 2025

Appendix ACCELERATING THE NEW BD STRATEGY JULY 14, 2025

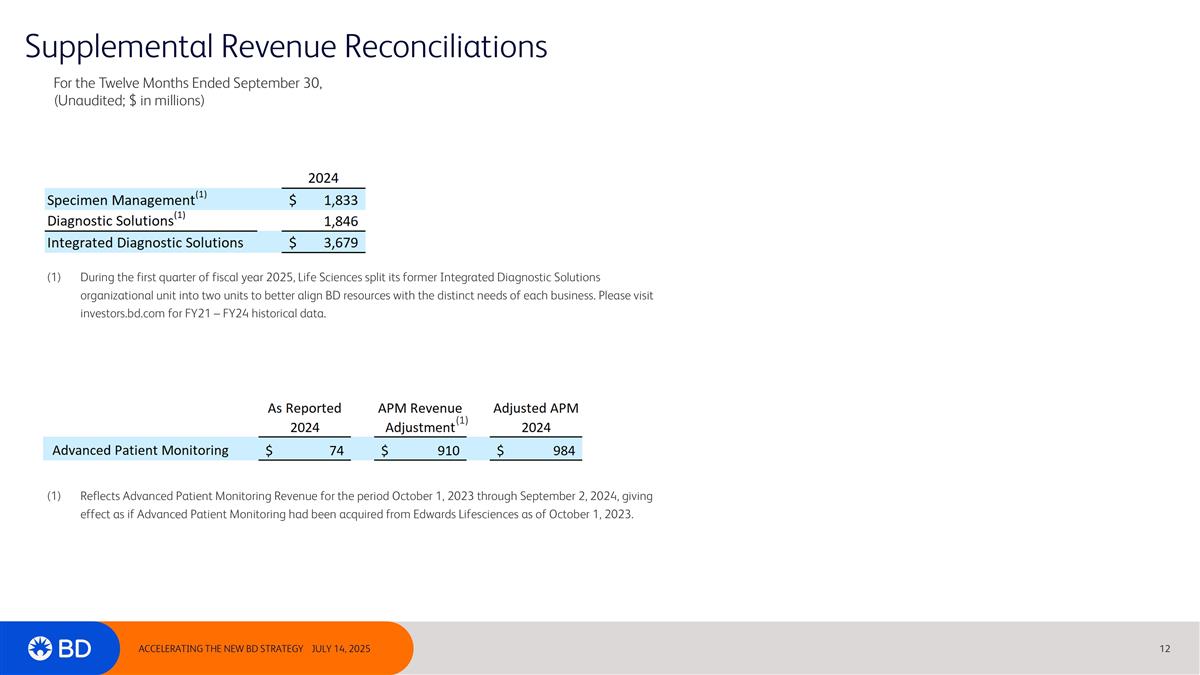

Supplemental Revenue Reconciliations For the Twelve Months Ended September 30, (Unaudited; $ in millions) Reflects Advanced Patient Monitoring Revenue for the period October 1, 2023 through September 2, 2024, giving effect as if Advanced Patient Monitoring had been acquired from Edwards Lifesciences as of October 1, 2023. During the first quarter of fiscal year 2025, Life Sciences split its former Integrated Diagnostic Solutions organizational unit into two units to better align BD resources with the distinct needs of each business. Please visit investors.bd.com for FY21 – FY24 historical data. ACCELERATING THE NEW BD STRATEGY JULY 14, 2025 (1)